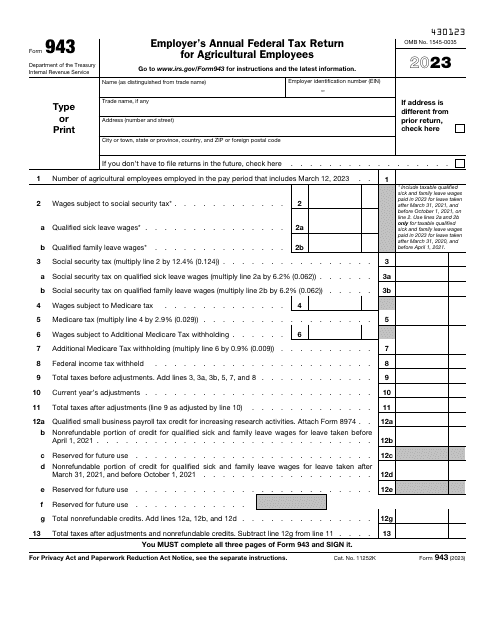

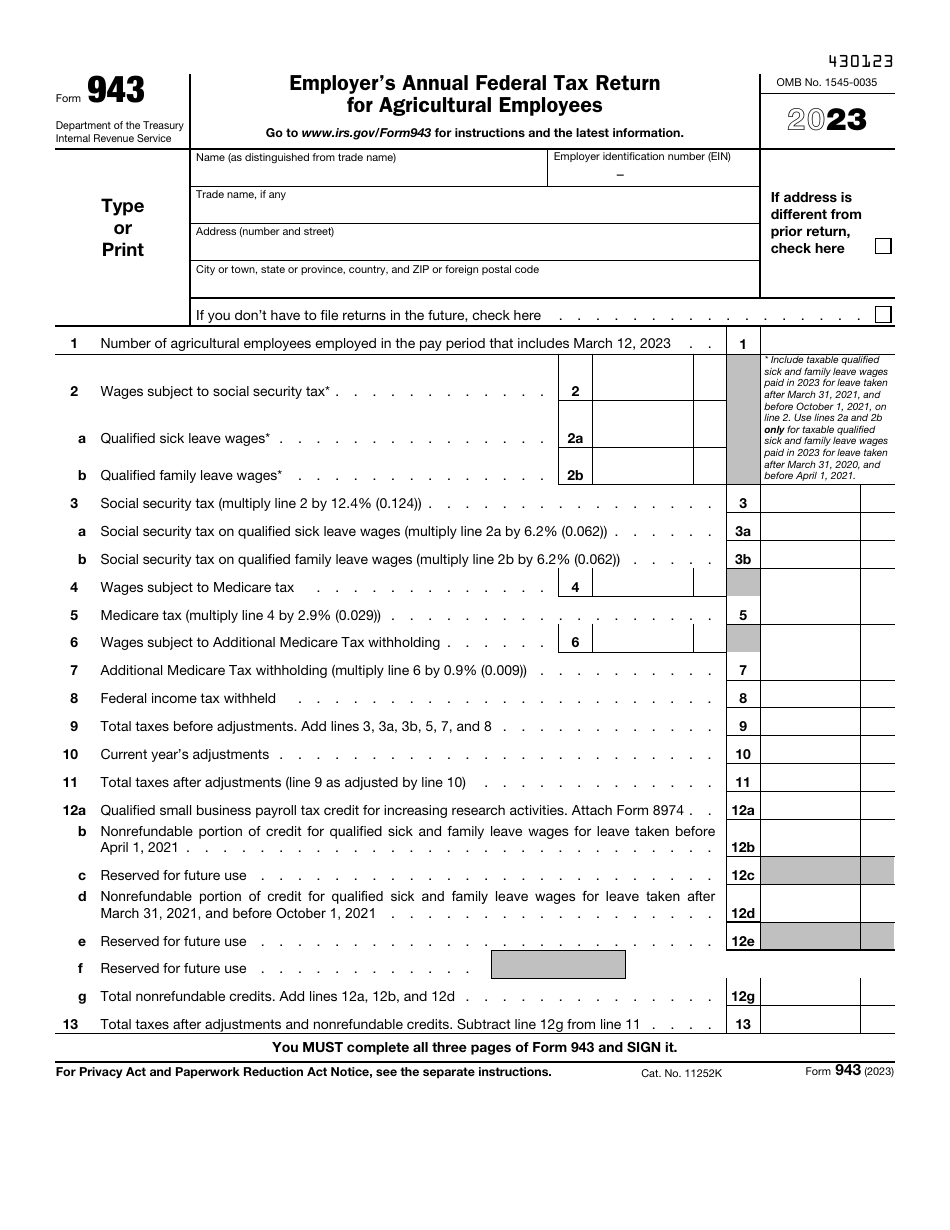

IRS Form 943 Employer's Annual Federal Tax Return for Agricultural Employees

What Is IRS Form 943?

