IRS Form 1120-W Estimated Tax for Corporations

What Is IRS Form 1120-W?

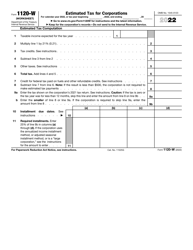

IRS Form 1120-W, Estimated Tax for Corporations , is a supplementary instrument corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities. Corporations whose total tax liability for the calendar year equaled or exceeded $500 as well as certain S corporations, organizations with tax-exempt status, and private foundations that operate domestically usually have to deal with estimated tax payments, and this worksheet allowed these entities to carry out the necessary calculations correctly.

This document was released by the Internal Revenue Service (IRS) in 2022 - an IRS Form 1120-W fillable version is available for download below.

Nowadays, corporations are no longer allowed to use this document to calculate the estimated tax amount to describe any quarter of the tax year - instead, taxpayers are supposed to deposit their payments via the Electronic Federal Tax Payment System (EFTPS).

Check out the 1120 Series of forms to see more IRS documents in this series.

When Are Corporate Estimated Tax Payments Due?

Corporate estimated tax payments are, in general, due by the 15th day of the tax year's 4th, 6th, 9th, and 12th months. If the due date falls on a weekend, or a legal holiday, the installment payment is due on the next business day.

Some corporations are required to electronically deposit all depository taxes, including the federal corporate estimated tax payments. If the estimated tax payments are not done by the due date, the corporation may be subject to an underpayment penalty for the underpayment period. Use Form 2220 to see if the corporation owes a penalty and to figure the penalty amount.

Form 1120-W Instructions

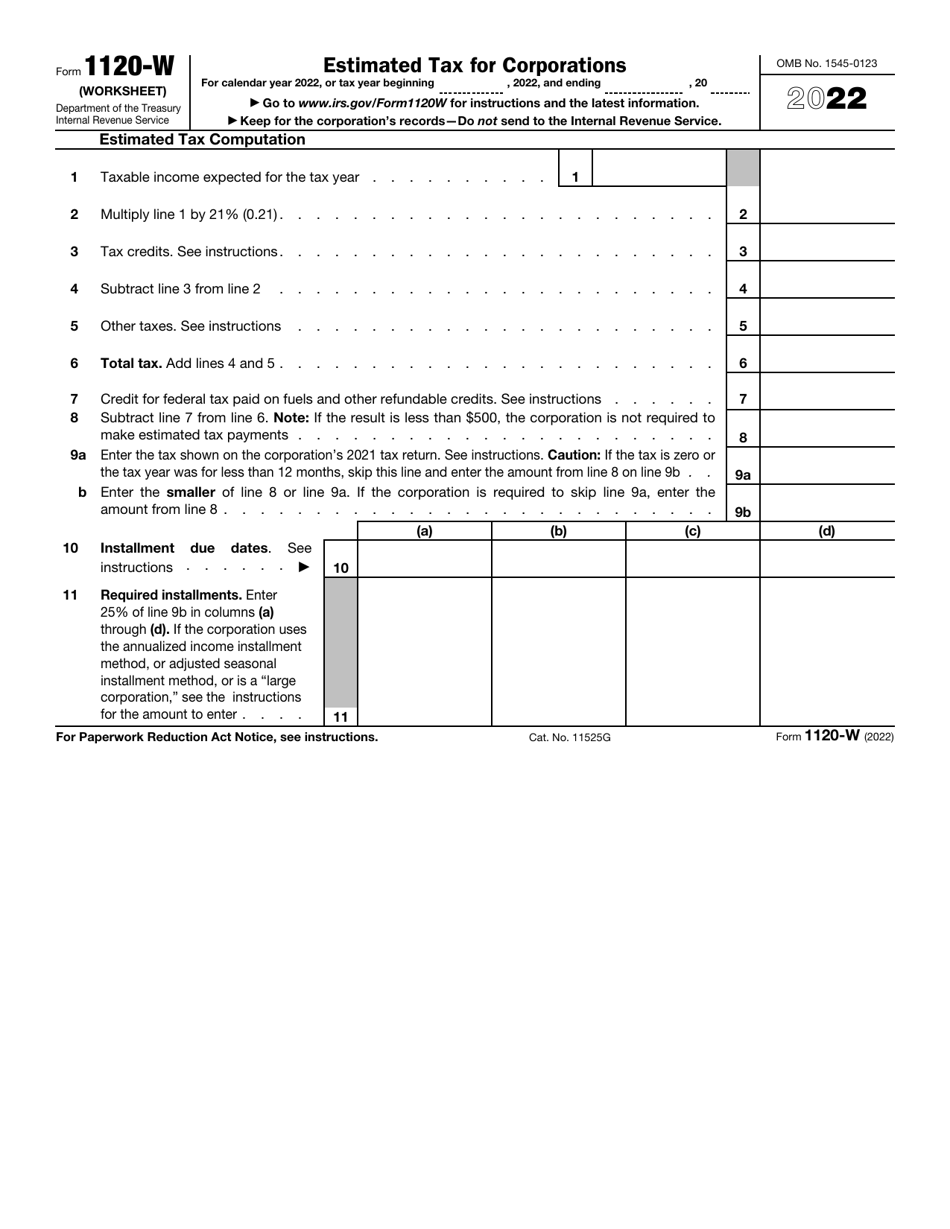

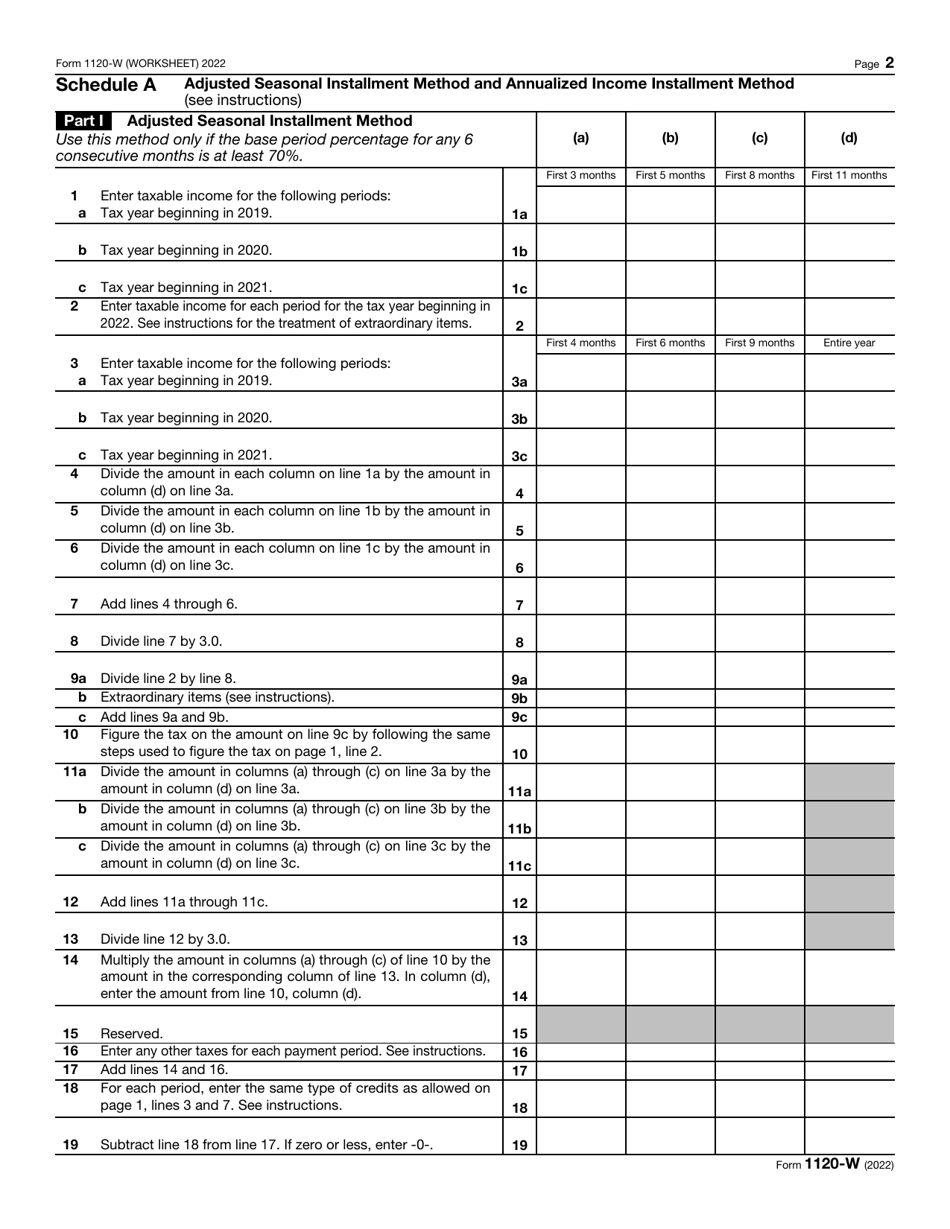

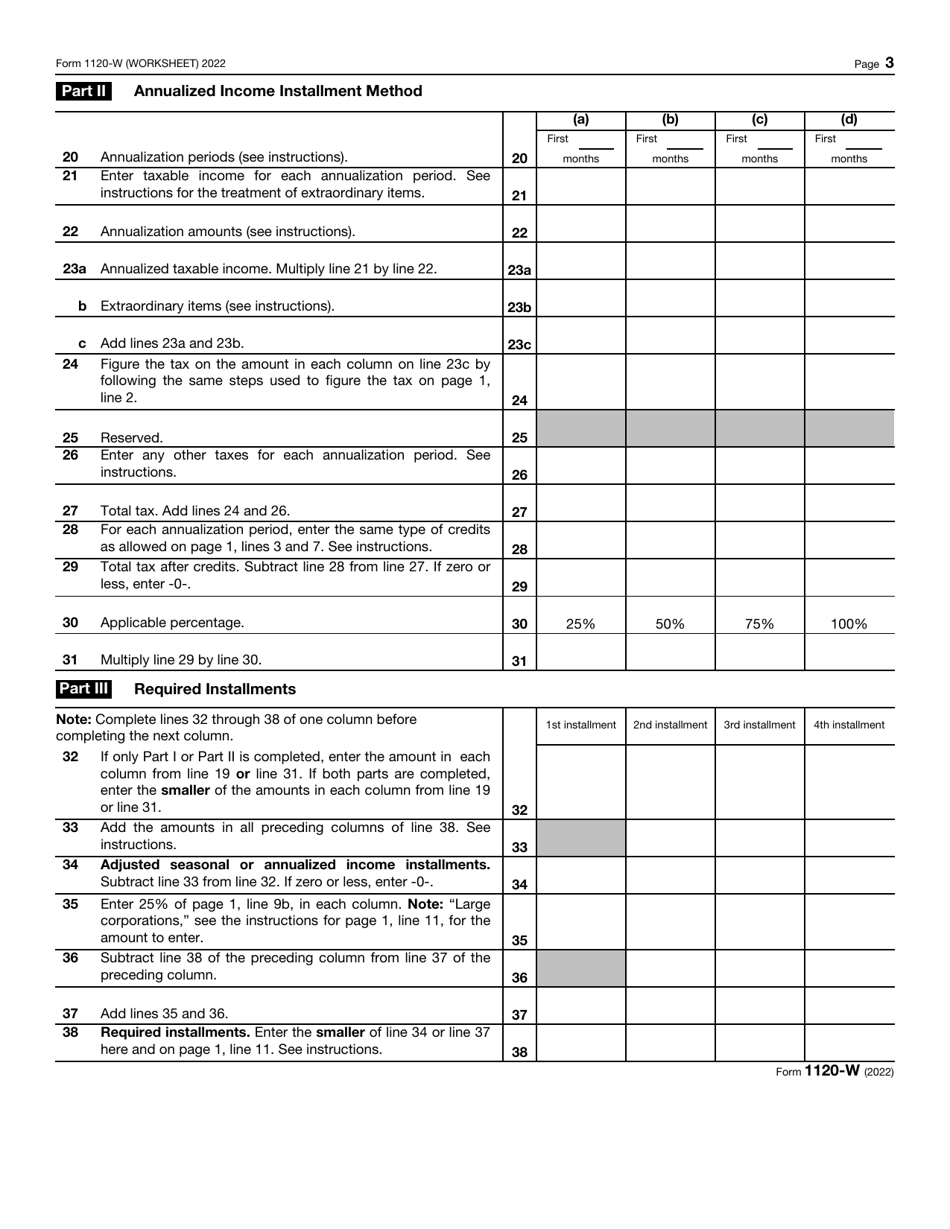

The Form 1120-W Instructions are as follows:

-

Record the tax period you will cover in the worksheet . Refer to your accounting documentation to enter the appropriate numbers in the form - state the amount of taxable income you believe you will generate, indicate the amount of tax credits, and include other taxes you have to pay. Apply the formulas in the document and find out the total amount of tax to pay. List the dates the installments are made and write down the amount of every installment.

-

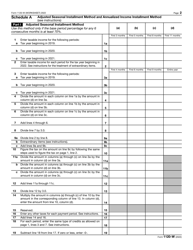

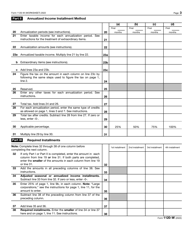

Specify what kind of installment method suits your corporation - choose between the adjusted and the annualized methods to understand what parts of the form you must complete . You will have to separate the numbers into four parts and use formulas to confirm the method you picked is the right one. Based on the section of the worksheet you filled out, elaborate on the exact amount of every installment.

-

Do not submit Form 1120-W to tax organizations - corporations whose duty it is to calculate the estimated tax without errors do not have such an obligation ; instead, they are asked to keep a copy of the worksheet in their records in case audit happens in the future and they have to demonstrate