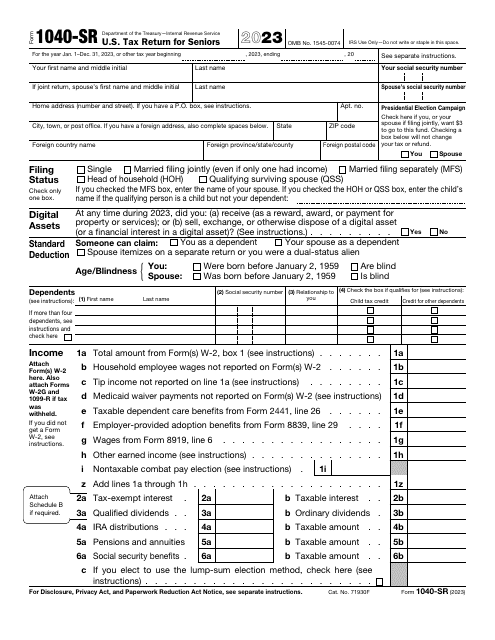

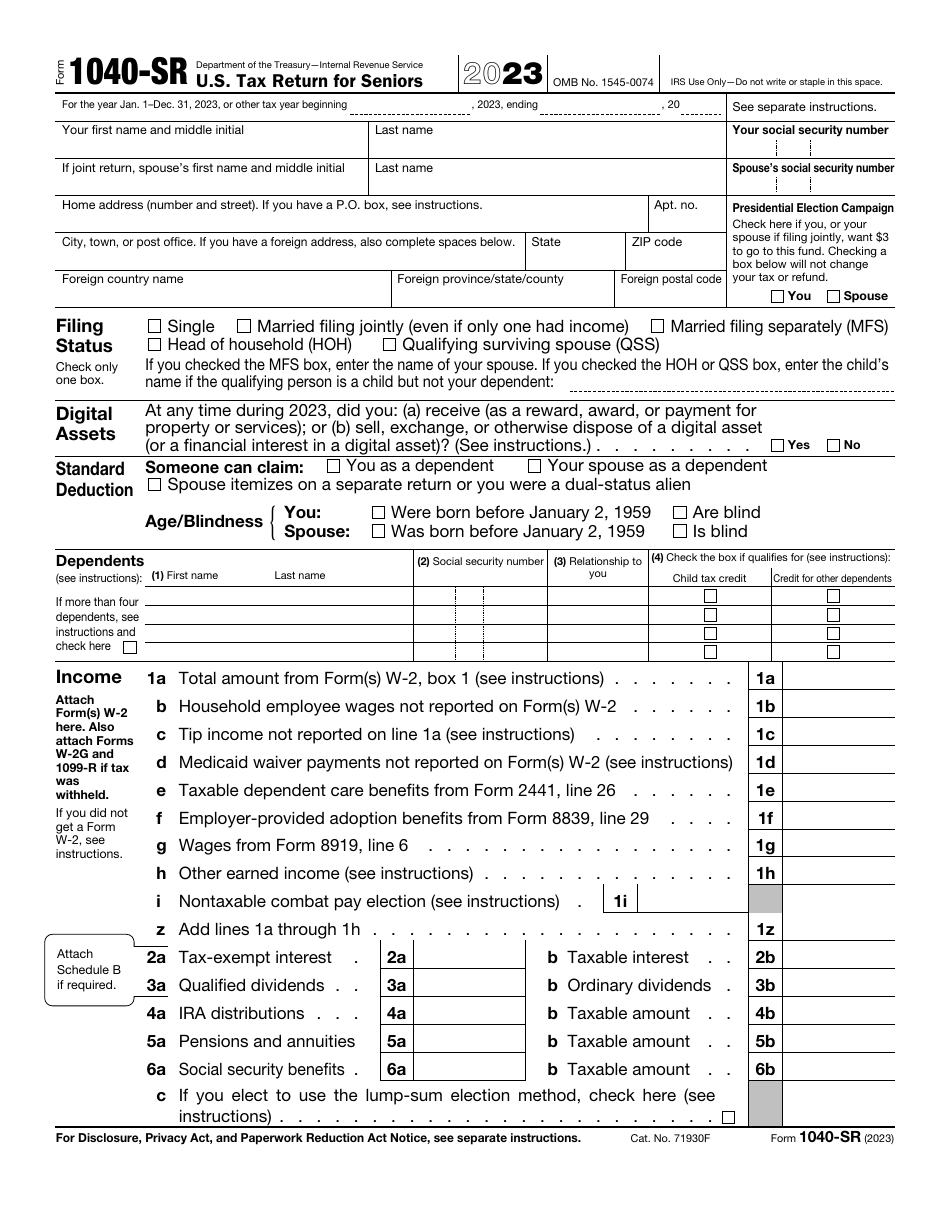

IRS Form 1040-SR U.S. Tax Return for Seniors

What Is Form 1040-SR?

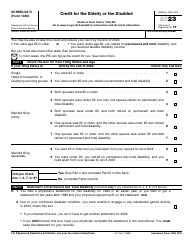

IRS Form 1040-SR, U.S. Tax Return for Seniors , is a document for those taxpayers who are 65 years old or older. The purpose of the document is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts (those used in IRS Form 1040, U.S. Individual Income Tax Return).

Alternate Name:

- Senior Tax Return Form.

The document is released by the Internal Revenue Service (IRS) and was last updated in 2023 . A fillable 1040-SR is available for download through the link below.

Form 1040-SR Instructions

-

The first part contains identifying information on the applicant, including:

- Applicant's filing status. This section offers the applicant to choose their filing status out of the provided options (single, married filing jointly, married filing separately, head of household, or qualified widow or widower);

- Applicant's name. Here, the applicant must designate their first name, middle initial, and last name;

- Spouse's name. The applicant's spouse's first name, middle initial, and last name (only if filing jointly);

- Applicant's Social Security Number. Applicants use this field to state their Social Security Number;

- Spouse's Social Security Number. Applicants must fill in the gap with their spouse's Social Security Number;

- Applicant's home address. This part includes building number, street name, apartment number and PO box (if the applicant has one);

- Information concerning the applicant's and their spouse's age and blindness. It will influence the amount of deduction further in the application;

- Standard deduction information. The applicant must designate if someone can claim them as a dependent, their spouse as a dependent, or if their spouse itemizes on a separate return or the applicant was a dual-status alien;

- Information about the applicant's dependents. This is the part of the application where the applicant must list their dependents, their social security numbers, relationships with them, etc.

