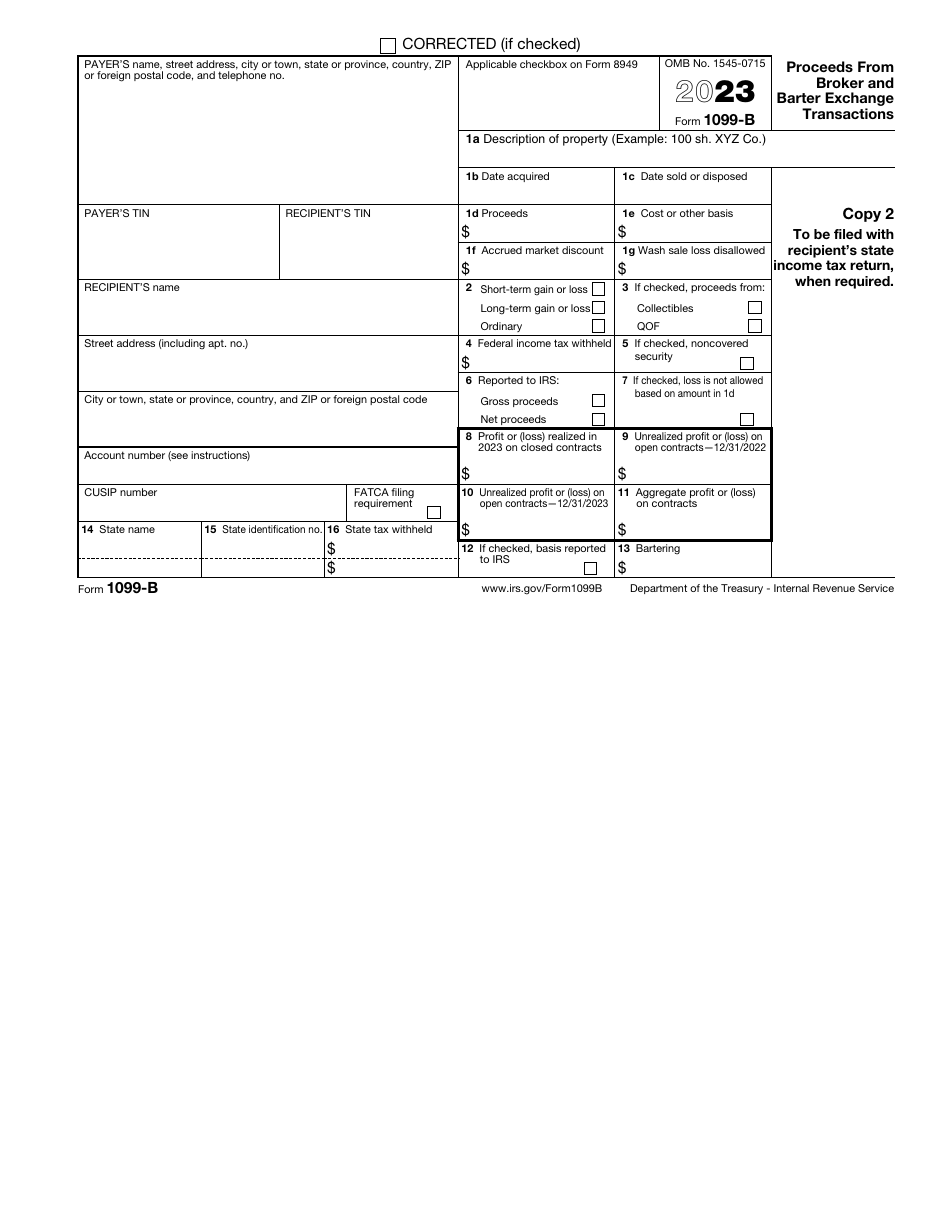

IRS Form 1099-B Proceeds From Broker and Barter Exchange Transactions

What Is IRS Form 1099-B?

IRS Form 1099-B, Proceeds From Broker and Barter Exchange Transactions , is a formal document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

Alternate Names:

- Tax Form 1099-B;

- Federal Form 1099-B.

You need to outline all the operations each customer has been a part of during the past twelve months and inform them about it; once the client gets the form, they will have an opportunity to check if the calculations are correct and submit their tax return with the required adjustments.

This statement was released by the Internal Revenue Service (IRS) in 2023 - older editions of the form are now obsolete. You may download an IRS Form 1099-B fillable version via the link below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-B Form Used For?

The purpose of Federal Form 1099-B is to notify the IRS about potential gains and losses various transactions with brokers led to. More and more individuals continue to earn money through selling bonds and stocks - it is important to explain to the fiscal authorities what was bought and sold, how much money has exchanged hands, and did the broker fulfilled their responsibility by deducting income tax from the amounts listed in the form. It is also mandatory to report bartering if you had an agreement with a barter exchange network trading your products and services for something that was not cash - for instance, you may have offered someone to design their website while they worked on the renovation of your residence.

There are many people that sell securities and stocks for more than it cost them to acquire them in the first place - in this scenario, the profit is considered to be a capital gain which means the amount is going to be taxed. Alternatively, you may have been unlucky during the past year when it comes to broker deals and you sold your shares for less than you wanted - a capital loss must be reported just the same. You will replicate the information from the 1099-B Form when you fill out and file your tax return making sure the government knows everything about your taxable income and no fines and sanctions are imposed on you.

Who Must File Form 1099-B?

Form 1099-B reporting requirements apply to brokers and barter exchanges whose obligation is to itemize all the transactions they have made during the period covered by the tax form. These entities must send a copy of the form to every individual that sold bonds, stocks, and other securities with the assistance of a broker - if you did that over the last twelve months, you can expect to receive Tax Form 1099-B in the mail by the end of January. The same responsibility lies with the people that exchanged services or belongings via a barter exchange.

Note that you cannot miss the Form 1099-B due date - if you prefer traditional paper filing, the deadline is March 1; the terms are less severe for taxpayers that opt for electronic submission - they must file the paperwork by March 31. If you believe your transactions with barter exchanges and brokers warrant filing this form yet you did not receive it in the mail by the end of winter, reach out to the other party and request the documentation so that you do not get in trouble with tax organs.

Form 8949 Vs 1099-B

IRS Form 8949, Sales and other Dispositions of Capital Assets, is a fiscal document taxpayers need to submit in order to describe every stock trade they have made over the past year. It is frequently mistaken for Form 1099-B yet they are different - you may use Form 8949 to elaborate on the discrepancy you have discovered on the Tax Form 1099-B so that your main tax return makes sense. Basically, the information you received or modified on the Form 1099-B will serve as a basis for a more significant statement for people that worked with brokers - you will use its summary for a more detailed description of your transactions and will be able to reconcile the numbers.

