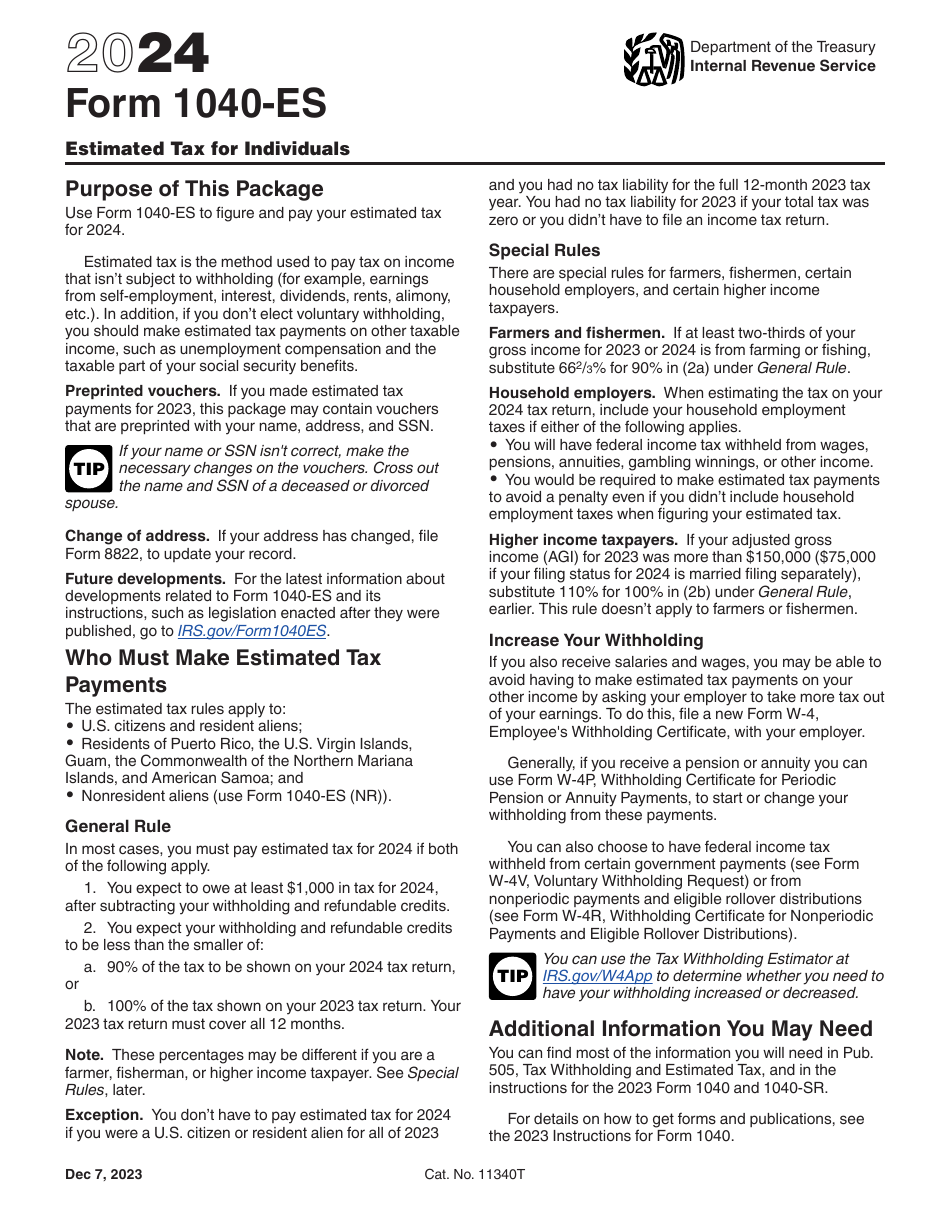

IRS Form 1040-ES Estimated Tax for Individuals

What Is IRS Form 1040-ES?

IRS Form 1040-ES, Estimated Tax for Individuals , is a fiscal instrument that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

Alternate Names:

- Tax Form 1040-ES;

- IRS Estimated Tax Form;

- Estimated Tax Form.

