Single Parent Tax Credit - Tips on Single Parent Tax Relief

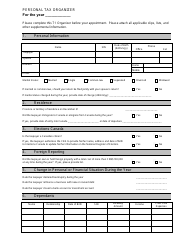

Filing taxes as a single parent entails a lot of questions about the filing status, potential tax credits and deductions you may qualify for, and other ways to ease the financial burden of raising a child. Claiming a tax credit is like putting money back in your pocket, and with the help of our guide, you will learn how to take advantage of the tax breaks for single parents.

Child Tax Credit for Single Parents

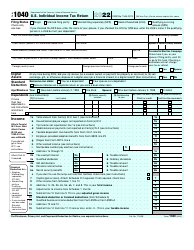

To claim the Child Tax Credit or Credit for Other Dependents, you must complete Form 1040, Individual Income Tax Return. List all qualifying dependents in the appropriate section. Write down their social security numbers, state their relationship to you, and tick the box to claim the single parent tax credit.

If the credit was disallowed or reduced, attach Form 8862, Information to Claim Certain Credits after Disallowance, to your tax return.

Filing as "Head of Household"

Indicate your filing status as “Head of Household” at the top of Form 1040. If you do not claim the child as a dependent, write down the child’s name on the far right of the filing status checkboxes and then use the Tax Computation Worksheet in Form 1041-ES to calculate your tax. To qualify, you must be unmarried or considered unmarried by meeting the following criteria:

- You file a separate tax return;

- You paid more than half the expenses of maintaining your home;

- Your spouse has not lived in your residence during the last six months;

- Your home was the main residence of the child;

- You have the right to claim the child as a dependent.

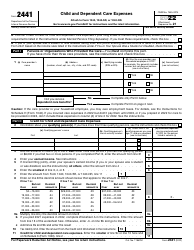

Deducting Childcare Expenses

To claim credit for childcare expenses, you must comply with the following criteria:

- You have claimed the child on Form 2441, Child and Dependent Care Expenses;

- You have earned income;

- You pay childcare expenses so that you can work or look for work;

- You make payments for child care to someone you do not claim as a dependent;

- You identify the care provider on the tax return.

Can I Claim My Child as a Dependent on My Taxes?

It is possible to claim a child as a dependent on the tax return if all of the following conditions apply:

- Child is related to you;

- Child is under age 19 (24 for full-time students) or no age limit for permanently disabled children;

- Child has lived with you for more than half the year;

- You financially support the child;

- Child is a U.S. citizen or resident;

- Child is not filing a joint return;

- You are the only person claiming the child as a dependent.

Can Both Parents Claim the Same Child?

If both parents claim a child on their tax returns, the return filed later will be rejected because the child’s SSN will have already been used in the e-filing system. Parents should decide in advance who is going to claim for the child. Usually, the IRS awards the deduction to the parent with the higher adjusted gross income. Nevertheless, if you think you have the right to claim the child, you can dispute the rejection:

- File a paper return by mail;

- Attach a letter with the evidence (medical records, school registration, etc.) explaining why you have the right to claim a child.

After that, the IRS will determine which individual has a right to claim the dependent.

Child Support and Taxes

Direct child support or help via child support payments is not tax-deductible. The IRS does not allow personal expenses to qualify as tax deductions.

Neither your ex-partner nor your child has to claim child support as income. Child support is viewed by the IRS as a tax-neutral event that does not result in benefits for single parents.

Want to find out more? Check out these related articles: