IRS Form 1099-S Proceeds From Real Estate Transactions

What Is IRS Form 1099-S?

IRS Form 1099-S, Proceeds From Real Estate Transactions, is a fiscal instrument used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

Alternate Name:

- Tax Form 1099-S.

If you finalized the sale of your land or purchased an industrial or commercial building, you are obliged to file a statement that describes the deal - attach this form to your regular tax return when you are submitting your annual paperwork.

This statement was released by the Internal Revenue Service (IRS) in , making other editions of the form obsolete. An IRS Form 1099-S fillable version is available for download below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-S Form Used For?

The function of the 1099-S Tax Form is to notify the fiscal authorities about the real estate purchased or sold during the tax year whether you represent yourself or work on behalf of the business. You are obliged to report transactions that transfer apartments, land, nonmovable buildings, and condominiums. People that bought or sold a house to live in, invested in real estate or inherited property, or got real estate to rent out to individuals and business entities are expected to complete the form that summarizes the details of the transaction, elaborates on the earnings received from it, and specifies the real estate tax paid to comply with the current tax legislation.

Note that certain transactions do not have to be reported to the tax organs - for example, if the money you received is less than $600 or the seller of the real estate is a government unit, there is no legal obligation to inform the IRS about the transfer. You can also disregard this form if you sold your principal home for $250.000 or less.

Who Must File Form 1099-S?

As a general rule, the individual whose responsibility it was to close the transaction outlined in writing is also supposed to submit a 1099-S Tax Form. There are also alternative scenarios where the paperwork can be filed by a different person yet remain valid for review:

-

Authorize a different individual to prepare and submit the documentation on your behalf . They can be identified with the help of a closing disclosure - ensure the name, mailing address, and signature of the authorized individual are recorded to keep the agreement legally enforceable. It is rather common when a legal adviser handles this matter in the name of their client so if you are working with a lawyer or legal representative, ask them if they will do it for you.

-

In case no one in particular is obliged to close the transaction, the authority to file the form is given to the broker of one of the parties, the transferee, or the person or entity that lends their funds to finance and secure the transaction.

-

Allow a partner, agent, or employee from a partnership, agency, or employer respectively to report the details of the transaction to the IRS - this is possible if they took part in the deal in question.

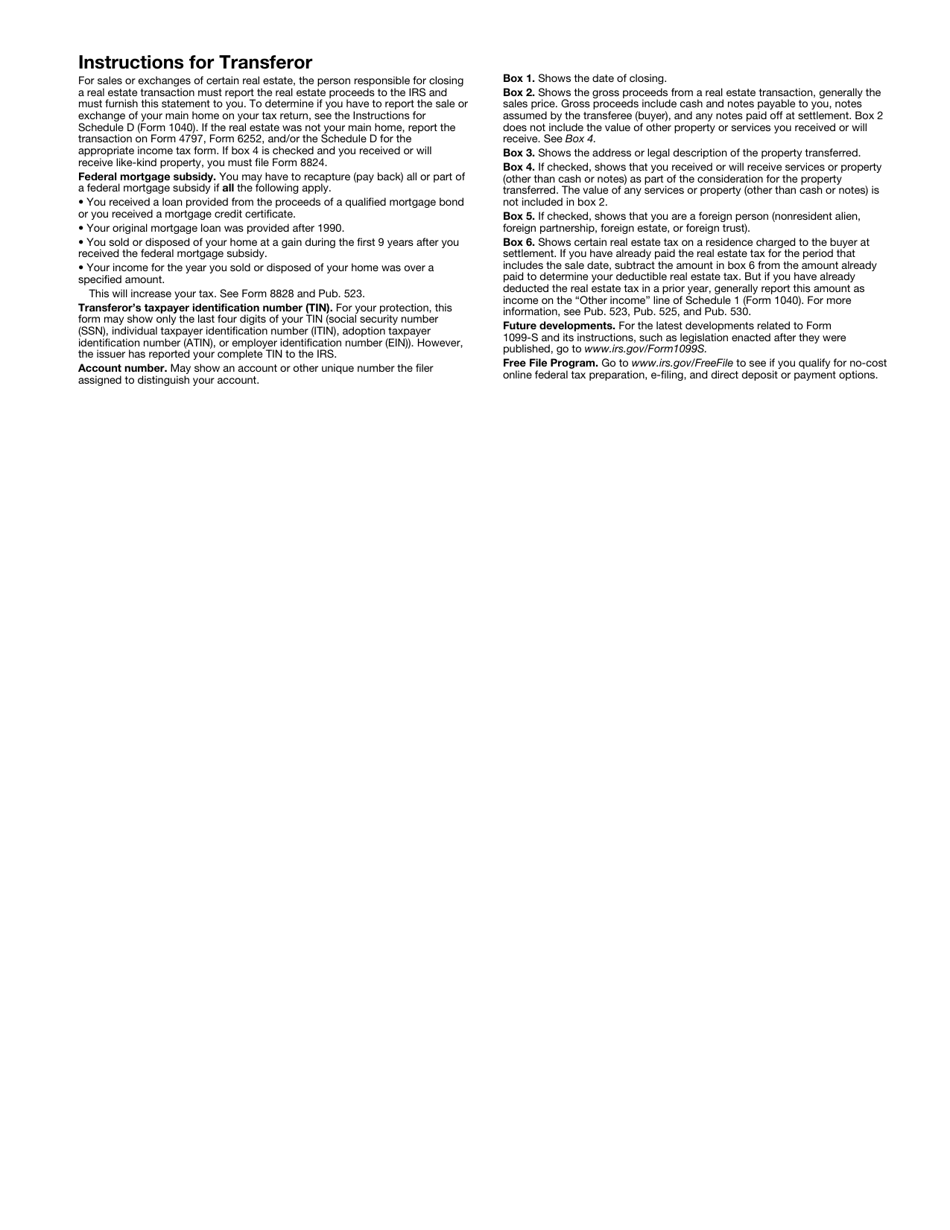

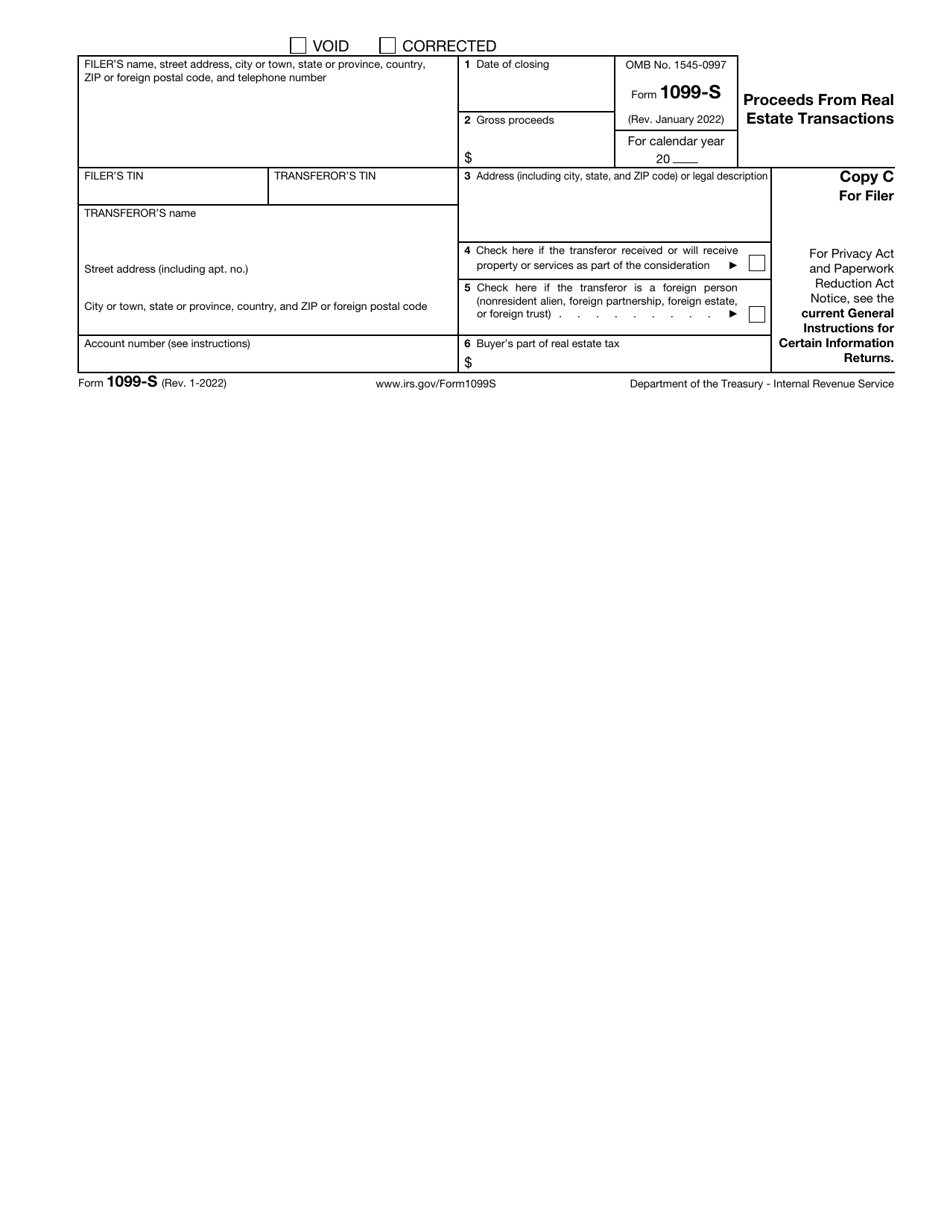

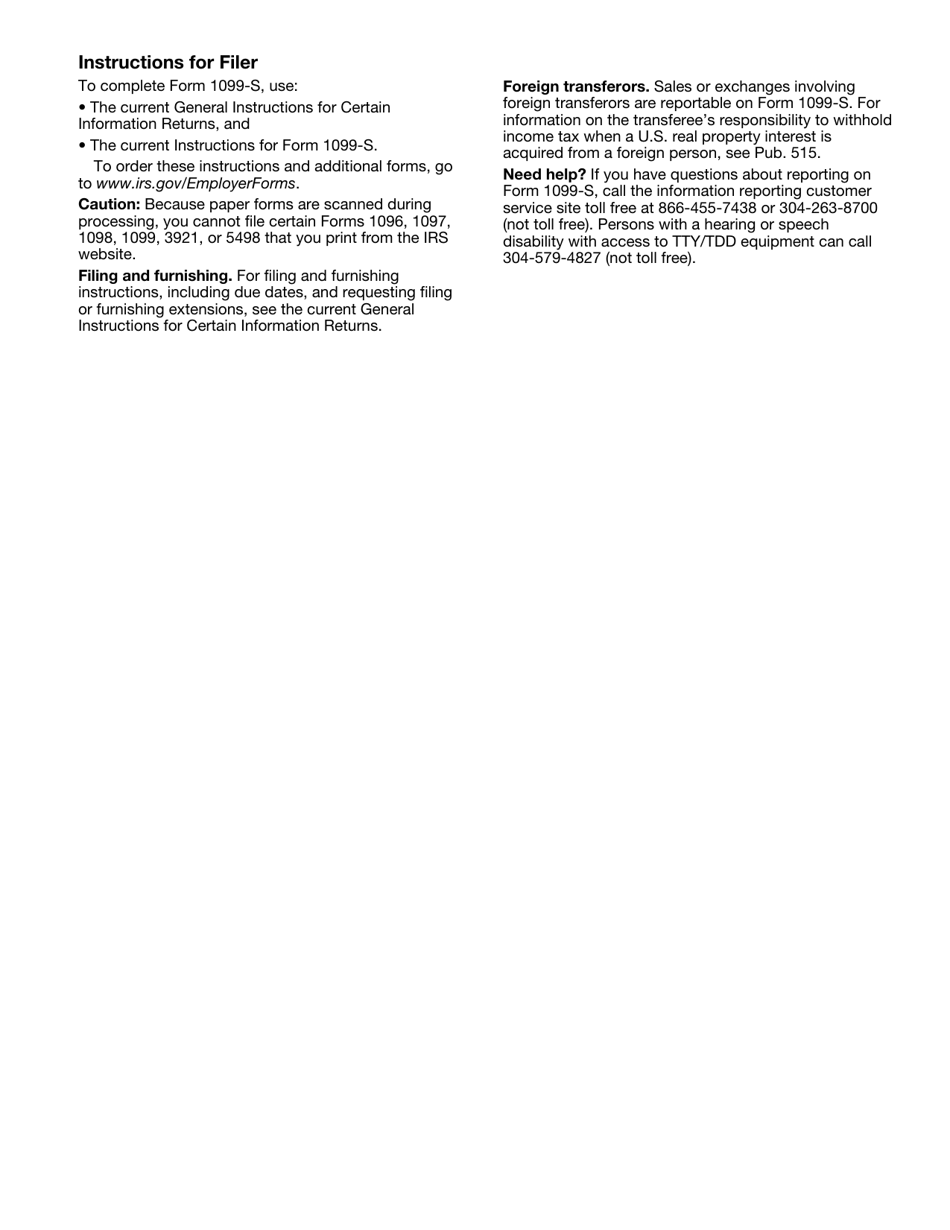

Form 1099-S Instructions

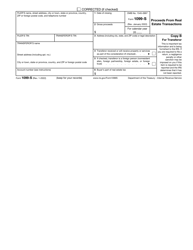

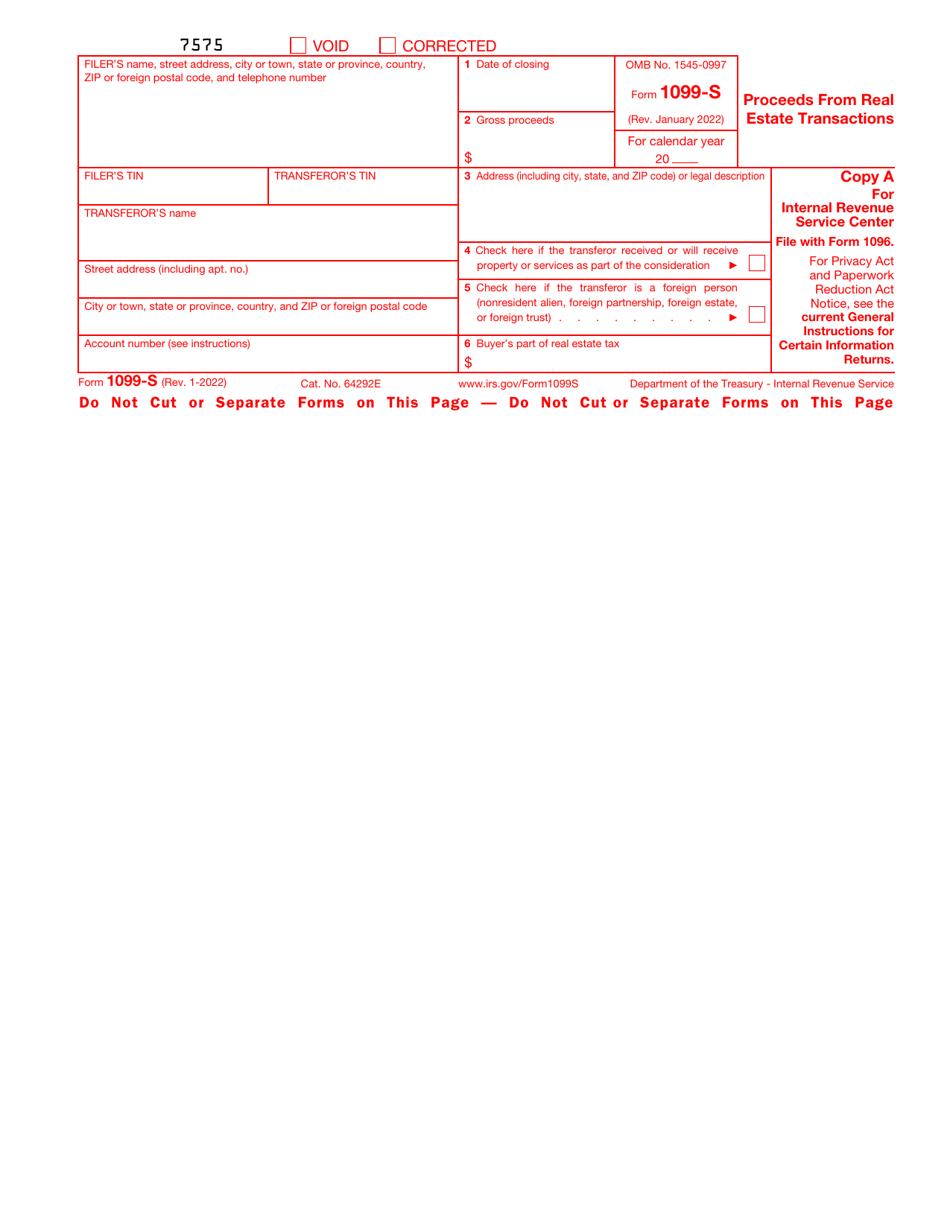

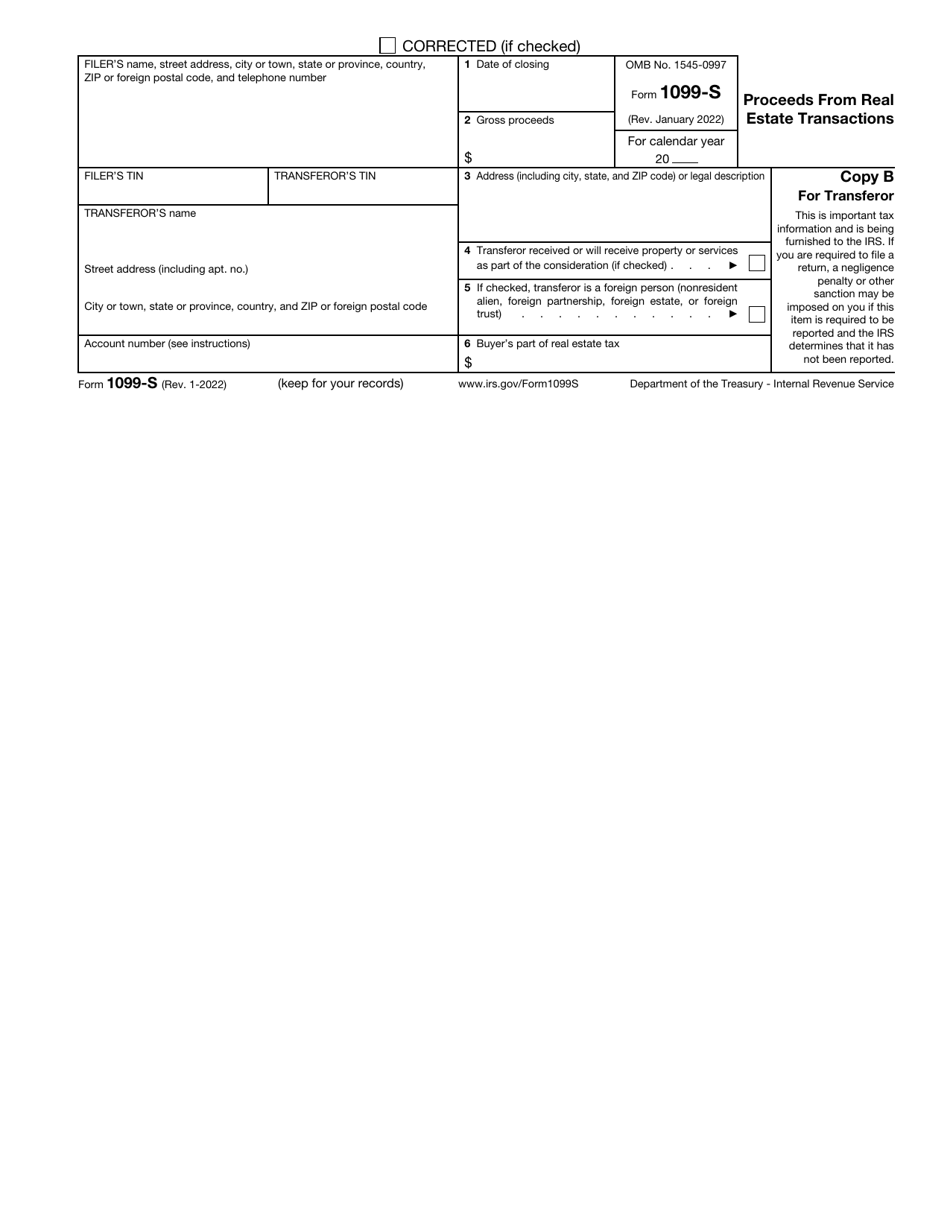

Follow the Form 1099-S instructions to make sure the tax organs know about your capital gain or loss in relation to real estate transactions during the course of the year:

-

Identify the filer by their full name, correspondence address, telephone number, and taxpayer identification number . The same details have to be given to describe the transferor of the real estate. Do not forget to clarify the number of the account - in some instances, the transferor has more than one account with the filer which is why it is important to differentiate between them to avoid confusion.

-

Write down the date the transaction took place - the date of closing you can find in the closing disclosure statement ; alternatively, this will be the date when the title transfers to a person or entity purchasing real estate.

-

Record the tax year you outline in the form and enter the total amount of money received for the real estate - the sales price . The number you state cannot contain the cost of services or property you may mention later. Briefly describe the property that was transferred - usually, a legal address is enough, but sometimes it is necessary to add a few words that facilitate the identification of the building.

-

Check the boxes if instead of money the transferor agreed to receive services or property as a part of the profits and if the transferor is a foreign citizen or organization . Indicate the share of the real estate tax allocated to the buyer.

-

Prepare a copy you will file to fulfill your taxpayer obligations and a copy for the transferor . Remember that if several transferors participate in the transaction involving the same real estate, there has to be a separate 1099-S Form for each of them. The exception applies to married couples that own the property jointly - they will be considered as one party. If you are reporting a real estate transaction where a partnership transferred property, you do not have to contact every partner - it is enough to send a copy of the instrument to the entity. It is also a smart idea to retain a copy of the form in your records.