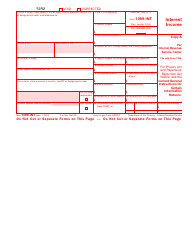

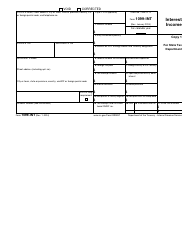

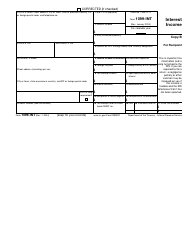

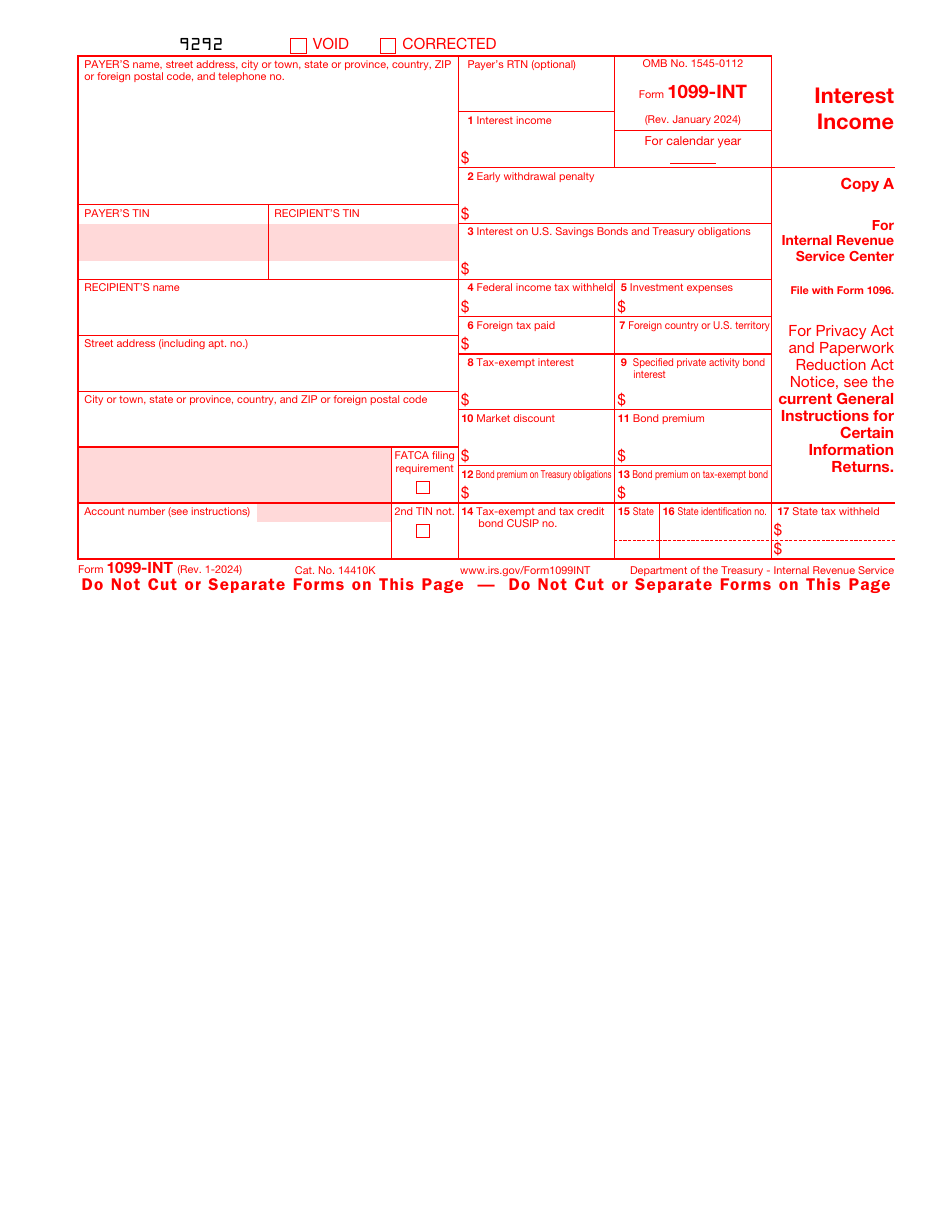

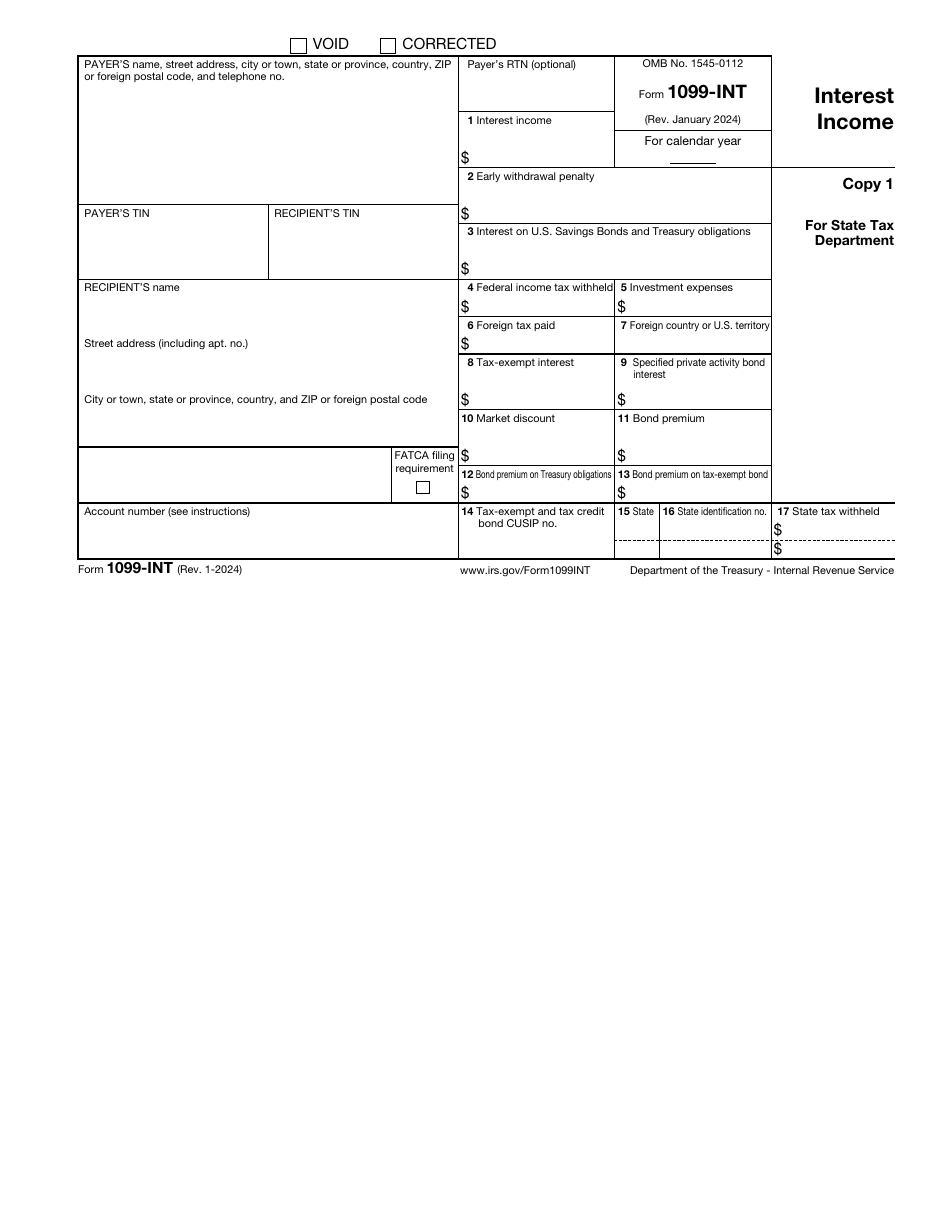

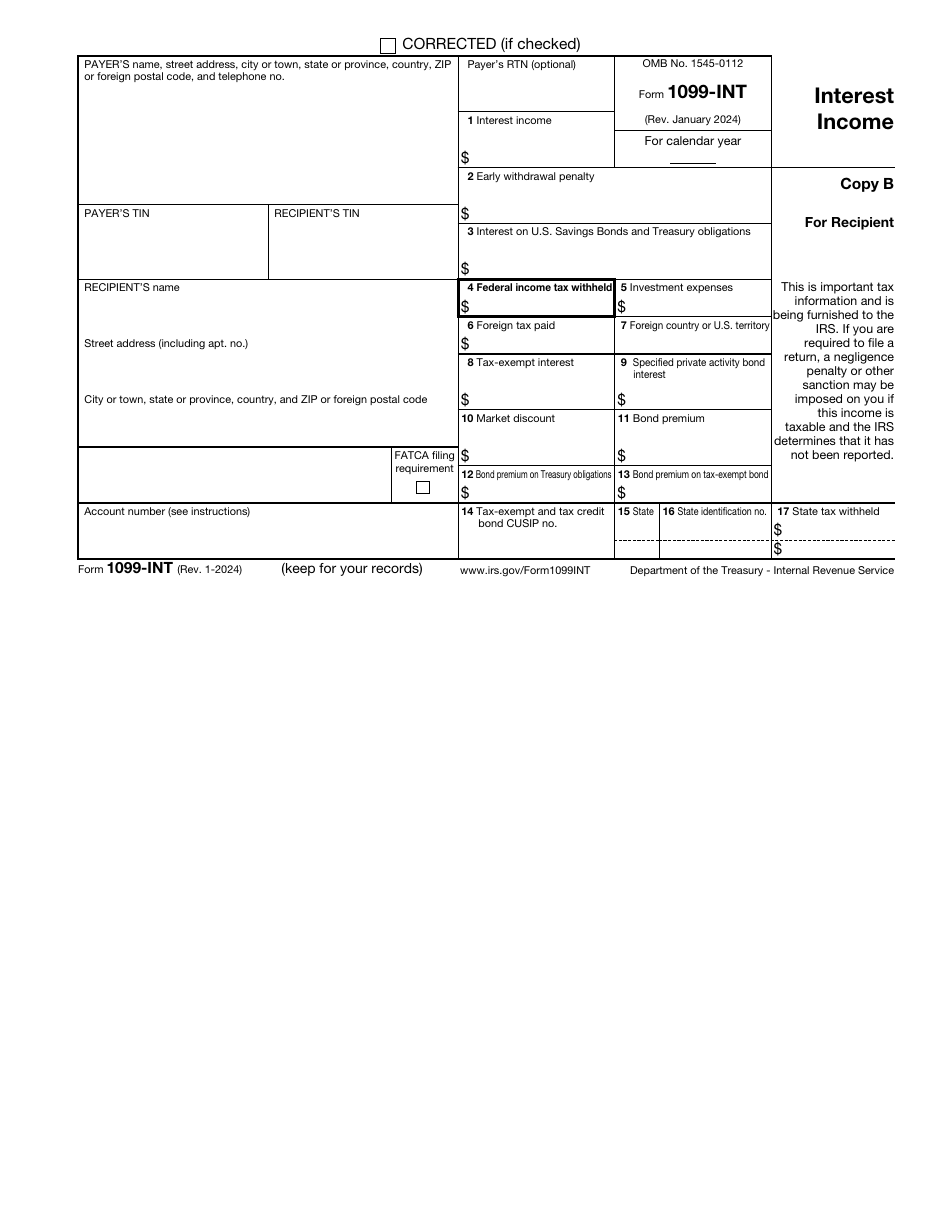

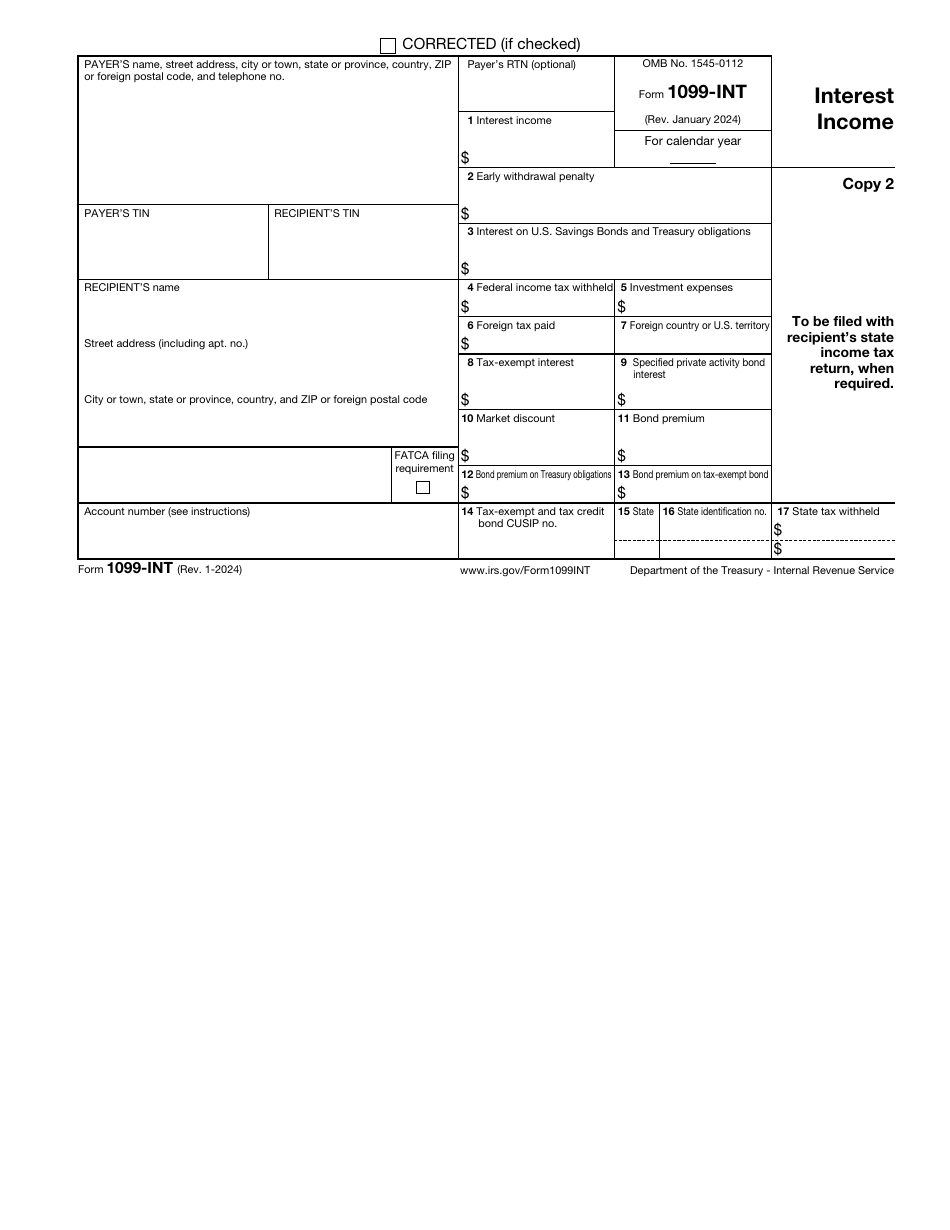

IRS Form 1099-INT Interest Income

What Is IRS Form 1099-INT?

IRS Form 1099-INT, Interest Income , is a fiscal document designed for taxpayers that received different types of interest income.

Alternate Name:

- Tax Form 1099-INT.

The entity that paid the interest in question has to send this document to every investor and elaborate on all the interest and expenses related to it. The interest you must describe in this form includes but is not limited to dividends, deposit account interest, and interest accrued through investments in real estate mortgages.

This instrument was issued by the Internal Revenue Service (IRS) on January 1, 2024 - older editions are now obsolete. An IRS Form 1099-INT fillable version is available for download below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-INT Form Used For?

