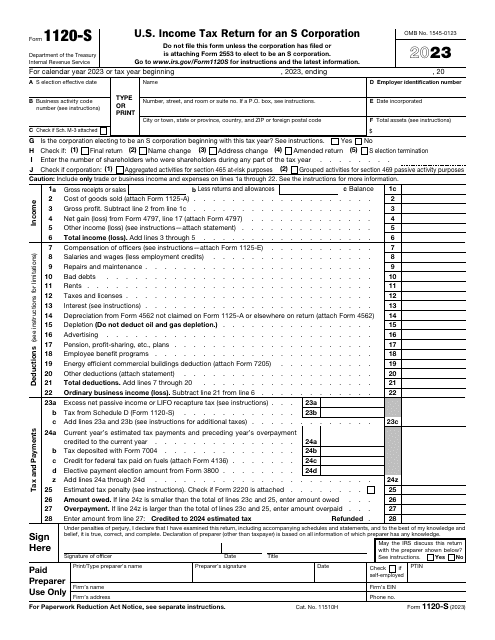

IRS Form 1120-S U.S. Income Tax Return for an S Corporation

What Is Tax Form 1120-S?

IRS Form 1120-S, U.S. Income Tax Return for an S Corporation , is a form filed with the Internal Revenue Service (IRS) to report the income, gains, losses, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation.

Alternate Name:

- S Corporation Tax Return Form.

The form was issued by the IRS and last revised in 2023 . Corporations can electronically file Form 1120-S, as well as related forms, schedules, and attachments. You can download a fillable IRS Form 1120-S down below.

IRS Form 1120 Vs. 1120-S

The difference between these two forms is that the Form 1120, U.S. Corporation Income Tax Return, is filed every year by corporations, and the 1120-S form is filed only by corporations that have elected the "S" status.

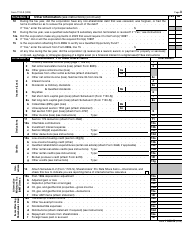

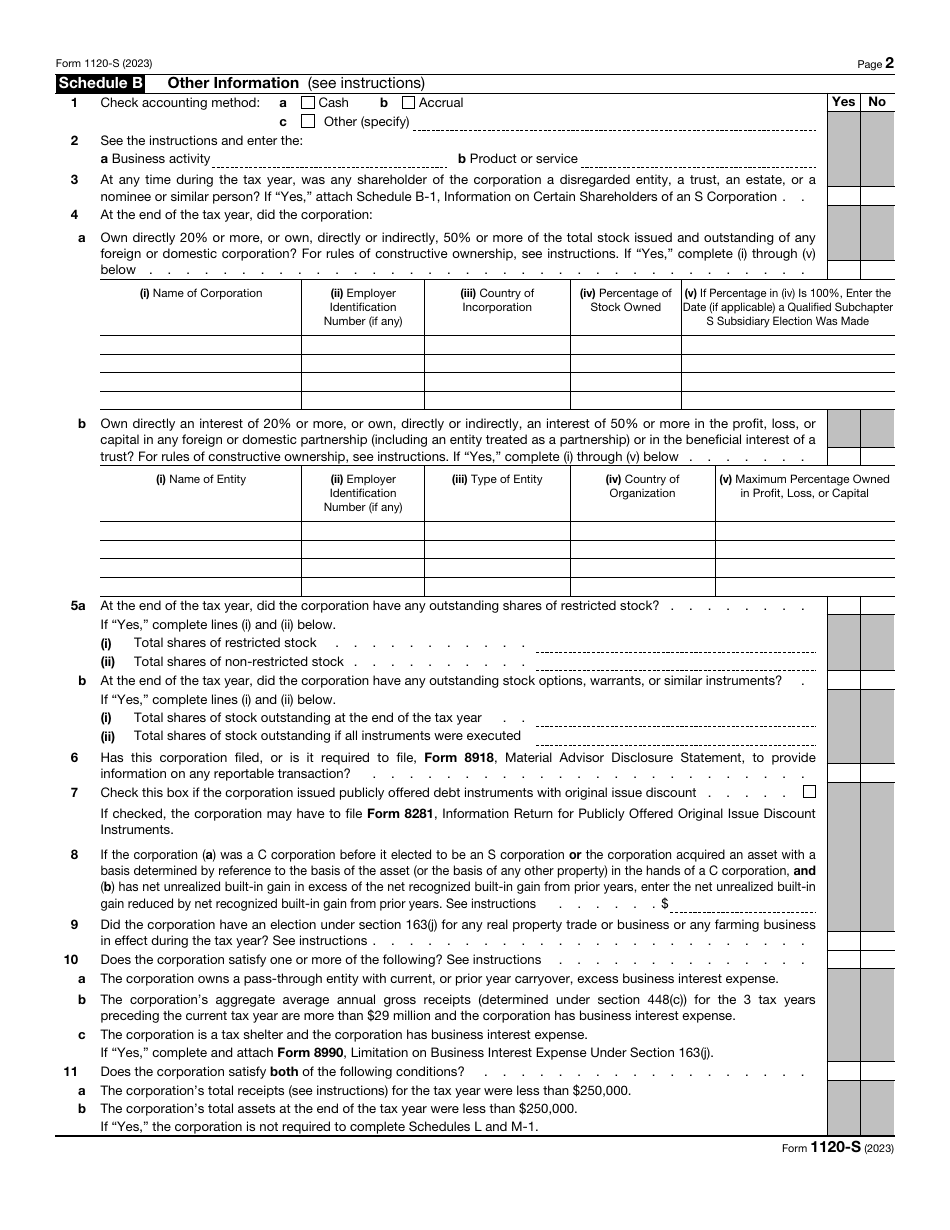

