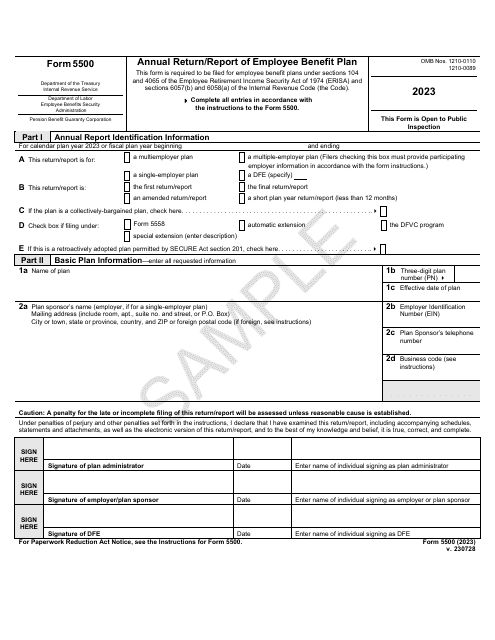

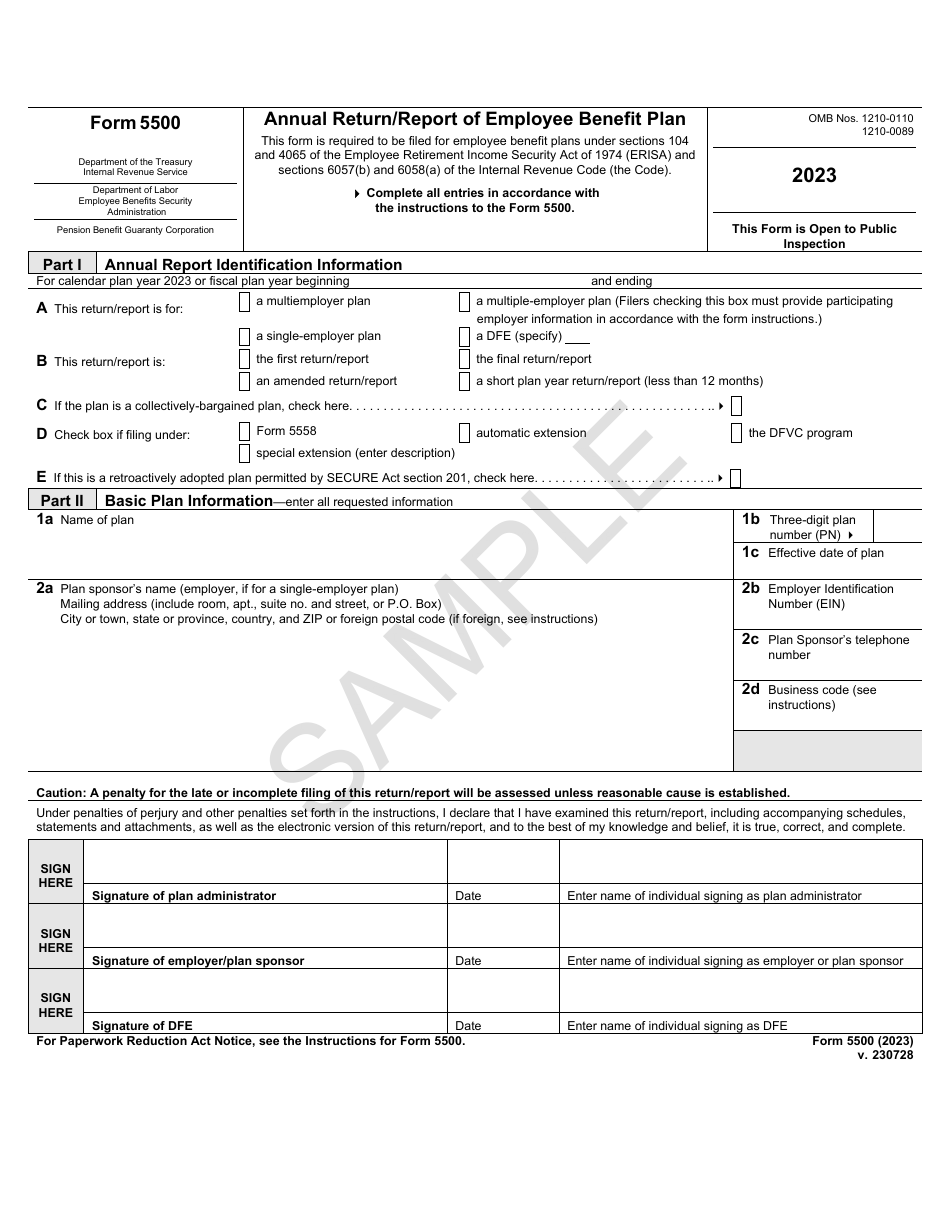

Form 5500 Annual Return / Report of Employee Benefit Plan - Sample

What Is IRS Form 5500?

