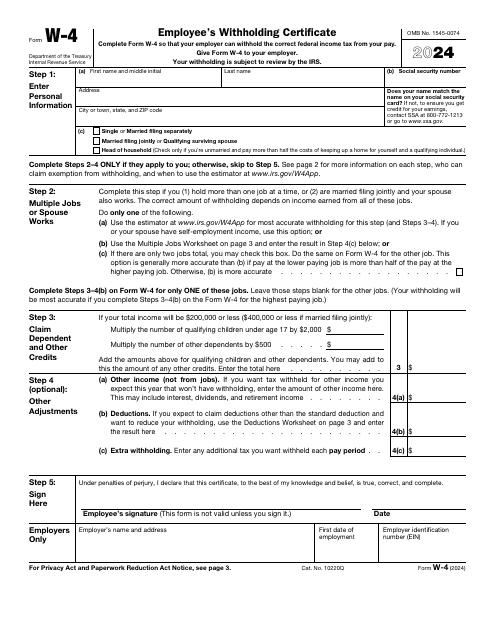

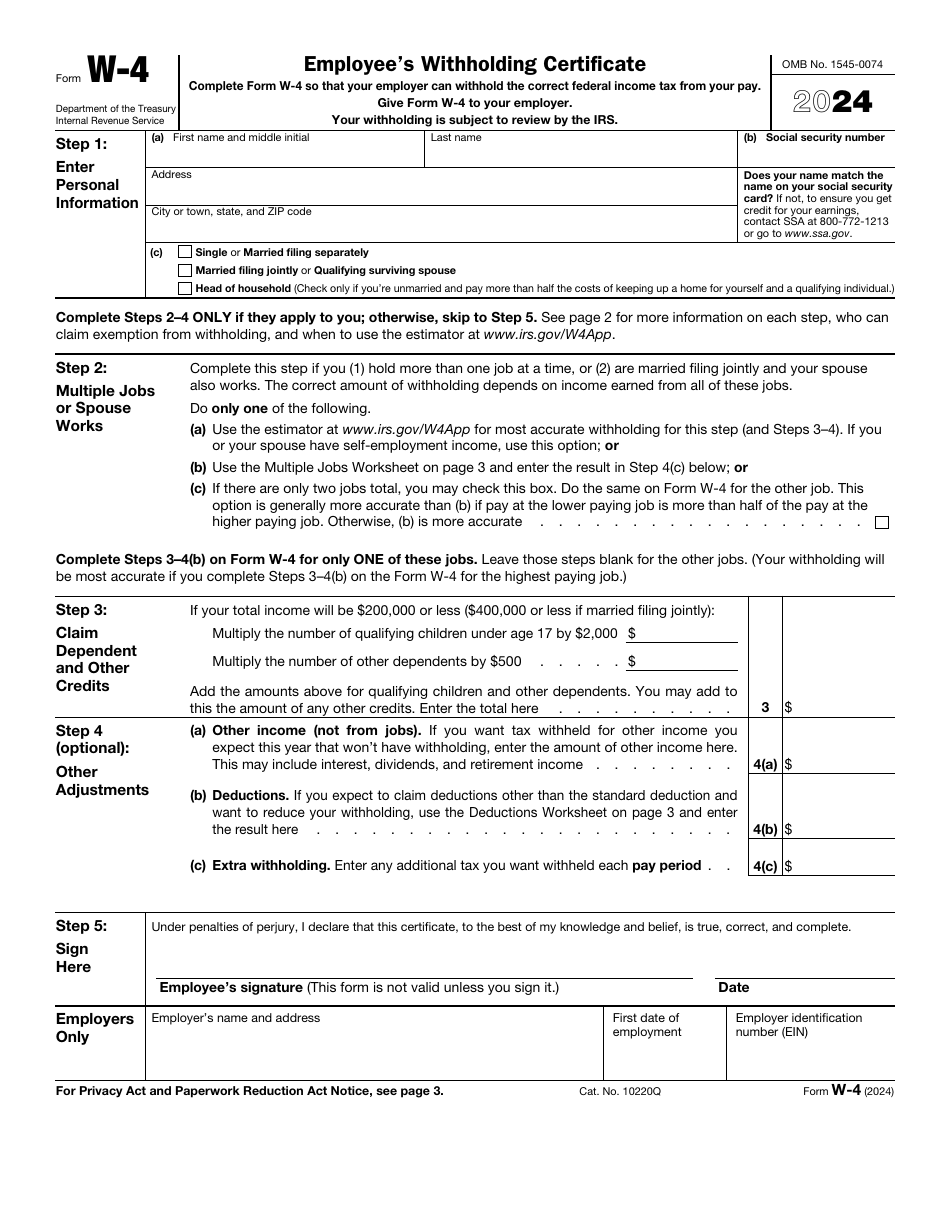

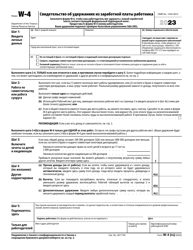

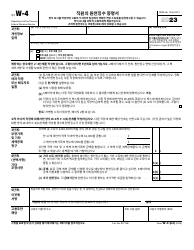

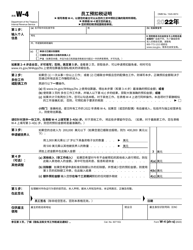

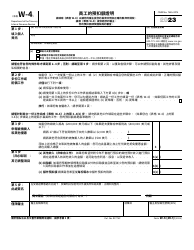

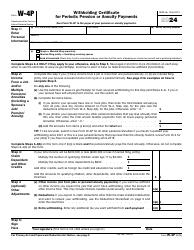

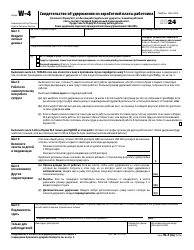

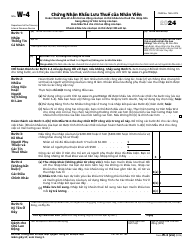

IRS Form W-4 Employee's Withholding Certificate

What Is IRS Form W-4?

IRS Form W-4, Employee's Withholding Allowance Certificate , is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

Alternate Names:

- Tax Form W-4;

- Federal W-4 Form;

- IRS Employee Withholding Form.

The objective of this tool is to facilitate the payroll process - the employees let the organizations that hired them understand how many allowances they are permitted to claim, how many dependents they name on their income statements, and how many adjustments must be taken into account if the individual has more than one job.

This document was released by the Internal Revenue Service (IRS) in 2024 , rendering older editions of the form obsolete. Download an IRS Form W-4 fillable version via the link below.

Check out the W-4 Series of forms to see more IRS documents in this series.

What Is a W-4 Form Used For?

Complete IRS Form W-4 and give it to your employer right after you are hired to tell the company how much money must be deducted from your paycheck for tax purposes. This statement summarizes the financial standing of the employee - whether they have multiple sources of income in their household, have no kids to take care of or provide for the entire family, or have extra income such as interest or dividends, it is crucial to inform your organization about the payroll taxes you expect them to deduct on your behalf before they file tax documentation with the IRS and send you the details.

Remember that this document may also be used to announce your tax-exempt status to the employer - some employees do not have a responsibility to pay income tax at all which means no deductions are required.

What Is the Difference Between a W-2 and a W-4 Form?

While both IRS Form W-4 and IRS Form W-2, Wage and Tax Statement, contain the description of income the employee receives alongside with their personal details, these forms are fundamentally different. Form W-4 is filled out by the employee as soon as their employment begins while Form W-2 is prepared by an employer who is supposed to inform their employers about their salaries and tax deductions that were already carried out. Moreover, Form W-4 is submitted by the employee to the HR office - you are not required to file it with tax organizations; Form W-2, on the other hand, must be filed with the IRS on an annual basis.

