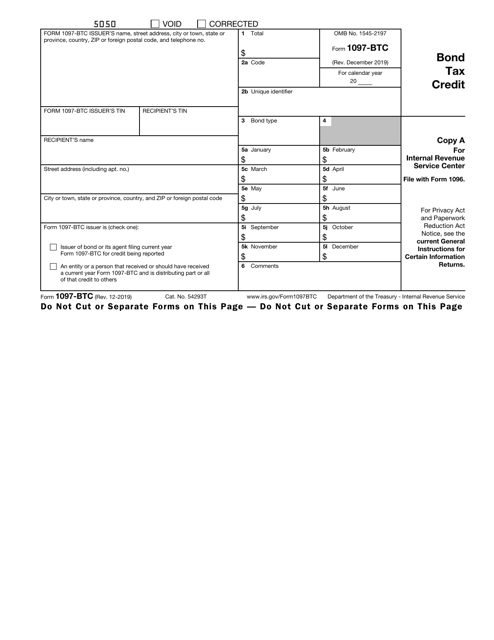

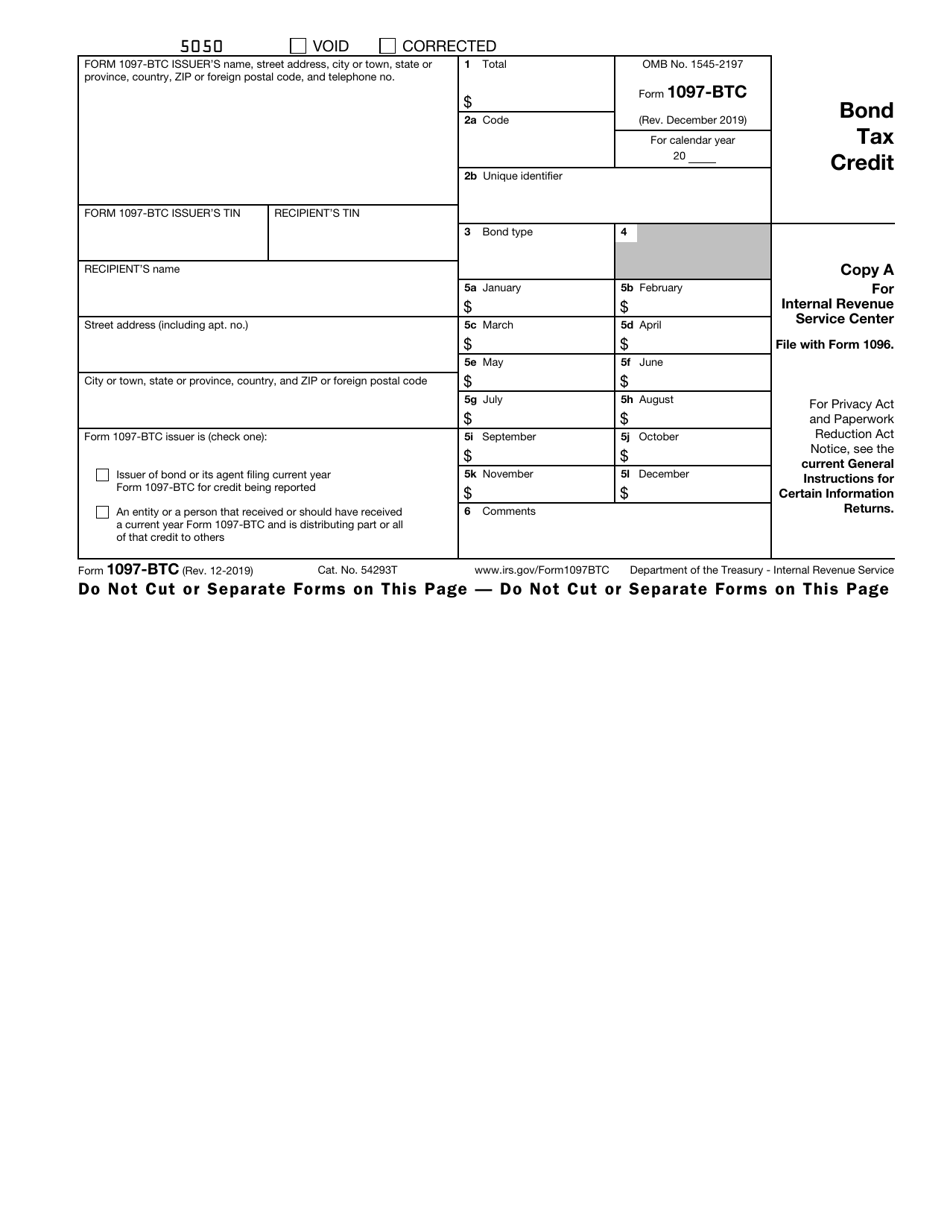

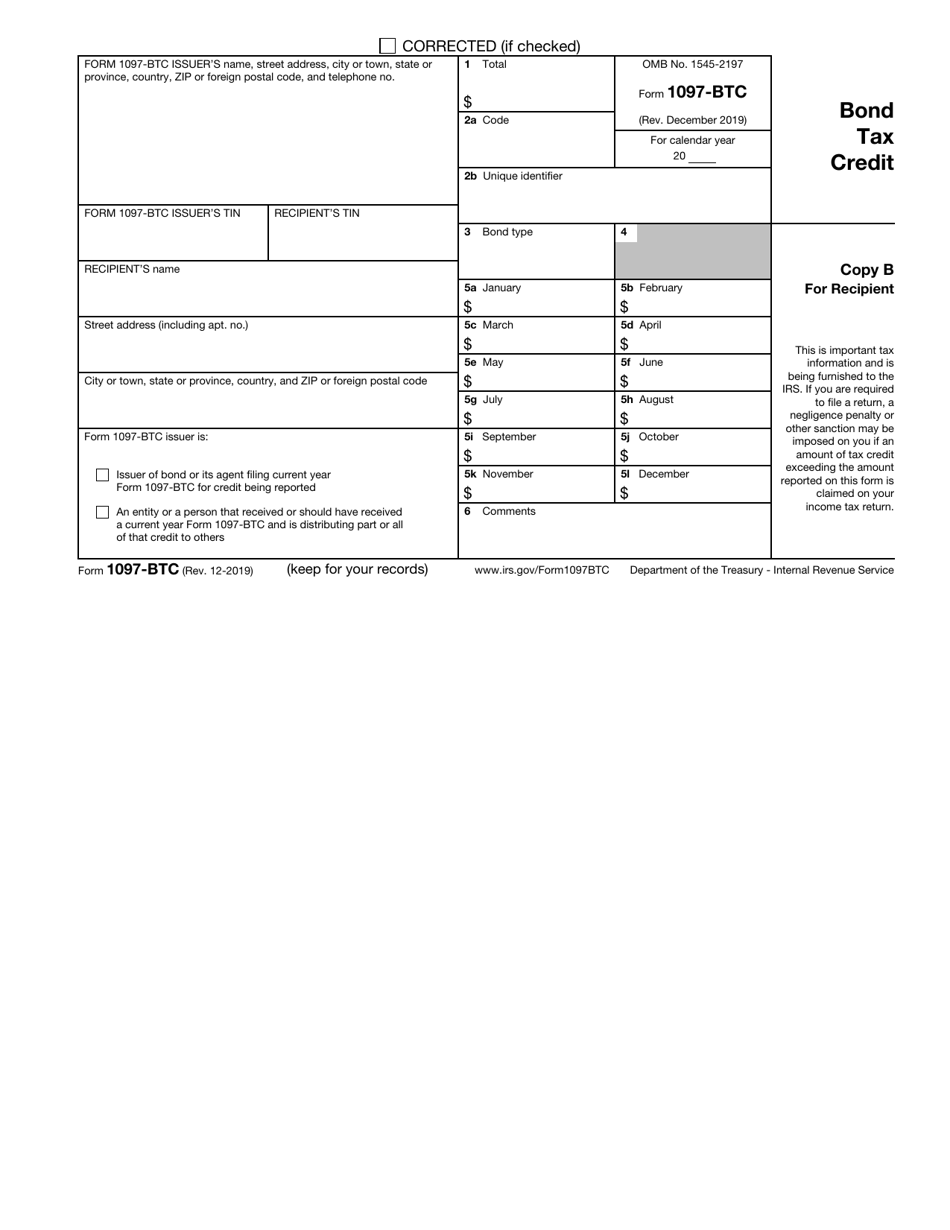