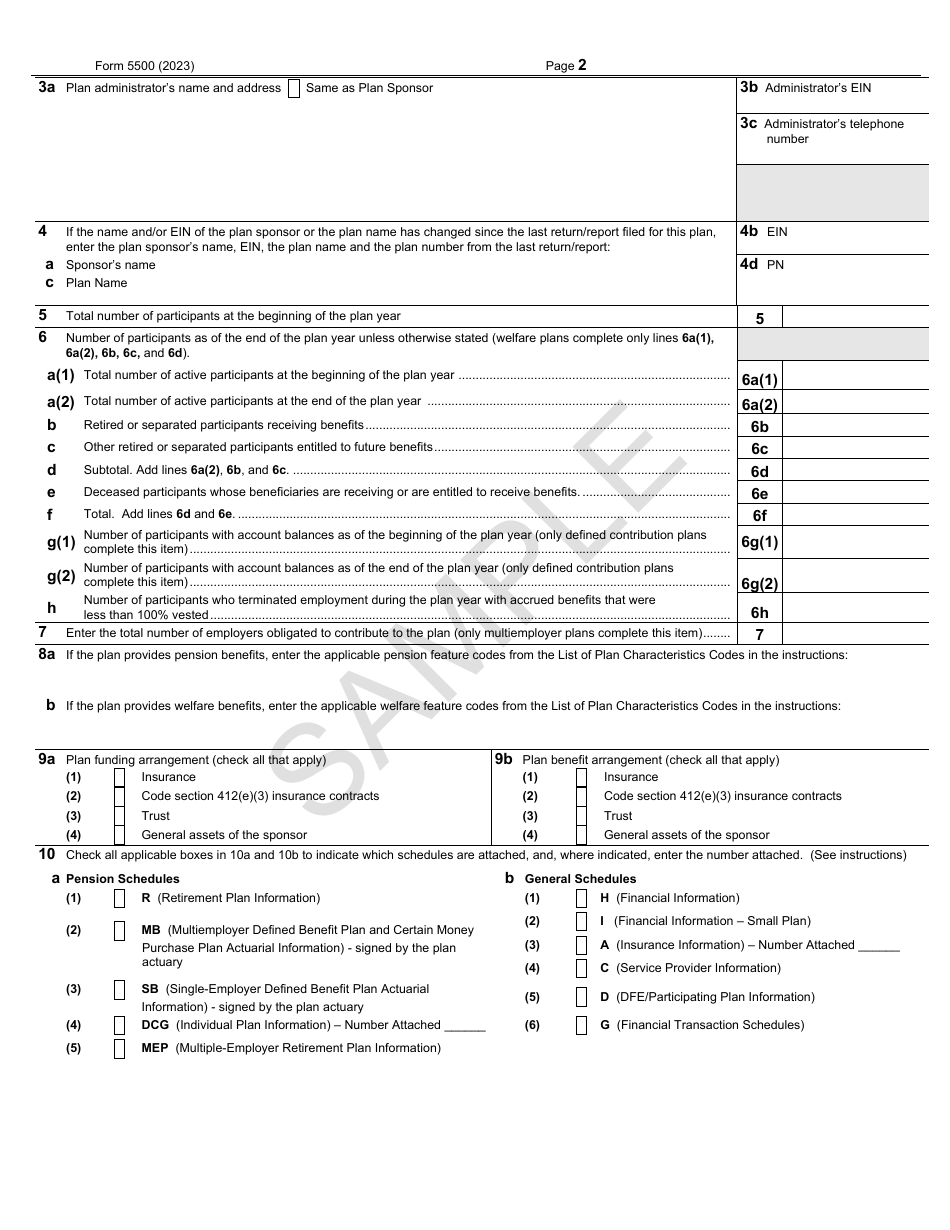

Form 5500, Annual Return/Report of Employee Benefit Plan, is a formal instrument used by employers that manage the employee benefit program to inform the authorities about the qualifications of the plan, investments made to the plan, and financial details of the program.

Alternate Name:

- Tax Form 5500.

This document is a joint effort of the Internal Revenue Service (IRS), the U.S. Department of Labor, and the Pension Benefit Guaranty Corporation - the form was issued on July 28, 2023 with all previous editions obsolete. A Form 5500 fillable version is available for download via the link below.

Check out the 5500 Series of forms to see more IRS documents in this series.

What Is Form 5500 Used For?

Prepare and file IRS Form 5500 if you manage an employee benefit plan to let authorities know about the benefits employees got to receive. This is the main statement you are expected to submit to notify the government about the sponsor of the plan, the number of active participants, and the identity of the plan administrator.

Additionally, you will have to attach various schedules appropriate for your situation whether you have a duty to share information about insurance coverage or disclose the details of contributions made to retirement accounts.

Form 5500 Schedules

To comply with the IRS Form 5500 filing requirements, you must file it with certain schedules. Schedules depend on whether the form is filed for a "large plan" (100 or more participants at the beginning of the year) or a "small plan" (under 100 participants at the beginning of the year). You need to know what particular plan of the DFE is involved - pension plan, welfare plan, group insurance arrangement (GIA), etc.

-

