Tax Deductions Guide: How to Get the Most out of Your Tax Return

Tax deductions are tax incentives that can save you a lot of money if you know how they work, what tax deductions you qualify for, and how to claim them. Read on to learn about the best tax deductions and the ways to get the maximum refund.

What Is a Tax Deduction?

A tax deduction results in a reduction of your taxable income. This money-saver will decrease the overall amount paid towards taxes. The lower the taxable income, the lower your tax bill.

Difference Between Tax Deduction and Tax Credit

Unlike a tax deduction, a tax credit lowers the tax bill directly, dollar-for-dollar. If you qualify for a tax credit, you will lower the tax owed to the IRS by the exact amount of this credit, while a tax deduction will reduce the amount of money subject to taxation. You can learn about the difference between these two tax savings methods by following this link.

How to Claim Tax Deductions?

The IRS offers taxpayers two means of claiming tax deductions – a standard deduction or itemizing deductions. It is not allowed to claim both, so choose one option. Find out the main characteristics of these two categories of tax deductions below.

How to Claim Standard Deduction?

A standard deduction is a set amount of money that taxpayers automatically subtract from their Adjusted Gross Income (AGI). The size of this deduction depends on your income, age, and filing status. The standard tax deduction has grown significantly in recent years, so consider this option now even if you have itemized in the past. If you file your tax return in 2020, a flat-dollar standard deduction is as follows:

| Single | $12,200 |

| Married (filing separately) | $12,200 |

| Married (filing jointly) | $24,400 |

| Head of the household | $18,350 |

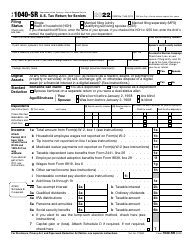

To claim a standard deduction, check the appropriate boxes on the first page of IRS Form 1040, Individual Income Tax Return. There are additional standard deduction amounts for certain individuals:

| 65 or older | $1,650 |

| Married filing jointly + you or your spouse is 65 or older | $1,300 |

| Married filing jointly + both you and your spouse are 65 or older | $2,600 |

| Legally blind | $1,650 |

| Married filing jointly + you or your spouse is blind | $1,300 |

| Married filing jointly + both you and your spouse are blind | $2,600 |

When Is It Better to Itemize Deductions?

Many contributions and costs may be deductible – student loan interest, mortgage interest, charitable gifts, medical expenses, and business-related costs. You may deduct these individual expenses on your tax return by itemizing deductions.

If the sum of your itemized deductions is more than the standard deduction, it will be wiser to itemize and save money. To itemize taxes, you need to attach an IRS Schedule A to your Form 1040. List the tax deductions you qualify for and enter the total on Form 1040. You will also need additional proof to itemized deductions – sales tax records, receipts for medical expenses, records of your charitable donations, etc.

What Are the Best Tax Deductions for 2020?

Check out our list of tax deductions and find out how much money you can get from them.

| Type | How much you can deduct | Related tax form |

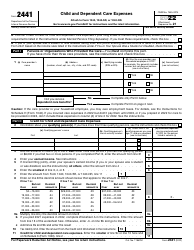

| Child and Dependent Care Credit | 20%-35% of $3,000 of daycare and other costs for one dependent or child | File Form 2441 to calculate and claim |

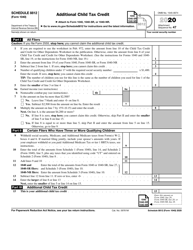

| Child Tax Credit | $2,000 per child ($500 for other dependents). | File Schedule 8812 (Form 1040) to figure out child tax credit |

| Adoption Credit | $14,080 | File Form 8839 to figure the amount of adoption credit and any employer-provided benefits |

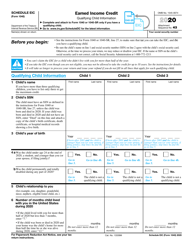

| Earned Income Tax Credit | Between $529 and $6,557 | File Schedule EIC (Form 1040) to calculate and claim |

| Student Loan Interest Deduction | $2,500 | See Form 1098-E for more information |

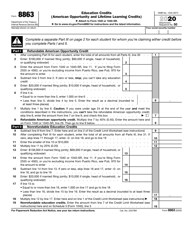

| American Opportunity Tax Credit | All of the first $2,000 spent on tuition and school expenses | Complete Form 8863 and submit along with Form 1040 or Form 1040-SR to the IRS |

| Lifetime Learning Credit | $2,000 - 20% of the first $10,000 paid toward tuition and school fees | |

| Mortgage Interest Deduction | Interest on the first $750,000 of the mortgage | See Form 1098 for information on how to file |

| Gambling Loss Deduction | Any amount to the extent of gambling winnings | Read the description for Form W-2G for more information |

| Individual Retirement Account (IRA) Contributions Deduction | $6,000 for people under 50, $7,000 for people 50 years old and older | See Form 8606 and Form 5498 for more information |

| 401(k) Contributions Deduction | $19,000 ($25,000 for people 50 years old or older) | Deducted automatically |

| Charitable Donations Deduction | 60% of your AGI via charitable donations made throughout the year | Fill out Form 8283 and attach it to your return |

| Medical Expenses Deduction | Unreimbursed expenses (more than 10% of your AGI) | Include medical expenses on Schedule A (Form 1040) |

| Home Office Deduction | Direct and indirect expenses based on the percentage of your home used for business | Use Form 8829 and Schedule C (Form 1040) |

| Educator Expenses Deduction | $250 spent by teachers on classroom supplies | Claim this deduction on Form 1040 or Form 1040NR |

| Residential Energy Credit | 30% of the installation cost of solar energy systems. File Form 5695 to calculate. | File Form 5695 with the IRS to claim |

| Deduction for State and Local Taxes | $10,000 ($5,000 if married filing separately) | Withheld state and local income taxes will show up on your Form W-2 |

| Saver’s Credit | $2,000 in contributions to retirement plans ($4,000 if filing jointly) | See instructions for Form 8880 for more information |

| Health Savings Account Contributions Deduction | $3,500 ($7,000 if you have family high-deductible coverage) | File Form 8889 to report contributions and figure out deductions |

| Self-employment Expenses Deduction | Various bonuses for freelancers and contractors | File Schedule C-EZ or Part II of Schedule C (Form 1040) |