Form 1099-B Instructions

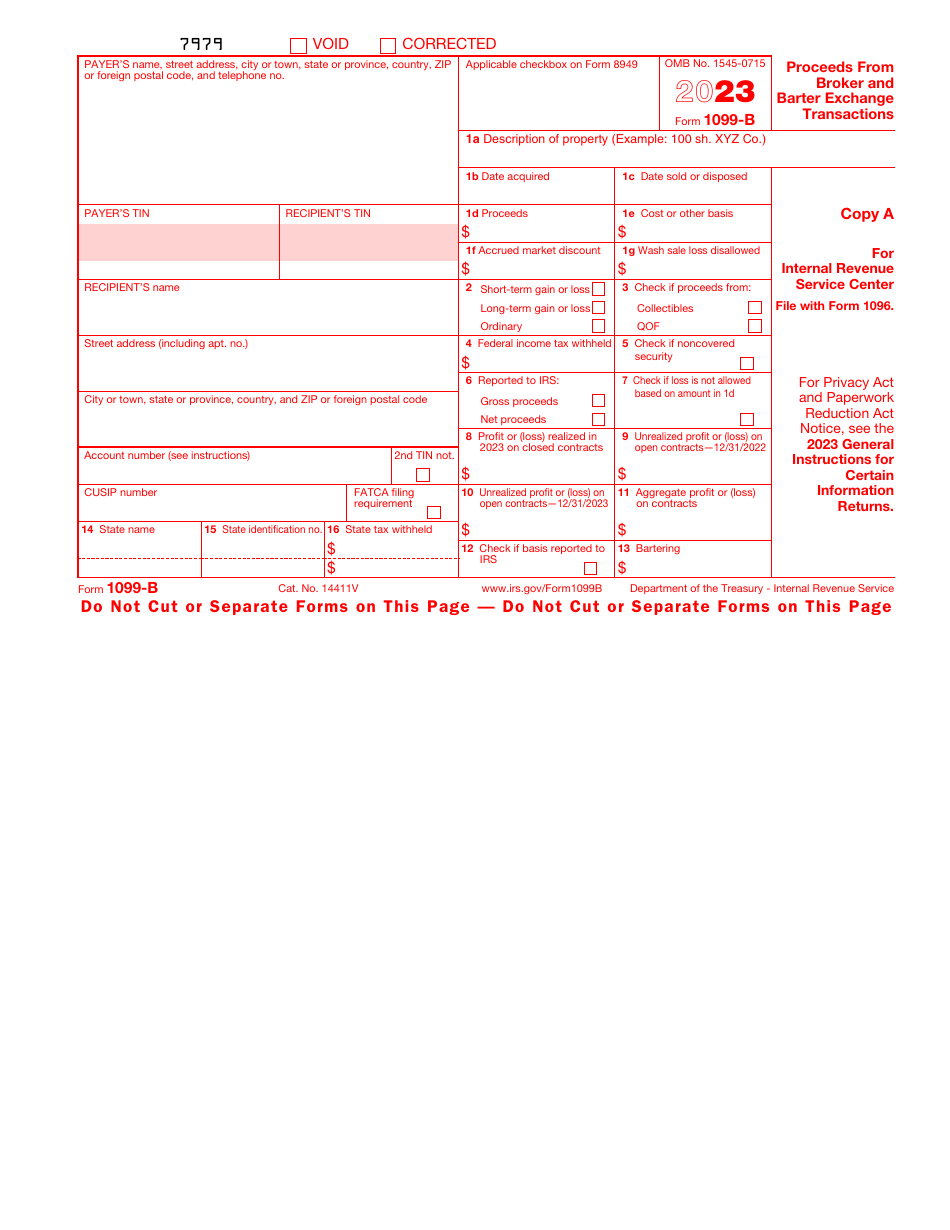

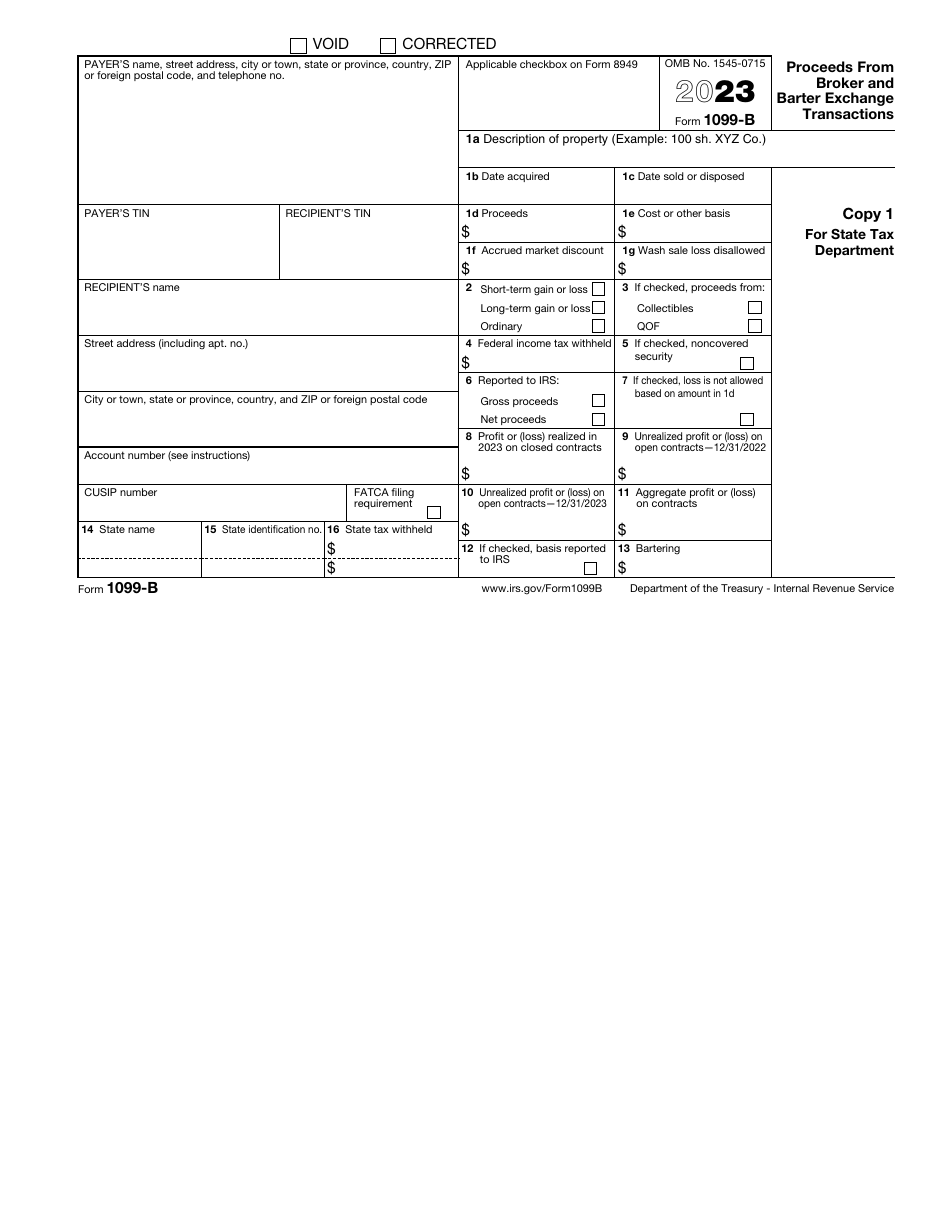

Follow the Form 1099-B instructions to indicate the losses and gains of your clients:

