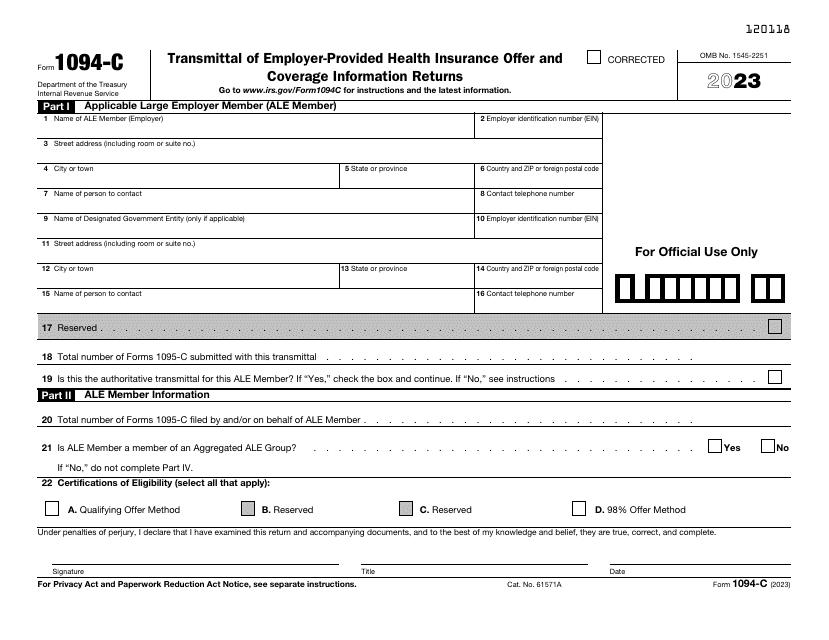

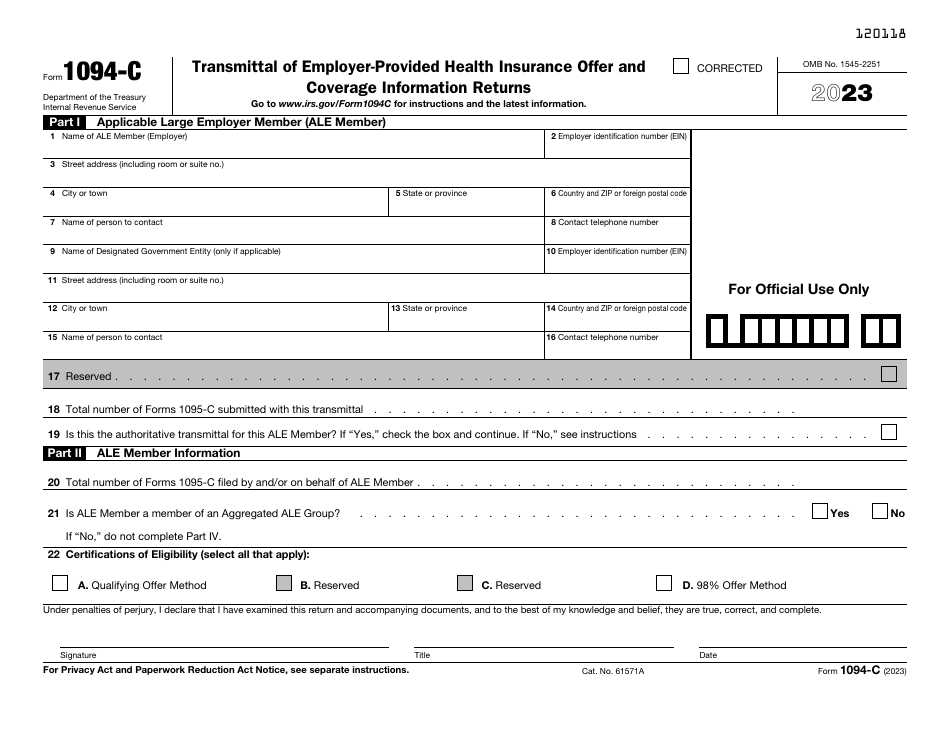

IRS Form 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

What Is Form 1094-C?

