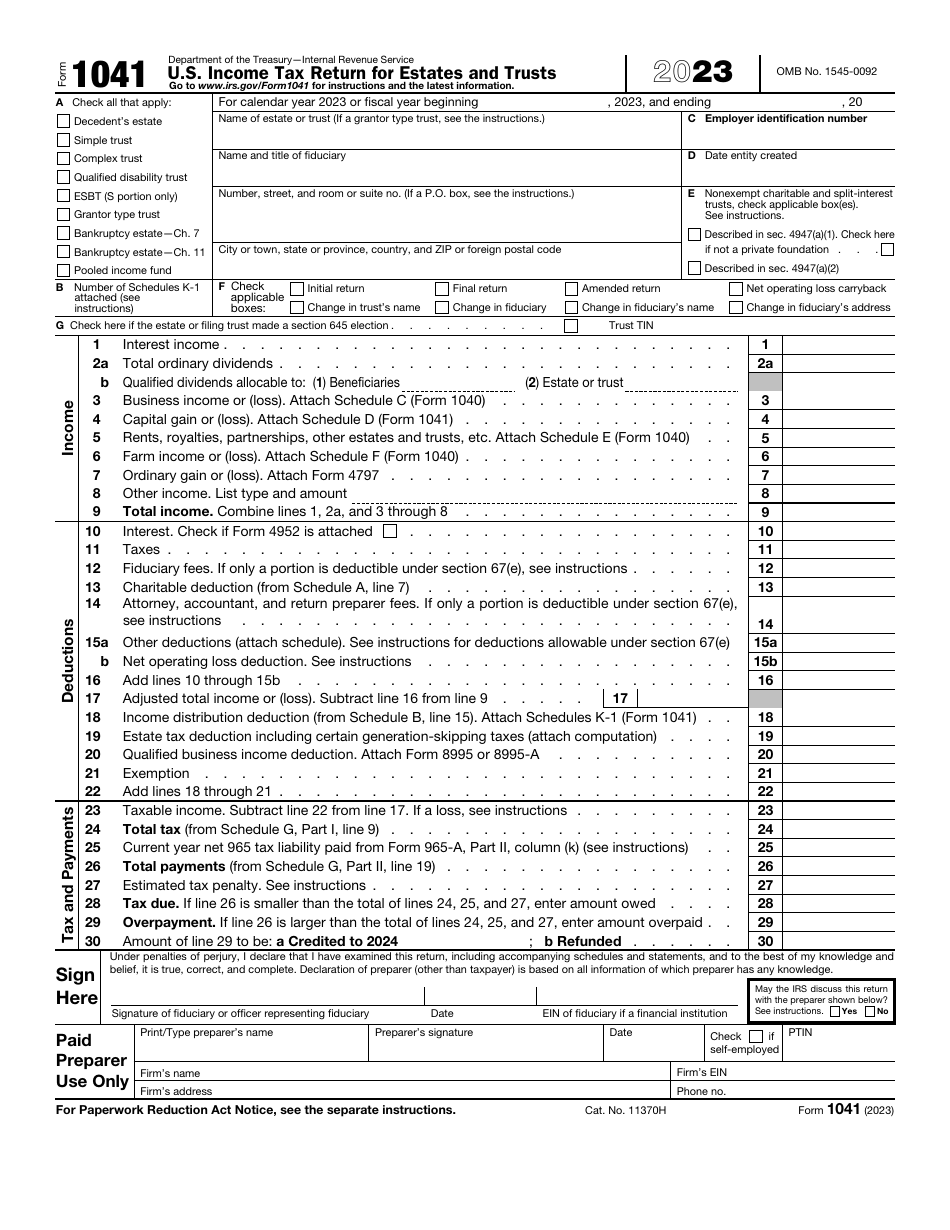

IRS Form 1041 U.S. Income Tax Return for Estates and Trusts

What Is Form 1041?

IRS Form 1041, U.S. Income Tax Return for Estates and Trusts , is a document filed as an income tax return by a fiduciary of a bankruptcy estate, domestic decedent's estate, or trust. The issuing department of IRS Form 1041 is the Internal Revenue Service (IRS). The document was last revised in 2023 .

Alternate Name:

- Estates and Trusts Tax Return.

Download the fillable Form 1041 through the link below or order a paper version through the IRS.

What Is Form 1041 Used for?

IRS Form 1041 is used to report deductions, income, gains, and losses of an estate or trust. It is also applicable to inform the IRS about income that is accumulated, held for future distributions, or distributed currently to the beneficiaries. Besides this, you may use the form to document the income tax liability of an estate or trust, net investment income tax, and employment taxes on salaries paid to household employees.

IRS Form 1041 Schedules

- Schedule D, Capital Gains and Losses. Fill it out to report your gains and losses from the sale or exchange of capital assets as a trust or estate;

- Schedule I, Alternative Minimum Tax - Estates and Trusts. Complete this schedule to calculate an alternative minimum tax, alternative minimum taxable income, and income distribution deduction on a minimum tax basis for an estate or trust;

- Schedule J, Accumulation Distribution for Certain Complex Trusts. Report on this schedule an accumulation distribution for a domestic complex trust; and

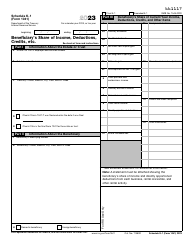

- Schedule K-1, Beneficiary's Share of Income, Deductions, Credits, etc. Complete it to report a share of the beneficiary in trust's or estate's income, deductions, credits, and other.

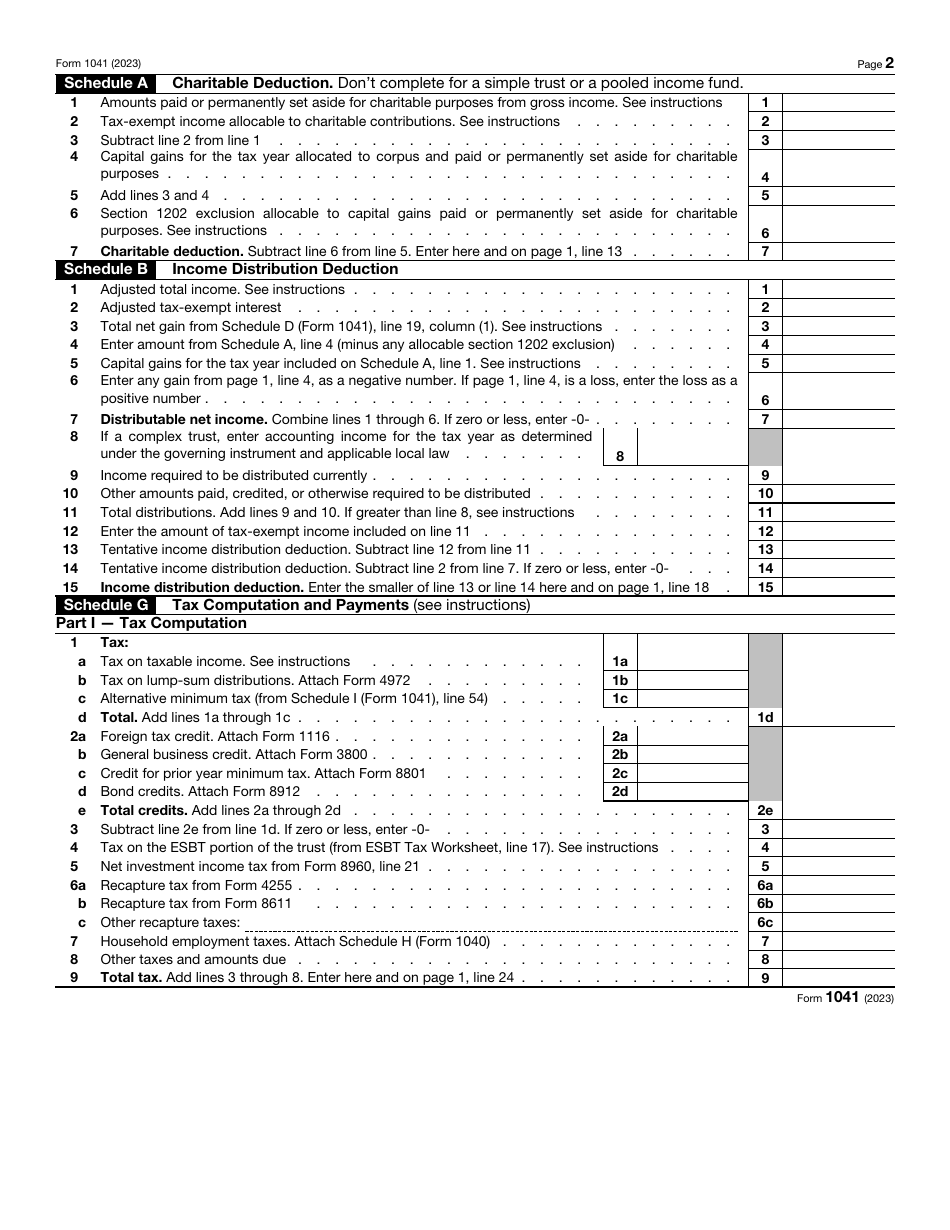

Besides these, three schedules already come with the Estates and Trusts Tax Return:

- Schedule A, Charitable Deduction. Any part of trust's or estate's gross income paid for a charitable purpose during the tax year is allowed to the trust or estate as a deduction and should be reported on this schedule;

- Schedule B, Income Distribution Deduction. Fill out this part if the estate or trust during the tax year was required to distribute income or credited, paid, or distributed any other amount to the beneficiaries; and

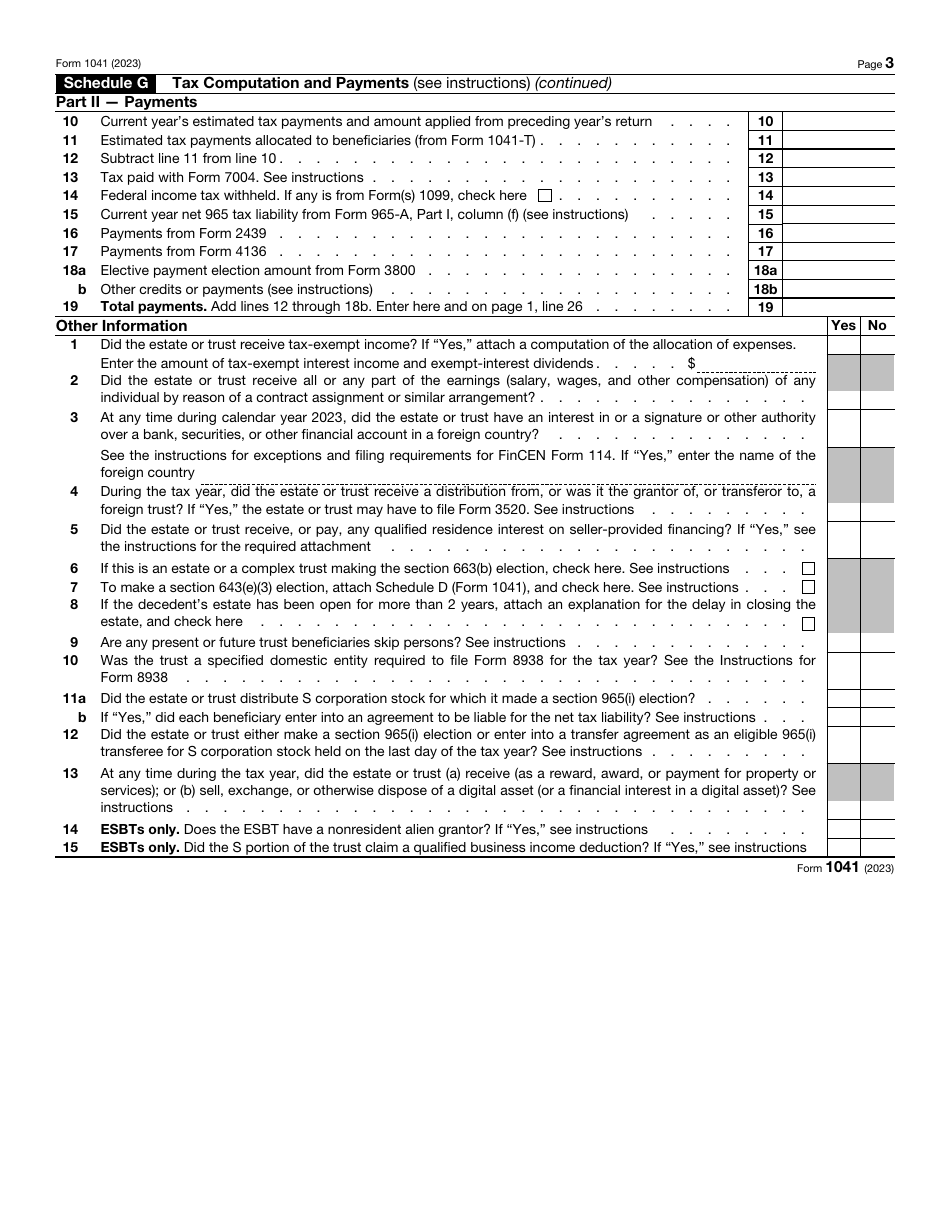

- Schedule G. Tax Computation. Use this schedule to calculate your tax and tax credits.

Where to Send Form 1041?

File an IRS 1041 Form and related schedules electronically or by mail. To send the form via an electronic service you need to create an IRS e-Services account first, and then submit an e-file provider application. After passing a suitability check, you are considered an e-file provider and must use e-Services to update the account. If you file the form electronically, sign it with your personal identification number.

Besides, estates and trusts, split-interest, and charitable trusts can submit the estates and trust tax return via mail. The mailing addresses for different locations are provided in the IRS instructions for Form 1041. You can also order paper instructions through the IRS.

IRS Form 1041 Instructions

The IRS instruction file contains detailed explanations, tax rate schedule, Qualified Dividends Tax Worksheet, and all of the addresses, links, and form numbers you may need when filling out the form.

Form 1041 due dates depend on the type of year your trust or estate uses. For calendar year trusts and estates, file the form by April 15. If your trust or estate uses a fiscal year, submit the document before the 15th day of the 4th month that follows the close of the tax year. In case the due date falls on a legal holiday, Saturday, or Sunday, submit your form on the next business day. If you cannot file the tax return form on time, apply for a 5.5-month extension. File Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and other returns for this purpose.

If you fail to file the tax return form on time, you will have to pay a penalty of 5% to 25% of the tax due for each month. If the failure to file the form is fraudulent, the penalty rate may grow up to 15% - 75%. If the delay is more than 60 days, the penalty will be $210 or the tax due, whichever smaller. You may be exempted from any penalties if you prove that the failure to file IRS 1041 Form was caused by a valid reason.

IRS 1041 Related Forms:

- Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts;

- Form 1041-ES, Estimated Income Tax for Estates and Trusts;

- Form 1041-T, Allocation of Estimated Tax Payments to Beneficiaries;

- Form 1041-V, Payment Voucher;

- Form 1041-QFT, U.S. Income Tax Return for Qualified Funeral Trusts;

- Form 1116, Foreign Tax Credit;

- Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts;

- Form 4255, Recapture of Investment Credit;

- Form 4972, Tax on Lump-Sum Distributions;

- Form 5227, Split-Interest Trust Information Return;

- Form 5884-A, Credits for Affected Disaster Area Employers;

- Form 8582, Passive Activity Loss Limitations.