2020 Tax Return Due Dates And Deadlines: All You Need to Know

In order to have a successful tax return one of the key things that any business or individual can do is to have all of their documents and forms ready to go in advance to avoid paying any late fees.

When Can I Start Filing Taxes for 2020?

As of January 27th, 2020 the Internal Revenue Service (IRS) is officially accepting tax returns for processing so the sooner you file with them the sooner you will have one less thing to worry about. To minimize errors and speed up refund time, the IRS encourages users to file their taxes electronically. Regardless of this users should be sure to click on the forms below for information on late filing penalties or any other requirements that are needed to file the necessary forms.

You can request a six-month extension from the IRS if you need additional time to prepare and file your return. This would shift your filing deadline to October 15th, 2020.

2020 Tax Deadlines for Business Owners

Depending on the business you own, there are different documents that are needed to be filed in order to pay the taxes that owed. In general, it is expected for businesses and employees alike to pay their taxes regularly as they receive income over the course of the year.

When to File 2020 Taxes as a Business Owner?

As a business owner, it’s important to keep track of your tax responsibilities. Check out our business tax schedule for 2020 to stay on top of this year's tax season.

|

January 31st, 2020 |

○ Form 1099-MISC, Miscellaneous Income (Box 7); ○ Form 1099-A, Acquisition or Abandonment of Secured Property; ○ Form 1099-C, Cancellation of Debt; ○ Form 1099-DIV, Dividends and Distributions; ○ Form 1099-G, Certain Government Payments; ○ Form 1099-INT, Interest Income; ○ Form 1099-K, Payment Card and Third Party Network Transactions; ○ Form 1099-PATR, Taxable Distributions Received From Cooperatives; |

|

February 10th, 2020 |

This is the final date to submit Form 940 and Form 941 (if all of the previous payments have been made). |

|

February 15th, 2020 |

|

|

February 18th, 2020 |

Employers need to give annual information statements to recipients of certain payments which were made during 2019. You can use the applicable version of Form 1099 or other information return to report this information. Keep in mind that the IRS 1099 Forms can be issued electronically with the consent of the recipient. This due date applies only to the following types of payments:

|

|

February 29th, 2020 |

|

|

March 16th, 2020 |

|

|

March 31st, 2020 |

Final due date to file electronic IRS 1099 Forms (except Form 1099-MISC reporting nonemployee compensation) and Form 8027. This due date also applies to the electronic filing of Forms 1097-BTC, 1098, 3921, 3922, and W-2G. |

|

April 15th, 2020 |

○ Form 1041, U.S. Income Tax Return for Estates and Trusts (all deductions, income, losses, and gains from the operation of a trust or an estate); ○ Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation; ○ Form 1120-H, U.S. Income Tax Return for Homeowners Associations; ○ Form 1120-L, U.S. Life Insurance Company Income Tax Return; ○ Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons; ○ Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return; ○ FinCEN Form 114, Foreign Bank and Financial Accounts Report. |

|

May 15th, 2020 |

Most nonprofits (excluding all churches and church-related organizations), must file one of the following forms for the previous year:

|

|

June 15th, 2020 |

|

|

July 31st, 2020 |

File Form 941 by this day. If all of the required payments have been paid in full by the due dates, you have 10 more days to submit this form. |

|

August 10th, 2020 |

If all of the previous payments have been made, file and submit Form 941, Employer’s Quarterly Federal Tax Return by this date. |

|

September 15th, 2020 |

|

|

October 15th, 2020 |

Corporations must file an income tax return for the 2019 calendar year (Form 1120) and pay any tax, interest, and penalties due. This due date applies only if you timely requested an automatic 6-month extension. |

|

November 16th, 2020 |

Extended deadline given to nonprofit organizations to file any form of the Form 990 Series. |

|

December 16, 2019 |

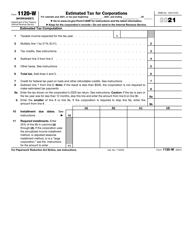

Corporations must estimate their fourth and final installment of estimated income tax for 2018. The amounts are estimated via Form 1120-W. |

2020 Tax Deadlines for Individuals

One of the first things an individual needs to do when they begin to fill out their taxes is understanding if they need to file at all. There are three important factors that are used to determine a need to file. These include gross annual income, file status, and the applicant’s age. If you are currently a married adult filing jointly with your spouse and have a household income of over $24,400 you have to file your taxes this year. You also have to file if you’re a single adult under the age of 65 and have made over $12,200 this year.

When to File 2020 Individual Taxes?