Schedule A (Insurance Information), is filed if the insurance provider is offering the benefits to employees;

-

Schedule C (Service Provider Information). Prepare this instrument if the provider was compensated directly or indirectly by receiving $5.000 or more;

-

Schedule D (DFE/Participating Plan Information), discloses information about the plan or direct filing entity in further detail;

-

Schedule DCG - Individual Plan Information. You will have to prepare this tool if the reporting is necessary within a defined contribution group;

-

Schedule G (Financial Transaction Schedules), is required for large plans; plans that elaborate on welfare benefits usually do not oblige taxpayers to file this document;

-

Schedule H (Financial Information). Just like the previous statement, this one applies to plans with more than a hundred participants and direct filing entity submissions;

-

Schedule I (Financial Information - Small Plan). As the title suggests, fill out this form if the plan benefits less than a hundred individuals;

-

Schedule MB (Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information), must accompany the main form when several employers contribute to the plan to report various actuarial details;

-

Schedule MEP - Multiple-Employer Retirement Plan Information, describes the arrangement or plan that involves several employers and elaborates on pooled employer plans;

-

Schedule R (Retirement Plan Information). Prepare this tool to offer particulars of the distributions, plan coverage, and modifications that were implemented within the plan;

-

Schedule SB (Single-Employer Defined Benefit Plan Actuarial Information). This document is a part of the filing package for benefit plans managed by single employers.

Who Files Form 5500?