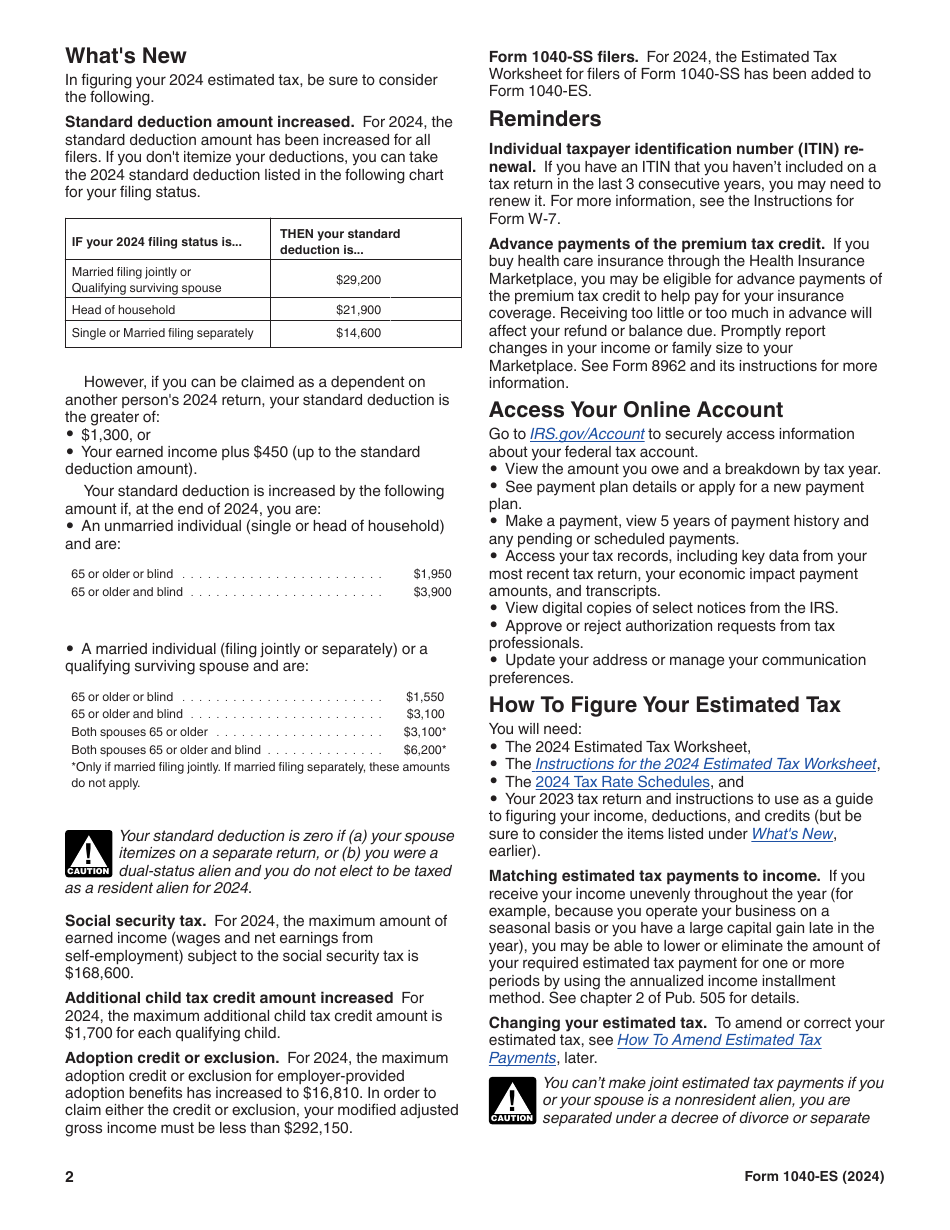

If the amount of tax equaled or exceeded $1,000 and the tax deductions and credits that reduce your tax liability are below 100% of the amount you must pay in 2023 (90% in 2024), it means you can pay taxes this way.

This statement was issued by the Internal Revenue Service (IRS) on December 7, 2023 , making previous editions of the form obsolete. You may download an IRS Form 1040-ES fillable version through the link below.

What Is Form 1040-ES Used For?

The 1040-ES Tax Form must be prepared and submitted by individuals that pay estimated tax. While regular employees have taxes deducted from their wages and salaries, this is not the case for every person with tax obligations - for instance, freelancers and independent contractors do not have to deal with tax deductions. However, this does not absolve them from the responsibility to pay tax after receiving income. In a similar way, people that receive various benefits from governmental units, compensation for being out of work through no fault of their own, and individuals that get dividends and interest still have to calculate the tax they owe to fiscal authorities.