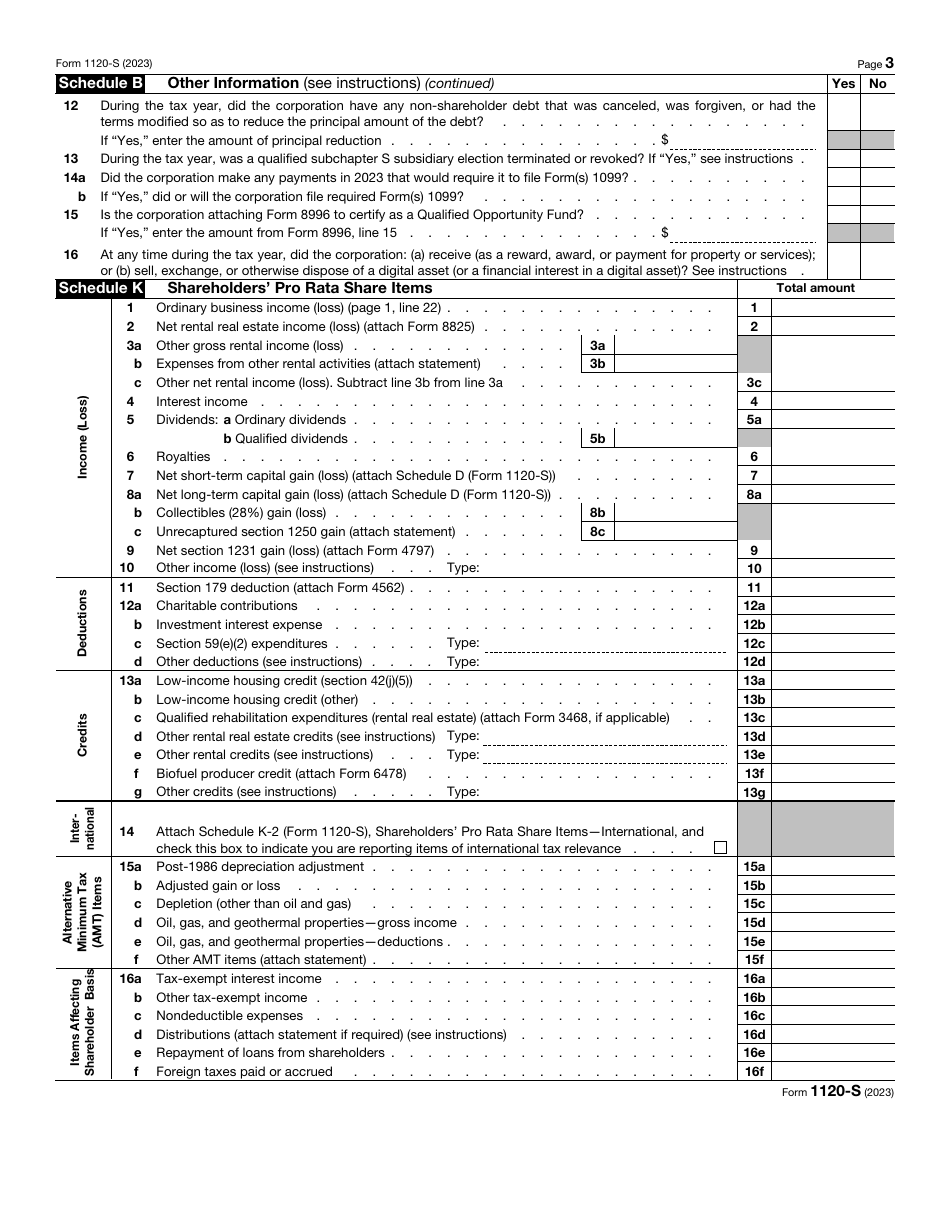

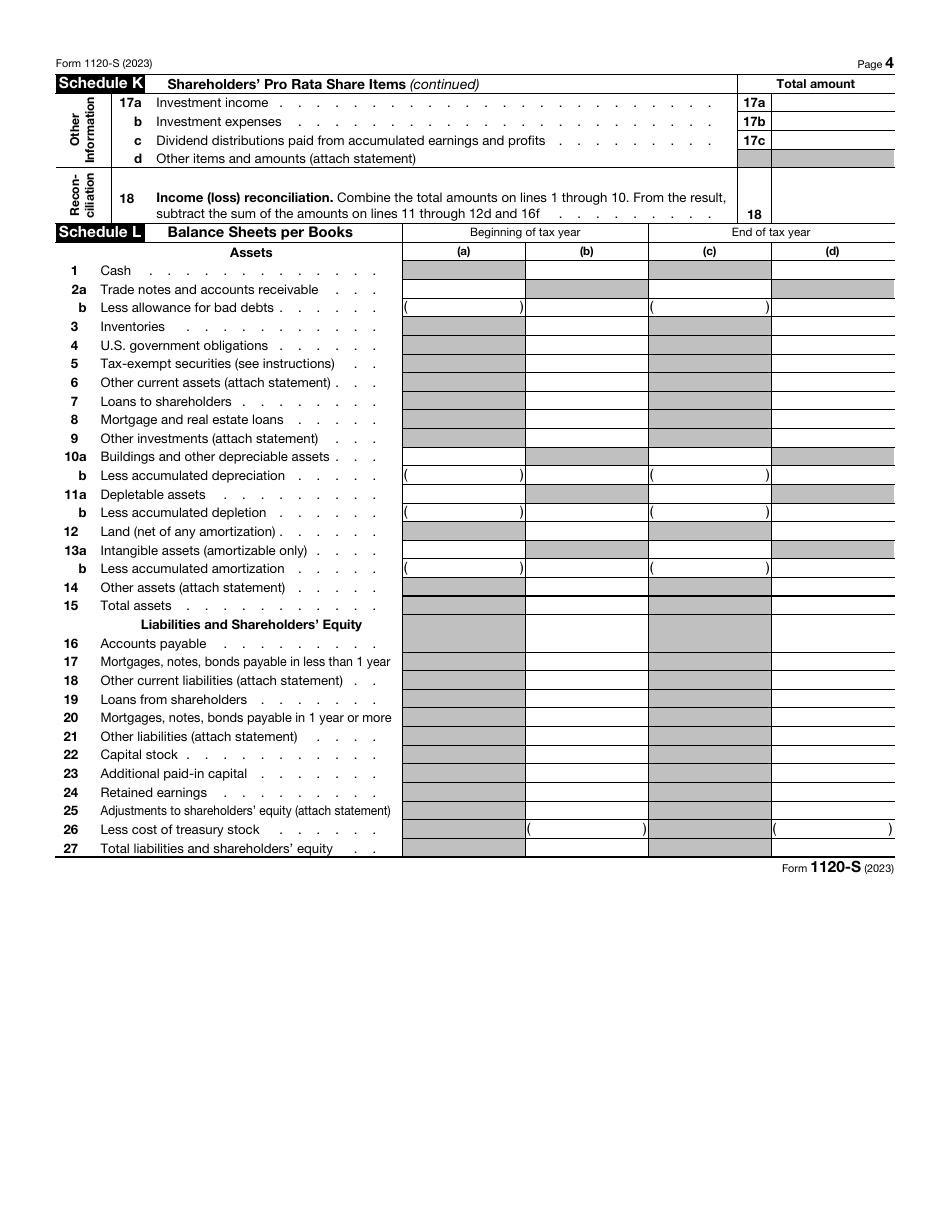

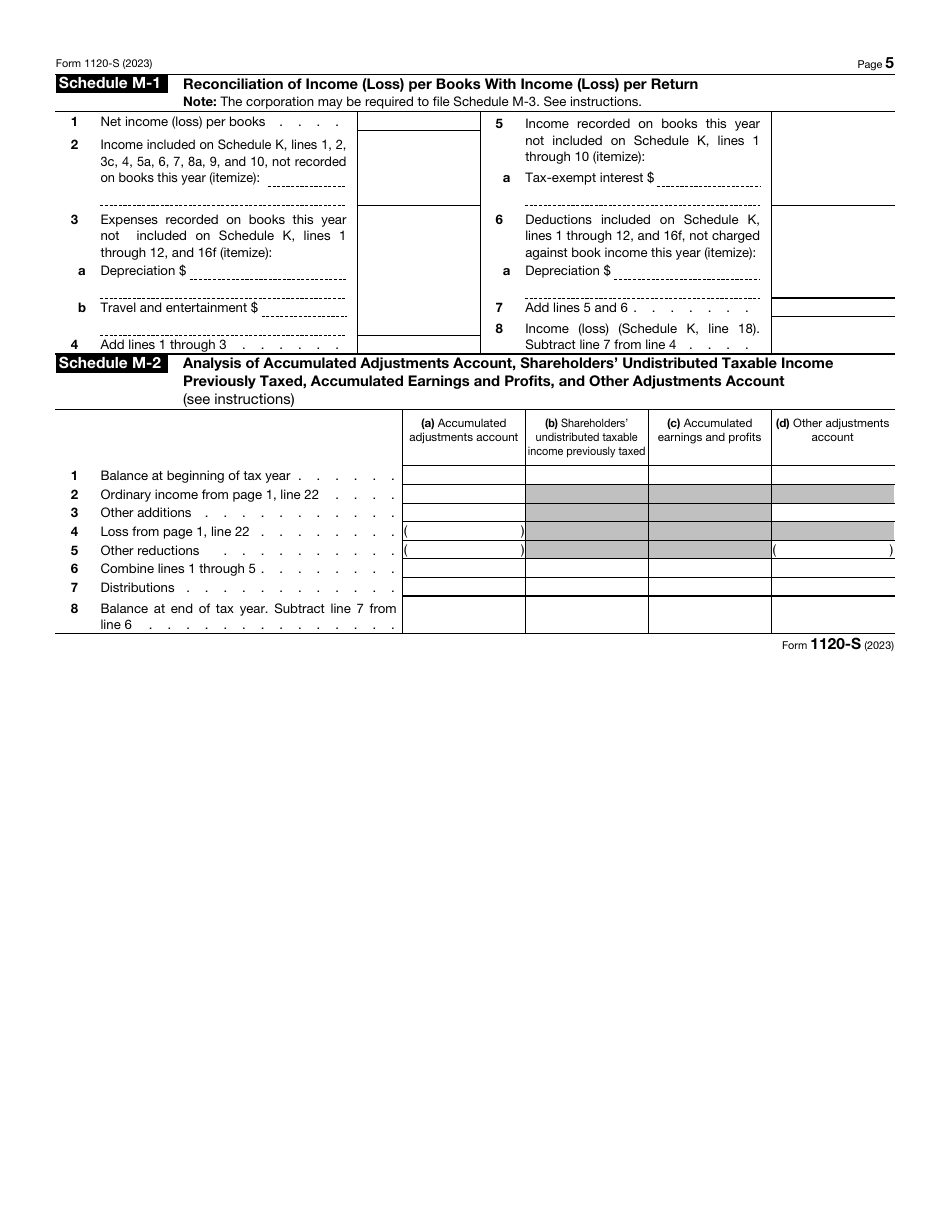

IRS Form 1120-S Schedules

- Schedule B-1, Information for Certain Shareholders of an S Corporation.