-

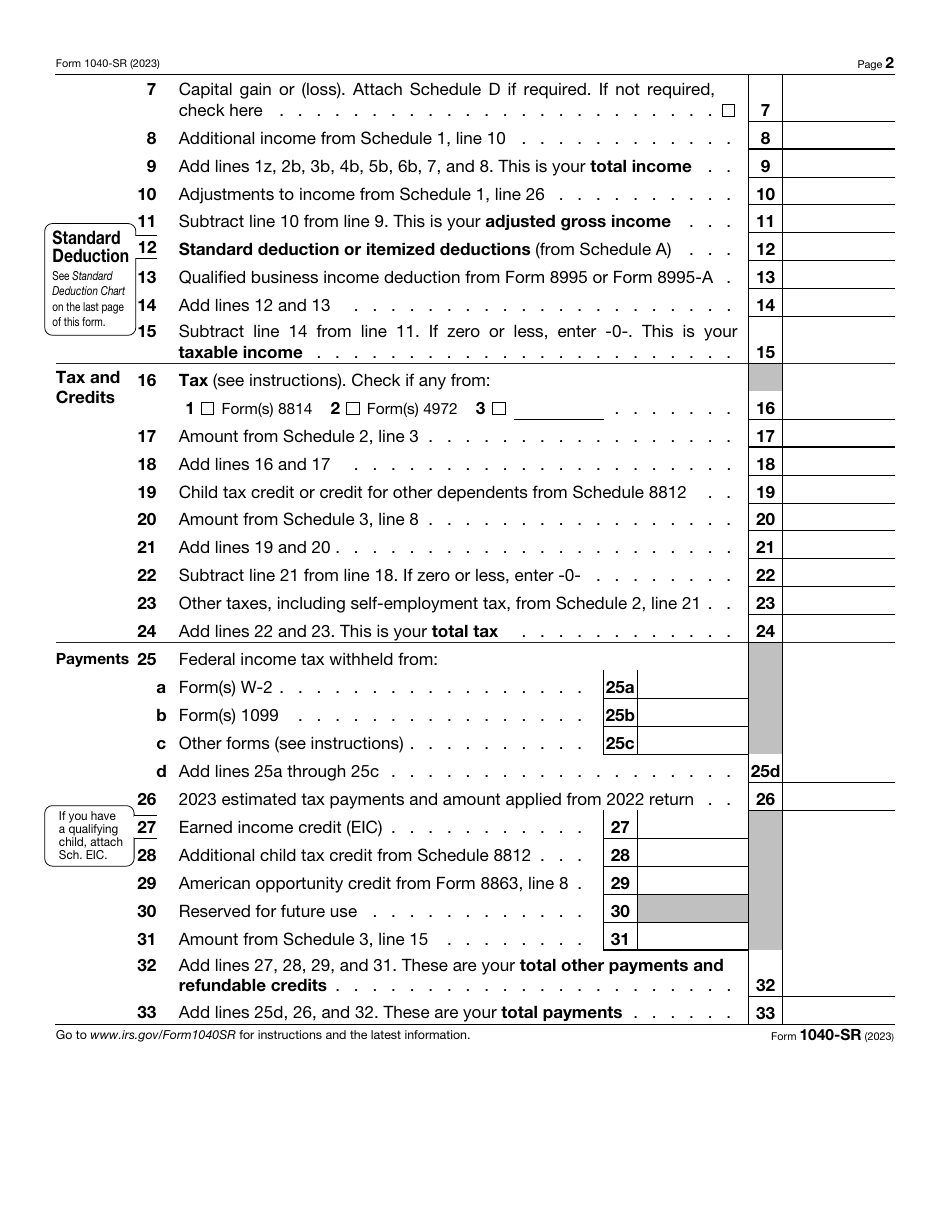

After entering identifying information, the applicant is supposed to fill in the gaps connected with their financial information. This part of the application contains statements, such as IRA distributions, pensions and annuities, social security benefits, tax-exempt interest, qualified dividends, and many more. The official 1040-SR Form instructions provide explanations on how to fill in each line. For example, in Line 6 (Capital Gain or Loss), the applicant is supposed to designate if they sold a capital asset.

-

Then taxpayers are supposed to fill out a few more charts. These charts are systematized in a certain way and are supposed to sum up all the financial information reported in the document:

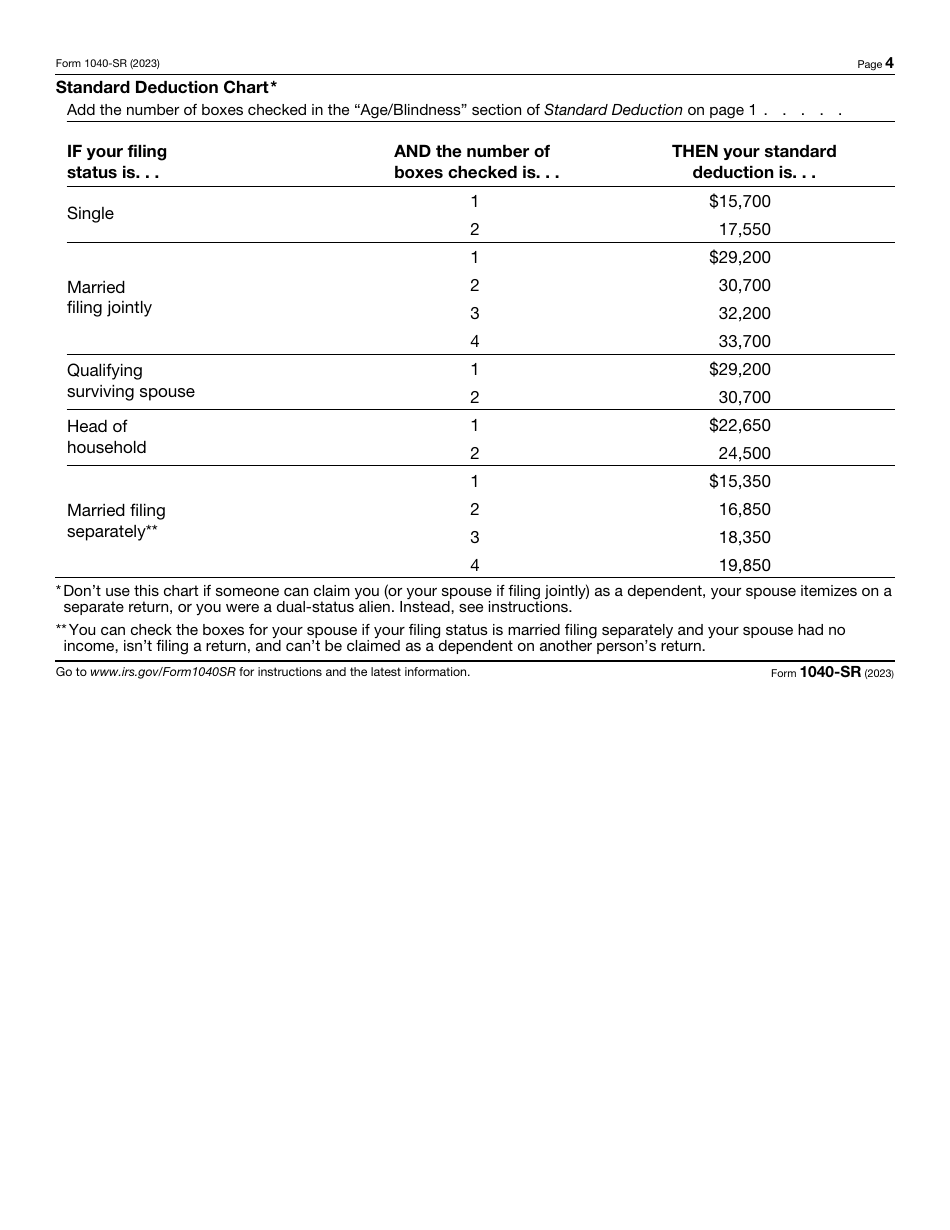

- Standard Deduction Chart

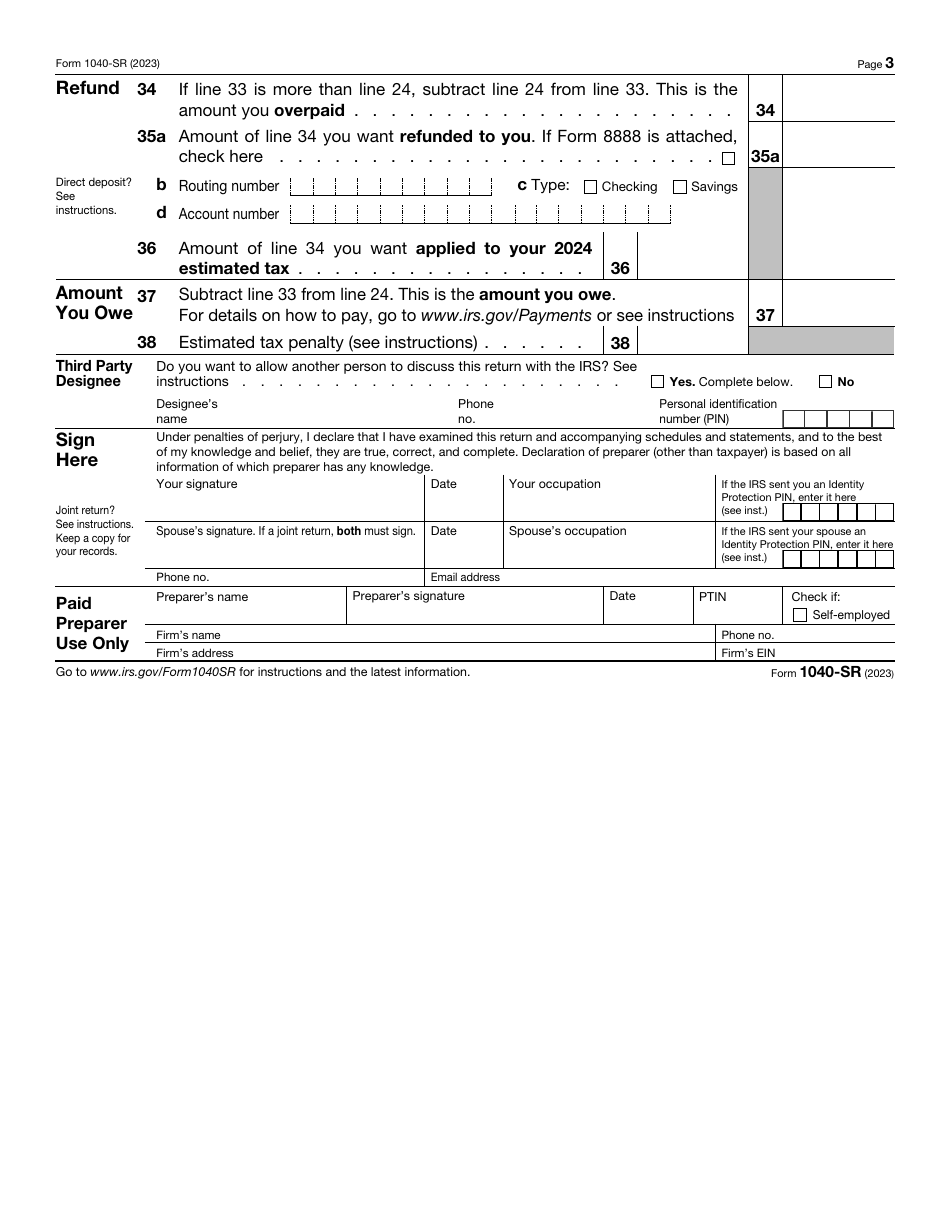

- Refund. This section contains a formula which the applicant is supposed to follow to count the amount they wanted to be refunded to them;

- Amount you owe. To count the amount the applicant owes they should subtract their total tax from their total income. These numbers can be found earlier in the application.

-

The rest of the form includes sections like third party designee (if the applicant wants to allow another person to discuss their return with the IRS), a place for the applicant's signature, and a section for a paid preparer use only.

1040-SR Related Forms:

- IRS Form 1040-C, U.S. Departing Alien Income Tax Return. A document developed for aliens who are going to leave the US and want to report income they received (or will receive) for the entire tax year;

- IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return. A form for nonresident aliens who participated in a trade or business in the US;

- IRS Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents. This application is supposed to be used by those filers whose only income in the US was salaries, tips, wages, etc .;

- IRS Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico). Taxpayers can use this document if they are nor required to file a US income tax return;

- IRS Form 1040-V, Payment Voucher. Taxpayers must use this form when they send their check or money order due on the "amount you owe" line in their income tax return application;

- IRS Form 1040-X, Amended U.S. Individual Income Tax Return. The application can be used to make corrections in income tax return forms;

- IRS Form 1040-ES, Estimated Tax for Individuals. This document can be used by applicants to figure their estimated tax.