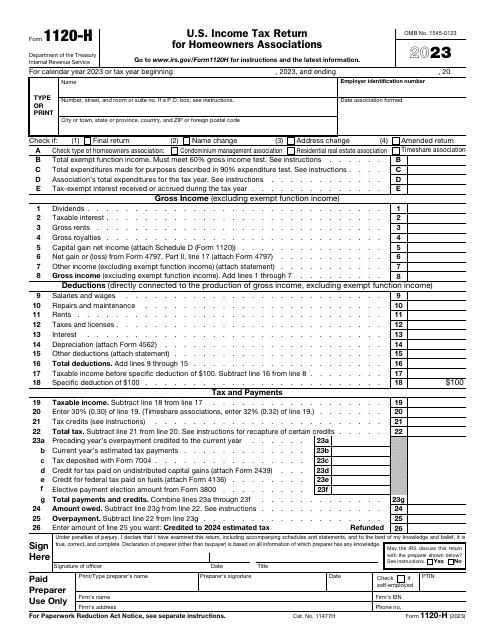

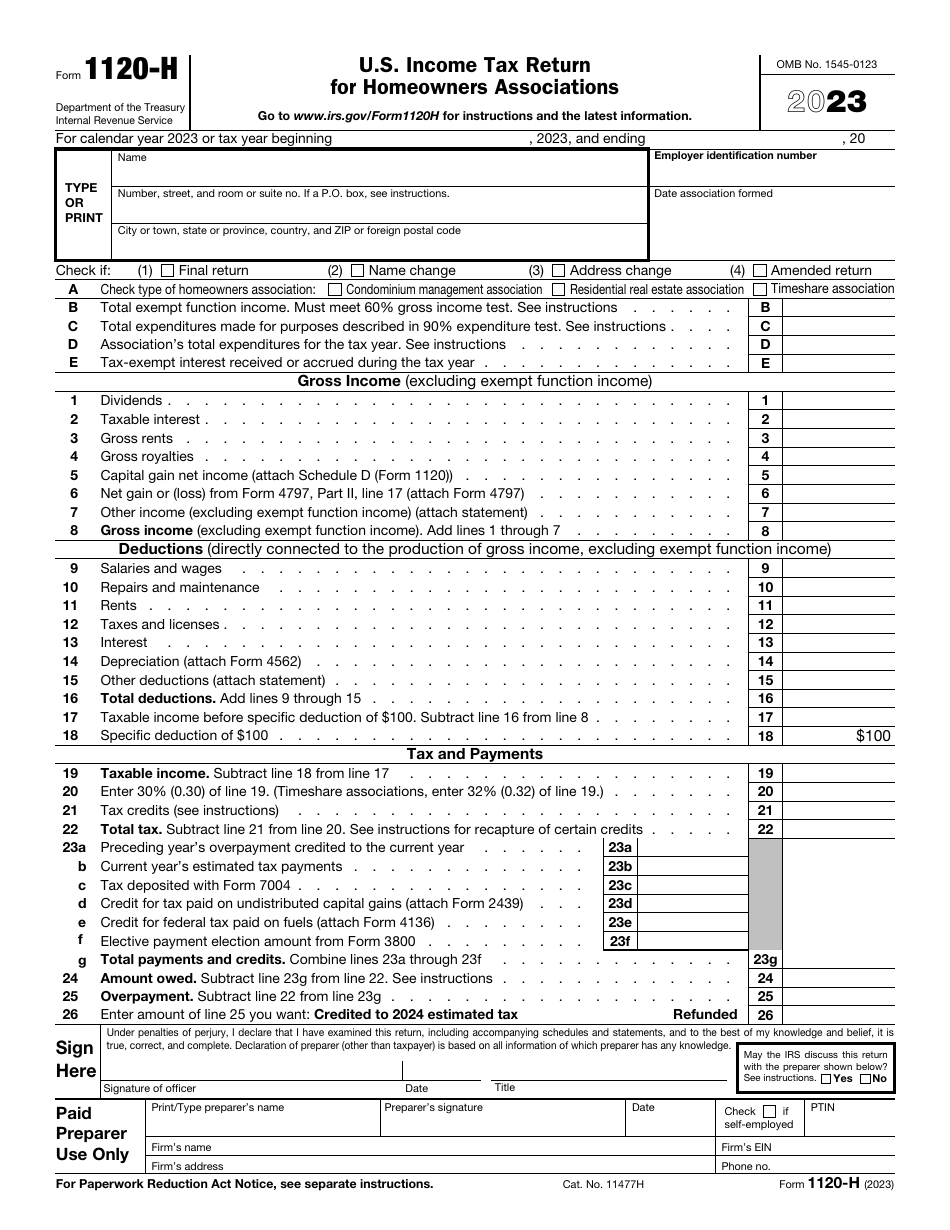

IRS Form 1120-H U.S. Income Tax Return for Homeowners Associations

What Is IRS Form 1120-H?

IRS Form 1120-H, U.S. Income Tax Return for Homeowners Associations, is a formal document used by private corporations that make and enforce rules for homeowners in their community to inform the government about their income and tax liability for a specific tax period and certify their right to get tax benefits. As a result of the filing, the association will have an opportunity to exclude particular income from the total amount of its taxable income.

Alternate Names:

- Homeowners Association Tax Form;

- Tax Form 1120-H;

- Federal Form 1120-H.

This statement was released by the Internal Revenue Service (IRS) in 2023, making older editions of the form outdated. You can download an IRS Form 1120-H fillable version via the link below.

Check out the 1120 Series of forms to see more IRS documents in this series.

Form 1120-H Instructions

The Form 1120-H Instructions are as follows:

-

Specify the start and end dates of the tax period covered in the form. List the main details of your association - its name, correspondence address, employer identification number, and date of formation. Check the appropriate box if you have changed the name of your entity or its address, you are correcting the document you filed previously, or this is the last ever income statement you are submitting.

-

Pick one of the three options that defines the type of the association you represent. State the precise amount of income your entity generated from various fees, dues, and charges, indicate how many expenditures were related to the activities offered to the members of the association and to the maintenance of its property, and record the amount of interest you managed to receive or accrue as long as it is not subject to taxation.

-

Provide information about different sources of income the association has earned - from dividends to rental payments - and enter the total income after adding the amounts. List the deductions that have a direct connection to the earning of income - for instance, point out how many salaries you paid out and how many licenses you had to acquire. Calculate the taxable income using the formulas and rates in the form, apply the credits you qualify for, and figure out the tax you are supposed to pay. Pay attention to the supplementary documentation you will be obliged to file to confirm your right to receive certain tax credits in line with the guidelines indicated in the form.

-

Certify the paperwork. The instrument must contain the signature of the president of your association, its treasurer, or chief accounting officer who has a formal authorization to sign documentation of this sort - the individual in question also has to date the form and add their title. Taxpayers may hire a tax professional to help them out with the 1120-H Tax Form - the preparer also certifies the form. Put a tick in the box if you are allowing fiscal authorities to reach out to the person identified in the document to talk to them about the tax matters at hand.

When Is Form 1120-H Due?

Make sure you comply with the IRS Form 1120-H due date - the deadline for taxpayers is the fifteenth day of the fourth month that follows the tax period described in the document. It means that if you are outlining the previous calendar year in writing, the due date for the paperwork is April 15. There is, however, an exception - if your fiscal year ends on June 30, you must file the instrument by the fifteenth day of the third month after the aforementioned date.

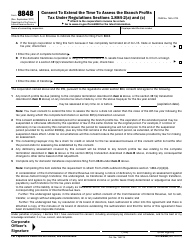

Filers are permitted to send the form a day or two later in case the deadline falls on a holiday, Saturday, or Sunday. Note that if you discover you cannot file the papers on time, you may request an extension to have more time to prepare the form - to do so, file IRS Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

Where to Mail Form 1120-H?

The IRS Form 1120-H mailing address depends on the location of your association:

-

If you operate in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming, send the documentation to the Department of the Treasury, IRS Center, Ogden, UT 84201-0012.

-

Associations from Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin must file the paperwork with the Department of the Treasury, IRS Center, Kansas City, MO, 64999-0012.

-

Submit the form to the IRS Center, P.O. Box 409101, Ogden, UT 84409 in case the association is located abroad or in the U.S. territory.

IRS 1120-H Related Forms:

- 1120, U.S. Corporation Income Tax Return. The United States domestic corporations use this form to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-C, U.S. Income Tax Return for Cooperative Associations. The American corporations operating on a cooperative basis use this form to report their income, gains, losses, deductions, and credits, and to calculate their income tax liability.

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. Foreign corporations file this document to inform the IRS of their income, gains, losses, deductions, and credits, and to figure their U.S. income tax liability.

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form used to report the income, gains, losses, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation.

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability.

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is filed by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. This form is filed by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability section 527.

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies use this form to report income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this form to report income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, as well as Section 4951 initial taxes.

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, apart from life insurance companies.

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporation, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated Investment Companies (RIC) file this form to report their income, deductions, gains, losses, credits, and to calculate their income tax liability.

- 1120-SF, U.S. Income Tax Return for Settlement Funds (under Section 468B). Qualified settlement funds file this form to report transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability.

- Form 1120-W, Estimated Tax for Corporations. Corporations use this form to estimate their tax liability and to figure the amount of their estimated tax payments.

- Form 1120-X, Amended U.S. Corporation Income Tax Return. This form is used by corporations to correct a Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make various elections after the due date.