Submit 5500 Tax Form for every benefit plan (both pensions and welfare) as well as for every organization treated as a direct filing entity - you are obliged to send the information to the IRS even if the benefits were not accumulated or there were no contributions over the course of the year. Traditionally, the benefits reported relate to life insurance, health insurance, disability benefits, and pension plans.

Who Is Exempt From Filing Form 5500?

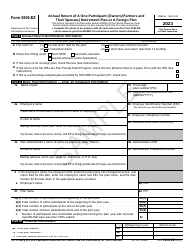

As a general rule, if you are in charge of the welfare plan with less than a hundred people who do not have any assets in trust, you are not obliged to abide by Form 5500 requirements and file the form. If your plan only applies to one participant, two partners, or a participant and their spouse, you will have to file IRS Form 5500-EZ, Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan, instead. Note that religious organizations and governmental entities that offer employee benefit plans via a trust also do not have to file this document.

Form 5500 Instructions

The Form 5500 Instructions are as follows:

-

Add the start and end dates of the calendar year or fiscal year - whichever applies in your case. Provide a few details about the report or return you are filling out - you may need to specify whether one or more employers contribute to the plan in question, indicate the document you are completing has been modified or you are filing the paperwork for the last time, confirm the plan you are outlining is an outcome of collective bargaining, certify you requested an extension, and check the appropriate box to let the IRS know the plan was retroactively adopted.

-

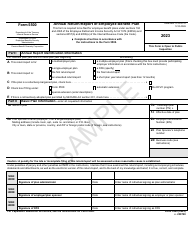

List the details of the plan - its name, number, and the date it became effective. Identify the sponsor of the plan by their name, correspondence address, telephone number, taxpayer identification number, and the code that defines their main business activity. Write down the name, taxpayer identification number, and contact information of the plan administrator and mention any changes to the names of the plan or sponsor that may have occurred.

-

State how many participants the plan had at the start of the tax period and break down the participants in accordance with listed categories. Record the number of employers who are supposed to make contributions to the plan and enter the codes that represent the characteristics of the plan.

-

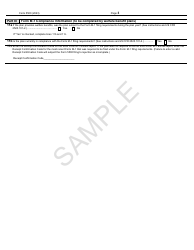

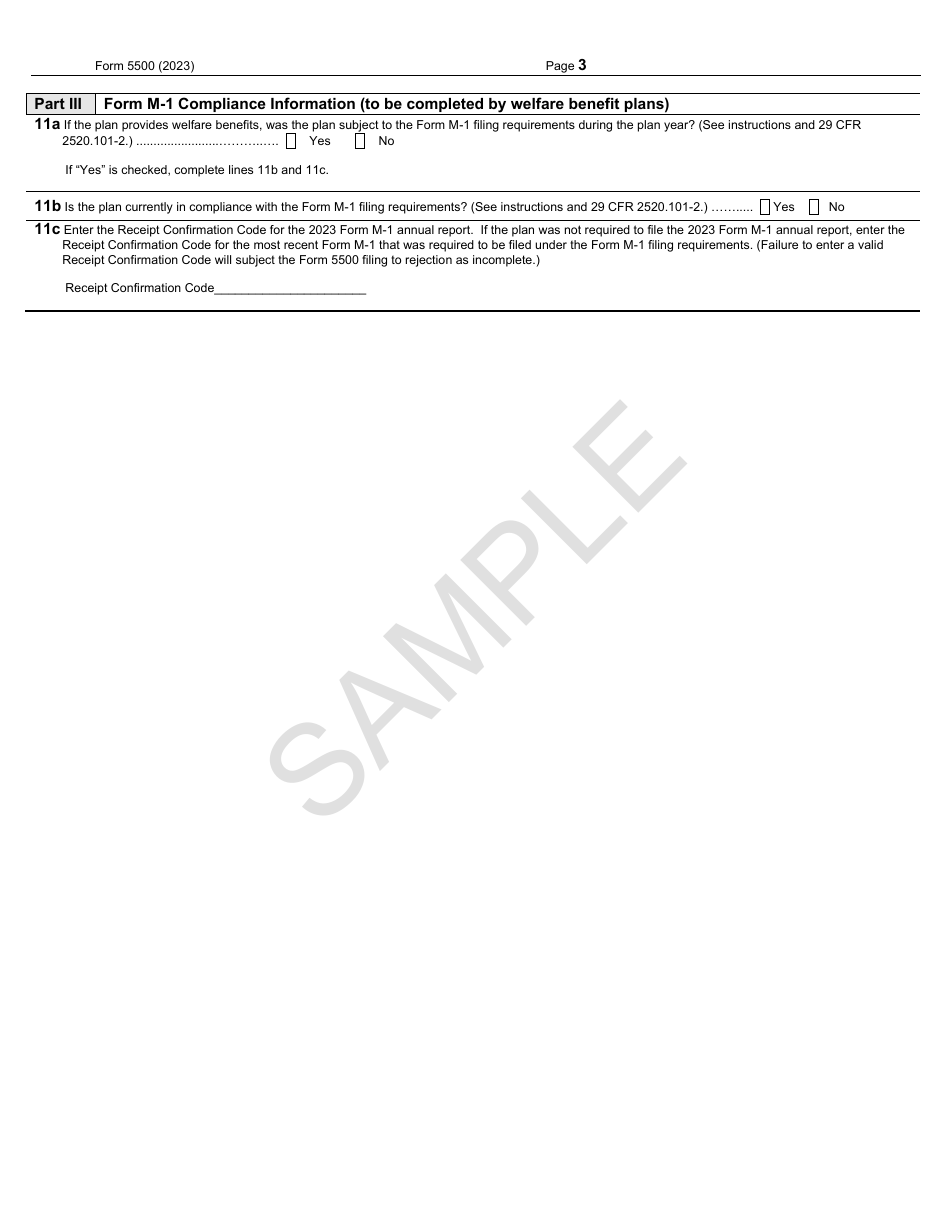

Check the boxes that explain what kind of arrangement you have whether you are managing funding or benefits. Use the checklist to confirm what schedules you are enclosing with the form. If you need to comply with the requirements set for multiple employer welfare arrangements, check the boxes and include the confirmation code that was generated through Form M-1. Certify the documentation - it must be signed by the plan administrator, plan sponsor, and the direct filing entity.

When Is Form 5500 Due?

The Form 5500 due date falls on the last day of the seventh month that comes after the calendar year or the end of the plan - the deadline will vary depending on the tax period you are using. Taxpayers are permitted to request a Form 5500 extension - as soon as you realize you cannot file the documentation on time, prepare IRS Form 5558, Application for Extension of Time To File Certain Employee Plan Returns, and send it to the Department of the Treasury, IRS Center, Ogden, UT 84201-0045 at any time before the deadline comes.

What Is the Penalty for Late Filing of Form 5500?

The maximum Form 5500 late filing penalty is $2.586 for every day of delay - even 24 hours matter when it comes to complying with submission requirements established for this instrument. The penalty will be adjusted for every taxpayer, and the aforementioned number is not going to apply in every case - still, filers are highly advised to send the paperwork on time especially if they do not have reasonable cause to neglect their tax obligations. There are also additional penalties for those who fail to submit mandatory schedules - your entity may receive a $1.000 penalty as well.

IRS 5500 Related Forms:

- IRS Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan, is a related simplified form used by certain small welfare and pension benefit plans. The plan must be small, it cannot be a multiemployer plan or hold employer securities, 100% of its assets must be invested in secure investments with a determinable fair value, and it has to be exempt from the audit by the independent qualified public accountant.

- IRS Form 5500-EZ, Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan, is a related form used for retirement plans if it is a one-participant plan (a plan that covers only you and your spouse/partner) or a foreign plan (a pension plan maintained outside the U.S. territory for nonresident aliens).