Some states have certain exceptions, taxpayers from Virginia or South Carolina have until May 1st, 2020, to file their returns. It can be beneficial to research your state tax deadlines and find the appropriate date that applies to you.

|

January 10th, 2020 |

|

|

January 15th, 2020 |

Form 1040-ES, Estimated Tax for Individuals is used by individuals to make a payment on their estimated tax for 2019 if they did not make a payment on their income tax for the year through withholding. This payment does not need to be made if they file their 2019 return (Form 1040 or Form 1040-SR) and pay any taxes due by January 31st, 2020. Farmers and fisherman may also pay their estimated tax for 2019 by using Form 1040-ES. They have until April 15th to file their 2019 income tax return (Form 1040 or Form 1040-SR). If they do not pay their estimated tax by January 15th, they must file their 2019 return and pay any tax due by March 2nd, 2020, so that their estimated tax penalty is avoided. |

|

January 31st, 2020 |

This due date applies to the following forms: Individuals who didn't pay their last installment of estimated tax by January 15th may choose to file their income tax return (Form 1040 or Form 1040-SR) for 2019 by January 31st. If an individual files their return by this date this will prevent them from having any penalty on their last installment payment. If you are not able to file your taxes by this date, there is also the opportunity to file by April 15th, 2020. |

|

February 18th, 2020 |

For individuals that claimed an exemption from their income tax withholding last year on the W-4 Form you gave your employer, you must file a new W-4 Form by this date to continue your exemption for another year:

|

|

March 2nd, 2020 |

Farmers and fishermen need to file their 2019 income tax return using Form 1040 or Form 1040-SR and pay any necessary tax that is due. However, if needed you have until April 15th to file if you have paid your 2019 estimated tax by January 15th, 2020. |

|

April 15th, 2020 |

|

|

June 15th, 2020 |

|

|

September 15th, 2020 |

As the third installment date for paying your estimated taxes in 2019, you may use Form 1040-ES to make an estimated payment if you’re not paying your income tax for the year through withholding. |

|

October 15th, 2020 |

This is the final date to file individual tax returns (Form 1040 or Form 1040-SR) for 2019. This is also the last day that the IRS will accept tax returns that are electronically filed for 2019. If you choose to file after this date, in order to have your return processed, you will have to have your return sent in my mail. |

2020 Tax Calendar for Employers

The tax-reporting responsibilities of every employer depend on the type of business, the business location, and the number of staff that they employ. Tracking the ever-changing tax due dates is essential to avoid any expensive late filing fees and penalties.

Tax Filing Deadlines for Employers

It might feel intimidating to figure out the taxes you owe and all of the IRS guidelines that get changed every year. Sticking to a set schedule and developing an in-depth strategy is a great way to stay on top of your owed taxes and not miss a beat when filing the necessary forms that need to be filed.

|

January 31st, 2020 |

○ Form W-2VI, U.S. Virgin Islands Wage and Tax Statement; ○ Form W-2GU, Guam Wage and Tax Statement; ○ Form W-2AS, American Samoa Wage and Tax Statement. File Form W-3, Transmittal of Wage and Tax Statements (or Form W-3PR) along with Copy A of all the Forms W-2, Wage and Tax Statement that you issued in 2019. Use Form W-3C, Transmittal of Corrected Wage and Tax Statements to correct any errors on Forms W-2, W-2AS, W-2GU, or W-2VI. |

|

February 10th, 2020 |

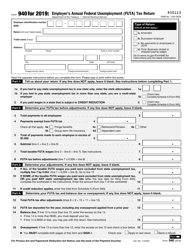

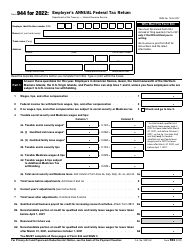

○ File Form 941 (fourth quarter of 2019); ○ Certain small business employers should file Form 944 (or Form 944 (SP)) to report withheld income tax, social security, and Medicare taxes for the previous year; ○ Farm employers must file Form 943 (or Form 943-PR) to report withheld social security, Medicare, and income taxes; ○ Concerning the federal unemployment tax, employers should file Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. |

|

February 19th, 2020 |

All employers must begin withholding income tax from the salary of any employee who has claimed an exemption from withholding in 2019, but didn't give the employer Form W-4 or Form W-4(SP) to continue the exemption this year. |

|

February 28th, 2020 |

|

|

March 31st, 2020 |

This due date only applies to these electronically-filed forms: ○ Form W-2G (paper version due February 28th); ○ Form 8027 (paper version due March 2nd); ○ Form 1094-C (paper version due February 28th); ○ Form 1095-C (paper version due February 28th); ○ Form 1094-B (paper version due February 28th); ○ Form 1095-B (paper version due February 28th). |

|

April 15th, 2020 |

If you are a household employer that paid cash wages of $2,100 or more to a household employee in 2019, file Schedule H (Form 1040 or Form 1040-SR). |

|

April 30th, 2020 |

File Form 941 (first quarter of 2020). If taxes for this quarter were deposited on time and in full, you have until May 11th to file the return. |

|

May 11th, 2020 |

Final due date to file Form 941 (first quarter of 2020). This due date applies only if you deposited the tax for the quarter on time and in full. |

|

July 31st, 2020 |

|

|

August 10th, 2020 |

Final due date to file Form 941 (second quarter of 2020) if taxes for that quarter were deposited on time and in full. |

|

November 2nd, 2020 |

File Form 941 for the third quarter of 2019. |

|

November 10th, 2020 |

Final due date for Form 941 (third quarter of 2020) if taxes for that quarter were deposited on time and in full. |