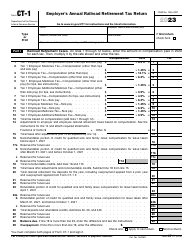

IRS Form 943, Employer's Annual Federal Tax Return for Agricultural Employees , is a fiscal document used by employers to report the total amount of wages they paid to individuals who are employed in agriculture. Additionally, this tool explains how much tax was deducted from the salaries you paid to the workers that belong to this category.

Alternate Names:

- Tax Form 943;

- Federal Form 943.

This statement was issued by the Internal Revenue Service (IRS) in 2023 , rendering older editions of the instrument outdated. You can find an IRS Form 943 fillable version via the link below.

The Spanish version of this form can be found here.

What Is Form 943 Used For?

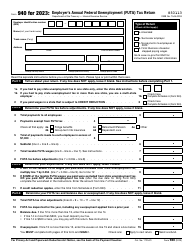

Prepare and submit Federal Form 943 to inform the government about the salaries you paid to agricultural workers over the course of the year outlined in writing. If you are an agricultural employer and you employ people that carry out various activities on ranches and farms, you have to pay taxes on wages they receive as well as elaborate on your calculations to let the IRS know you deducted the accurate amount of tax.

Form 943 Vs 941

Unlike Tax Form 943, IRS Form 941, Employer's Quarterly Federal Tax Return, is filed by all employers, not only those who belong to the agricultural industry. Moreover, as the title of the document suggests, the companies are obliged to comply with a different requirement in regard to filing - Form 941 is submitted four times during the year while Form 943 is mailed annually.

Form 943 Instructions

The Form 943 Instructions are as follows:

-

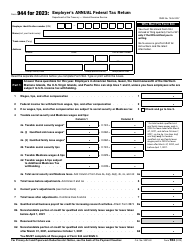

Indicate the names your company uses, its employer identification number, and mailing address . Check the appropriate box to confirm the address has changed or this is your final return. State how many agricultural workers you have employed, how many wages you paid to them, and how many taxes you deducted. Use the formulas in the instrument and figure out the total amount of tax you need to pay.