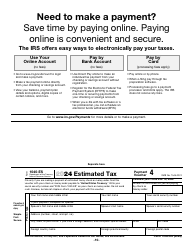

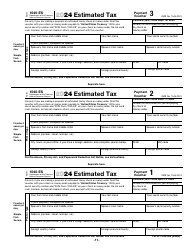

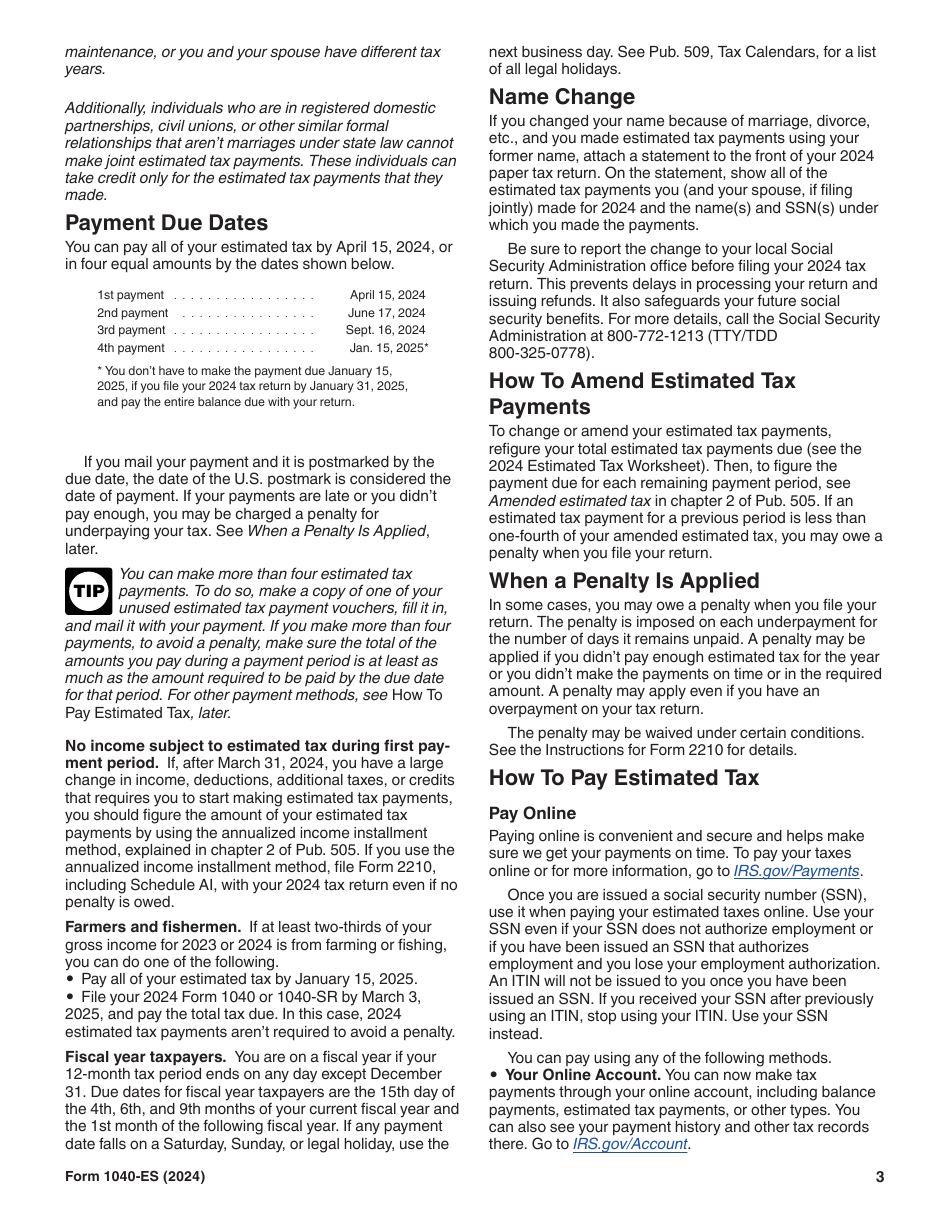

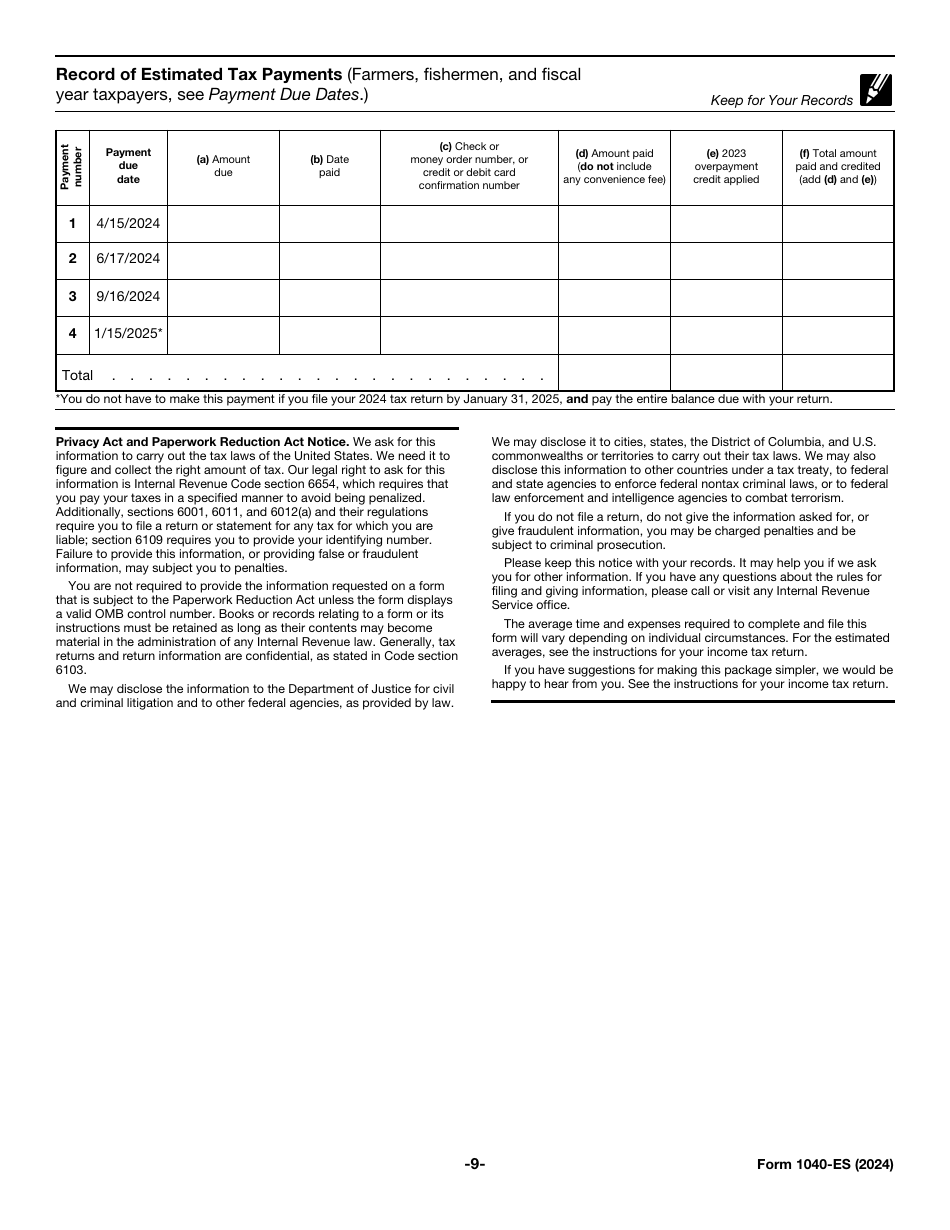

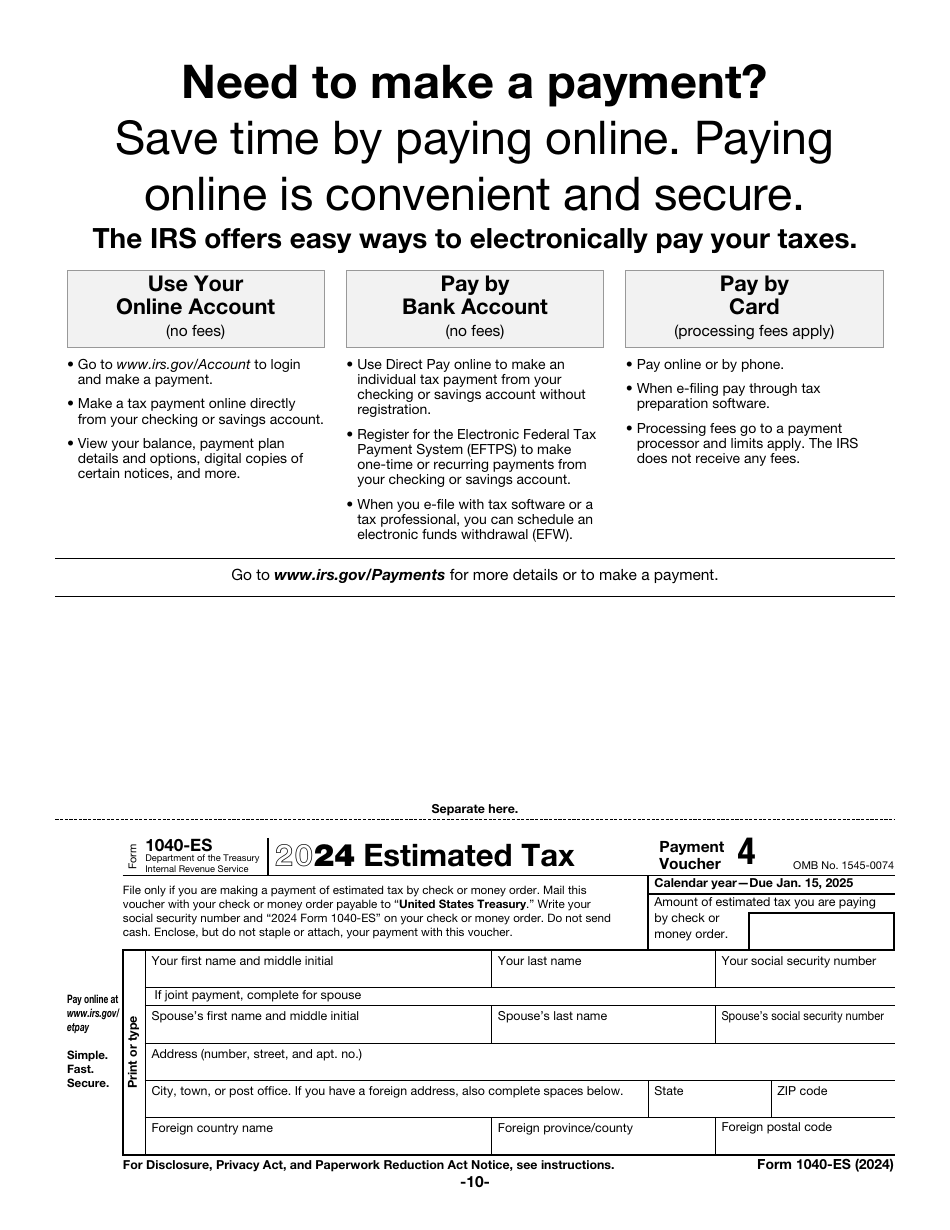

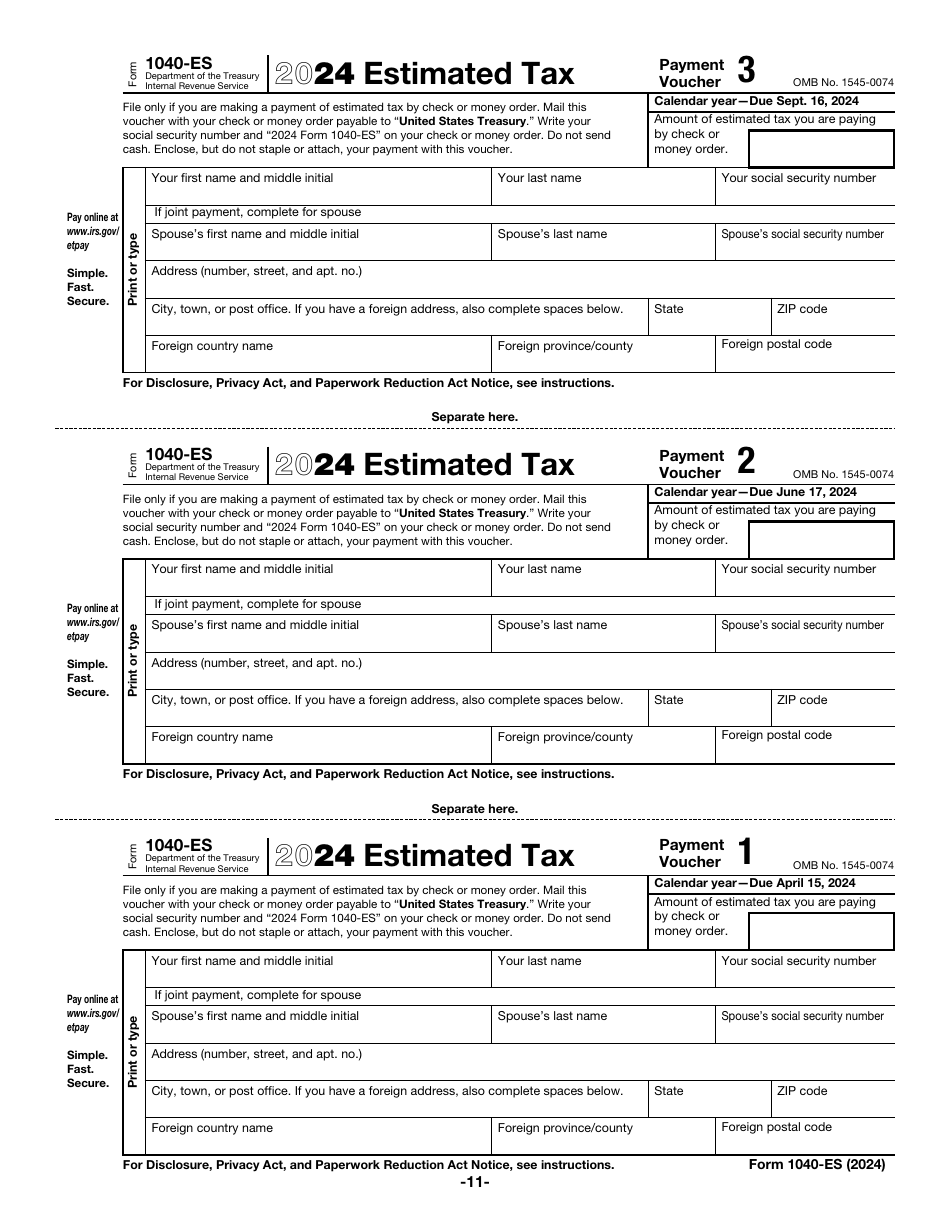

The Form 1040-ES payment voucher serves as a tool to identify the payer and confirms the amount of payment they sent to the IRS. There are four of those vouchers featured in the document - file them with tax organs before the due date specified in writing comes. The regulations above do not pertain to nonresident aliens - instead, taxpayers with this status are supposed to fill out and submit IRS Form 1040-ES (NR), U.S. Estimated Tax for Nonresident Alien Individuals.

Form 1040-ES Instructions

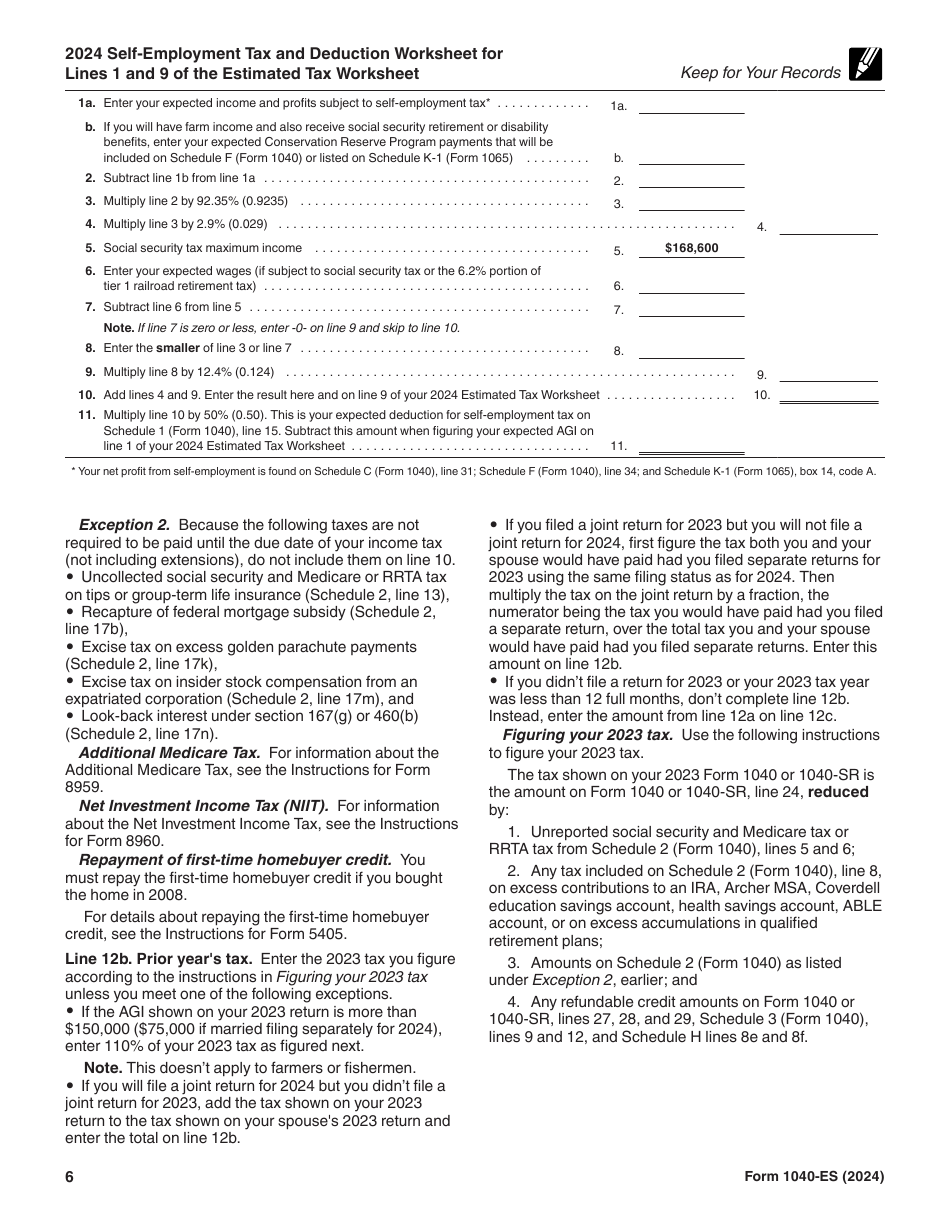

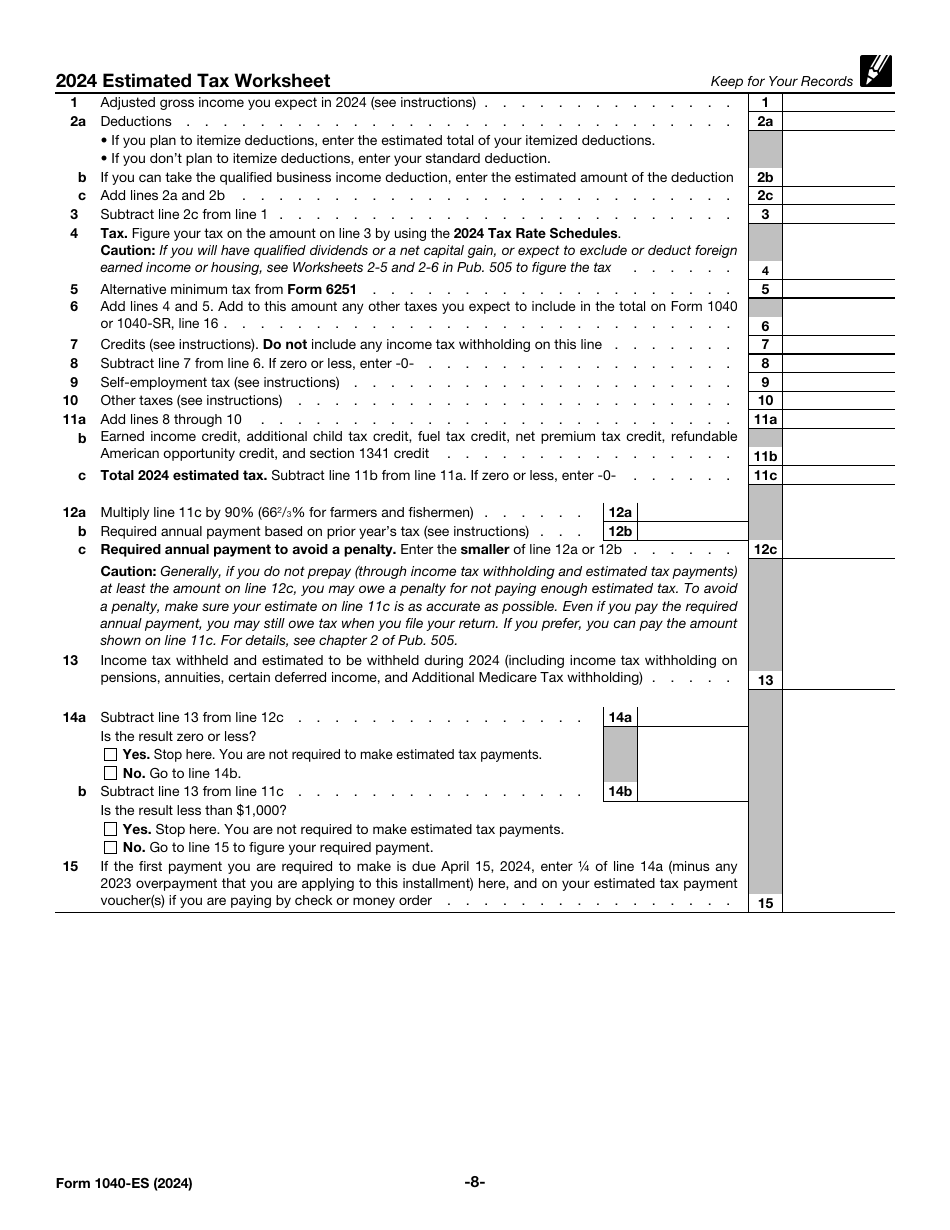

The 1040-ES Form instructions are as follows:

-

Carefully read the guidelines provided in the text of the 1040-ES Form . While you do not have to spend a lot of time filling out the voucher, there is still a requirement to be certain that estimated tax regulations allow you to compute and pay your taxes in this manner. Check if you fall under either of the categories of taxpayers who may handle their tax liability through estimated tax payments, figure out if the thresholds and rates apply to you, and use the worksheet to carry out the calculations. Retain a copy of the worksheet in your records in case you run into issues with your taxes in the future.

-

Make sure you are completing the right voucher - there is a number that specifies the order you have to adhere to as well as the deadline for submission in the top right corner of every voucher . Additionally, it is important to ensure you are allowed to file the voucher in the first place - you can only do it if you pay your taxes via a money order or check.

-

Indicate the amount of the estimated tax . Record your name and social security number. In case you are married, the document must certify the name and social security number of your spouse as well. Write down your mailing address. Taxpayers that reside abroad are obliged to disclose the details that identify the country in question - its name, the county or province where the person lives, and the postal code.

-

Do not permanently attach the voucher to the chosen form of payment - you cannot glue them together or staple two pieces of paper . Instead, simply put them together in a single envelope. The money order or check has to contain the indication either of them is payable to the United States Treasury and an inscription with your social security number to confirm the identity of the payer, the number of the form, and the year the payment is for. Remember not to put any cash in the envelope - tax authorities only accept checks and money orders.

Where to Mail Form 1040-ES?

