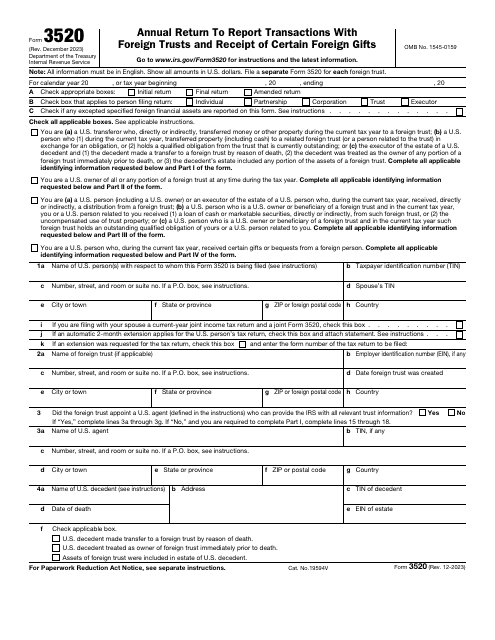

IRS Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

What Is IRS Form 3520?

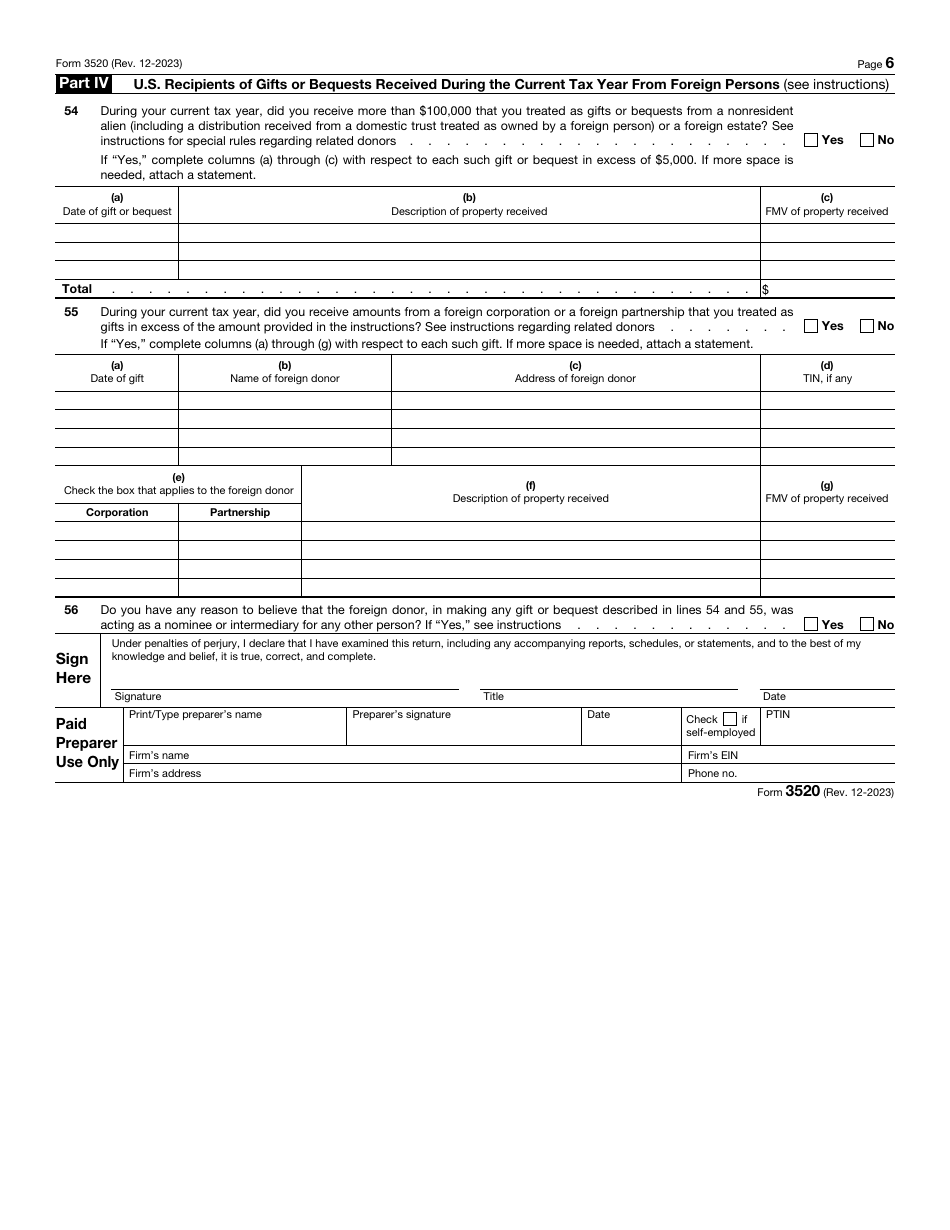

IRS Form 3520, Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts , is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

Alternate Names:

- Tax Form 3520;

- IRS Foreign Trust Form;

- Foreign Gift Tax Form.

This document was released by the Internal Revenue Service (IRS) in - older editions of the form are now obsolete. You can download an IRS Form 3520 fillable version through the link below.

What Is Form 3520 Used For?

If you or the entity you manage received any monetary assets, property, or inheritance from foreign individuals, estates, and trusts, you have to let the government know about these financial operations. Additionally, owners of foreign trusts and beneficiaries of those entities are under the obligation to inform the IRS about the distributions they received by filing IRS Form 3520.

What Is the Difference Between Form 3520 and 3520-A?

These forms are related, but Form 3520 is filed by U.S. persons to inform the IRS of a reportable event for the tax year, while Form 3520-A is filed by foreign trusts. The purpose of IRS Form 3520-A is to provide information about a foreign trust that has at least one U.S. owner, as well as about its U.S. beneficiaries and U.S. owners.

Form 3520 must be consistent with Form 3520-A, unless you report an inconsistency to the IRS. If you are treating items on 3520 differently from the way a foreign trust treated them on 3520-A, you must file Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request.

Who Must File Form 3520?

There are several categories of taxpayers that are expected to file IRS Form 3520:

-

Owners of a foreign trust . If you own the trust in its entirety or control only a part of it, you will be required to submit this statement.

-

Individuals and organizations that entered into particular transactions with foreign trusts during the tax year described in the form . In case you transferred monetary assets or property to foreign trusts or you received distributions from them, it is likely the obligation to file the form applies to you.

-

People and entities that received inheritance or large gifts from people residing abroad . While fiscal authorities will not care about a small cash gift your relative sends you from a foreign country, they will be interested to know the details of a gift if it is larger than $100,000.

Form 3520 Instructions

IRS Form 3520 Instructions are as follows:

-

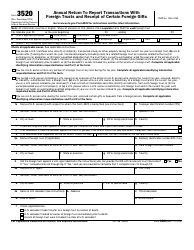

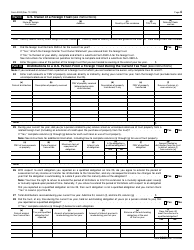

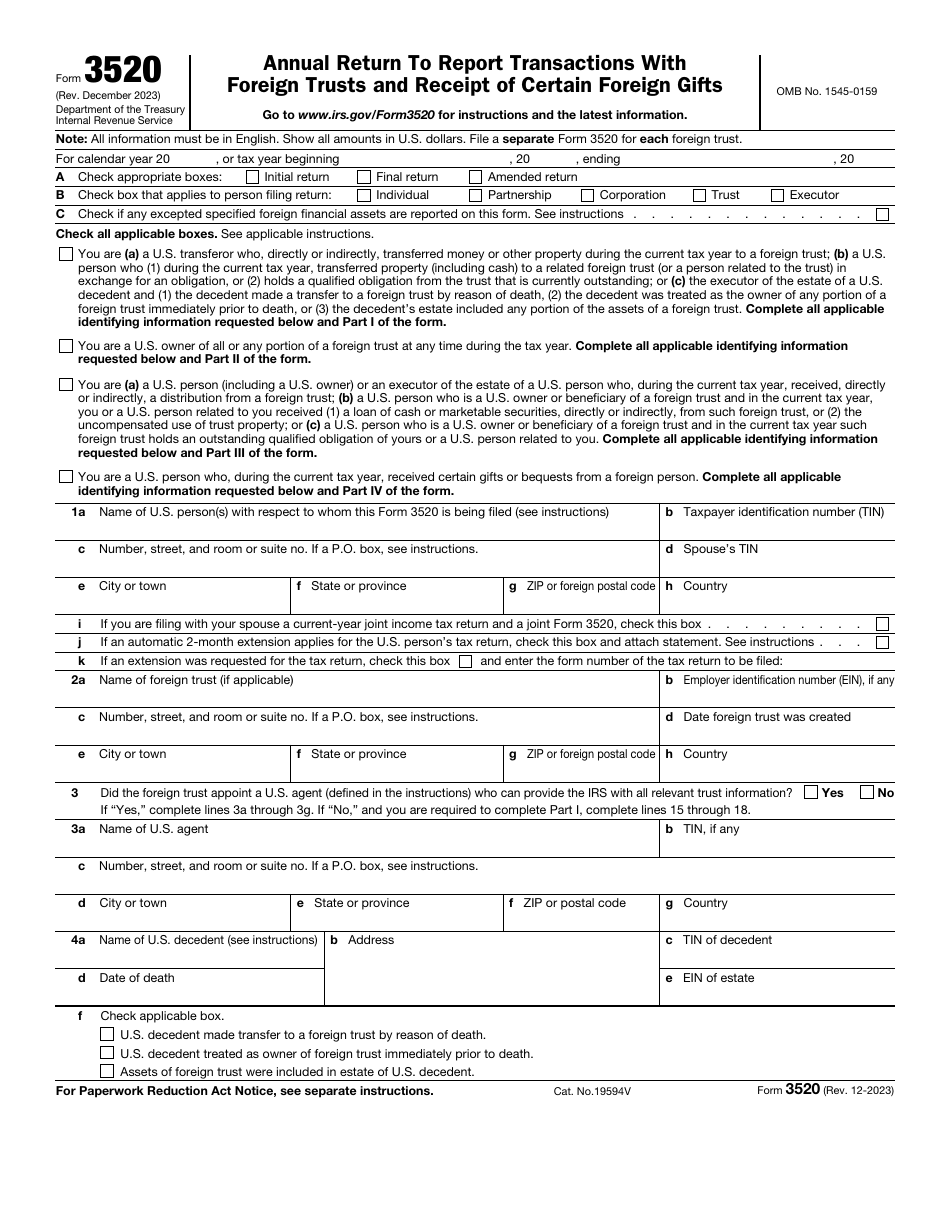

Specify what kind of return you are filing - it may be the initial return, a final return, or an amended document if you noticed an error upon submitting the previous one . Indicate your status and check the boxes that apply to you - when the tick is written in the box, you are supposed to fill out sections of the form listed after it skipping other parts of the document.

-

Identify yourself, the foreign trust in question, the agent that may have acted in your name with due authorization, and the deceased person if the objective of the form is to report the inheritance . Leave the fields that do not apply in your case blank and proceed to the page you must complete next.

-

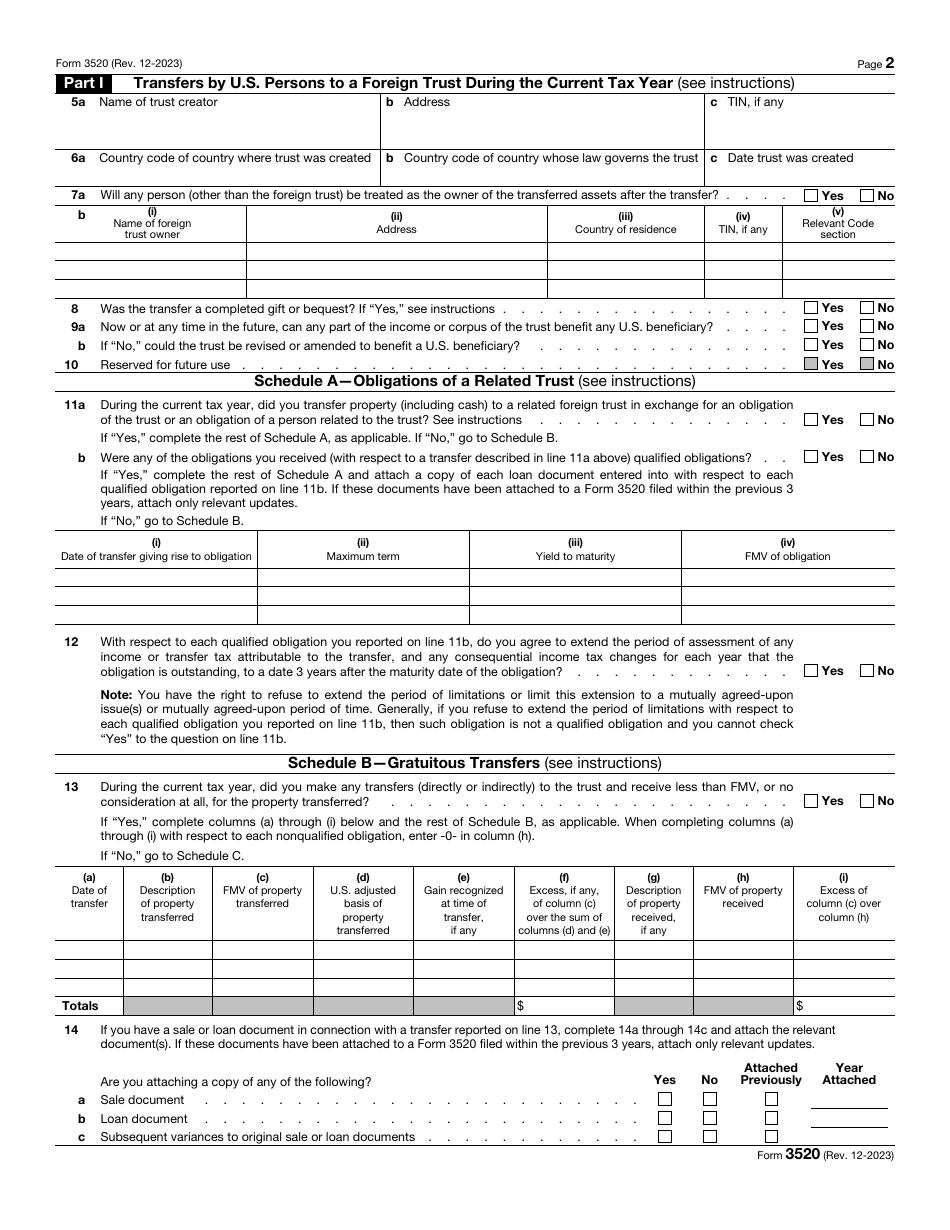

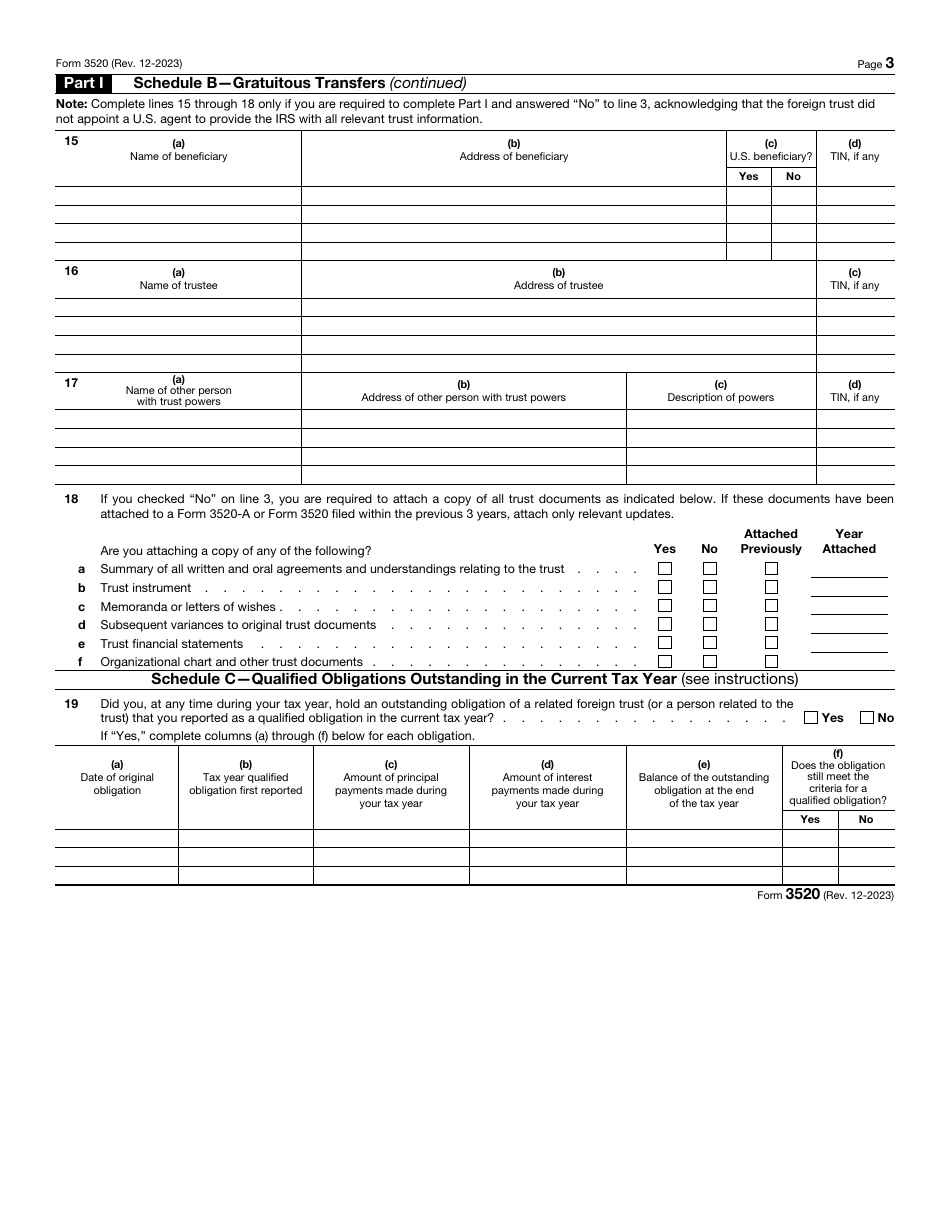

Describe the transfer you have carried out to a foreign trust during the tax year . It is necessary to identify the creator of the trust and the owner of the trust as well as specify whether the transfer was a bequest or gift. Fill out three schedules to list the obligations you received, outline the gratuitous transfers that took place, and provide the details on the status of obligations due in the future.

-

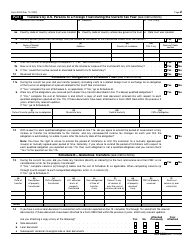

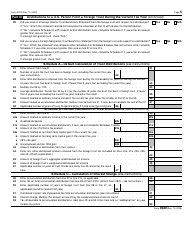

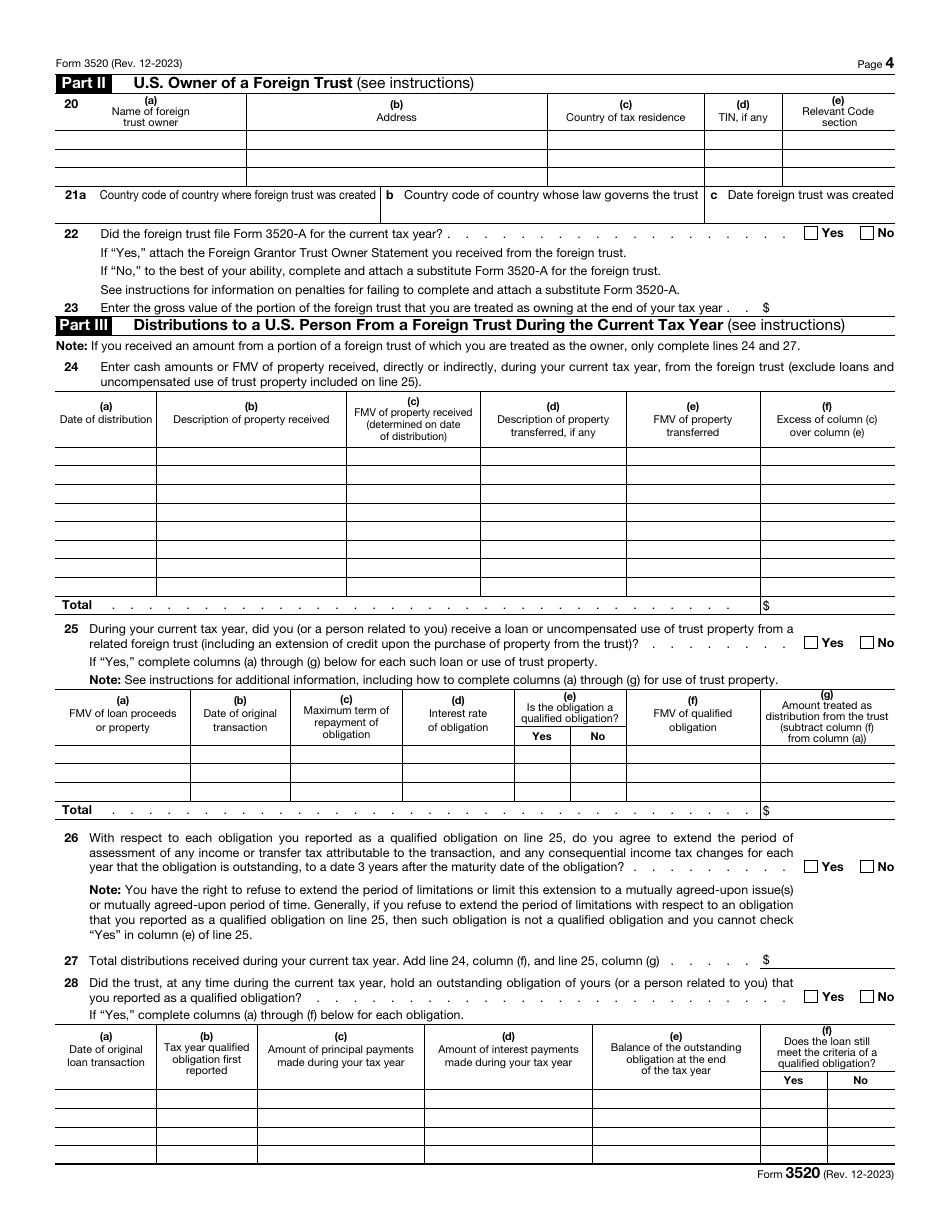

In case you are the foreign trust owner, enter information about those trusts, state the jurisdictions that govern them, and indicate the total value of the foreign trust you own.

-

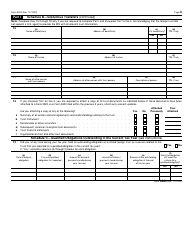

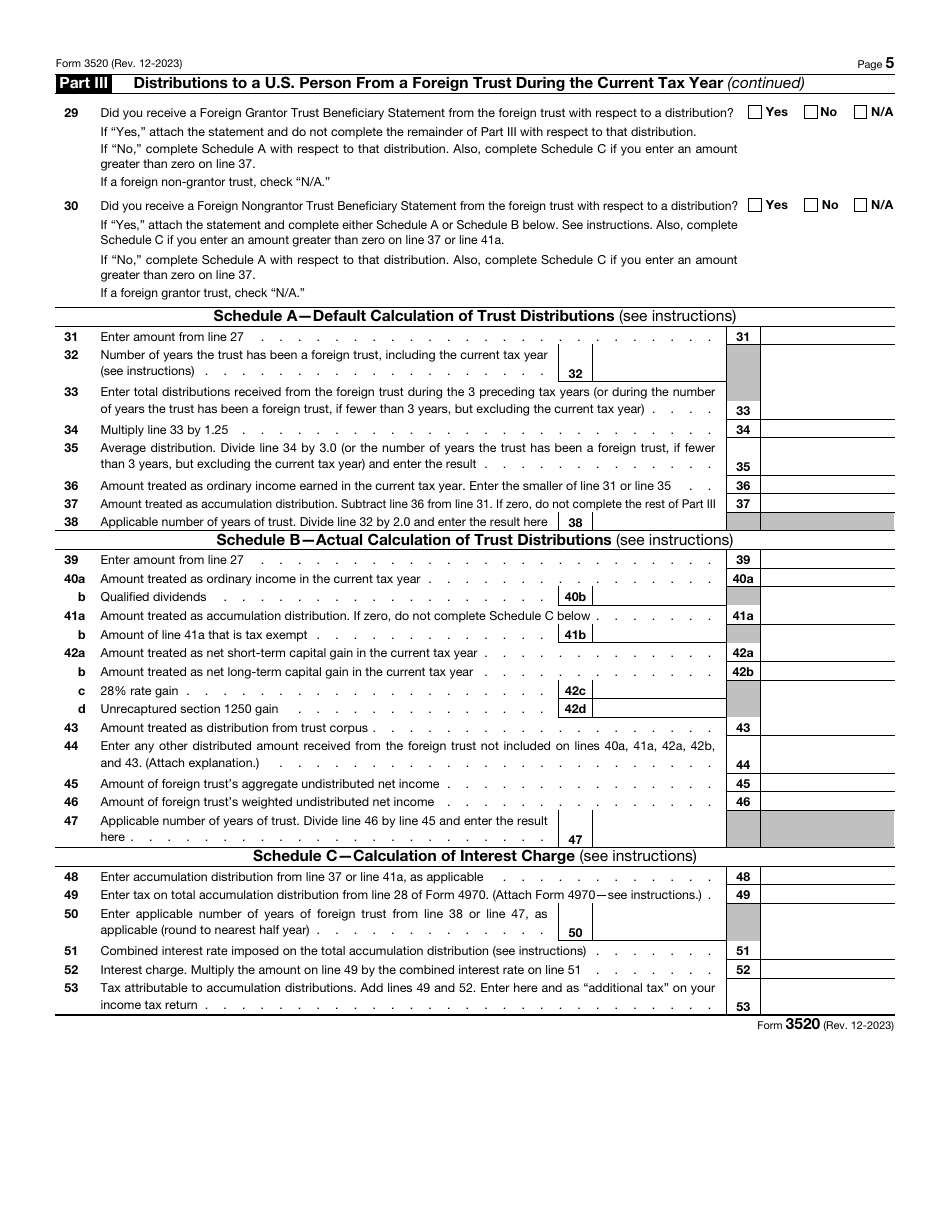

It is your duty to inform the IRS about the distributions you received from a foreign trust . You can list up to eight distributions and describe them in the table; it is also needed to record loans you and your family members received from foreign trusts. Fill out schedules to compute the trust distributions and the interest charge.

-

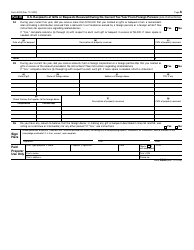

Describe the gifts you got from foreign individuals - state the date you received the present and elaborate on the status of the person or entity that sent you the gift . You also have to declare you filled out the form making true and accurate statements in writing.

Where to Mail Form 3520?

Once you are certain the document in question is ready and you have attached supplementary statements if necessary, the IRS Form 3520 mailing address you need to use is Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409 . In order for this tool to be valid, it has to be acknowledged by the individual, fiduciary, general partner, member of the limited liability company, or a corporate officer that has the authority to certify documentation of this kind on behalf of the corporation. The document must also contain the signature of the person or entity you hired to help you fill out the papers.

The IRS Form 3520 due date is the same as the deadline established for your regular tax return - in most cases, make sure you prepare and submit the paperwork by April 15. Note that you may be obliged to pay penalties and fines if you are unable to file this document by the prescribed deadline - only if you manage to prove to the IRS there was a significant reason that prevented you from submitting the form on time, you will have an opportunity to avoid the fine. However, it is strongly advised not to delay the process of filing - if you cannot prepare the return without delay, you should request a Form 3520 extension - inform the tax authorities about late filing in advance, and you will be permitted to report various foreign transactions in October.