-

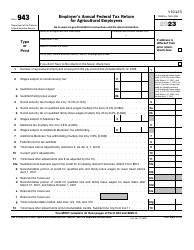

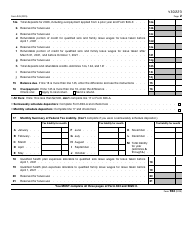

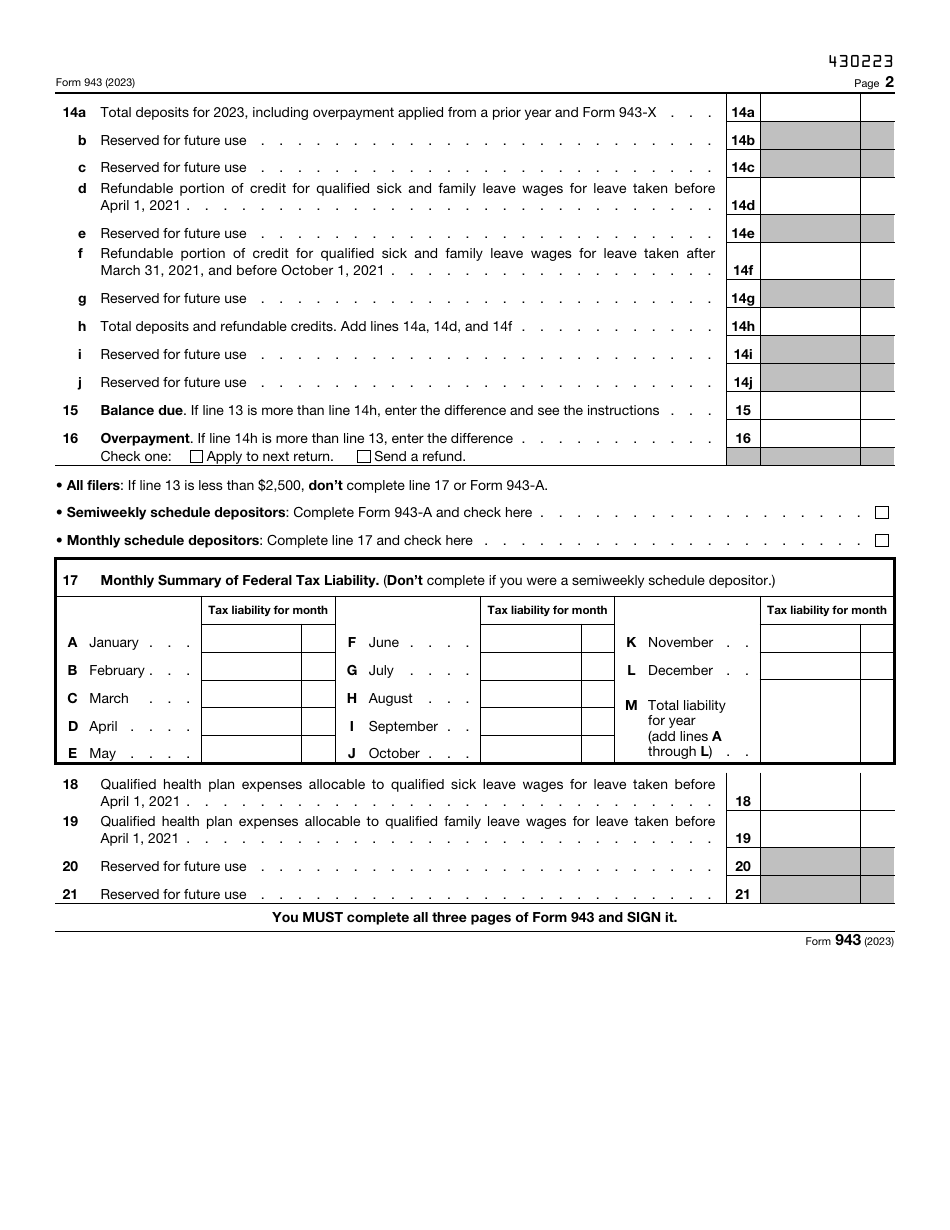

List the tax credits your business qualifies for and record the amount of taxes you get after extra calculations are taken into account . Elaborate on the amounts of deposits you have made, enter the balance due, and certify possible overpayment - you have an opportunity to ask for a refund right away. Break down your tax liability into twelve months of the year and provide information about health plan expenses, sick leave wages, and family leave wages during the periods pointed out in the document.

