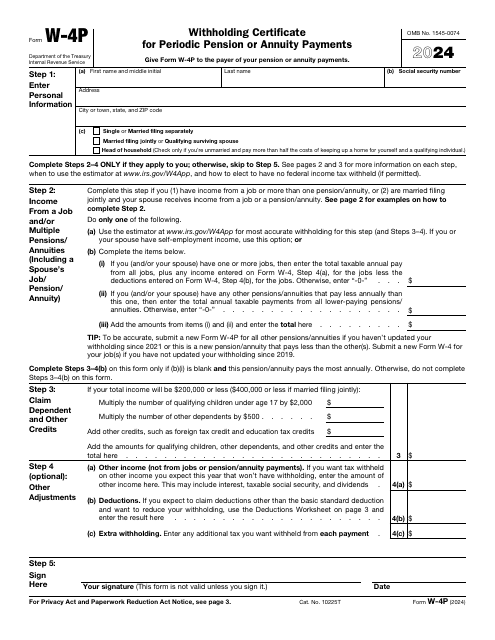

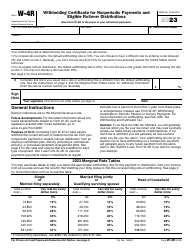

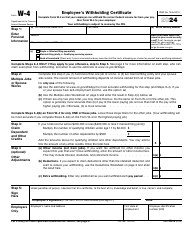

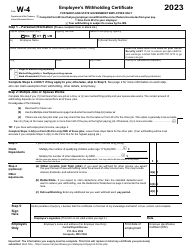

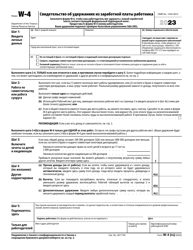

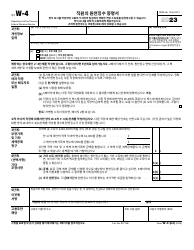

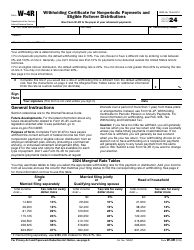

IRS Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

What Is IRS Form W-4P?

IRS Form W-4P, Withholding Certificate for Pension or Annuity Payments , is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

Alternate Names:

- Tax Form W-4P;

- IRS Withholding Form W-4P;

- Pension Withholding Tax Form.

Whether you get money from your retirement account or share the profits with your employer, it is possible to compute how big the tax deduction will be and inform the payer.

This certificate was released by the Internal Revenue Service (IRS) in 2024 - older editions of the form are now outdated. An IRS Form W-4P fillable version is available for download below.

Check out the W-4 Series of forms to see more IRS documents in this series.

What Is Form W-4P Used For?

Prepare Form W-4P if you are an individual taxpayer eligible to receive annuity, periodic pensions, individual retirement account payments, or incentive plans created to compensate employees. The tax will only apply to the taxable portion of either of these payments - they have to be periodic which means you cannot fill out this instrument if the payments you get do not recur at regular intervals. Note that the payer is not obliged to give you a copy of the blank W-4P Form - instead, you need to print it out on your own and send it to inform them how big the deduction is.

What Is the Difference Between Form W-4 and Form W-4P?

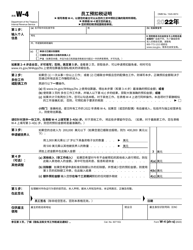

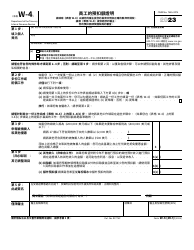

Some taxpayers confuse Form W-4P with a similar form - Form W-4, Employee's Withholding Certificate. However, unlike the former certificate, Form W-4 only covers the relationship between the employer and employee - you can use this document to tell them how much income tax must be deducted from your salary. It is recommended to complete this certificate whenever your financial situation becomes different.

Form W-4P, on the other hand, lists potential deductions you can ask for when dealing with a variety of payers that take care of your annuities, pensions, and plans that establish how much profit you generate depending on the earnings of your employer.

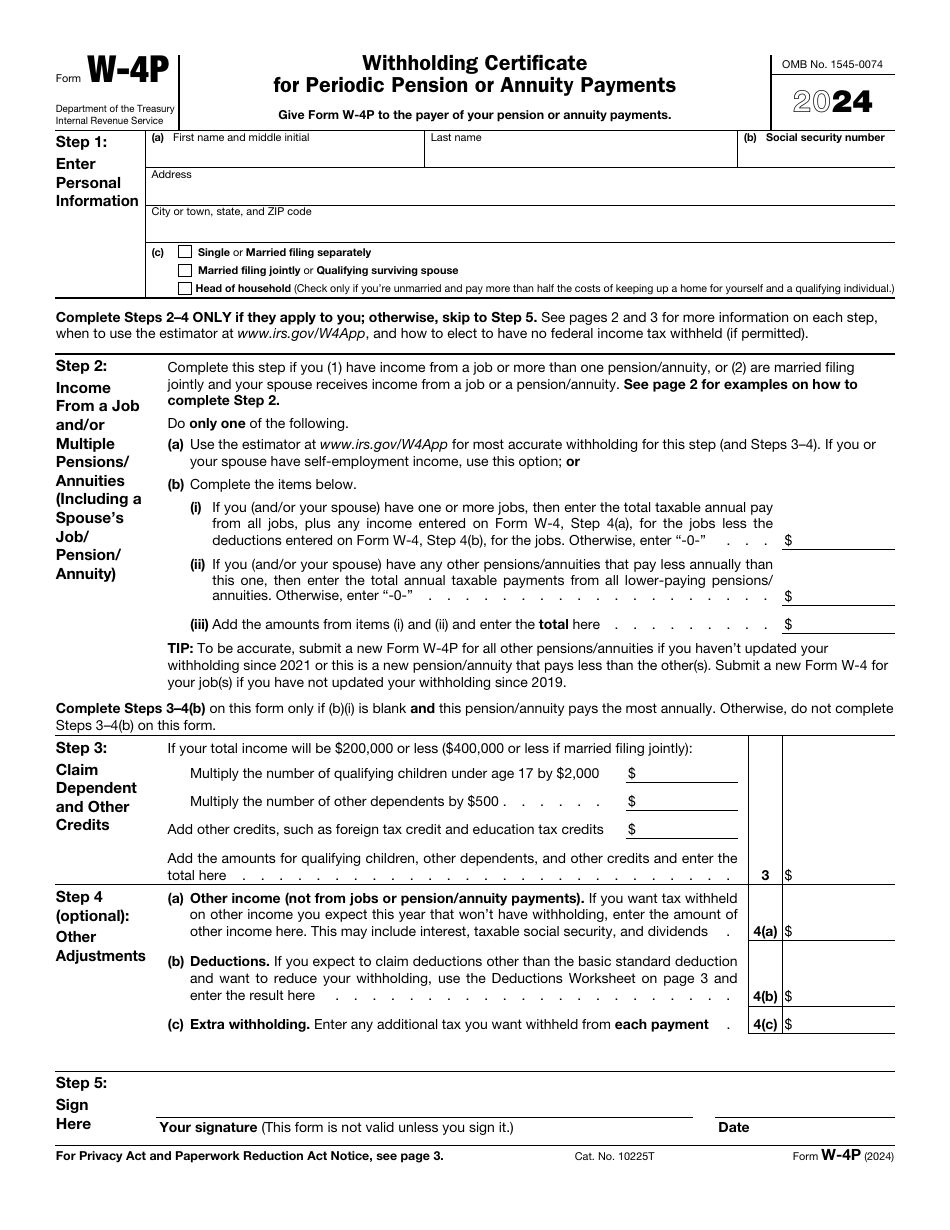

Form W-4P Instructions

Follow these Form W-4P instructions to ask for regular tax deductions from your annuity and pension:

-

List your full name, social security number, and mailing address . Make sure you include a correct social security number since any error will lead to the IRS treating you as a single filer without applying any adjustments. Check the box to confirm your filing status and properly calculate the deduction - you can choose between single, married filing jointly or separately, a spouse with dependents that is permitted to have the same status as married taxpayers, and the individual who provides for the family.

-

Proceed with subsequent sections of the form only if they apply in your case - you may leave the fields that do not describe your financial situation or filing status blank . If you are employed, have several pensions or annuities, or a joint filer whose spouse has either of these types of income, you need to state how much you earn throughout the calendar year and how much money you get via pensions and annuities. Combine those two results and indicate the total income you generate on your own or with your spouse.

-

Use the opportunity to claim tax credits for your dependents . One of the IRS Form W-4P mandatory requirements is the income threshold - you are only allowed to complete this part of the document if your income does not exceed $200.000 ($400.000 for joint filers). Use the formulas in the instrument to learn the amount of credit. Remember that if you request a credit as a parent, the child has to be younger than seventeen, reside with you for the majority of the year, and have a social security number. It is also permitted to claim a credit for older children and relatives and confirm your eligibility to claim a credit for taxes you paid abroad or offset certain education expenses.

-

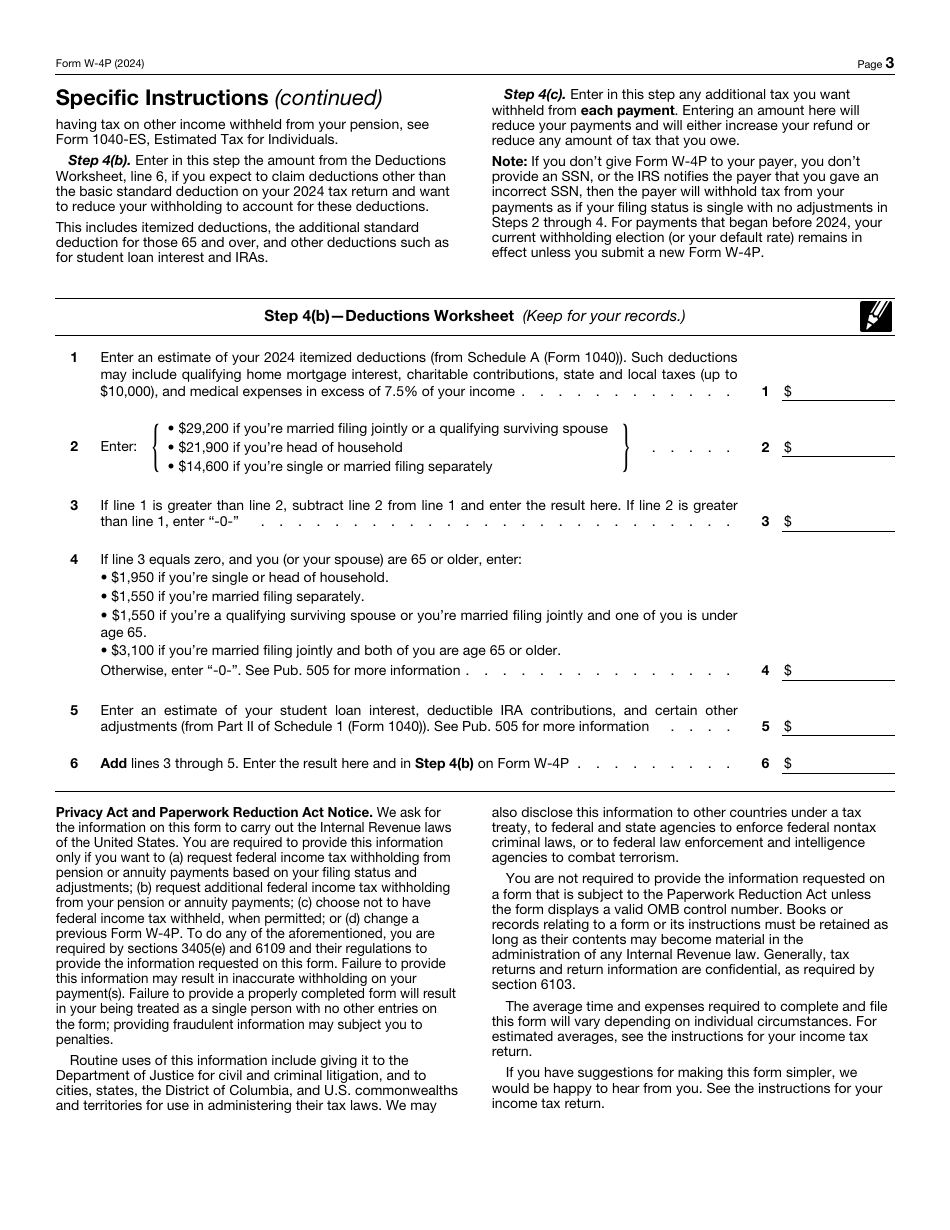

Apply extra adjustments to the deduction if you want - this particular section of the form is optional for taxpayers . In case you received dividends, interest, or social security benefits, you may enter their combined amount in the appropriate field. Specify the deductions using the worksheet featured on the third page of the form and clarify if there is another type of tax you want to deduct from all the payments.

-

Sign and date the paperwork to ensure the form is valid . As for the process of submission, it is up to you to decide how to deliver the documentation to the payer - you may present a copy of the certificate to them in person or send it via certified mail to obtain a receipt that will serve as proof of mailing.

How to Fill Out a W-4P Form If Single?

Both single and married taxpayers can use Form W-4P to notify the payers about the tax deduction they calculated taking their payments into account. Nevertheless, there are specific rules for people who are not married. You will need to skip the part of the form that outlines various sources of income unless you earn money via employment or have numerous pensions and annuities. Besides, there are different rates listed in the worksheet for deductions that will adjust the total deduction so it is important to clarify your filing status otherwise you will be subject to a penalty.

IRS W-4P Related Forms:

- IRS Form W-4, Employee's Withholding Allowance Certificate, also known as the IRS Employee Withholding Form, is a document completed by employees to let the employer know how much money to withhold from their paychecks for federal taxes.

- IRS Form W-4V, Voluntary Withholding Request is a document used to ask the payer to withhold federal income tax by individuals who receive social security payments, unemployment compensation, or other dividends and distributions that can be defined as a government payment.

- IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay, is a document the employee needs to give to the third-party payer of the sick pay, for example, an insurance company if the employee wishes federal income tax withheld from the payments.