If you receive a 1099-INT Tax Form in the mail - usually, it happens in winter so that you are ready to file paperwork with the IRS in April - it means that during the year covered by the form you were paid interest. In case a financial institution like a brokerage or bank paid you more than $10, you will get a form that confirms that an entity different from the one that employs you and pays you wages gave you a certain amount of money. Fill out your copy of this tax form to understand how much income you received, what type of income it was, and how to modify the main tax return to include the taxable interest.

Form 1099-INT Instructions

Follow the Form 1099-INT instructions to inform the IRS about the interest income you have received during the year:

-

Identify the payer by their name, mailing address, and taxpayer identification number . Provide the same details to explain who the recipient of the interest income is. It is also mandatory to enter the routing and transit number of the payer in the document if your institution wants to take part in a program whose purpose is to directly deposit refunds.

-

In case the recipient of the form has more than one account with the payer, it is necessary to record the number of their account . Check the box above this field if you need to comply with the filing requirement of the Foreign Account Tax Compliance Act. Note that even if the recipient did not have an account number before this form is prepared, it is advised to assign this identification information to them.

-

Record the taxable interest - only amounts of $10 and above should be taken into account . If you have to deal with a penalty for the early withdrawal, enter the appropriate amount on the form. Individuals and entities that received interest on savings bonds and payment instruments issued by the U.S. Treasury Department are expected to report their amounts.

-

Inform the tax authorities about the federal income tax deducted from the interest, the expenses related to investments, and the foreign tax you paid . The latter amount has to be in U.S. dollars - you also must specify the country the tax originated from.

-

Write down the interest that will be exempt from taxation and the interest that came from specific private activity bonds . Certain covered securities can be purchased with a market discount - enter its amount if it equals or exceeds $10. Pay attention to the bond premium - it is obligatory to report it if amortization of this kind was allocable to the interest, including the bond premium applied to tax-exempt bonds and obligations released by the U.S. Treasury.

-

If any of the accounts contained single bonds, write down the Committee on Uniform Securities Identification Procedures number . Identify the state of the payer if you are a participant of the program that facilitates combined filing on federal and state levels.

-

Once you have calculated the total amount of state tax deducted, consider the document ready for filing . Note that there must be several copies of the document prepared - one will be sent to a state tax department, another goes to the recipient, and the third one is for the payer. When you submit the documentation to the IRS, do not forget to add the interest income to your main tax return.