-

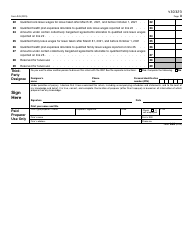

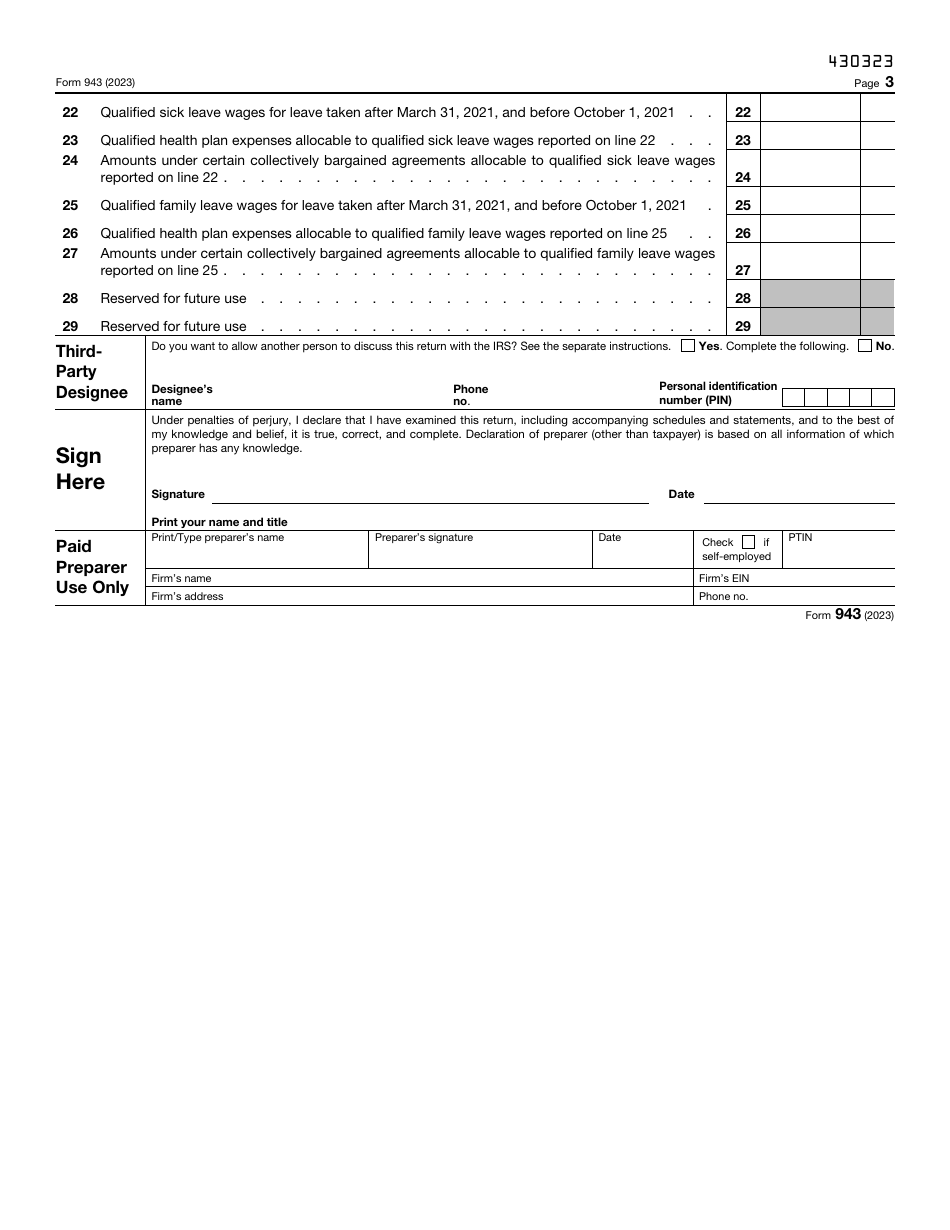

Enter the details of the person that can be contacted on behalf of your entity to discuss the information included in this form . Certify the details you have provided are true and accurate and sign the papers. A tax professional you hired to help you out with the document must identify themselves and sign the return also - they provide their phone number in case fiscal authorities have any issues with the instrument and need to talk to that person directly.