IRS Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns , is a cover sheet document used to report to the Internal Revenue Service (IRS) summary information about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage. An ALE is any single employer, or a group of employers, that employed at least 50 full-time employees on business days throughout the calendar year.

The latest version of the form was released by the IRS in 2023 with all previous editions obsolete. A fillable 1094-C Form is available for download below.

IRS Form 1094-B, Transmittal of Health Coverage Information Returns, is a related document used by insurance providers to send the IRS information about individuals who have essential health coverage meeting the standards of the Affordable Care Act.

What Is the Difference Between 1094-C and 1095-C?

Form 1095-C provides details about the coverage that is offered to employees, the lowest-cost premium available to them, and the months of the calendar year the coverage was available. When employers send this form to the IRS, they also have to submit an IRS 1094-C Form, which contains the main information about the related form. Form 1094-C (transmittal) is supplementary to Form 1095-C (returns).

IRS Form 1094-C Instructions

Instructions for Form 1094-C are as follows:

- Part I - ALE Member. Enter the employer's name, the employer identification number (EIN), the complete address, the name and telephone number of the person for the IRS to contact. If a Designated Governmental Entity (DGE) files on behalf of an ALE member, it is necessary to state their name, the EIN, the complete address, and the name and telephone number of the person for the IRS to contact. Write down the total number of form 1095-C submitted;

- Part II - ALE Member Information. State the total number of Forms 1095-C filed. Indicate if the employer is a member of an aggregated ALE group. Choose a certification of eligibility, if applicable. Sign and date the form;

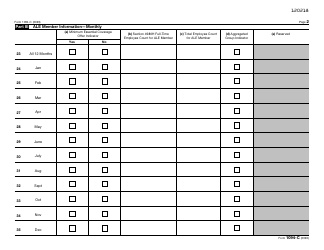

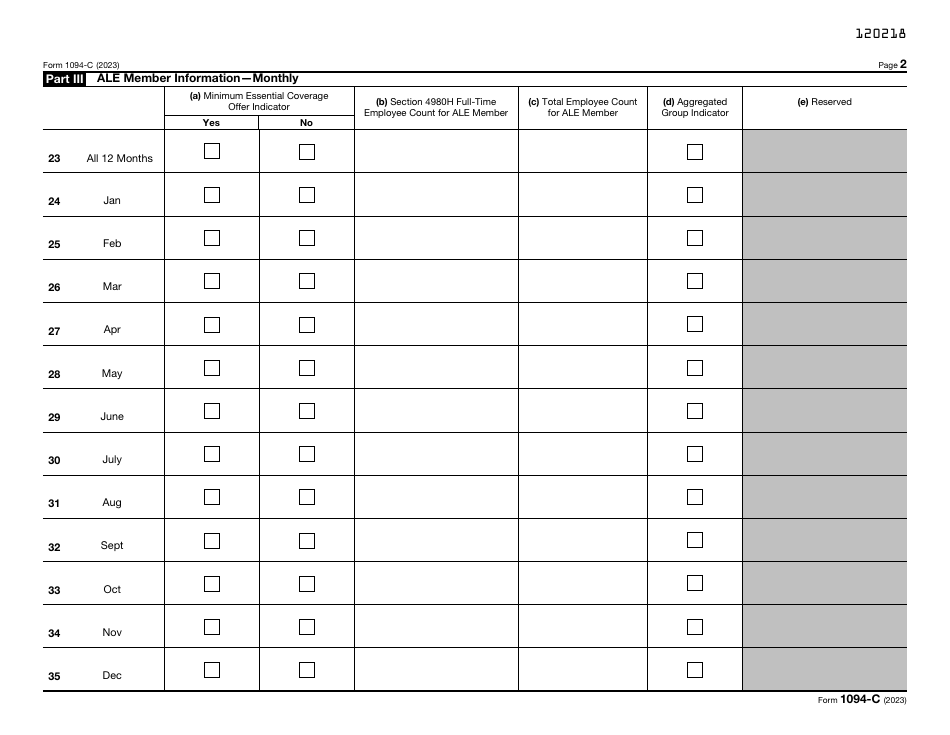

- Part III - ALE Member Information - Monthly. Check the appropriate boxes if the ALE member offered minimum essential coverage to at least 95% of its employees for the entire year/certain months. Provide the full-time employee count and total employee count;