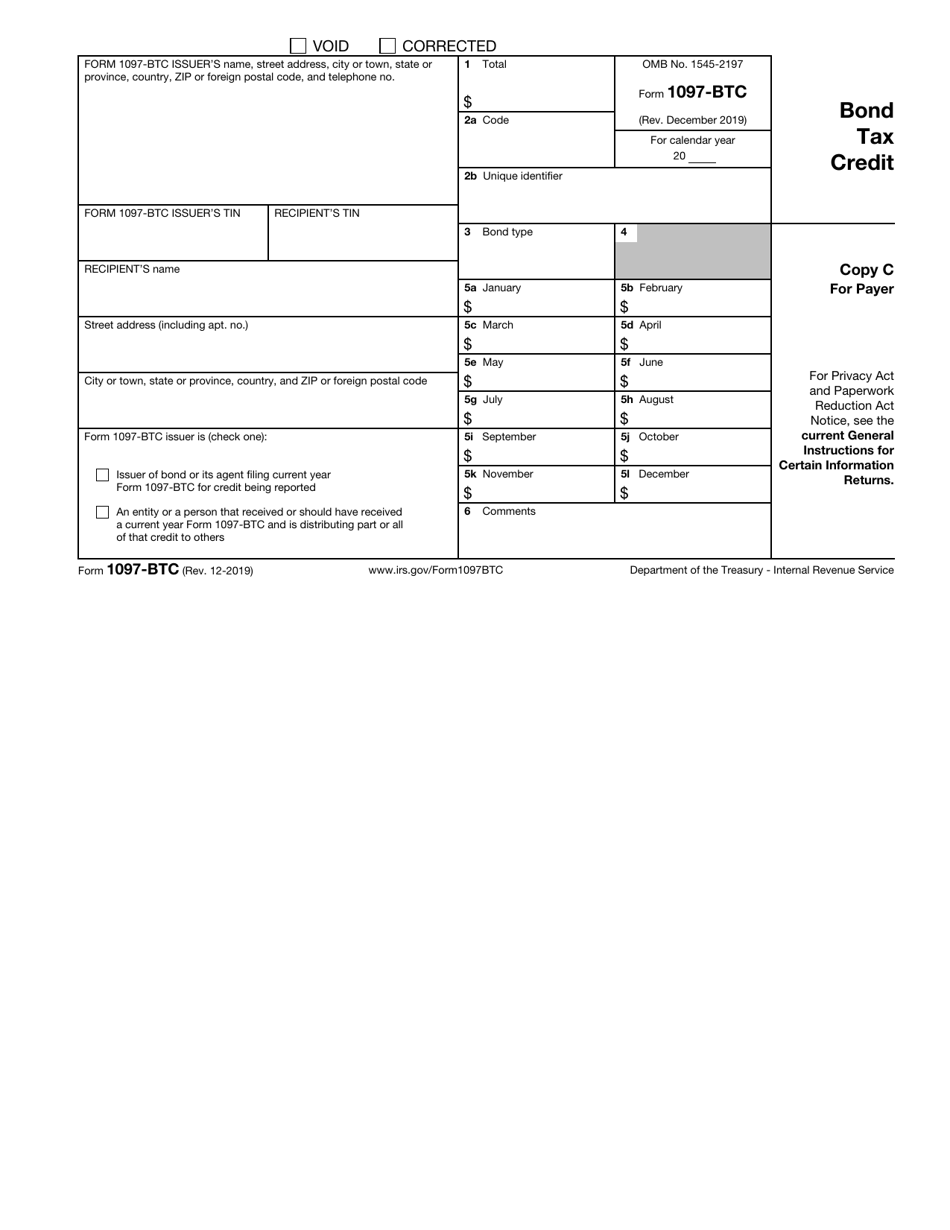

IRS Form 1097-BTC Bond Tax Credit

What Is IRS Form 1097-BTC?

IRS Form 1097-BTC, Bond Tax Credit , is a formal document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Alternate Names:

- IRS Form 1097;

- Bond Tax Credit Form.

