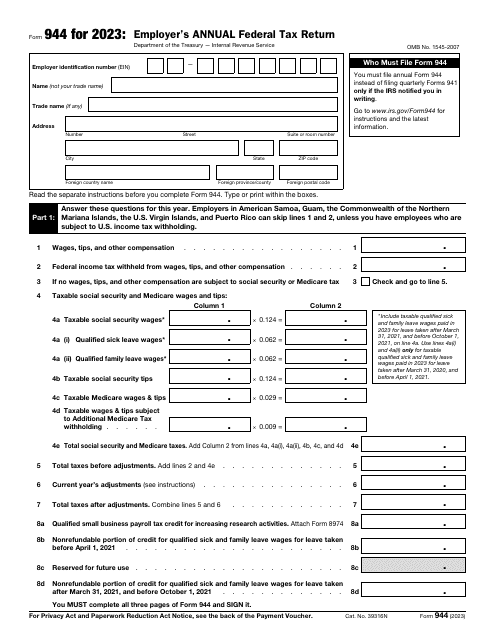

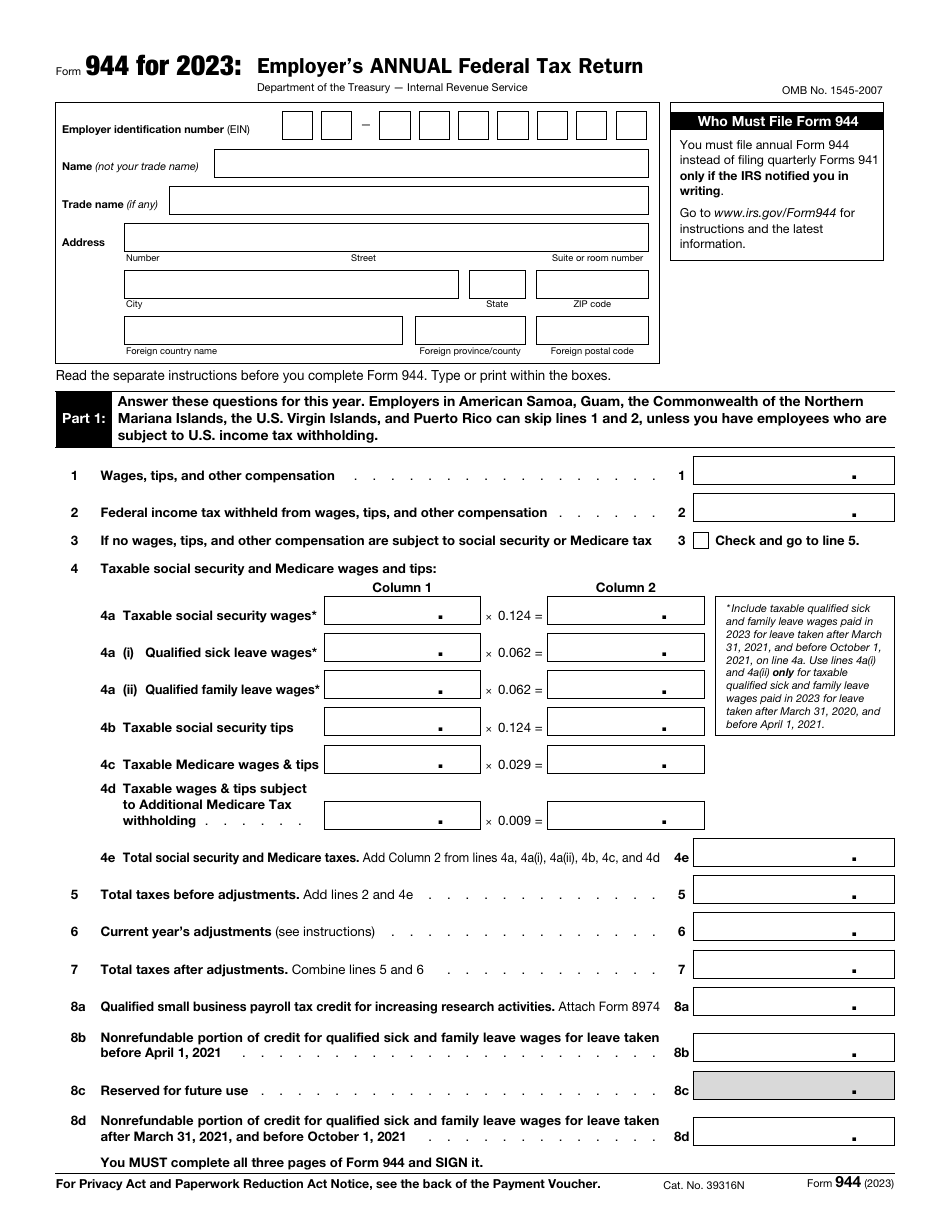

IRS Form 944 Employer's Annual Federal Tax Return

What Is IRS Form 944?