-

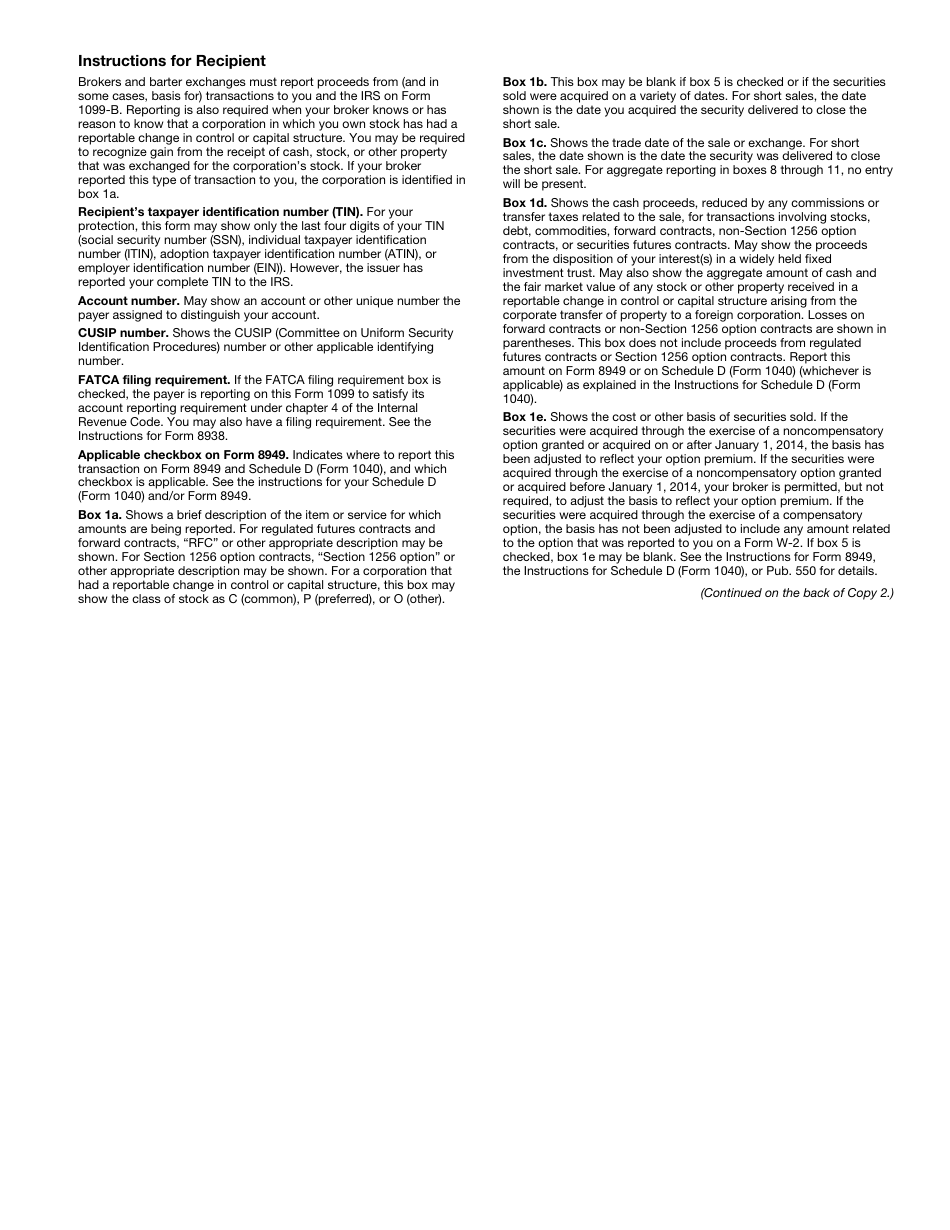

Identify the payer by their name, correspondence address, and taxpayer identification number . Provide the same details for the recipient of the form. Check the appropriate box in case fiscal authorities have warned you two times over the last three years about the fact that the payee has submitted the wrong taxpayer identification number.

-

Write down the Committee on Uniform Security Identification Procedures number if you are a broker reporting operations - the number is supposed to identify the security in question . Check the box to confirm you report payments in line with the terms of the Foreign Account Tax Compliance Act. Indicate the number of the account if the recipient of the form has several accounts - it is important to prevent confusion in this matter.

-

Enter the proper code to explain how you are reporting the transaction . Briefly clarify what property you are describing in the form. You may tell the IRS about the shares, securities, and bartering transactions. Add the date securities were acquired or the date the sale or exchange took place. List the proceeds from all operations as well as the adjusted basis of sold securities. Enter the market discount and the disallowed loss in case wash sale rules apply to you.

-

Check the boxes to report more about the transactions - record the type of loss or gain, explain where the proceeds came from, and confirm whether transactions involved noncovered securities . You have to state the total amount of income tax you deducted, realized and unrealized profit or loss on closed and open contracts, and the amount the client got as a result of barter exchange. Provide information about the state if you are filing taxes via a combined program for state and federal taxation.