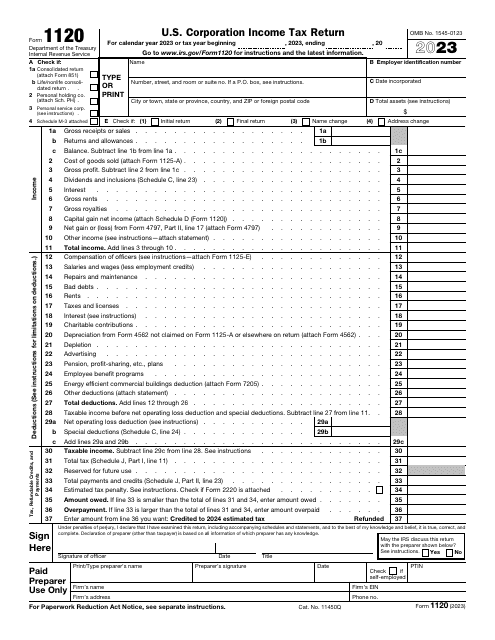

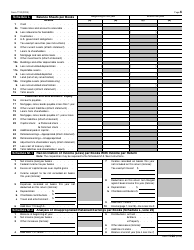

IRS Form 1120 U.S. Corporation Income Tax Return

What Is IRS Form 1120?

IRS Form 1120, U.S. Corporation Income Tax Return, is a formal document filed by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

Alternate Names:

- Corporation Tax Return;

- Tax Form 1120;

- Federal Form 1120.

If you manage a corporation or a business that decided to change its status to corporate one and have the same tax responsibilities and benefits corporations have, it is your duty to report your income and capital gains and losses using this form - domestic entities fill out the paperwork using the records and financial statements they have accumulated over the year and state the total amount of tax they will pay.

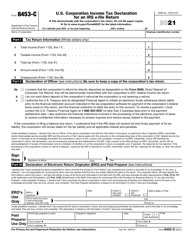

This form was issued by the Internal Revenue Service (IRS) in 2023 - older editions of the tax return are now obsolete. You can download an IRS Form 1120 fillable version through the link below.

Check out the 1120 Series of forms to see more IRS documents in this series.

What Is Form 1120 Used For?

The purpose of Tax Form 1120 is to report the tax liability of a particular corporation to fiscal authorities as well as calculate how much tax they need to pay for the tax period covered in the form. This document provides a summary of all sources of income the corporation has earned during the calendar or fiscal year and certifies the right of the entity to get certain credits and deductions.

Who Files Form 1120?

A 1120 Form must be completed and filed if your business is a domestic corporation whether you have any taxable income to report for the previous tax period or not. The list of corporations that have a duty to submit this form includes organizations that made an election to be treated as corporations, limited liability companies, entities involved in the farming trade, and investment vehicles that finance development in opportunity zones.

