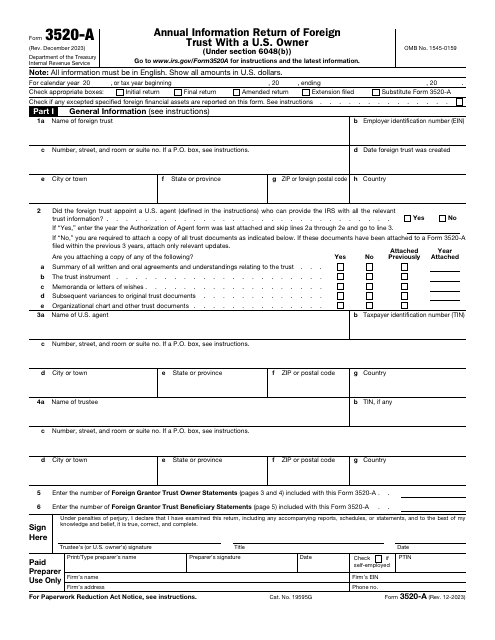

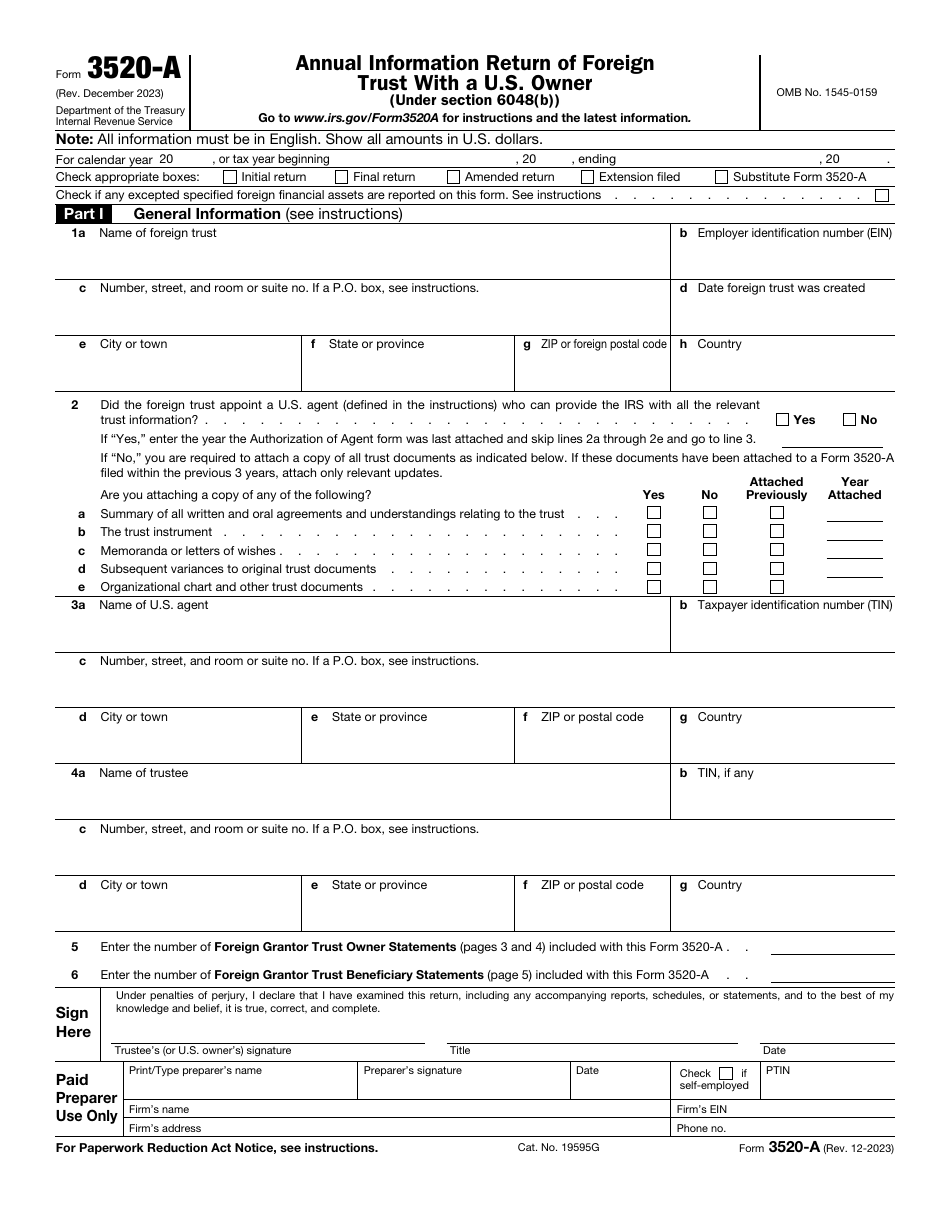

IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

What Is Form 3520-A?

