2020 Tax Deductions for Homeowners and Home Buyers

Buying a home can be one of the biggest investments a consumer can make during their lifetime. The U.S. government has implemented a variety of laws and tax write-offs for homeowners made to encourage home ownership. Becoming familiar with these benefits can save consumers a great deal of money both at the time of purchase and during the period of owning the property.

Navigating the available opportunities may be tricky, but knowing your rights and the available tax breaks for homeowners is extremely beneficial for your budget in the long run.

What Tax Deductions Are Available for Homeowners?

A tax deduction is a reduction of taxable income for the current year. These deductions are equal to certain expenses that the taxpayer incurs during the year that can be subtracted from their gross income when filing taxes as a homeowner with the IRS.

Any deductions related to the home must add up to more than the standard deduction when summed up with all other deductibles. The actual amount of money a homeowner can save on their annual Form 1040 depends on several key factors:

- Their standard deduction amount and the amounts of other itemized deductions;

- Taxable income;

- Whether they are a single-person household, the head of a household, or married and filing separately or jointly with a spouse.

What Are the Tax Benefits of Owning a House?

The Tax Cuts and Jobs Act - the biggest renovation of the U.S. tax code in decades - was introduced at the end of 2017 and made some homeowner deductions and tax breaks unavailable to consumers. Even though many deductions were kept as is, the others were significantly changed or entirely eliminated. There are several different tax deductions that American homeowners are entitled to:

1. Property Tax Deductions. Before the Tax Cuts and Jobs Act, a homeowner’s property taxes were usually fully deductible. For this year, the total deductible taxes for all state, local, sales, property, and income taxes cannot exceed $10,000 in a single year.

2. Home Office Deductions. Before the law passed, homeowners were allowed to deduct some expenses associated with doing business from their home office claiming it as a miscellaneous itemized deduction.

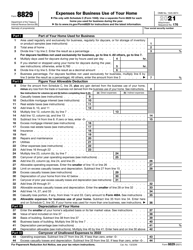

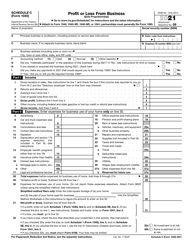

Since 2017, only self-employed workers can deduct their expenses for their home office. Self-employed workers must use Form 8829 to calculate the allowable expenses for business use of their home on Schedule C (Form 1040). Any amounts not deductible in the current year are carried over into the next one. Household employers must also use Schedule H (Form 1040) to report employment taxes.

3. Mortgage Interest Deductions. After 2017, all mortgage debt deductions are limited to $750,000, whereas before the law passed, homeowners could deduct mortgage interest of up to $1 million.

4. Mortgage Insurance Premium Deductions. This benefit will allow homeowners to apply for a reimbursement of their expensive mortgage insurance if they manage to default on their mortgage loan.

5. Home Equity Debt Interest Deductions. Previously, the interest on your home equity debt that was used for any purpose up to $100,000 was usually deductible. But for 2019, the new tax law no longer allows the home equity interest deduction. However, a recent update from the IRS has stated that the interest may still be deductible if the home equity is being used to improve the home. Make sure you get credible advice on home equity interest deductions as well as tax-deductions on cash-out refinances.

6. Home Sale Gain Exclusions. The current legislation allows consumers to deduct as much as $250,000 of the gain from selling their first home if they meet the IRS-identified criteria.

How to Deduct House Taxes?

All personal income taxes are reported on Form 1040, U.S. Individual Income Tax Return. As per IRS publication 530, the following types of property may be eligible for home tax deductions:

- The primary home of residence.

- Vacation homes.

- Land located outside of the U.S.

- RVs and boats.

Any taxes paid on property that the taxpayer does not own are not eligible for deductions. File Schedule A (Form 1040) to calculate your itemized deductions.

File Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment) to exclude the discharges of qualified principal residence indebtedness from personal gross income. File Form 5405, Repayment of the First-Time Homebuyer Credit to figure out any applicable exemptions from repaying claimed credit for your first home.

If you are self-employed and renting out property - including vacation homes - you may need to file the following forms with the IRS:

- File Form 4562, Depreciation and Amortization (Including Information on Listed Property) if claiming depreciation on property placed in service during the previous year and car expenses incurred when collecting rental income or maintaining rental property.

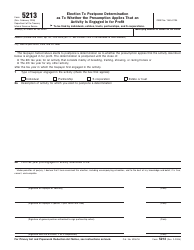

- File Form 5213, Election To Postpone Determination as To Whether the Presumption Applies That an Activity Is Engaged in for Profit to postpone reporting the fact that the rental is a for-profit business.

- File Form 8582, Passive Activity Loss Limitations if you incurred a loss from your rental real estate activity.

- File Schedule E (Form 1040) to report rental income and expenses made from leasing buildings, rooms, or apartments.

Want to learn more about this topic?

- Read about this year's tax deadlines and due dates;

- Get information about how to buy land to build a house;

- Find out more about selling your property;

- Learn the tips and tricks on getting your first mortgage.