- Schedule D, Capital Gains and Losses and Built-In Gains.

- Schedule K-1, Shareholder's Share of Income, Deductions, Credits, Etc.

- IRS Form 1120-F Schedule M-1, M-2, Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings Per Books.

- Schedule M-3, Net Income (Loss) Reconciliation for S Corporations With Total Assets of $10 Million or More.

IRS Form 1120-S Instructions

The 1120-S Form must be signed and dated by the corporation's president, vice president, chief accounting officer, treasurer, assistant treasurer, or any corporate officer authorized to sign.

Generally, an S corporation is required to file this form by the 15th day of the 3rd month after the end of its tax year but for calendar-year corporations, the due date is March 15, 2019. A corporation that has dissolved must file by the 15th day of the 3rd month after the date of its dissolution. If the due date falls on a weekend or legal holiday, the form may be filed on the next business day.

If the return is filed after the due date or the return doesn't show all of the information required, a penalty may be assessed. However, if the failure is justified by a reasonable cause, no penalty will be imposed. For returns on which no tax is due, the penalty is $200 for each month or day the return is late or incomplete, multiplied by the total number of shareholders during any part of the corporation's tax year. If the tax is due, the penalty will be the amount stated above plus 5% of the unpaid tax for each month or day the return is late and may go up to a maximum of 25%. The minimum penalty for being 60 or more days late is the tax due or $210, whichever is smaller.