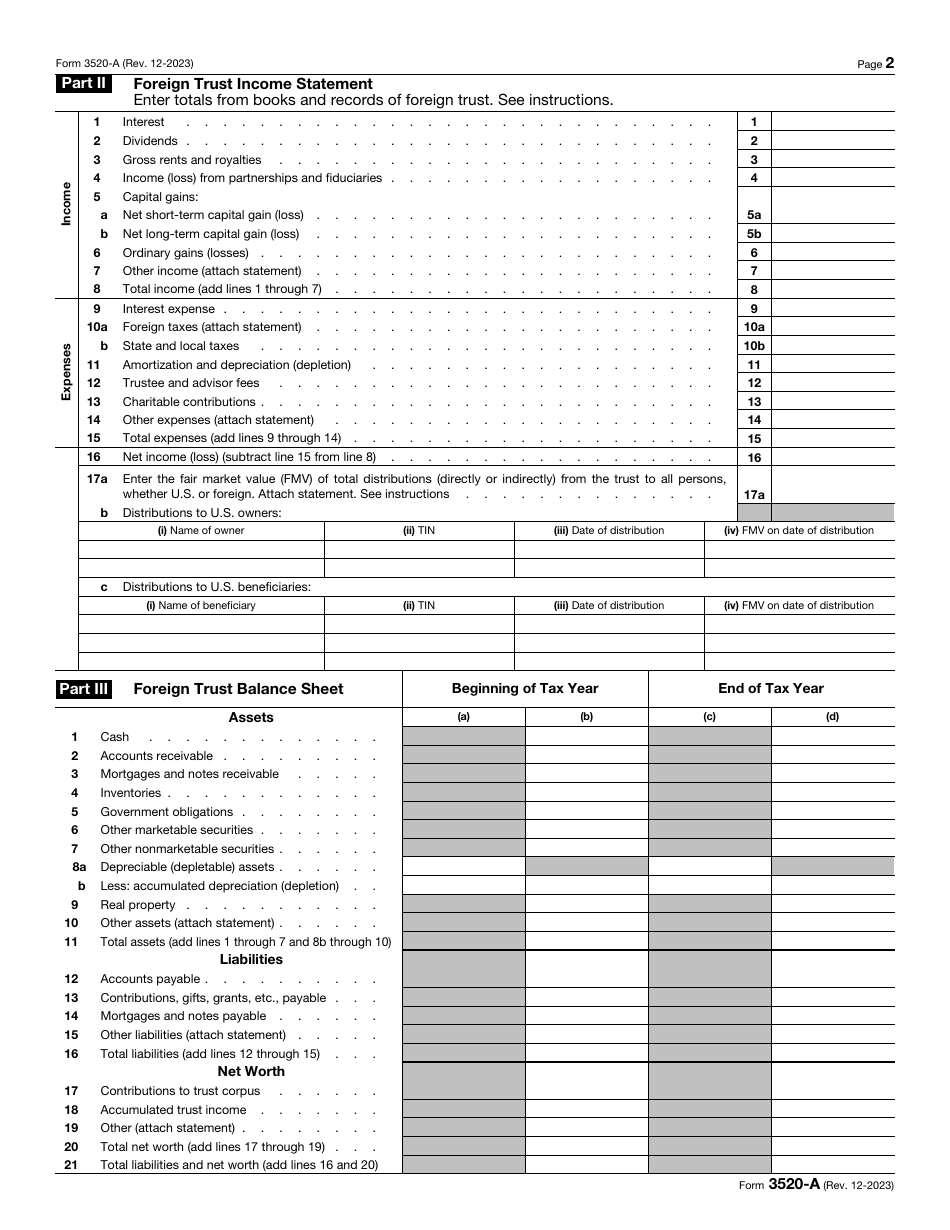

IRS Form 3520-A, Annual Information Return of Foreign Trust with a U.S. Owner, is a form filed with the Internal Revenue Service (IRS) annually by foreign trusts that have at least one U.S. owner in order to provide information about the trust, its beneficiaries from the United States, and any U.S. owner of a foreign trust. This form was issued by the IRS and last revised in 2023.

A fillable version of the form may be found through the link below. The IRS provides Form 3520-A filing requirements and instructions as a separate document.

What Is the Difference Between Form 3520 and 3520-A?

Both forms are related and their information must coincide. Unlike Form 3520‑A, Form 3520 is filed by United States persons - as opposed to foreign trusts - in order to report certain transactions with foreign trusts, ownership of foreign trusts, and receipts of large gifts or bequests from foreigners.

Where to Mail Form 3520-A?

File your Form 3520-A, including all the required statements, with the Internal Revenue Service Center, PO Box 409101, Ogden, UT 84409.

IRS Form 3520-A Instructions

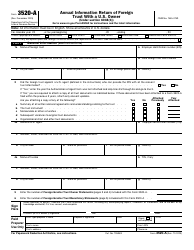

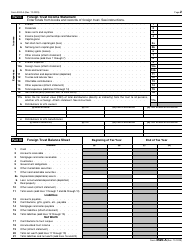

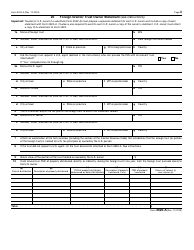

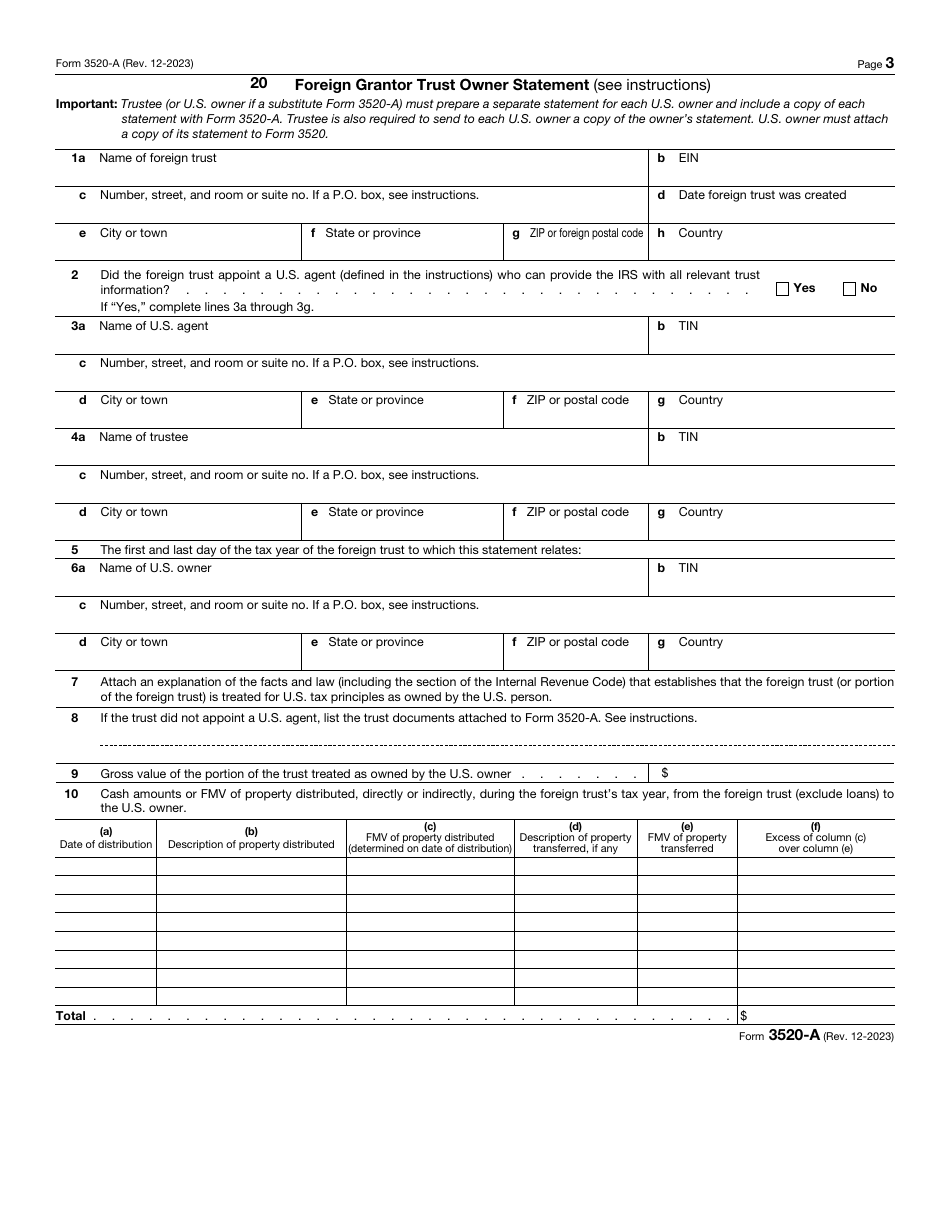

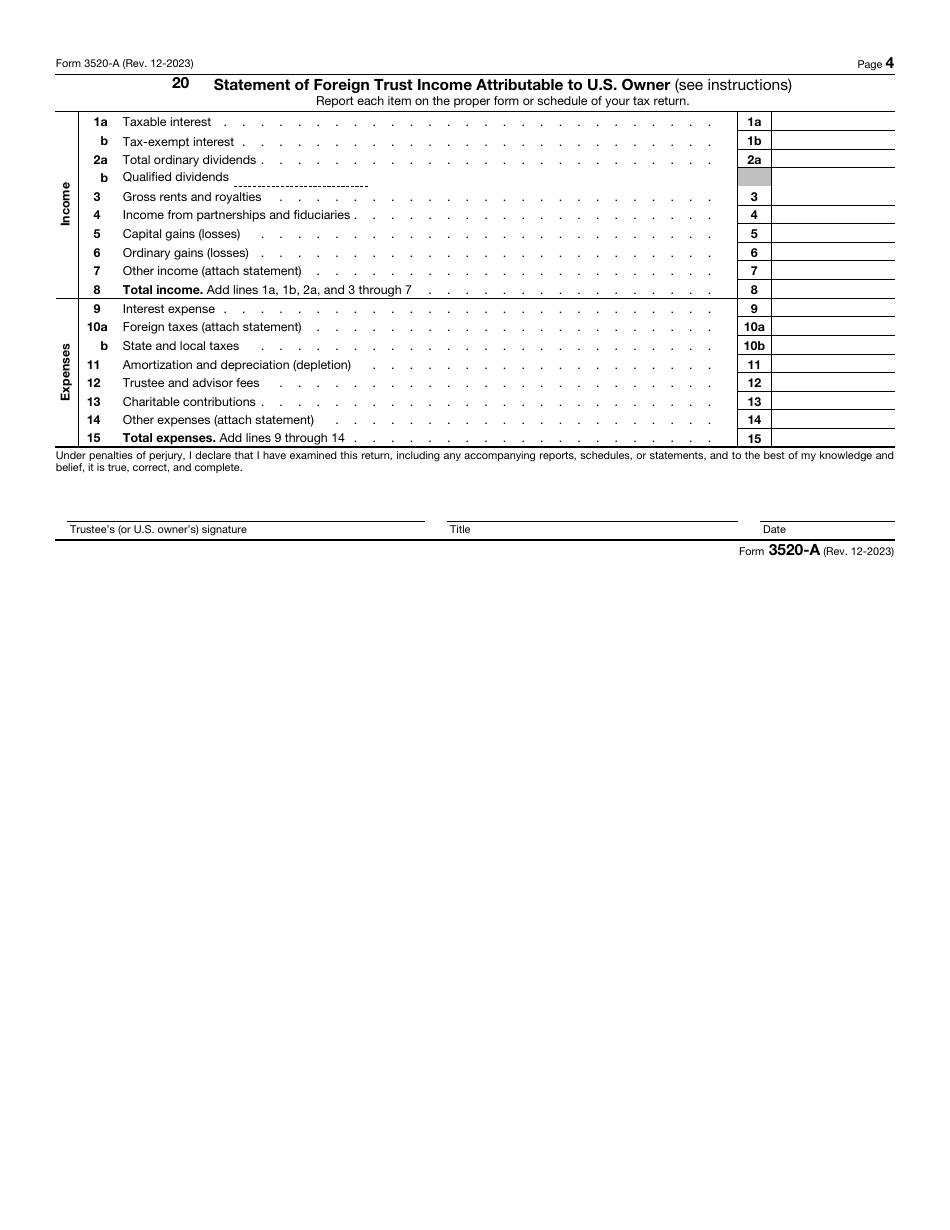

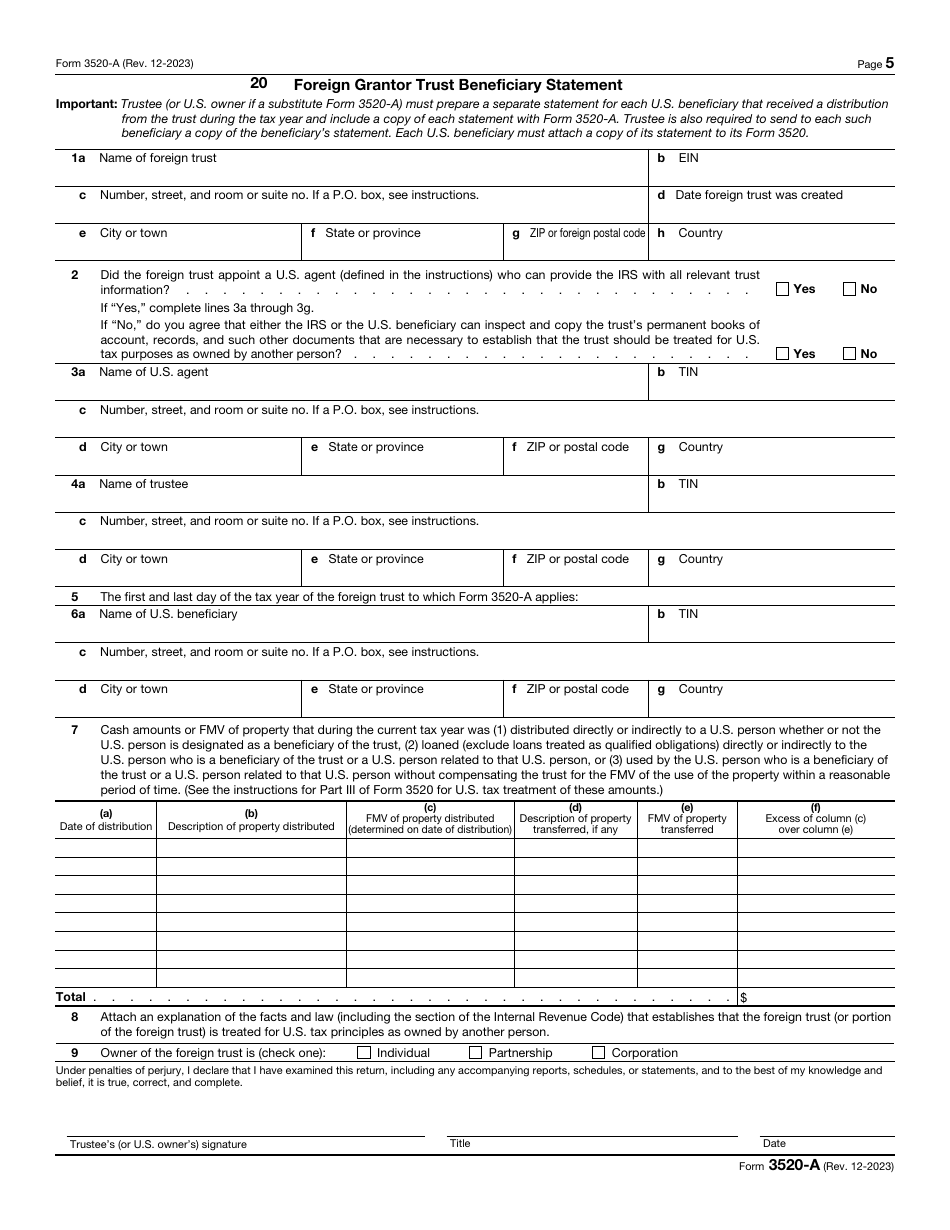

A foreign trust must file the IRS 3520-A Form by the 15th day of the 3rd month following the end of their tax year. It is required to provide the U.S. owners and U.S. beneficiaries with copies of pages 3 and 4 of Form 3520-A (Foreign Grantor Trust Owner Statement) and page 5 of the form (Foreign Grantor Trust Beneficiary Statement) by the 15th day of the 3rd month