IRS Form 1040-ES mailing address depends on the location of the filer:

-

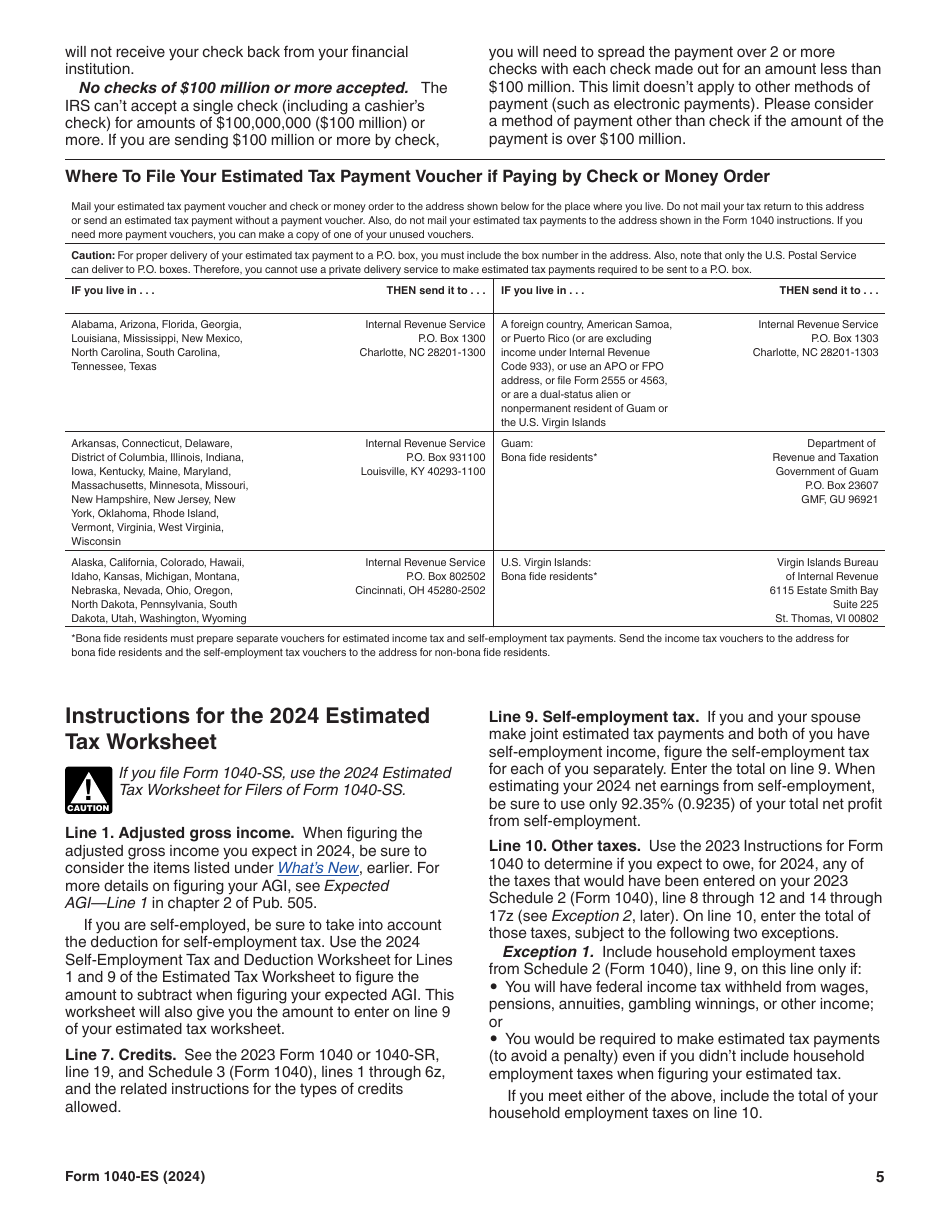

If you reside in Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi, New Mexico, North Carolina, South Carolina, Tennessee, or Texas, send the paperwork to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201-1300 .

-

Residents from Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, Pennsylvania, South Dakota, Utah, Washington, and Wyoming must mail the form to the Internal Revenue Service, P.O. Box 802502, Cincinnati, OH 45280-2502 .

-

Submit the document to the Internal Revenue Service, P.O. Box 931100, Louisville, KY 40293-1100 if you live in Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, or Wisconsin.

-

Taxpayers that reside abroad, in Puerto Rico, or American Samoa, have a military address, fill out IRS Form 2555 or IRS Form 4563, had the status of a resident and non-resident alien during the same tax year, or are nonpermanent residents of the U.S. Virgin Islands and Guam need to file the papers with the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303 .

IRS 1040-ES Related Forms:

- Form 1040, U.S. Individual Income Tax Return;

- Form 1040-C, U.S. Departing Alien Income Tax Return;

- IRS Form 1040-ES (NR), U.S. Estimated Tax for Nonresident Alien Individuals;

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents;

- Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico);

- Form 1040-V, Payment Voucher;

- Form 1040X, Amended U.S. Individual Income Tax Return;

- Form 5405, Repayment of the First-Time Homebuyer Credit;

- Form 8822, Change of Address;

- Form 8959, Additional Medicare Tax;

- Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts;

- Form 8962, Premium Tax Credit;

- Form 8965, Health Coverage Exemptions;

- Form W-4V, Voluntary Withholding Request.