IRS Form 1099-C Cancellation of Debt

What Is IRS Form 1099-C?

IRS Form 1099-C, Cancellation of Debt, is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

Alternate Names:

- Tax Form 1099-C;

- Cancellation of Debt Form;

- Cancellation of Debt Tax Form.

If your financial entity has chosen to forgive a debt of a particular individual or company, it must be done as long as you comply with the reporting requirements established by the tax authorities - send the debtor a copy of the document and then furnish the same information to the government.

This statement was released by the Internal Revenue Service (IRS) in , making previous editions of the form outdated. You can download an IRS Form 1099-C fillable version via the link below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is Form 1099-C Used For?

Complete and submit the 1099-C Tax Form for every debtor whose debt of $600 or more is written off. It is the duty of the financial organization to remind the taxpayer about the canceled debt so that every person and entity fills out their annual income statement correctly and disclose the details of the cancellation to the IRS.

It is permitted to cancel or forgive the debt under certain circumstances - for example, the property was abandoned, the person who borrowed money to finance their mortgage had to give their house back due to their inability to handle their repayment obligations, or the taxpayer became bankrupt. Note that to be able to submit this form, your entity needs to meet certain criteria - only file the documentation if you represent the interests of a financial institution like a bank that operates domestically, an association that issues loans, a credit union, a government agency, or entity whose main purpose is to lend money. The debtor whose information is listed in the form may be an individual taxpayer, trust, corporation, or estate.

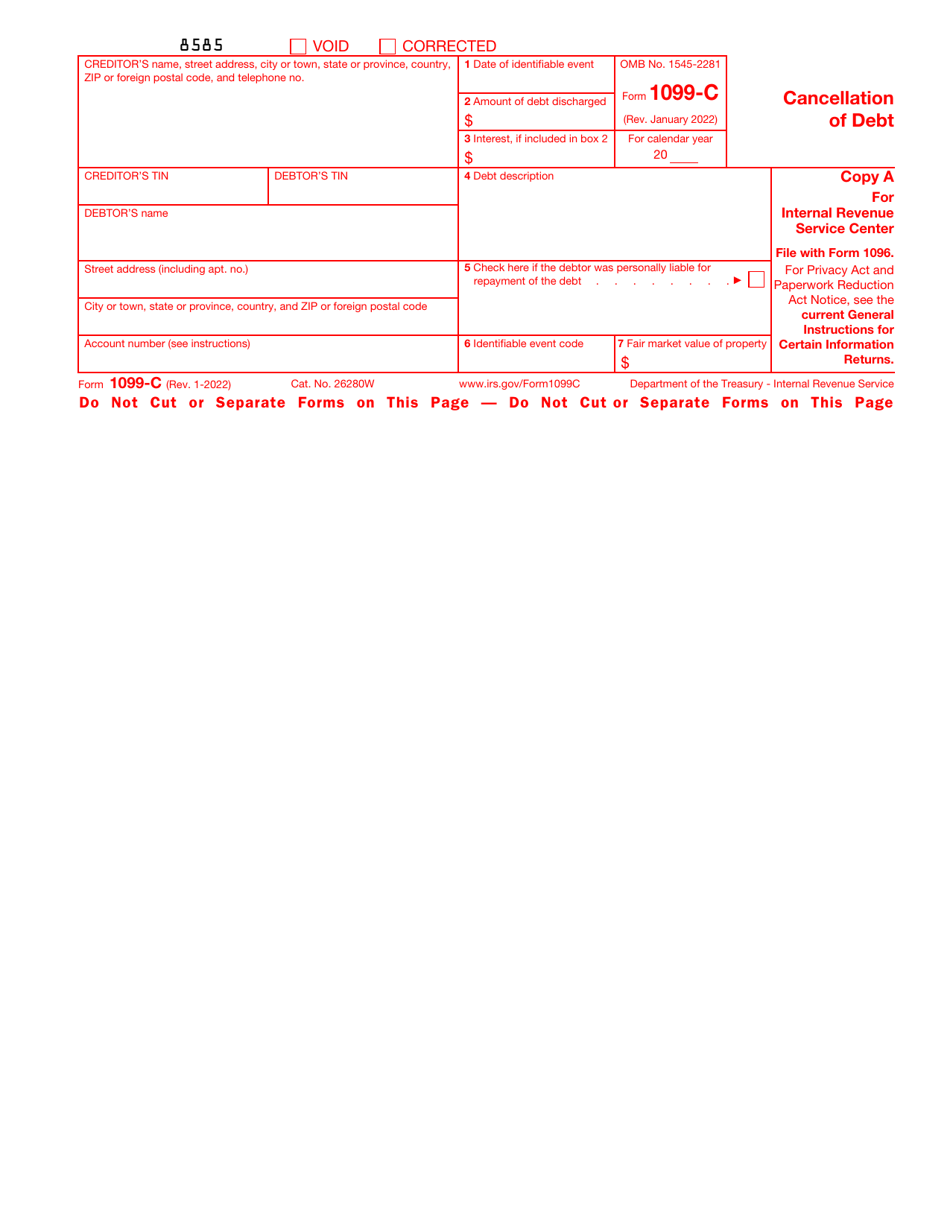

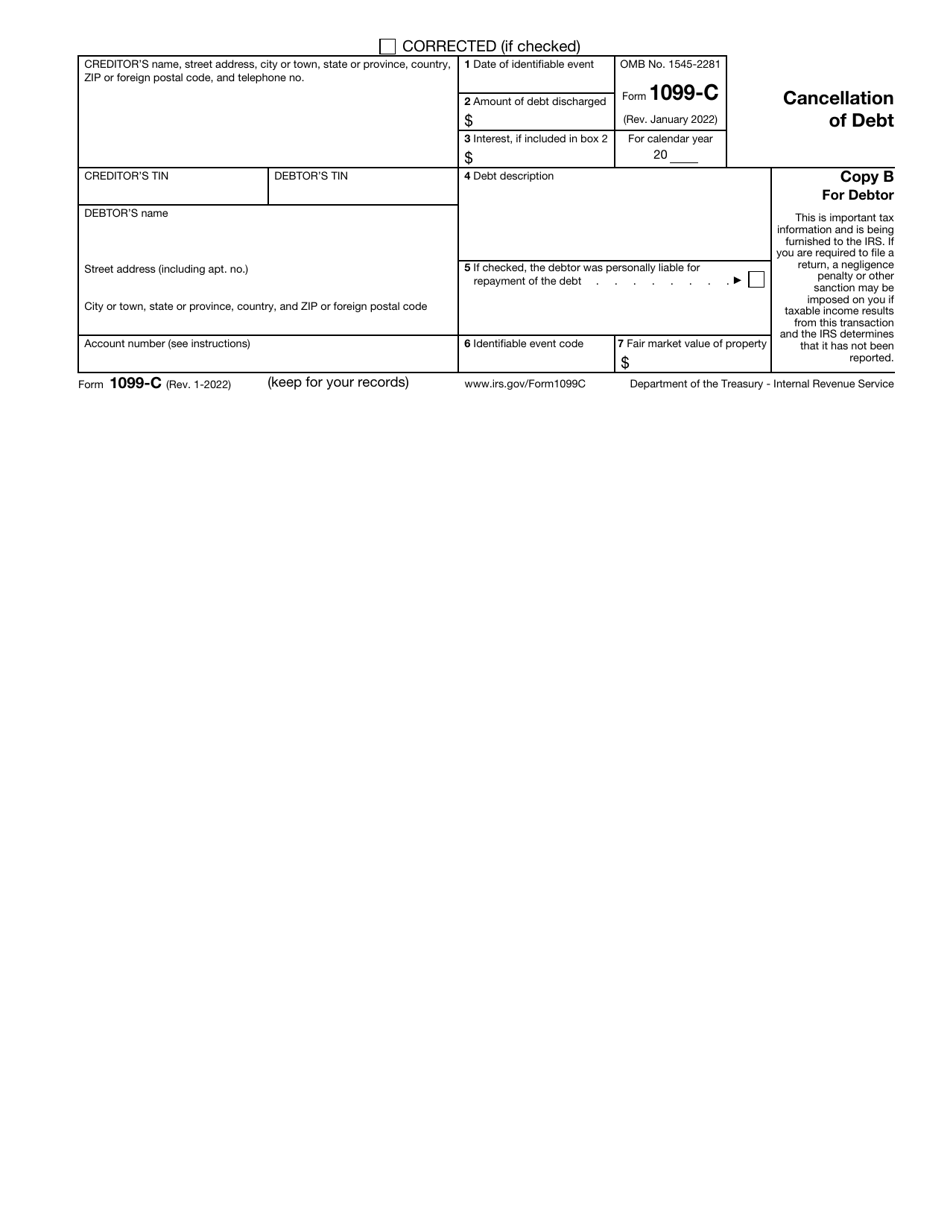

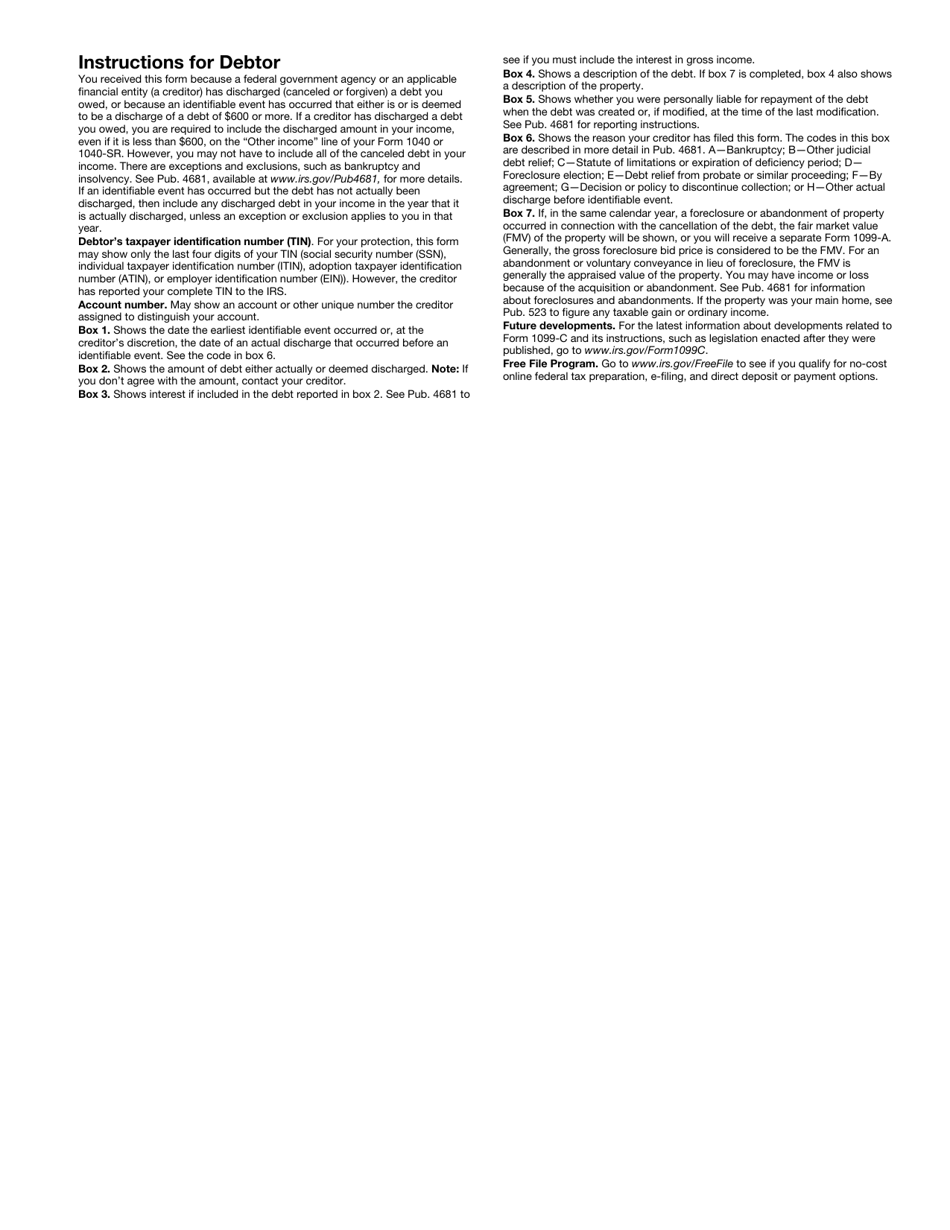

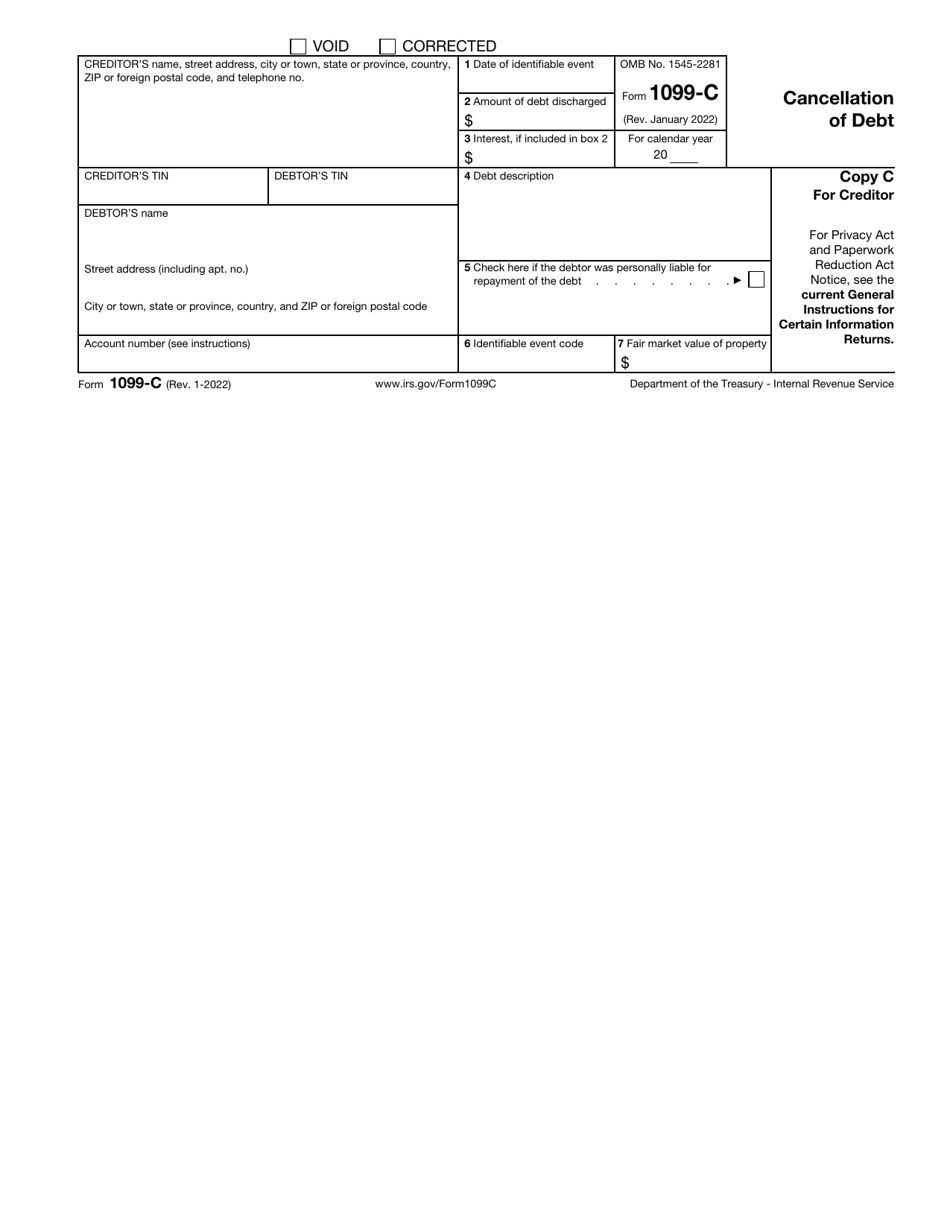

Form 1099-C Instructions

Follow these Form 1099-C Instructions to outline the forgiveness and cancellation of debt your debtor used to owe you:

-

Check the appropriate box to void the completed copy of the form to let the IRS know they have to disregard the return in question or correct the information you sent to fiscal authorities previously.

-

Identify the creditor that prepares the return - state the name of your entity, its taxpayer identification number, correspondence address, and telephone number. Record the details of the debtor - their full name, taxpayer identification number, and the number of the account in case they have more than one account with your entity and you have to differentiate between them.

-

Write down the date of the event that allowed you to cancel the debt. If you decided to go through with the cancellation before it happened, you must indicate the date of cancellation instead. Specify the debt amount and interest if the amount includes it. Briefly summarize the debt - you are not obliged to add too many particulars in this field, it is possible to simply explain the debt was a student loan or home mortgage.

-

Put a tick in the appropriate box to confirm the debtor identified in the paperwork had personal liability to repay the debt when it was established or at the moment it was modified for the last time. To further elaborate on the nature of the event that gave you the opportunity to cancel the debt, refer to IRS Publication 4681 and find the code assigned to the event. Enter the value of the property in case you are reporting a foreclosure or a sale of a similar kind.

-

Once the paperwork is ready, submit it to the IRS by the end of February. The due date is different for taxpayers that opt for e-filing - they are expected to send the information by the last day of March that follows the year described in the Tax Form 1099-C. Remember that it is required to provide debtors with copies of the form earlier so that they are able to fill out their own tax documentation on time - send the instrument to every debtor by January 31.

Where to Report 1099-C?

The Form 1099-C mailing address depends on your place of residence:

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury, Internal Revenue Service Center, P.O. Box 219256, Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201 |

| Your place of residence or a principal place of business is outside the U.S. | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301 |

What Is a 1099-C Cancellation of Debt Notice?

When you resolve a debt, you may receive a 1099-C notice in your mail. The IRS considers canceled or forgiven debt as income. If you receive this form from a lender, you need to report the portion of the waived debt on that document to the IRS as taxable income. Enter the canceled amount on the "Other Income" line of your Form 1040, U.S. Individual Income Tax Return. The 1099-C tax rate you pay is the same as if you received the income as salary or wages. File Form 1099-C in the year that follows the reporting year in which the identifiable event occurs.

However, there are situations when income from a canceled debt is not taxable - 1099-C exceptions include certain bankruptcies, interest, non-principal amounts (fines, fees, penalties, and administrative costs), foreign debtors, guarantors and sureties, and 1099-C insolvency cases (taxpayers owe more in debt that they have in assets).