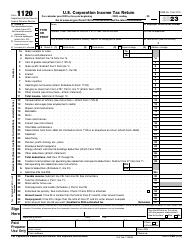

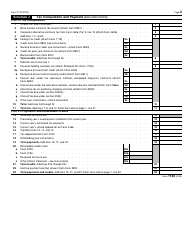

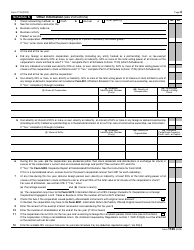

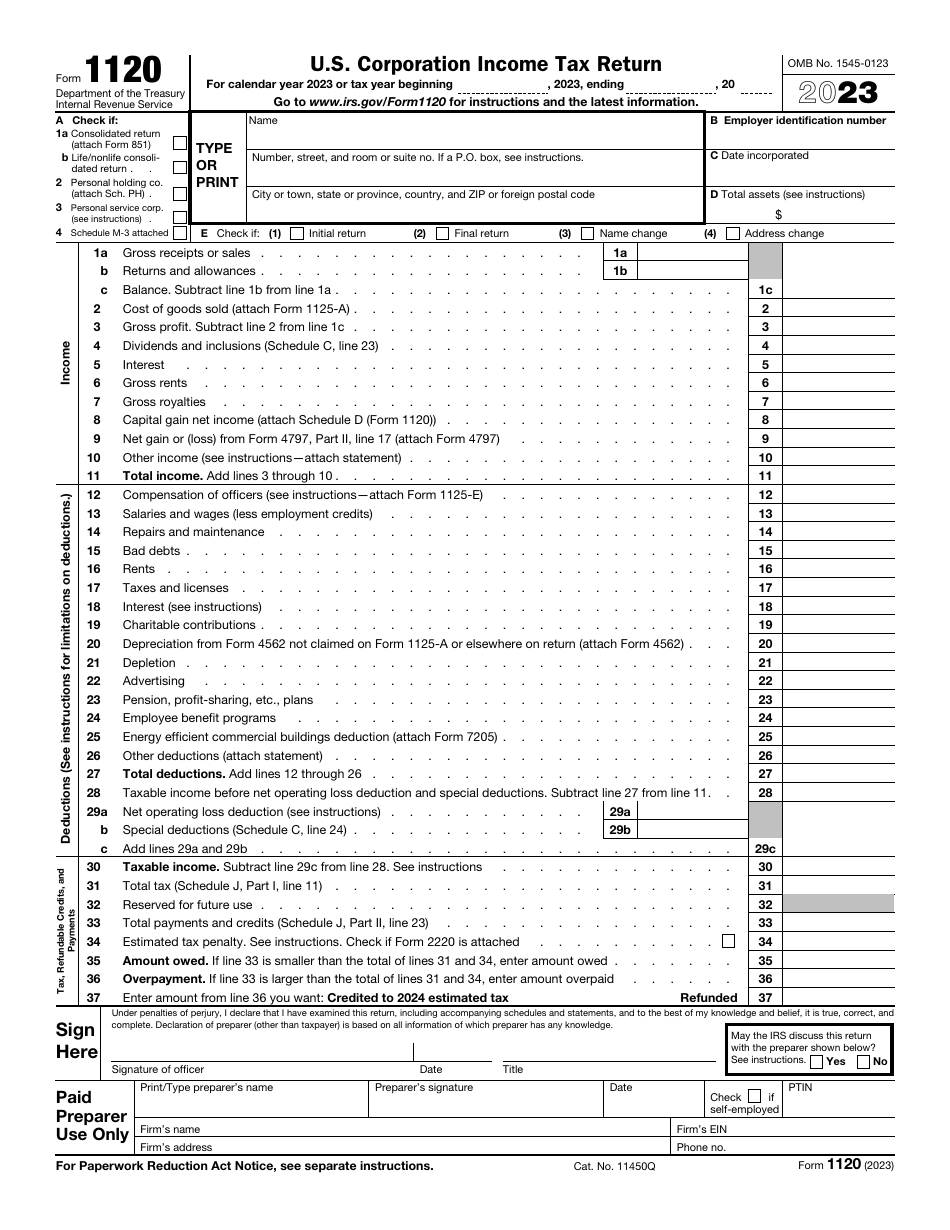

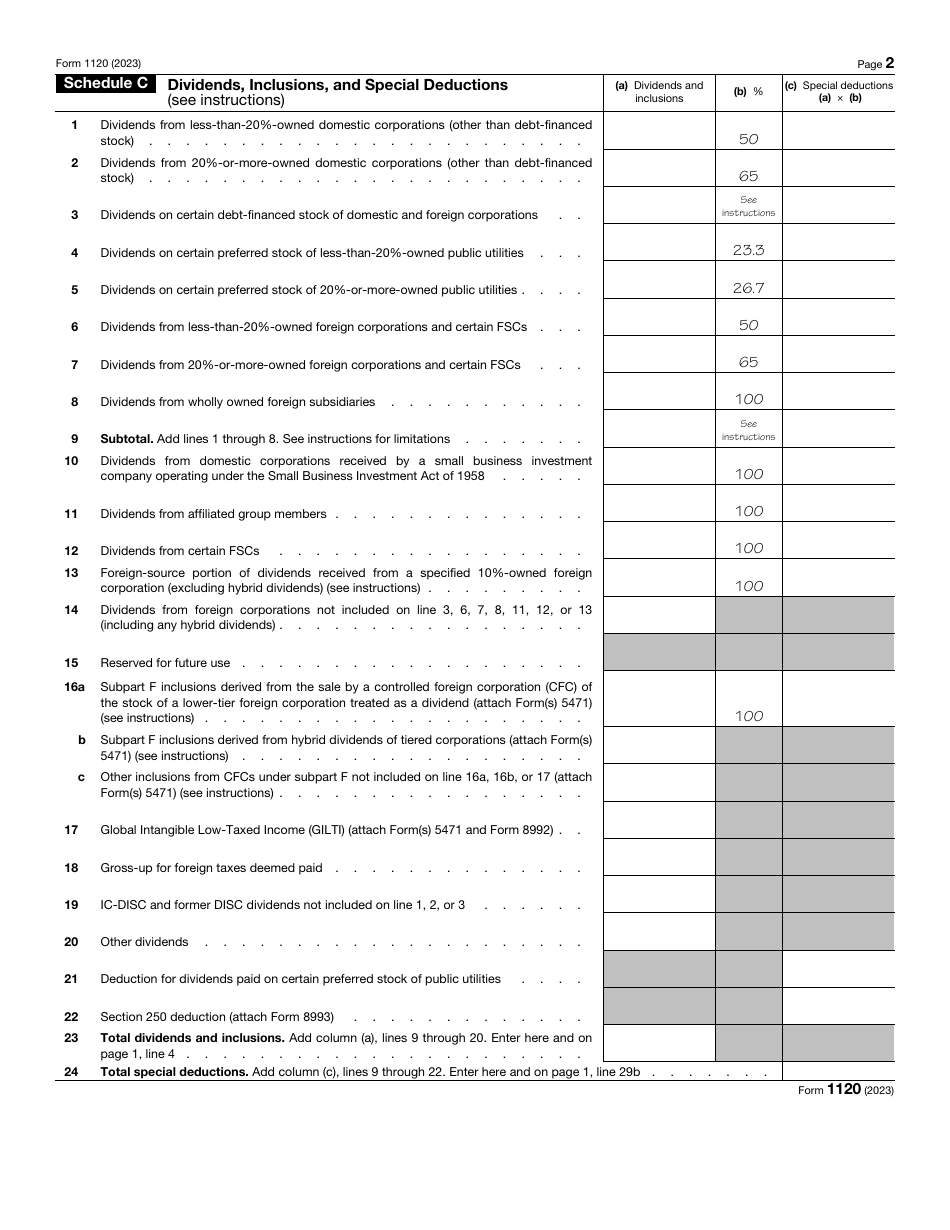

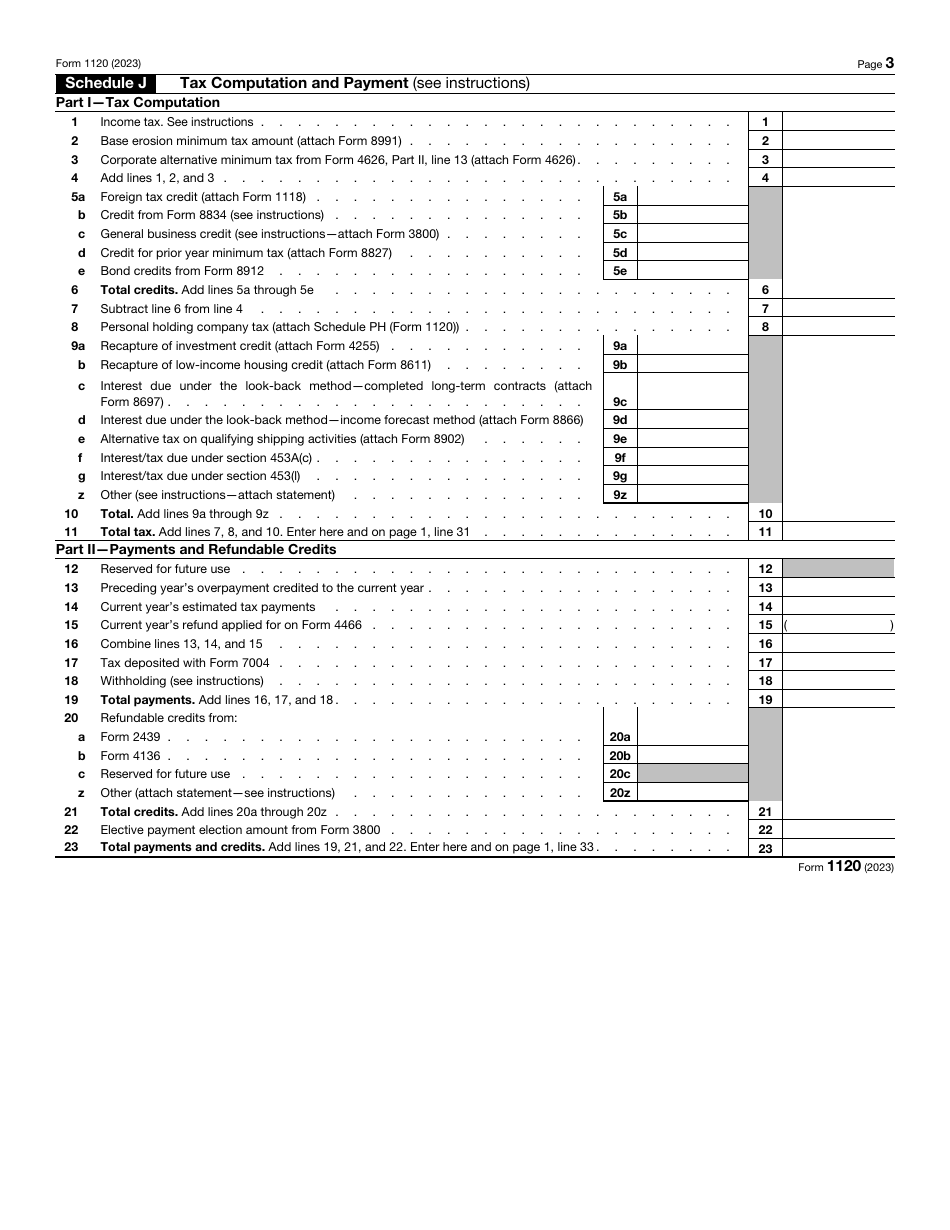

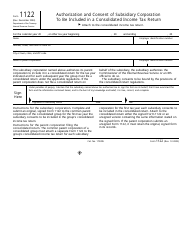

IRS Form 1120 Schedules

- Schedule B (Form 1120), Additional Information for Schedule M-3 Filers. Filers of Schedule M-3 (Form 1120) use this schedule to provide answers to additional questions.

- Schedule D (Form 1120), Capital Gains and Losses, is used to estimate the overall gain or loss from transactions reported on Form 8949, as well as to report certain transactions not reported on Form 8949, and to report capital gain distributions not reported on Form 1120.

- Schedule G (Form 1120), Information on Certain Persons Owning the Corporation's Voting Stock, is used to provide information applicable to certain individuals, entities, and estates that own, directly, at least 20%, or own, directly or indirectly, at least 50% of the total voting power of a corporation's voting stock.

- Schedule H (Form 1120), Section 280H Limitations for a Personal Service Corporation (PSC), is used by PSCs to determine if they meet the minimum distribution requirement for the tax year, or to estimate the limits on deductions if the requirement were not met.

- Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations with Total Assets of $10 Million or More, is filed to answer the corporation's financial statements questions and to reconcile financial statement net income (loss) for the corporation to the net and taxable income reported on Form 1120.

- Schedule N (Form 1120), Foreign Operations of U.S. Corporations, may be filed if the corporation had assets in or operated a business in a foreign country.

- Schedule O (Form 1120), Consent Plan and Apportionment Schedule for a Controlled Group, is used to consent to an apportionment plan and allocated income, taxes, or other items.

- Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax, is used by a Personal Holding Company (PHC) to compute tax and is then filed with every PHC return.

- Schedule UTP (Form 1120), Uncertain Tax Position Statement, is used by corporations that issue or are included in audited financial statements and have assets equal or greater than $10 million to provide information on tax positions that affect their federal income tax liabilities.

Form 1120 Instructions

The IRS Form 1120 Instructions are as follows:

-

Specify the tax period you are going to outline in the form. Check the boxes that apply to you - for example, if the documentation is filed on behalf of the affiliated group, you have to tick the appropriate box and attach IRS Form 851, Affiliations Schedule, to the instrument. Indicate the name of your corporation, its taxpayer identification number, the date it was incorporated, the total amount of assets, and its current correspondence address. Confirm a name change or address change if necessary and point out whether you are sending an initial or final return.

-

List the categories of income the corporation was able to generate throughout the year - from the cost of goods you sold to rental payments. Write down the amounts of deductions that apply in your case whether you paid salaries to employees, spent funds on advertising, or made contributions to charitable organizations. Use the guidelines and formulas in the document to figure out how much tax you owe - if you paid too much tax, it is possible to ask for a refund right away. Certify the paperwork - you must add your title, signature, and date. The tax professional that assisted you with the document is supposed to identify themselves as well - check the box to confirm you are letting tax organs reach out to them directly to discuss the information from this tax return.