IRS Form 944, Employer's Annual Federal Tax Return , is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

Alternate Names:

- Tax Form 944;

- Federal 944 Form.

Since certain businesses do not have a responsibility to pay thousands of dollars in taxes every year, it makes no sense to request a quarterly summary of their internal operations from them - instead, the government asks these employers to prepare Form 944.

This instrument was released by the Internal Revenue Service (IRS) in 2023 - older editions of the form are now obsolete. Download an IRS Form 944 fillable version below.

The Spanish version of this form can be found here.

Check out the 944 Series of forms to see more IRS documents in this series.

What Is Form 944 Used For?

An employer is allowed to use Form 944 when tax authorities inform them about the responsibility to submit this document in a formal notice. The IRS learns about small companies - businesses with an annual tax liability that does not exceed $1.000 - and notifies them that from that moment forward they will be expected to prepare and file this type of tax return. You will be able to disclose the amount of salaries your employees received during the year, the income tax you deducted from those wages, additional taxes you have deducted from your workers, and the tax credits your business qualifies for.

Form 944 vs 941

Some employers are not sure whether they have to file Form 944 or a similar form - IRS Form 941, Employer's Quarterly Federal Tax Return. By default, prepare and submit Form 941 until you receive a written letter from fiscal organizations reminding you about your low tax liability - after you receive this document, be ready to switch to the 944 Tax Form and update the IRS on your employees' wages and tax deductions less often.

Form 944 Instructions

The IRS Form 944 Instructions are as follows:

-

Start with identifying your business - indicate its employer identification number, the name you selected when setting up the entity, the name you operate under, and the mailing address you regularly use . In case you are located abroad, do not forget to list the name of the country in question, the country or province where you conduct your business, and the postal code.

-

Provide the information about the various types of compensation you paid individuals that work for you and the taxes you deducted already . It is possible the wages and similar compensation are not subject to Medicare or social security tax - check the appropriate case if this is your situation.