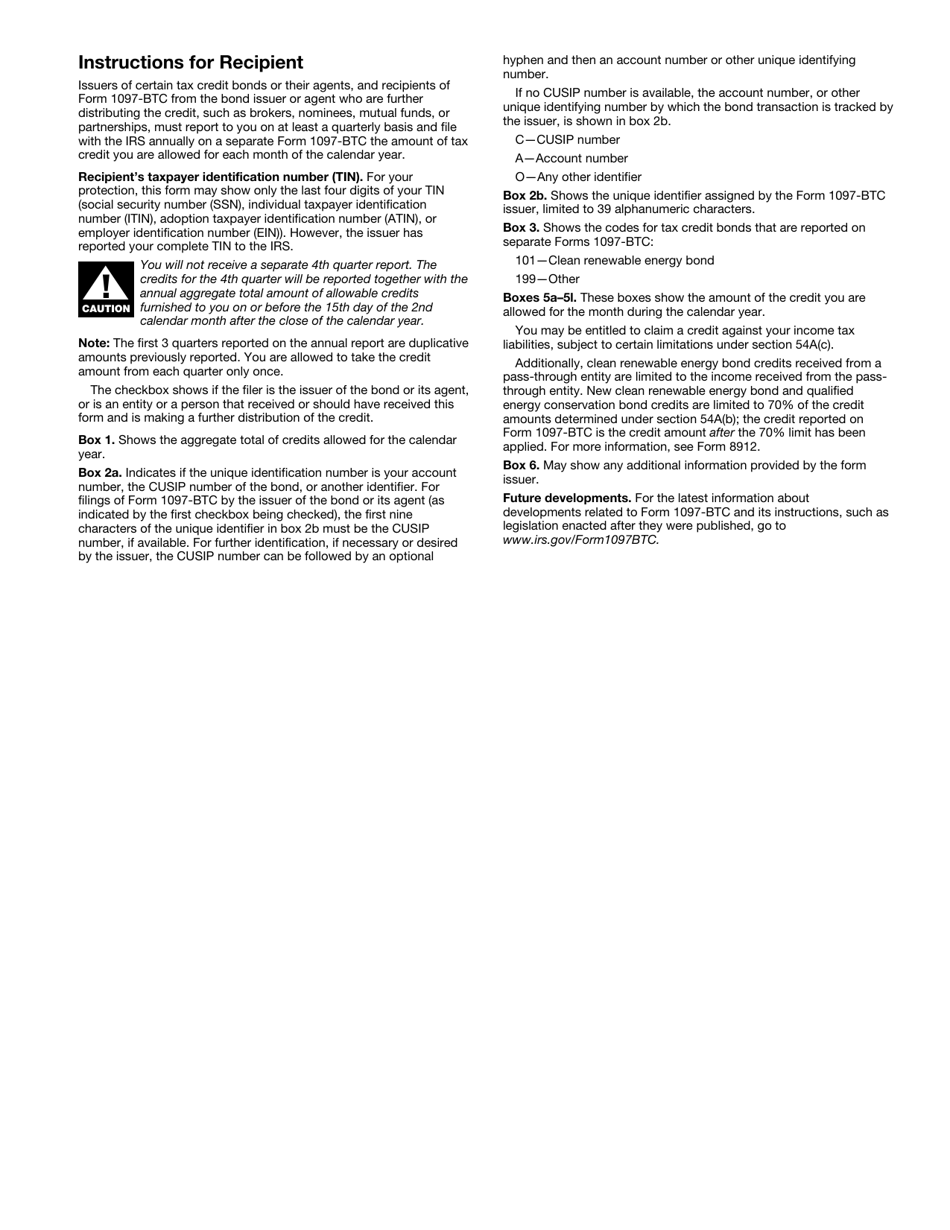

Regulated investment companies are supposed to inform the fiscal authorities about the tax credit bonds they distributed to their shareholders - partnerships and mutual funds have to fill out a separate form for every tax credit they distributed during the calendar year as long as the amount equals or exceeds $10. Even indirect holders of a tax credit have to complete this instrument in line with their tax obligations.

This instrument was released by the Internal Revenue Service (IRS) on December 1, 2019 , making older editions obsolete. You may download an IRS Form 1097-BTC fillable version through the link below.

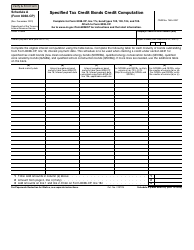

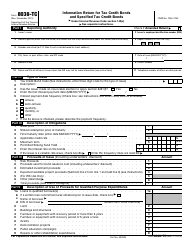

State the name of the credit issuer, their contact information, and taxpayer identification number, provide the details of the credit recipient, check the box to clarify the status of the entity that issued the form, indicate the total amount of the credit, add the unique identifier you use to track transactions, and specify the type of the bond.

Calculate the amount of credit allowed for every month of the year covered in the form and add remarks and comments if necessary. Note that you have to prepare three copies of Form 1097-BTC - one of them is for your records, another one must be submitted to the IRS, and the third document has to be sent to the recipient of the tax credit.

IRS Form 1097 Instructions

You can find detailed instructions for this form on the IRS website or by following this link. General guidelines are provided below.