after the end of the foreign trust's tax year. The foreign trust may request an extension to file 3520-A Form (including the statements) by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

The penalty that applies if the foreign trust does not file Form 3520-A on time or if it is incomplete or incorrect is equal to the greater of $10,000 or 5% of the gross value of the foreign trust's assets owned by a U.S. person under the grantor trust rules. Additional penalties will be imposed if the failure to comply continues for 90 days or more after the IRS serves notification about the noncompliance. U.S. owners are subject to an additional separate penalty to the mentioned above if they fail to file a Form 3520 timely, or if the form is incomplete or has incorrect information. Also, criminal penalties may apply for failure to timely file and for filing a counterfeit or a fraudulent return. However, if the taxpayer can show that the failure to comply was due to a reasonable cause, no penalties will be imposed.

How to File Form 3520-A?

If the return is filed by an individual or a fiduciary, the form must be signed by them. If the form is filed by a partnership, it must be signed by a general partner or company member. If the return is filed by a corporation, it must be signed by the president, vice president, chief accounting officer, treasurer, assistant treasurer, or any other corporate officer having authority to sign.

All foreign trusts with a U.S. owner are required to file Form 3520-A so that the U.S. owner satisfies its annual information reporting requirements. Also, the U.S. person who owns any portion of a foreign trust under the grantor trust rules must ensure that the foreign trust files Form 3520-A and furnishes the required statements to its U.S. owners and U.S. beneficiaries. If a foreign trust does not file Form 3520-A, the U.S. owner is required to complete and attach a substitute Form 3520-A.