how they managed to compute specific numbers. Ensure the payment you end up making is accurate otherwise you may be subject to the penalty due to underpayment or request a refund because you paid too much money to the IRS.

IRS 1120-W Related Forms

- 1120, U.S. Corporation Income Tax Return. Domestic corporations use Form 1120 to calculate income tax liability and report losses, deductions, income, gains, and credits to the IRS.

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis file this form with the IRS to report their income, gains, losses, deductions, and credits, as well as to figure their income tax liability.

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. Foreign corporations must use this form to report their income, gains, losses, deductions, and credits, and to figure their U.S. income tax liability.

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form filed with the IRS in order to report the income, gains, losses, deductions, and credits of domestic corporations or any other entity for any tax year covered by an election to be an S corporation.

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability.

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners association files this form in order to exclude exempt function income from its gross income.

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form must be filed by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. Political organizations and certain exempt organizations are required to file this form in order to report their political organization taxable income and income tax liability section 527.

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies are required to file this form to report income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. This form is used by Nuclear decommissioning funds to report income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, and the section 4951 initial taxes.

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. Insurance companies, apart from life insurance companies, file this form for reporting their tax return, and to figure their income tax liability.

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporation, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form for reporting their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form for reporting their income, deductions, gains, losses, credits, and to calculate their income tax liability.

- 1120-SF, U.S. Income Tax Return for Settlement Funds (under Section 468B). Qualified settlement funds file this form in order to report transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability.

- 1120-X, Amended U.S. Corporation Income Tax Return. This form is filed with the IRS by corporations to correct a Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make certain elections after the prescribed deadline.