File a separate form for every bond if you are an issuer or an issuer's agent. If the tax credit bond was issued with several maturities, report every maturity separately on the form. If you are the recipient of the Bond Tax Credit From the bond issuer or an agent who further distributes the credit (e.g., nominee, broker, partnership, or mutual fund), you must file only one IRS 1097 Form per account that aggregate credit from all applicable bonds. Filing instructions are as follows:

-

The form includes three copies: Copy A is for the IRS, Copy B is for the recipient, and Copy C is for the payer . All the boxes of the form are self-explanatory.

-

Submit the Copy A of the Form 1097 to the IRS . If you choose to file it electronically, the filing deadlines will be extended to March 31. If the due date falls on a Saturday, Sunday, or any legal holiday, file your form by the next business day.

-

You can apply for a 30-day extension if you cannot file the bond tax credit on time . For this purpose, submit an electronic or paper version of IRS Form 8809, Application for Extension of Time to File Information Returns, before the due date.

-

If you fail to file all the required information on time, the following penalties will be applied: $50 per form if the delay is no longer than 30 days, $110 per form if you file the correct bond tax credit by August 1, and $270 if you do not file at all or file after August 1 . The maximum penalty amount can reach $3,339,000 per year. For small businesses, the maximum penalty amount will be reduced to $1,113,000 per year.

-

You can file the form either electronically or on paper . If you file the form on paper, send the entire Copy A without cutting or separating the blank parts. The handwritten documents are acceptable, but all the entries must be accurate and legible to avoid errors during processing.

-

The paper copy of the form must be submitted with IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns (electronic filing does not require Form 1096).

Not what you were looking for? Check out these related forms: