IRS Form 945-A Annual Record of Federal Tax Liability

What Is IRS Form 945-A?

IRS Form 945-A, Annual Record of Federal Tax Liability , is a formal document employers use to reconcile their tax liability over the course of the calendar year.

Alternate Names:

- Tax Form 945-A;

- Annual Record of Federal Tax Liability Form.

Use this form to report tax liability with the following forms:

- IRS Form 944, Employer's Annual Federal Tax Return;

- IRS Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund;

- IRS Form 945, Annual Return of Withheld Federal Income Tax;

- IRS Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund;

- IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return;

- IRS Form CT-1 X, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund.

Whether you deducted income tax on nonpayroll payments such as pensions, gambling winnings, and certain dividends the employee is entitled to receive, handled retirement benefits, or deducted income tax and social security taxes, you need to summarize the information in a separate instrument that shows when those payments were made and confirms you adhered to the deposit schedule established for your entity.

This statement was issued by the Internal Revenue Service (IRS) on December 1, 2020 , rendering previous editions of the form obsolete. You may download an IRS Form 945-A fillable version below.

What Is Form 945-A Used For?

Prepare and file a 945-A Tax Form to inform fiscal authorities about your tax liability on a federal level. You have to summarize this liability based on several documents - IRS Form 945, Annual Return of Withheld Federal Income Tax, IRS Form 944, Employer's Annual Federal Tax Return, and IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return. Ensure the calculations you have carried out while filling out this instrument have the same results you report on either of these forms - it is your duty to reconcile the amounts before you submit the specifics of your tax obligations to the IRS.

It is mandatory to mail this form attached to either of these returns if you deposit employment taxes in three business days that follow a certain tax period. Additionally, employers that deposit once a month and have a tax liability of $100.000 and more belong to the same category the day after the deposit is done - this means, they also have an obligation to complete this instrument. Note that taxpayers are exempt from the obligation to file this statement if the total tax liability is below $2.500. Employers that deposit taxes monthly and have to pay less than $100.000 are also not supposed to submit this form.