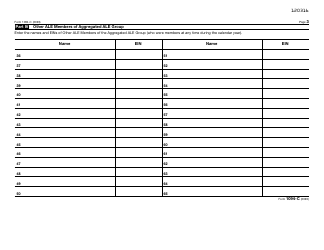

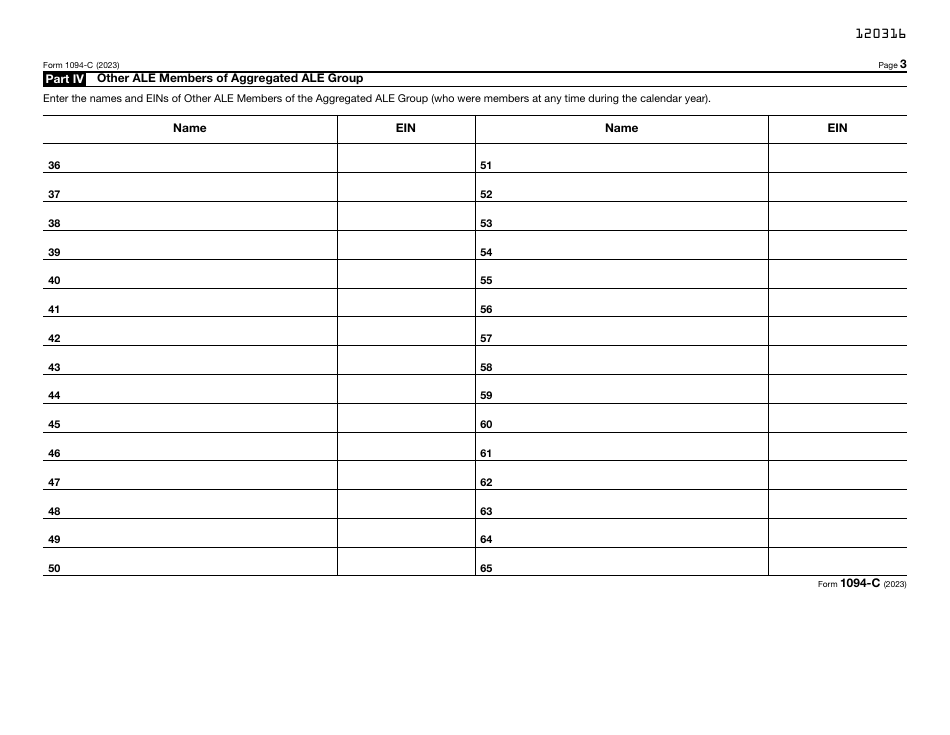

- Part IV - Other ALE Members of Aggregated ALE Group. If the ALE member is a member of an aggregated ALE group, it is necessary to submit the names and the EINs of the other group members (not more than 30).

When Is Form 1094-C Due?

The due date for Form 1094-C is the last day of February if you file it on paper and the last day of March if you file it electronically (the year that follows the calendar year of coverage). There is a penalty if you fail to provide an accurate information return - $270 for each return for which the failure has occurred.

Where to Mail Form 1094-C?

Mailing addresses for the form:

- Department of the Treasury Internal Revenue Service Center Austin, TX 73301 - for Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, West Virginia, and foreign countries;

- Department of the Treasury Internal Revenue Service Center PO Box 219256 Kansas City, MO 64121-9256 - for Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming.