Tax Credit Vs. Tax Deduction: What's the Difference and Which Is Better?

Both tax credits and tax deductions will significantly lower your income tax bill. In this article, you can discover how to reduce your tax payments, learn the difference between tax credits vs. tax deductions, and choose the best tax relief option for yourself.

What Is the Difference Between Tax Credits and Tax Deductions?

Tax credits are generally more valuable than tax deductions. A tax credit of $2,000, for example, will lower your tax bill by $2,000, whereas a tax deduction of 20% will save you only $400 out of $2,000. Keep in mind that tax credits save you more money than tax deductions. You can compare and contrast tax deductions and tax credits using the table below.

| Tax credit | Tax deduction | ==> | | -- | -- | | What it does | Deducts the amount of tax under certain circumstances | Reduces the overall taxable income | | When it is applied | After the tax due date is established | Before the application of the tax rate | | Which saving method is used | Dollar-to-dollar basis | Marginal percentage |

What Is a Tax Credit?

A tax credit (link to What Are Tax Credits? A Guide to Maximizing Your Tax Return) is a tax incentive, a government payout that gives extra money to the individuals in need. If you qualify for a tax credit, you will be able to subtract a specific amount of money from the total taxes you owe.

Common Types of Tax Credit

Find out about the different types of tax credits you qualify for in the list below. Most taxpayers take credits to save for retirement, raise children, go green, or invest in education.

- Earned Income Tax Credit – a refundable tax credit created to support lower-income workers with children under 19 (or 24 if they are still in school) and adjusted gross income $52,000 or less;

- Child Tax Credit - a credit for individuals raising a child. You may receive $1,000 in federal tax for each child under 17 years old;

- Child and Dependent Care Credit - this tax credit helps a working parent to cover the care expenses for dependents or children 13 years old and younger;

- Adoption Tax Credit – a non-refundable credit from the federal government for parents adopting a child;

- Retirement Savings Contributions Credit (Saver’s Credit) . It is a non-refundable credit that can help you to get back a portion of the contributions made to a retirement account;

- American Opportunity Tax Credit - an education credit that will help you to pay for the first four years of college tuition and supplies. An eligible student must pursue a degree while being enrolled in school;

- Lifetime Learning Tax Credit - this non-refundable credit will allow you to pay up to $2,000 of the cost of education. Take a class that may help you on the job or get a new training;

- Premium Tax Credit – a part of the Affordable Care Act (Obamacare) that lets you pay for insurance obtained through a Health Insurance Marketplace;

- Residential Renewal Energy Tax Credit - this tax credit will pay up to 30% of the cost to install a geothermal, solar, wind or fuel cell technology system.

What Is a Tax Deduction?

A tax deduction is a reduction that lowers an individual’s tax liability by lowering the taxable income - income subject to taxes.

2020 tax deductions include medical expenses, home mortgage interest, charitable contributions, and state and local income taxes. By reducing your gross income, they lower your overall tax liability.

How to Calculate State and Local Income Tax Deduction?

If you decide to claim the State and Local Income Tax Deduction (SALT) , you must comply with the following requirements:

- List your tax deductions using Schedule A (Form 1040), Itemized Deductions. You will have to forego the standard deduction – do not give the IRS more money than you need to. Line 5, state and local taxes, allows you to include taxes you paid from the adjusted gross income. It will lower your taxable income and tax bill;

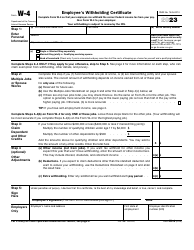

- Deductible expenses include estimated and extension tax payments made throughout the year, mandatory contributions to state benefit funds, and withholdings for income taxes on IRS Form 1099 and Form W-2;

- You can only claim deductions for yourself, not for your dependent or spouse;

- Deductible local payments depend on your location – each state establishes its own guidelines on how to fund its treasury, including the tax rate and tax type;

- Choose which tax to deduct, state income tax or state sales tax, but not both.