What Are Tax Credits? Your Guide to Maximizing Your Tax Return in 2020

Tax credits and deductions allow you to use every tax benefit you are eligible for. Discover more about non-refundable and refundable tax credit options in this article, about the difference between tax credits and tax deductions, how these methods of reducing taxes affect your tax return and how to claim them.

What Are Tax Credits?

A tax credit is an amount of money that taxpayers subtract from the total amount of taxes they owe their state government. This tax incentive lowers your tax liability dollar-for-dollar, whereas a tax deduction reduces your overall amount of taxable income, and you are not eligible to get money back from a deduction.

A refundable tax credit is paid back to the taxpayer regardless of the individual’s liability, whereas a non-refundable tax credit only reduces this person’s liability to zero.

Generally, tax credits save you more money than deductions. Tax deductions are intended to reduce the amount of your income subject to tax, while tax credits directly reduce the total amount of tax. See the difference between these two tax incentives below:

| Tax deduction | Tax credit | ==> | | -- | -- | | Your income | $150,000 | $150,000 | | If we apply a tax deduction | -$10,000 | ==> | | Taxable income | $140,000 | $150,000 | | Tax rate | 20% | 20% | | Tax | $28,000 | $30,000 | | If we claim a tax credit | -$10,000 | ==> | | Tax bill | $28,000 | $20,000 |

What Tax Credits Can I Qualify for?

The following tax credits are among the most relevant for the taxpayer. Decide which credit to choose from, whether you want to invest in your education, prepare for retirement, cover expenses of raising children with the help of various tax credits for parents, or build a better future for your family and the world with renewable energy tax credits.

Child Tax Credits

If you have young children or other dependents, you may qualify for different types of child tax credits. Lower your tax bill so that you can receive a tax refund in the form of a mailed check or a deposit into your bank account.

Who Gets Child Tax Credits?

Child tax credits are for individuals with children, regardless of their employment status. The amount you can claim depends on your income, marital status, birth dates of your children, your working hours, and whether or not you have a disability or qualify for sickness benefits.

Tax Credits for Parents

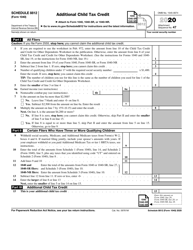

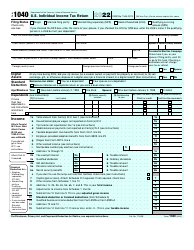

- Child tax credit . If your child is 16 years old or younger, it is possible to receive a credit of up to $2,000. It also covers qualifying dependents are eligible for a $500 non-refundable credit. Take full advantage of this credit if your modified adjusted gross income is under $400,000 (married filing jointly) or $200,000. Use Schedule 8812 of the IRS Form 1040 to fill out your Child Tax Credit;

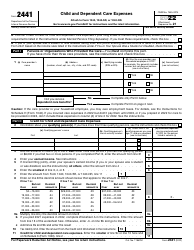

- Child and dependent care credit . It extends to physical care and household expenses. Claim this credit if you have household chores expenses or if you claim reimbursement associated with caring for a family member. Seek financial assistance if your child is 12 or younger, or your spouse (dependent) is physically or mentally incapable of self-care. Attach IRS Form 2441 to your IRS 1040 or 1040NR;

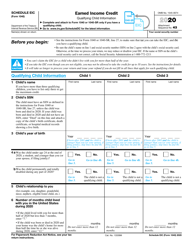

- Earned income credit . This credit was specifically created to help working individuals with low incomes. The less you earn, the larger your credit. It ranges from $529 to $6,557. You qualify for this credit if your investment income is $3,600 and less, you are married and filing jointly, and you do not have any foreign income. Fill out IRS Form 1040, Schedule EIC - Earned Income Credit if you have a qualifying child;

-

Adoption credit . You are eligible for a non-refundable tax credit of up to $14,080 per adopted child. You are able to cover the adoption expenses by filing IRS Form 8839, Qualified Adoption Expenses, if:

- You have adopted a child other than a stepchild (under 18 years old, or with a mental or physical disability);

- You are within the income limits:

| Below $211,160 | Full credit |

| From $211,160 to $251,160 | Partial credit |

| Above $251,160 | No credit |

Tax Credits for Education

The IRS Form 8863 is the basic form to file for Education credits. If you are pursuing higher education, you are eligible to receive a tax credit that will reduce the costs and expenses you will have to pay. Find the main differences between the education tax credits in our table:

| American Opportunity Tax Credit (AOTC) | Lifetime Learning Credit (LLC) | ==> | | -- | -- | | Maximum amount of money available | $2500 per each qualified student | $2000 per tax return, regardless of the number of students | | Credit period | 4 educational years | Unlimited years if you are receiving higher education | | Refundability | Refundable tax credit | Non-refundable tax credit | | Modified Adjusted Gross Income | Less than $80,000 (filing singly) and $160,000 (filing jointly) | Less than $65,000 (filing singly) and $131,000 (filing jointly) |

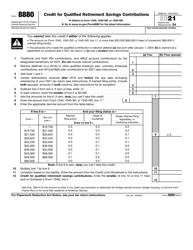

Tax Credits for Retirement

There is a special tax credit designed for low- and moderate-income taxpayers, the Saver’s Credit. It provides individuals with a special tax break. They are allowed to claim the credit for a share of the income contributed to a qualifying retirement plan. The maximum amount of credit is $1,000 ($2,000 if you are married filing jointly). Requirements to qualify for this credit are as follows:

- You must be at least 18;

- You cannot be a full-time student or a dependent on someone else’s tax return;

- Your gross income is less than $32,000 if you are not married filing jointly.

File IRS Form 8880, Credit for Qualified Retirement Savings Contributions with your standard tax return - Form 1040 or Form 1040NR.

Tax Credits for Green Energy

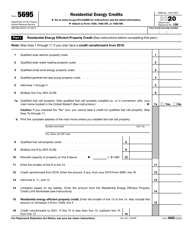

Use IRS Form 5695 to figure and take your residential energy credits. The two main green energy tax credits used to make certain improvements to homes and install appliances designed to boost the energy efficiency of the house are as follows:

- Plug-in electric-drive motor vehicle credit. If you buy such a vehicle, you could receive up to $7,500. According to the IRS latest guidelines, the car must have at least four wheels and a rechargeable battery with 4 kilowatt hours capacity. The minimum amount of credit for a new car is $2,500, and it goes up depending on the battery capacity.

- Residential energy tax credit. If you install solar panels and solar water heaters, you may receive up to 30% of their cost.