-

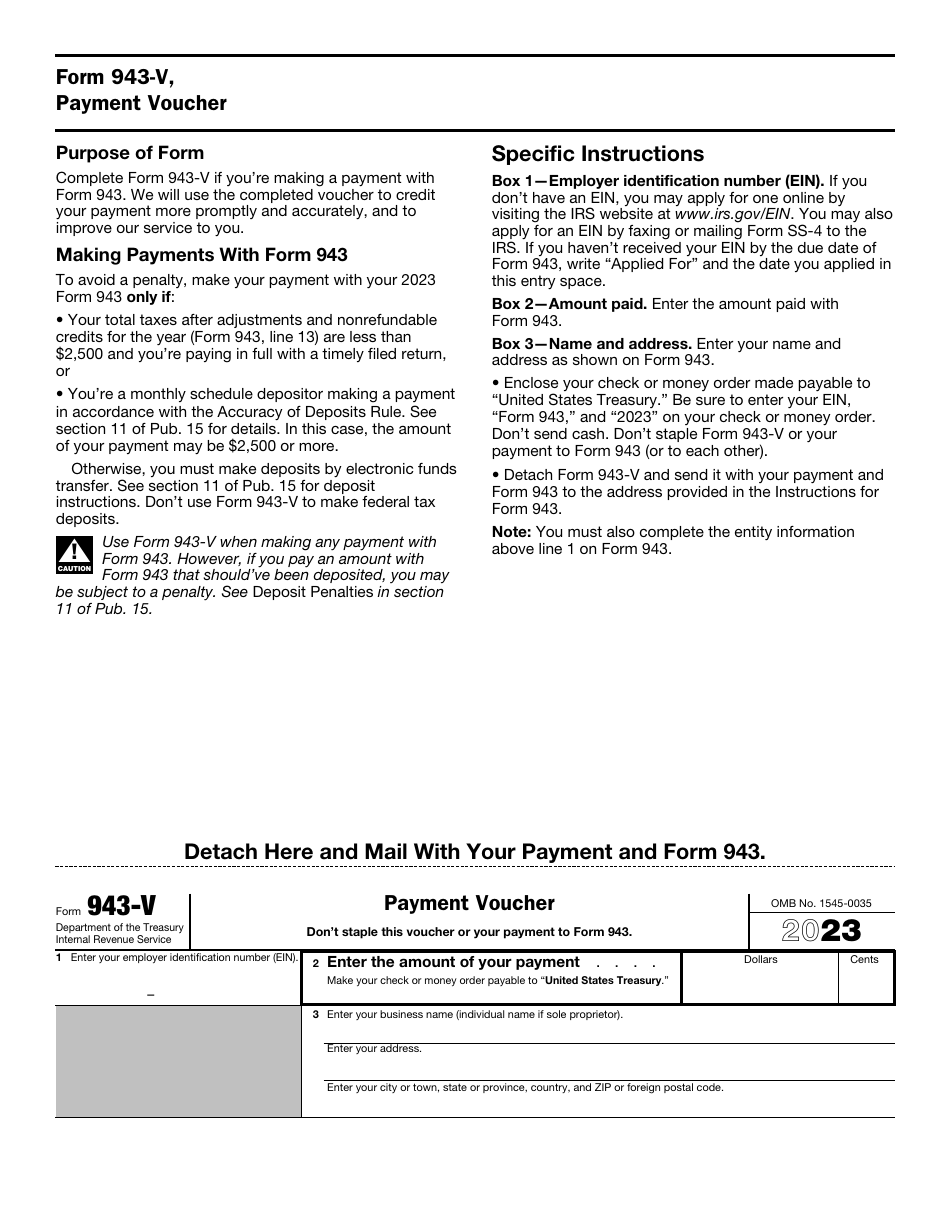

If you want to pay taxes with the help of a check or money order, you are required to fill out a voucher . Write down your employer identification number, name of the business, and correspondence address and specify the payment amount. Carefully cut the voucher from the rest of the page and send it with the tax return - do not staple or glue the documents together.

When Is Form 943 Due?

Form 943 due date falls on January 31 of the year that follows the calendar year described in the form. Instructions for Form 943 list a single exception to a general rule - the deadline is February 12 if the employer managed to make all the deposits on schedule and the taxes are paid in full.

Where to Mail Form 943?

Employers are highly advised to opt for electronic submission when it comes to the 943 Tax Form - you do not have to file a paper document if you decide e-filing is the most convenient option for you. Nevertheless, businesses are still entitled to send regular paper returns. Make sure you choose the right IRS Form 943 mailing address:

-

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming employers are supposed to file the paperwork with the Department of the Treasury, IRS, Ogden, UT 84201-0008 or IRS, P.O. Box 932200, Louisville, KY 40293-2200 if payment is attached. The same rules apply to tax-exempt organizations and governmental entities.

-

In case you are located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin, send the tax return to the Department of the Treasury, IRS, Kansas City, MO 64999-0008 . Employers that enclose checks and money orders have to use a different address - IRS, P.O. Box 806533, Cincinnati, OH 45280-6533 .

-

Employers without a main place of business need to mail the form to the IRS, P.O. Box 409101, Ogden, UT 84409 - if the paperwork is accompanied by a payment, the address is IRS, P.O. Box 932200, Louisville, KY 40293-2200 .

Can Form 943 Be Filed Electronically?

To speed up the processing, file your IRS Form 943 electronically. You can do it by e-file or by using the Electronic Federal Tax Payment System (EFTPS). To e-file, you will need to purchase the IRS-approved software or use an authorized IRS e-file provider. The e-filing may require paying a fee. To use the EFTPS you need to enroll and receive your credentials first. You can use this system for free.

IRS 943 Related Forms:

- Complete the related IRS Form 943-A, Agricultural Employer's Record of Federal Tax Liability if you are a semi-weekly schedule depositor. The form is used to report only tax liability: federal income tax withheld, as well as employer and employee Medicare and Social Security taxes. Do not enter federal tax deposits on this form. The IRS uses the information you provide via this form to determine if you have timely deposited tax liabilities indicated on the document. The semi-weekly depositors who do not fill out and submit Form 943-A with IRS 943 Form may be subject to penalties. IRS Form 943-X (PR) is a Spanish version of the form.

- IRS Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refundis used to correct errors on a previously filed Form 943.

- IRS Form 943-PR, Planilla Para La Declaracion Anual De La Contribucion Federal Del Patrono De Empleados Agricolas is a Spanish version of the main form.