-

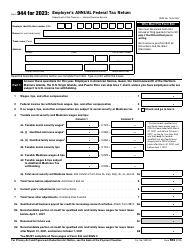

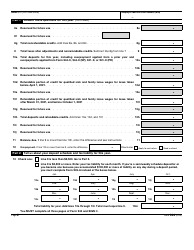

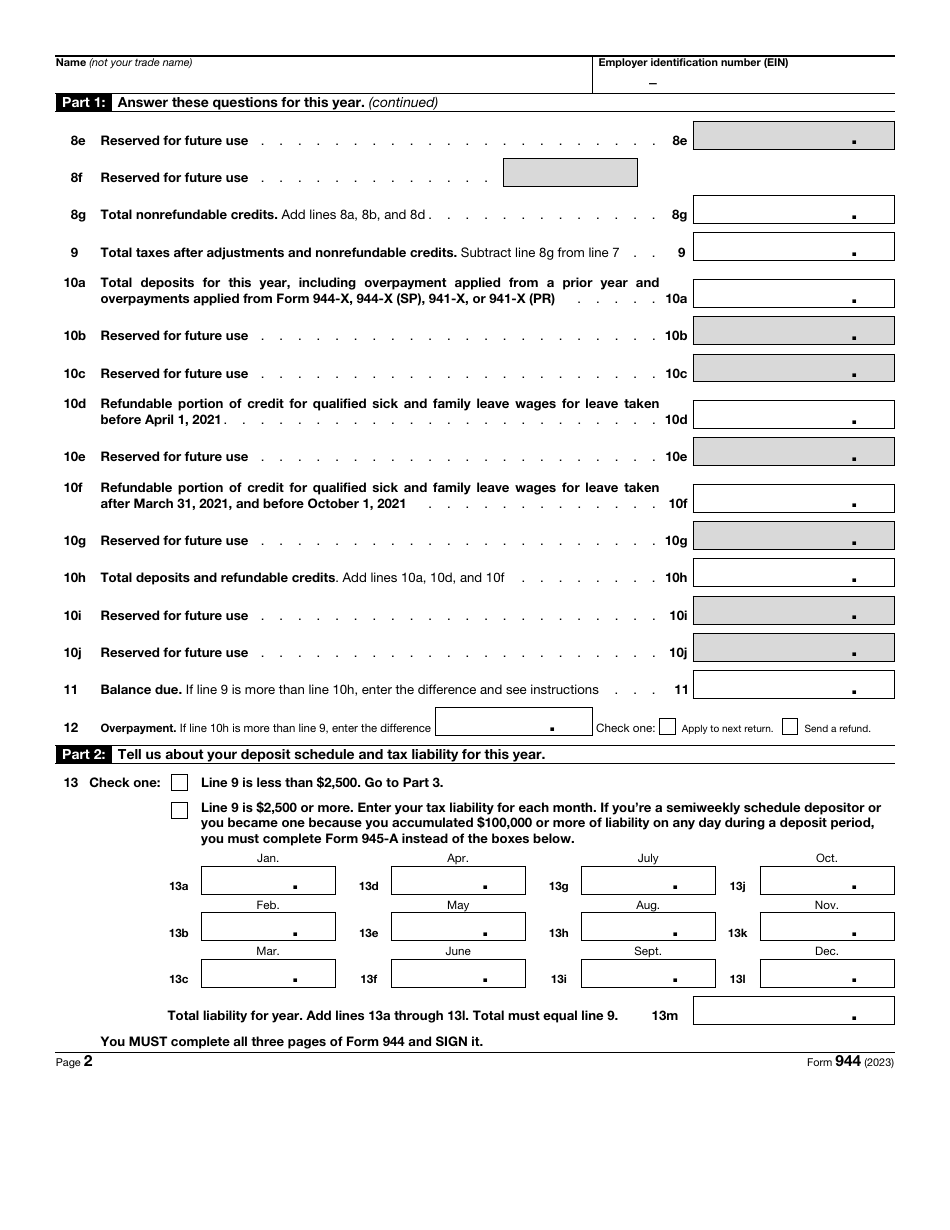

State the accurate amounts of wages and tips subject to tax - note that you have to put them in different categories and multiply the numbers in accordance with current rates . Record the amount of adjustments relevant for the tax period covered in the form and specify how many taxes you owe before and after the adjustments are applied. Enter the amounts of credits you qualify for and calculate the balance due. Some employers discover an overpayment occurred which means they can ask for a reimbursement right away or apply the difference they computed to the next statement they file.

-

Depending on the amount of taxes you have to pay after applying the credits and adjustments, fill out the second part of the form providing a breakdown of your tax liability during every month of the year . Combine the amounts and ensure they match the number you listed in the document above.

-

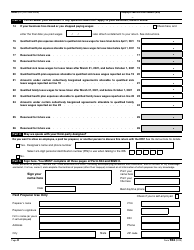

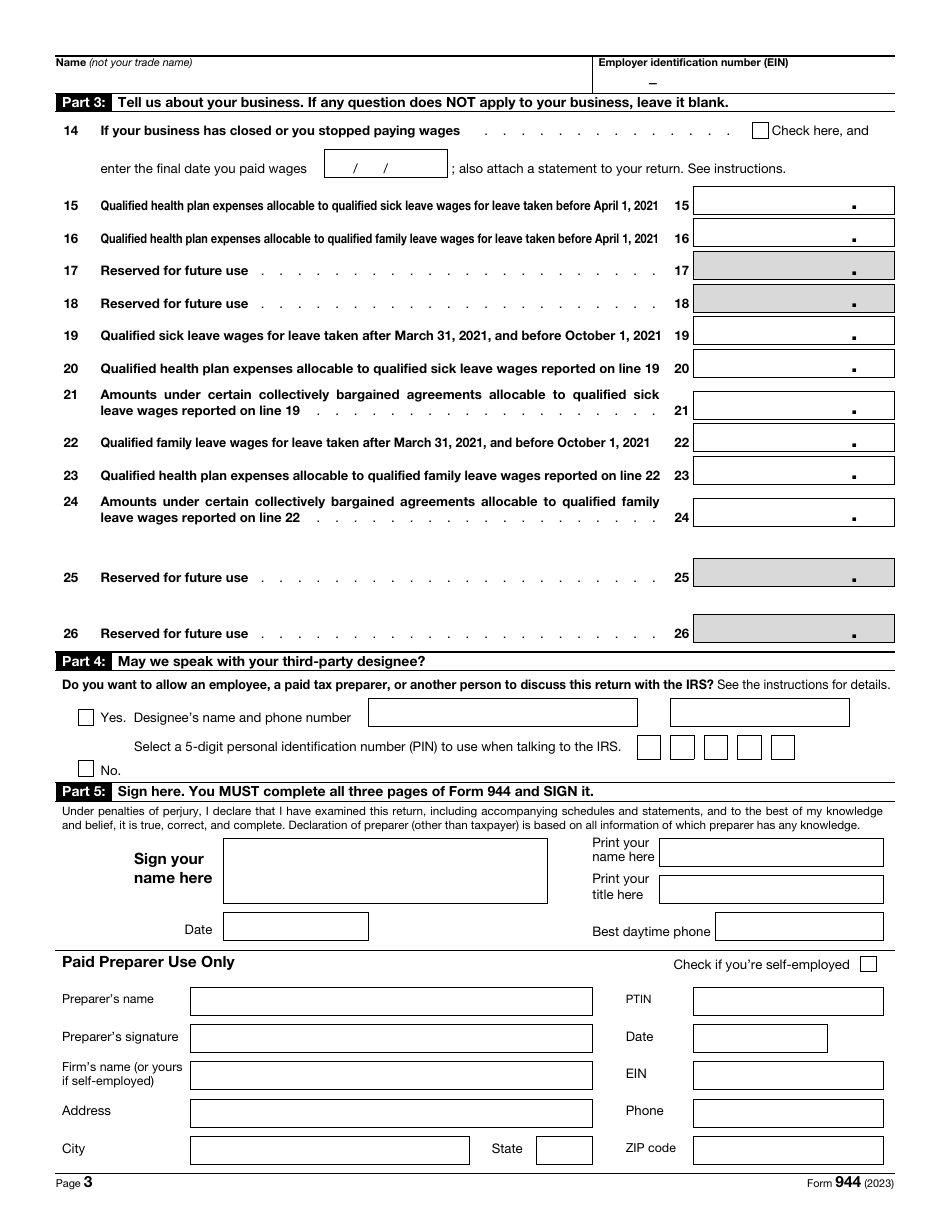

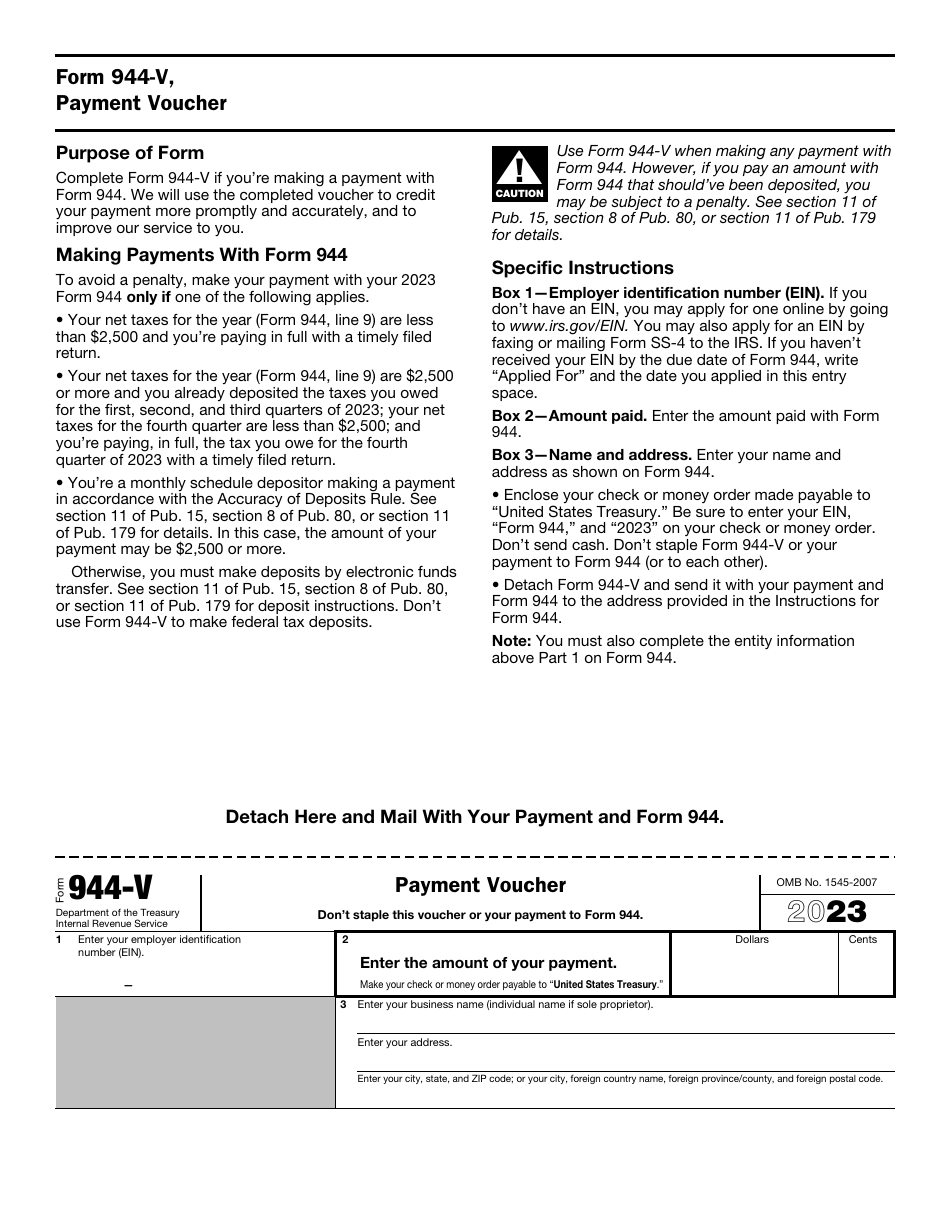

Inform the tax organizations whether you terminated your business activities and how many expenses were allocated to pay for sick leave and family leave . If necessary, give permission to a representative to discuss the information disclosed in the form with the IRS. Certify the paperwork by identifying yourself, adding your telephone number, signing, and dating the statement. A tax professional you hire to help you out with the filing is obliged to identify themselves as well. Complete a voucher if you decide to pay the taxes with a money order or check - state the payment amount, list the main details of your company, and attach the voucher to the form.

When Is Form 944 Due?

The IRS 944 Federal Tax Form must be submitted by employers before the end of January that follows the calendar year described in the statement. There is a different due date for businesses that managed to make their deposits without delay and paid taxes in full - the deadline they are obliged to comply with is February 12.

Where to Mail Form 944?

While taxpayers are always advised to file their tax documentation online whenever possible, paper returns remain a preferred filing method for many employers. Make sure you choose the right Form 944 mailing address when sending a paper return to the tax organizations:

-

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming employers are supposed to send the form to the Department of the Treasury, IRS, Ogden, UT, 84201-0044 . If you attach a payment, the address is IRS, P.O. Box 932100, Louisville, KY, 40293-2100 .

-

Submit the paperwork to the Department of the Treasury, IRS, Kansas City, MO, 64999-0044 if you operate in Connecticut, Delaware, the District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, or New Hampshire. Returns with checks or money orders should be mailed to the IRS, P.O. Box 806532, Cincinnati, OH, 45280-6532 .

-

Tax-exempt companies as well as governmental organizations are required to mail the instrument to the Department of the Treasury, IRS, Ogden, UT, 84201-0044 . In case no payment is attached, the address they have to use is IRS, P.O. Box 932100, Louisville, KY, 40293-2100 .

-

If your company does not have a main place of business, you need to file the document with the IRS, P.O. Box 409101, Ogden, UT 84409 ( IRS, P.O. Box 932100, Louisville, KY, 40293-2100 if the package does not contain a payment).

IRS 944 Related Forms:

- IRS Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund is used to correct mistakes on the previously filed IRS Form 944. This form can be used only to correct administrative mistakes, which occur only when the employer overreports or underreports taxes on their return;

- You can use IRS Form 944 (SP), Declaracion Federal ANUAL de Impuestos del Patrono o Empleador, if you are a Spanish-speaking taxpayer;

- Use IRS Form 944-X (PR) if you reside in Perto Rico or IRS Form 944-X (SP) to claim your refund if you are a Spanish speaking individual.