Form 945-A Instructions

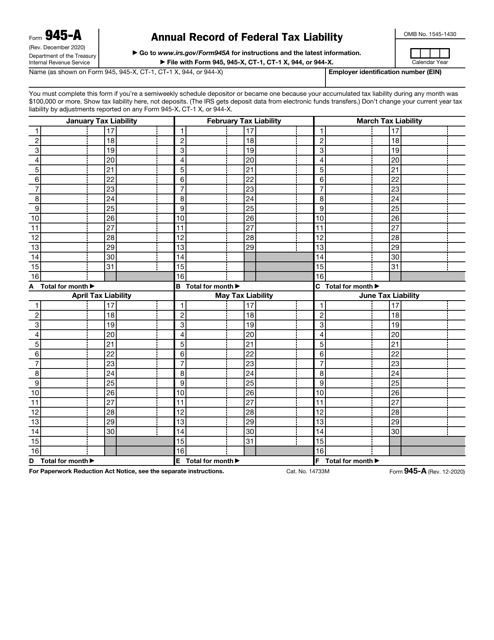

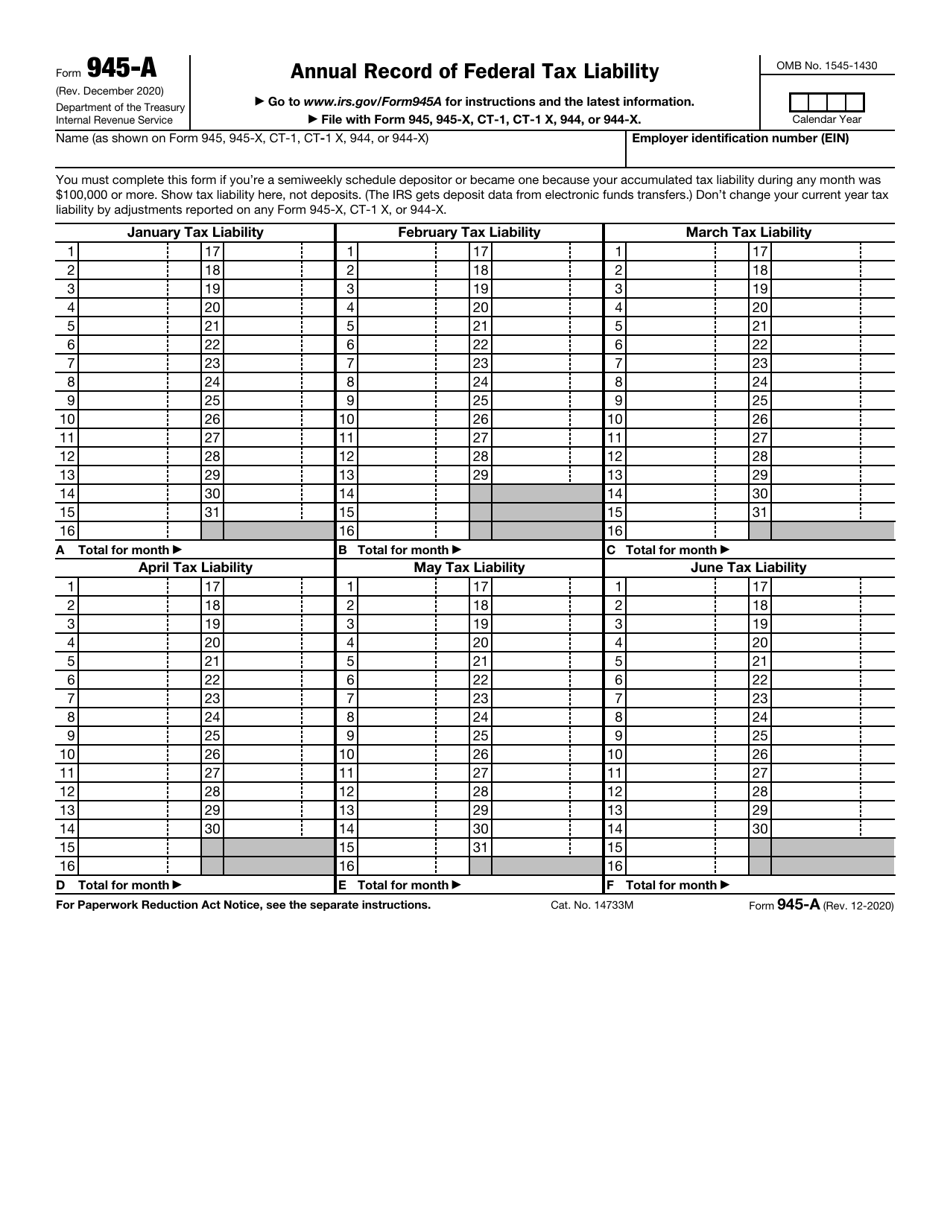

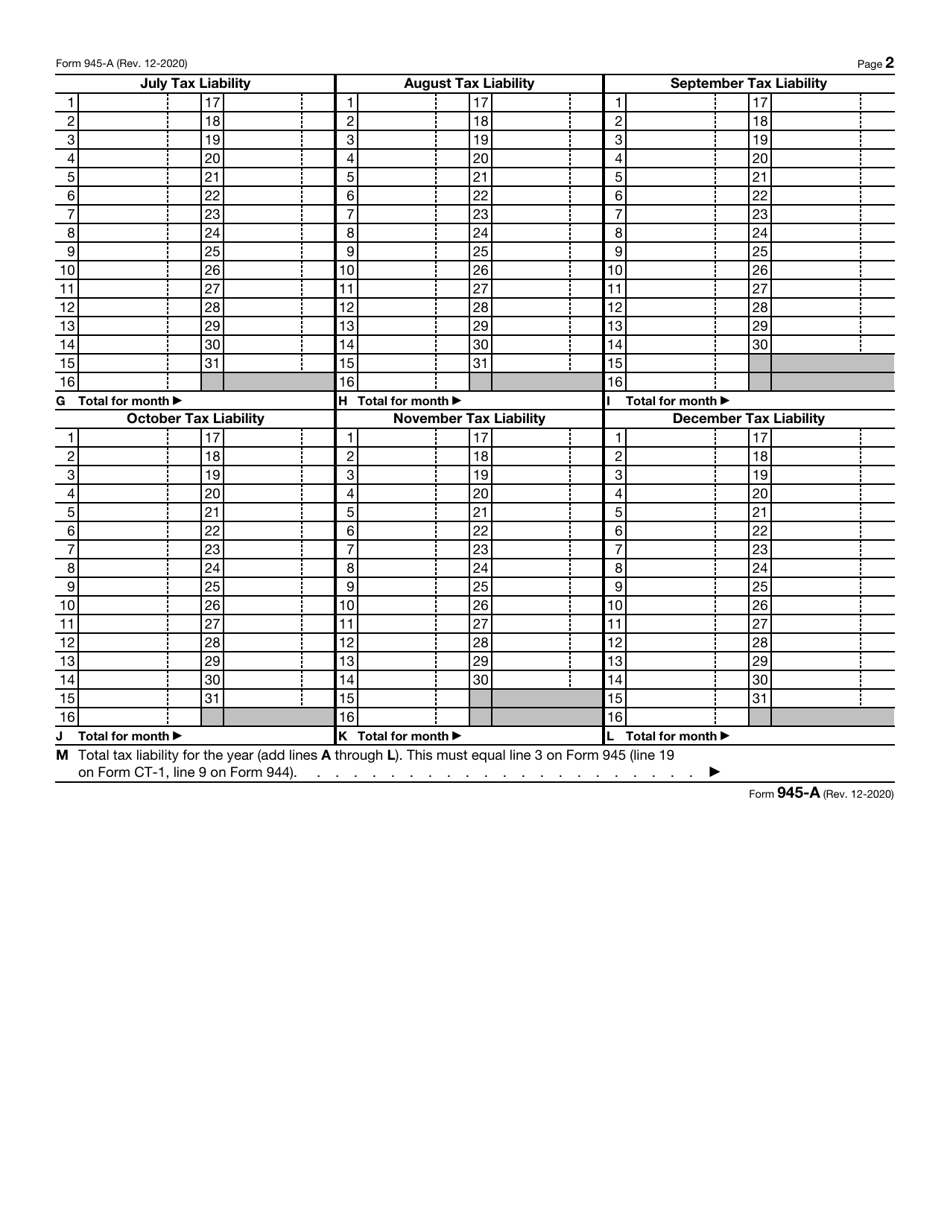

Follow these Form 945-A Instructions to determine and report your yearly tax liability:

-

Specify the calendar year you describe in the form, write down the name of your entity, and add your employer identification number - the information you list has to match the details you have included in your main tax return.

-

Certify your tax liability . The form is separated into twelve months of the year as well as the days of the calendar year - the information you disclose must be entered into fields that correspond to the dates when you issued nonpayroll payments and paid salaries to people you classify as your employees. Combine the results and calculate the total amount of tax liability for each month of the year.

-

Indicate the tax liability of your organization at the end of the calendar year - the number you get must be the same you list on the tax return you are supposed to file . If you submit Form 944 or Form 945, mail them to the IRS with a copy of Form 945-A attached by January 31 of the year that comes after the calendar year outlined in writing. Employers that must file Form CT-1 need to submit the paperwork by February 29.

-

Modify the information you filed via this form earlier if fiscal organs notified you about a mistake you have made and imposed a penalty on your organization . If you are amending the documentation, mark the instrument with the word "Amended" on the top of the first page so that your penalty may be reduced.

When Is 945-A Due?

The Form 945-A due date depends on the form it is filed with. If the form is filed with Form 945 or Form 945-X, the due date is January 31st of the next year. If filed with Form CT-1 or Form CT-1 X, the due date is February 28th of the next year. If filed with Form 944 or Form 944-X, the due date is January 31st of the following year.

Where to Mail Form 945-A?

The mailing address for IRS Forms 945-A depends on the form it is filed with. If the form is filed with the Forms CT-1 or CT-1 X, the form should be mailed to the Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999-0048 . The mailing address for forms filed with Forms 945 or 944 depends on the locations the form is filed at, the type of organization, when the form is filed and whether payment is included with the form. The complete lists of mailing addresses can be found on the IRS-issued instructions for each form.

IRS 945-A Related Forms

- IRS Form 945, Annual Return of Withheld Federal Income Tax is used to report taxes withheld from non-payroll payments. These payments include Annual Return of Withheld Federal Income Tax is a form used to report taxes withheld from pensions, gambling winnings, Indian gaming profits, backup withholding, military retirement and voluntary withholding on certain government payments.

- IRS Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund is used to correct mistakes on previously filed IRS form. If a mistake was discovered on any of these forms, the employer must file IRS Form 945-X as soon as possible.