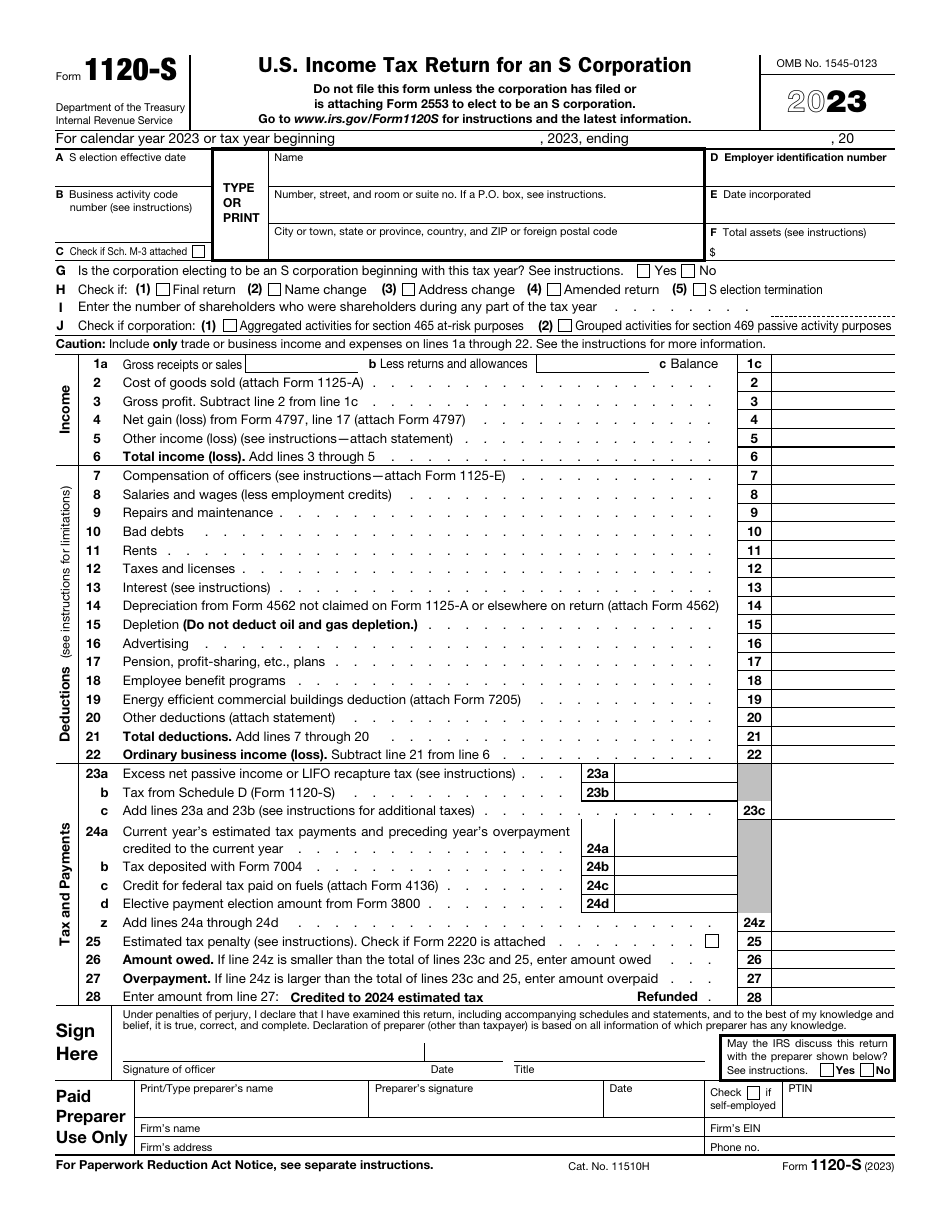

How to Fill out 1120-S Form?

- Item A. S Election Effective Date. Enter the effective date when the corporation became an S corporation.

- Item B. Business Activity Code Number. Read the Principal Business Activity Codes provided in the IRS separate instructions for Form 1120-S and enter the code that applies to the S corporation's business activity.

- Item D. Employer Identification Number (EIN). Enter the corporation's EIN.

- Item E. Date Incorporated. Enter the date of incorporation.

- Item F. Total Assets. Enter the corporation's total assets at the end of the tax year.

- Item G. S Corporation Beginning Year. Check the applicable box.

- Item H. Initial Return, Final Return, Name Change, Address Change. Check all that apply.

- Section 1. Income. Enter the income amounts on each line, as per the form instructions.

- Section 2. Deductions. Enter the appropriate corporation's costs, expenses, contributions, and other deductible amounts on each line.

- Section 3. Payments, Refundable Credits, and Section 965 Net Tax Liability. Enter the applicable tax, credits, and payment amounts on each line.

Where to Mail Form 1120-S?

The applicable IRS address where a corporation must file this form depends on the amount of the total assets reported on an S Corporation tax return and the location of the S Corporation. Please refer to the instructions for Form 1120-S in order to know if you must mail the form to the IRS Center in Kansas City, MO or to the IRS Center in Ogden, UT.

IRS 1120-S Related Forms:

- 1120, U.S. Corporation Income Tax Return. This form is used by domestic corporations to report income, gains, losses, deductions, and credits, and to calculate income tax liability;

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form for reporting their income, gains, losses, deductions, and credits, and also to figure their income tax liability;

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations to report their income, gains, losses, deductions, and credits, as well as to figure their U.S. income tax liability;

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability;

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners association files this form to be able to exclude exempt function income from its gross income;

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is filed with the IRS by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs;

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527;

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies must use this form to report income, gains, losses, deductions, and credits, and to figure their income tax liability;

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds are required to file this form to report income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, and the section 4951 initial taxes;

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, as well as to figure the income tax liability of insurance companies, apart from life insurance companies;

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporations, trusts, and associations electing to be treated as Real Estate Investment Trusts are required to file this form to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability;

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form in order to report their income, deductions, gains, losses, credits, and to calculate their income tax liability;

- 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B). Qualified settlement funds file this form for reporting transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability;

- 1120-W, Estimated Tax for Corporations. Corporations use this form in order to estimate their tax liability and to figure the amount of their estimated tax payments;

- 1120-X, Amended U.S. Corporation Income Tax Return. This form is filed by corporations to correct a Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make certain elections after the prescribed deadline.