-

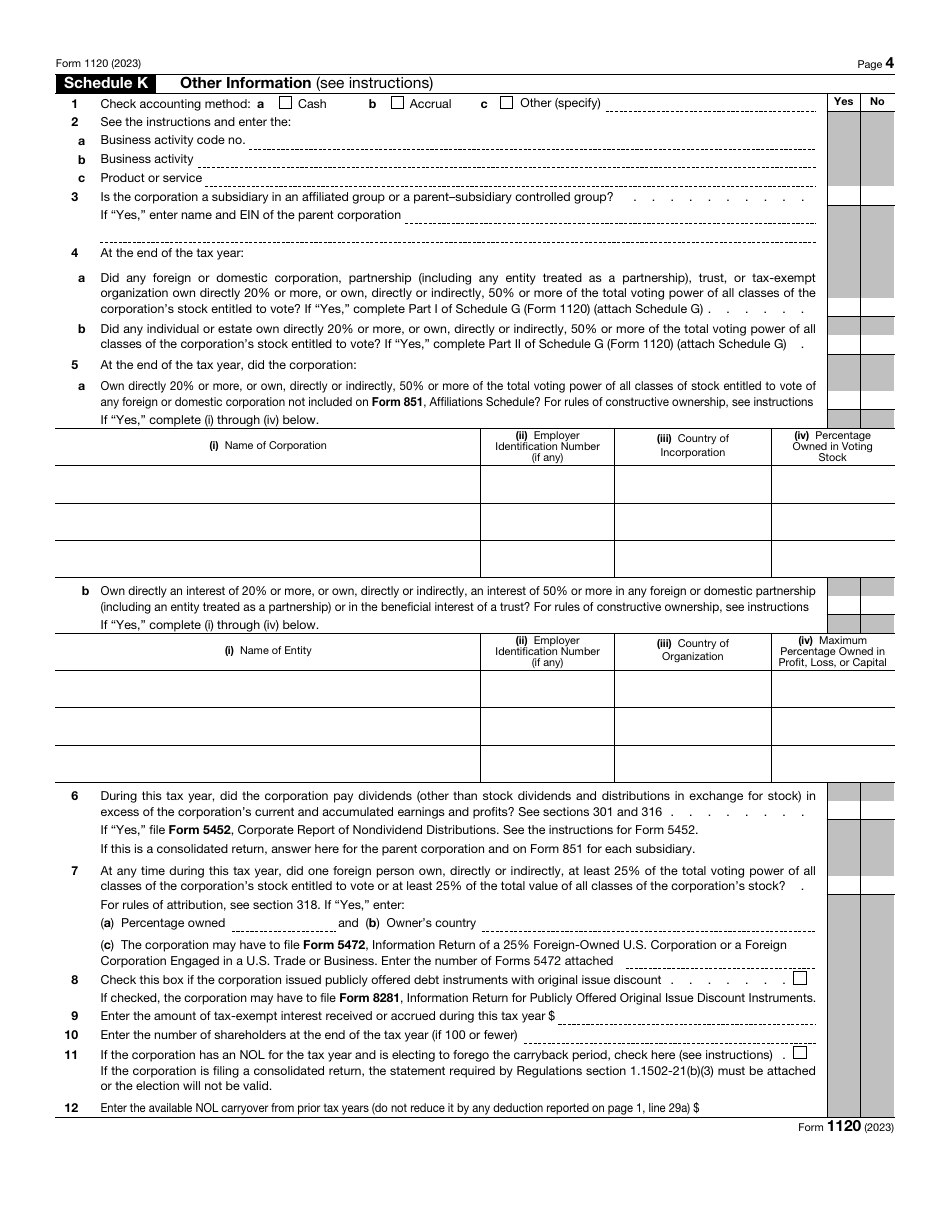

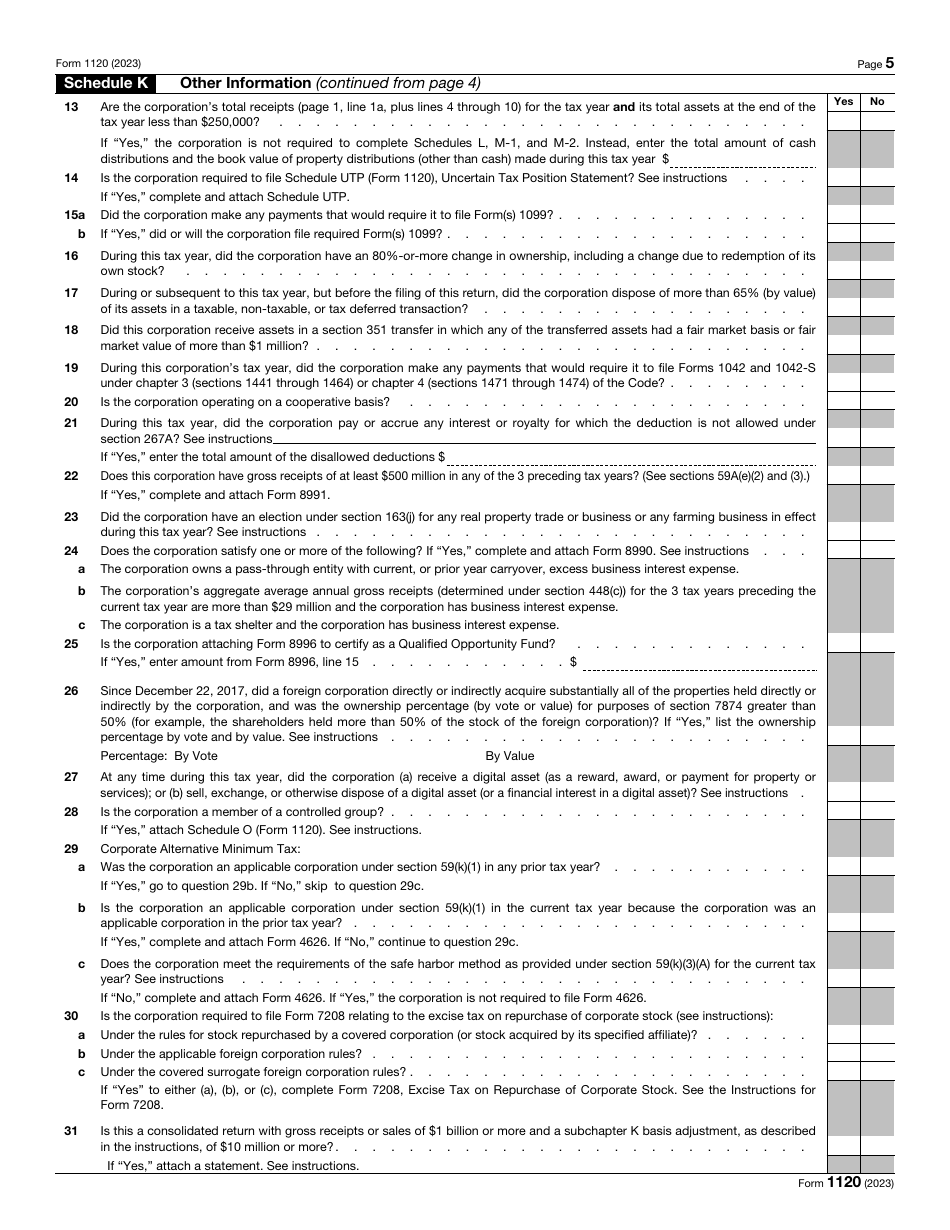

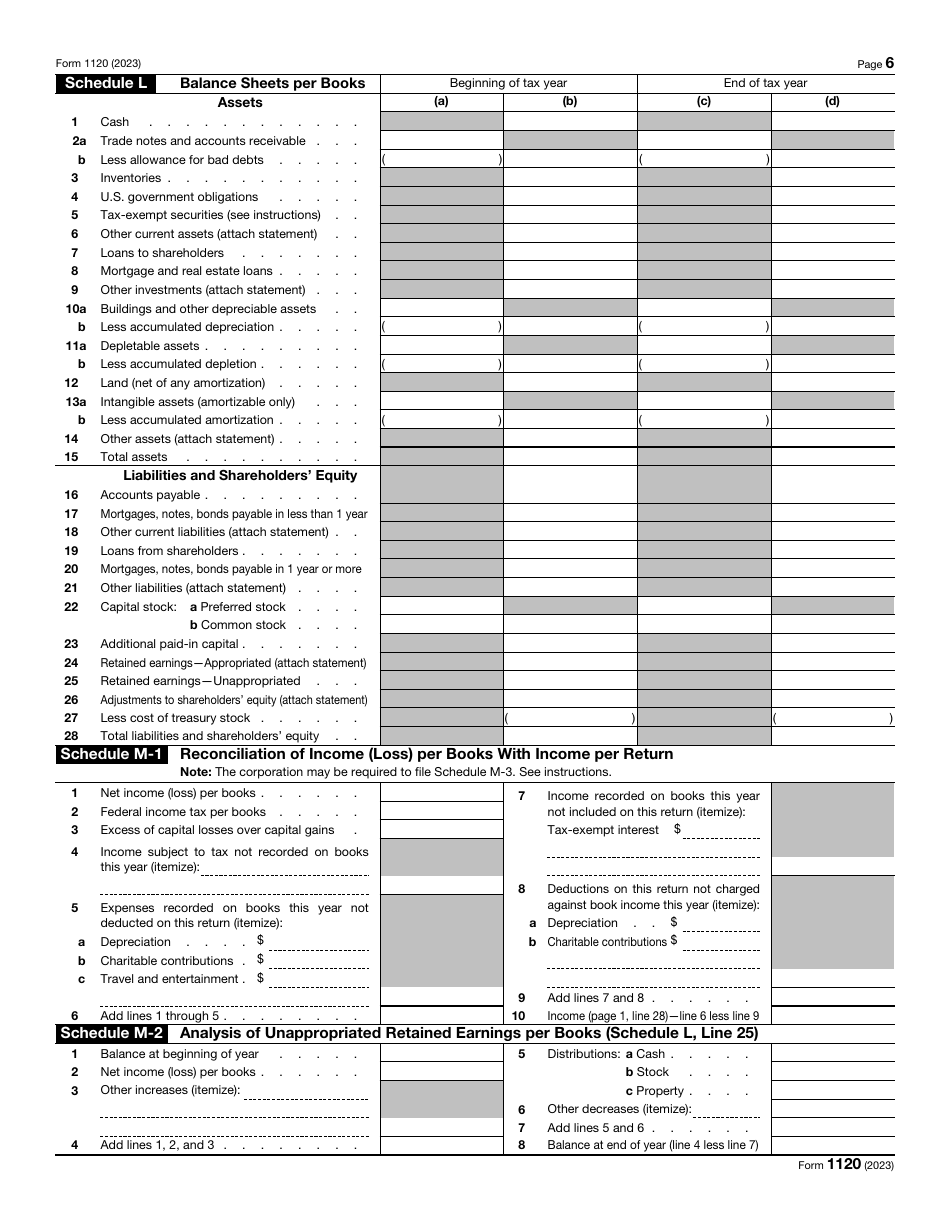

Fill out the schedules to disclose more details about your corporation. Those schedules are an integral part of the form that allow the taxpayer to categorize their dividends, compute the tax and claim tax credits the corporation is entitled to receive, provide specifics about their business activities, accounting, and affiliated businesses, specify the amount of assets at the start and at the end of the tax period, elaborate on the earnings of shareholders, and reconcile the financial documentation of the entity.

When Is Form 1120 Due?

Form 1120 due date is the fifteenth day of the fourth month of the year that comes after the end of the previous calendar year you are describing in writing or the end of the alternative tax period covered in the form. The same deadline applies if you dissolved your corporation. Taxpayers that understand their inability to comply with the filing requirement on time are advised to inform fiscal authorities about it in advance - file IRS Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to qualify for a Form 1120 extension.

Where to Mail Form 1120?

Here is how you are supposed to select the correct Form 1120 mailing address:

-

If your entity is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming, send the paperwork to the Department of the Treasury, IRS Center, Ogden, UT 84201-0012.

-