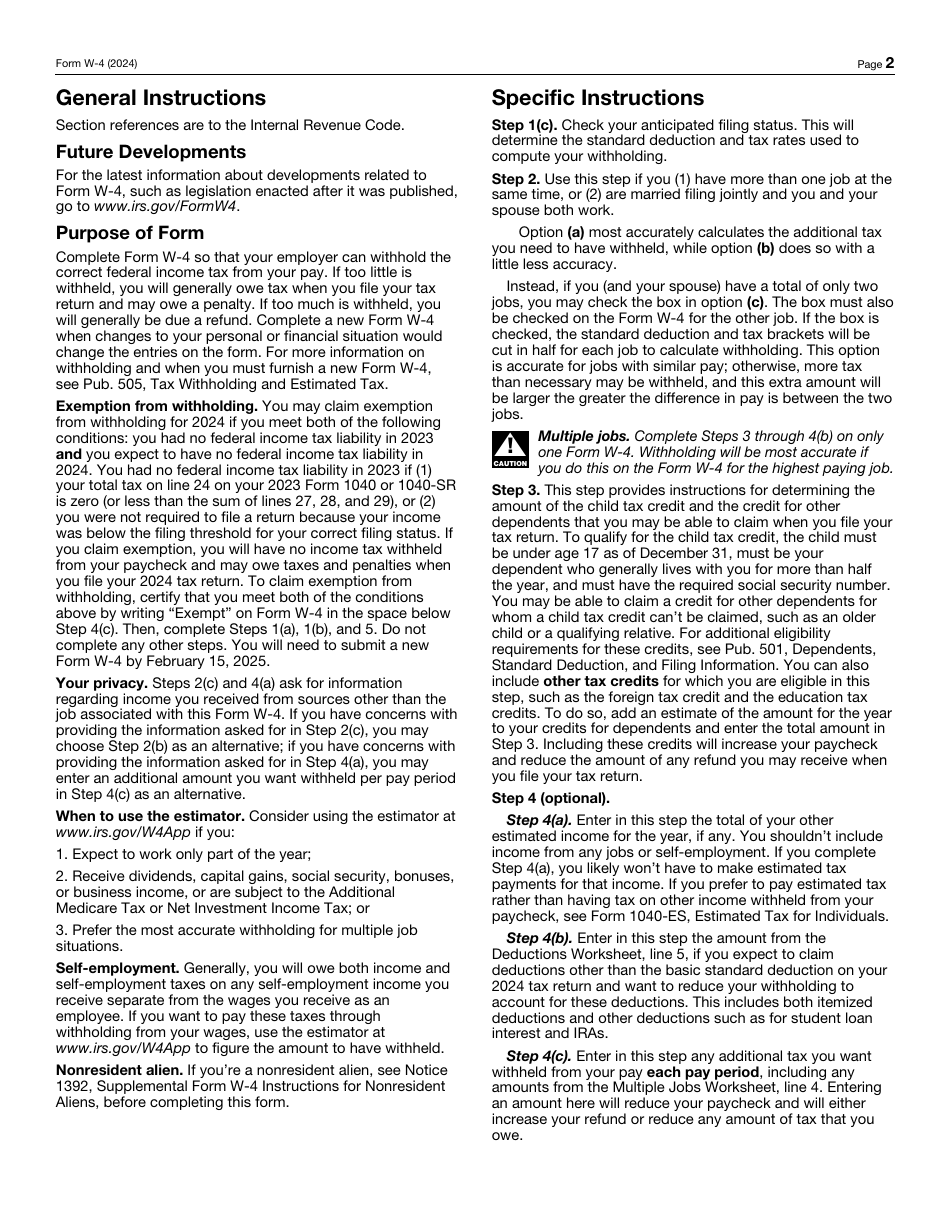

Form W-4 Instructions

Here is how you need to fill out the Federal W-4 Form:

-

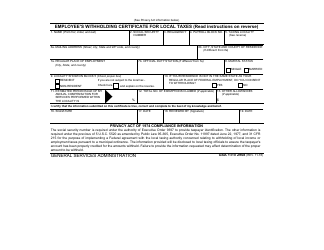

Identify yourself - write down your full name, social security number, and mailing address . Make sure the name you include in this document matches the one featured on your social security card. Check the appropriate box to confirm your filing status - either you are single, submitting tax returns with your spouse or separately from them, qualifying as a surviving spouse, or handling the majority of the household expenses.

-

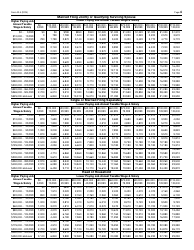

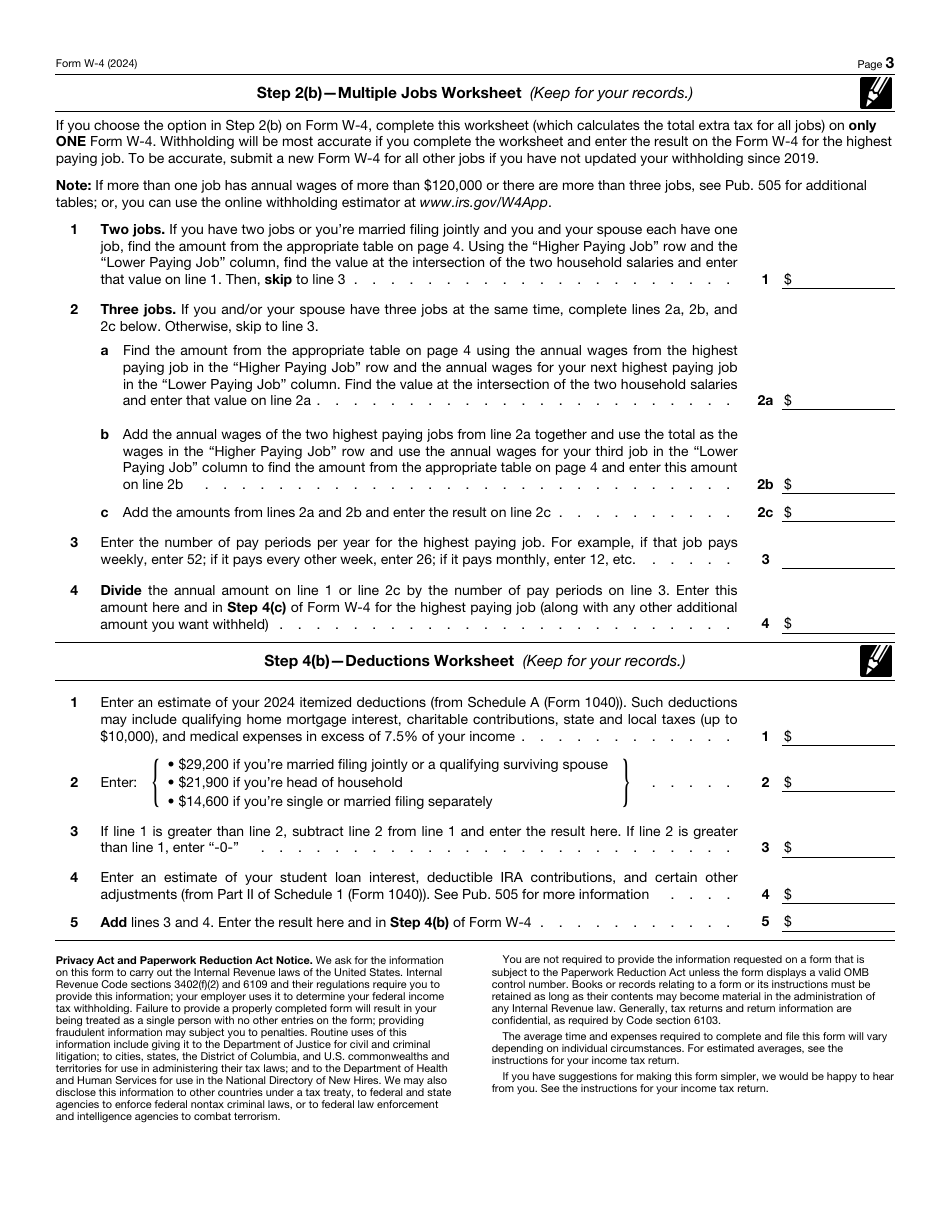

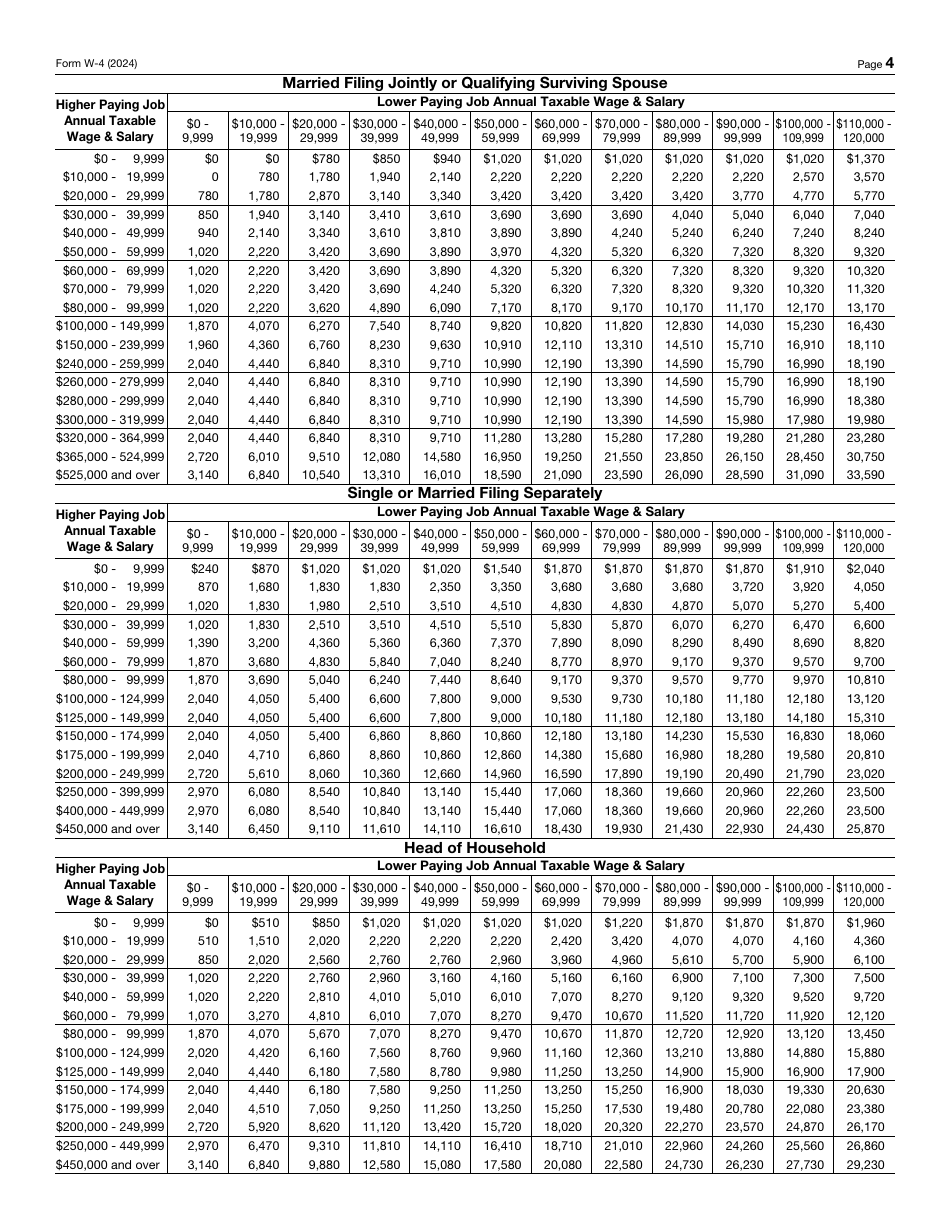

Complete the sections of the instrument that apply to your situation - you can skip the parts you do not relate to by simply leaving them blank . Otherwise, inform the employer about the other job you have or the job your spouse has in case you are filing income statements together. When filling out a W-4 Form, taxpayers need to be certain the deduction is as accurate as possible which is why they are given a choice when it comes to the calculation process. For instance, if you have two employers, just check the box and complete the other W-4 Tax Form the same way. Alternatively, you can make computations with the help of the worksheet on the third page of the form - use the formulas provided by the IRS, record the amount of extra deduction in the section devoted to adjustments, and retain a copy of the worksheet in your personal records.

-

Figure out the child tax credit amount you are entitled to claim and learn how big the credit for other dependents will be . Note that fiscal authorities have come up with the income threshold employees have to keep in mind when claiming various credits - $200.000 for single taxpayers and $400.000 for people that file tax returns with their spouses. You need to multiply the number of minor children by $2.000, multiply the number of other relatives you are supporting financially by $500, and combine the results.

-

In case you have other income that does not come from jobs or self-employment activities, indicate the estimated amount . Some employees would rather deal with estimated tax instead of deductions from their paychecks - they are advised to fill out IRS Form 1040-ES, Estimated Tax for Individuals. Refer to the worksheet that allows employees to claim additional deductions and write down the amount if needed.

-

Certify the documentation by signing and dating it . When you give the paperwork to the employer, they must identify the company by its name and address, add the date when you first worked as an employee, and list their employer identification number. Employees are encouraged to submit a new form every time their life circumstances change - for example, a person may get a divorce and file their tax documents on their own in the future.

How Can Claiming Dependents on a W-4 Form Benefit You?

Tax Form W-4 gives employees an opportunity to file a claim for certain allowances - while you are not obliged to list the personal details of minor children and other dependents you identify on your tax return, it is essential to state the number of people that qualify for tax credits. Naturally, if the employee has more than one dependent, the amount of the allowances will grow and the tax deducted from your wages will be lower. Employees must know that if they provide information about numerous credits related to their children and dependents, their paychecks will be bigger while the amount of potential refunds may decrease.

IRS W-4 Related Forms:

- IRS Form W-4P, Withholding Certificate for Pension or Annuity Payments is a document used by U.S. citizens, resident aliens, and their estates who receive annuities, pensions, and other deferred compensation. It is necessary to inform the payers of the accurate amount of federal income tax to be withheld from the payments.

- IRS Form W-4V, Voluntary Withholding Request is a document used to ask the payer to withhold federal income tax by individuals who receive social security payments, unemployment compensation, or other dividends and distributions that can be defined as a government payment.

- IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay is a document the employee needs to give to the third-party payer of the sick pay, for example, an insurance company if the employee wishes federal income tax withheld from the payments.