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin corporations are obliged to mail the form to the Department of the Treasury, IRS Center, Kansas City, MO 64999-0012 in case the total amount of assets is lower than $10 million and they are not filing Schedule M-3. However, if the assets equal or exceed $10 million or the Schedule M-3 is a part of the filing package, the address is the Department of the Treasury, IRS Center, Ogden, UT 84201-0012.

-

File the document with the IRS Center, P.O. Box 409101, Ogden, UT 84409 if you are carrying out your operations in the U.S. territory or abroad.

Note that if you represent a corporate group whose members operate in different areas yet you prefer to retain your records and books in the office of the main corporation, you are permitted to submit the documentation to the service center closest to the corporation in question. Entities with the obligation to file ten or more returns must do it electronically - otherwise, taxpayers get to choose between paper filing and e-filing.

IRS 1120 Related Forms:

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations to report their income, gains, losses, deductions, and credits, and to figure their U.S. income tax liability.

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form used to report the income, gains, losses, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation.

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability.

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners' association files this form to be able to exclude exempt function income from its gross income.

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is filed by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. This form is filed by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability section 527.

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies use this form to report income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this form to report income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, and the section 4951 initial taxes.

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, apart from life insurance companies.

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporations, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated Investment Companies (RIC) file this form to report their income, deductions, gains, losses, credits, and to calculate their income tax liability.

- 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B). Qualified settlement funds file this form to report transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability.

- Form 1120-W, Estimated Tax for Corporations. Corporations use this form to estimate their tax liability and to figure the amount of their estimated tax payments.

- Form 1120-X, Amended U.S. Corporation Income Tax Return. This form is used by corporations to correct a Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make certain elections after the prescribed deadline.