Child College Tax Credit: Tax Breaks for Parents Paying for College

In the United States students and their parents can claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit to offset the costs of higher education. These tax credits help compensate the charges for tuition and related expenses (fees, books, supplies, equipment) of college or career school by reducing the amount of your income tax:

- The AOTC allows you to claim up to $2,500 per eligible student, per year;

- The Lifetime Learning Credit allows you to claim up to $2,000 per student per year for any college or career school tuition and fees, as well as for books, supplies, and equipment that were required for the course and had to be purchased from the school.

Is my Child's College Tuition Tax Deductible?

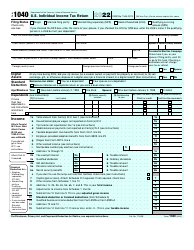

A child’s college tuition is tax-deductible: parents can claim a tuition tax credit for a dependent child in college. The dependent will receive Form 1098-T (Tuition Statement) from the educational institution the tuition was paid to by January 31. The form will report the amount of qualified education expenses paid during the previous tax year. To claim this deduction, complete the section titles “Adjustment to Income” on Schedule 1 of Form 1040.

Independent students and their parents can also use the student loan interest deduction tax break. The deduction will be equal to the amount you pay on interest for your student loan, with the maximum deduction being $2,500. To claim for the deduction, you must meet the following criteria:

- You paid interest, in 2019, on a qualified student loan.

- You’re using any filing status except “Married Filing Separately”.

- Your modified adjusted gross income (MAGI) is less than $80,000 for singles.

- Your MAGI is less than $160,000 if you’re filing a joint return.

- No one else is claiming you (or your spouse, if you’re filing a joint return) as a dependent on their tax returns.

You can use the Student Loan Interest Deduction Worksheet provided by the Internal Revenue Service (IRS) to calculate your exact deduction.

American Opportunity Credit

Students, parents or guardians can benefit from the American Opportunity Tax Credit if they paid for qualified education costs for the first four years of undergraduate education. Expenses include tuition, fees, college textbooks, and other required class supplies. This tax credit for child in college allows to offset the tax bill by up to $2,500 for up to four years. The amount you’re admitted to claiming depends on your MAGI. The limit on MAGI is $160,000 if married filing jointly and $80,000 if single, head of household or qualifying widow(er). To receive the full $2,500 credit, your MAGI cannot be higher than $90,000 (or over $180,000 if you’re filing a joint tax return. The credit covers 100% of the first $2,500 of qualified tuition, required fees, and qualified expenses, plus 25% of the next $2,000. Furthermore, 40% of the credit is refundable, so you may receive $1,000 per eligible student as a tax refund even if you owe no tax.

The student for whom you’re claiming the credit must be enrolled at least half-time and have no felony drug convictions. You cannot claim this credit if you’re married and file a return separately from your spouse.

The Lifetime Learning Credit

The Lifetime Learning Credit is a non-refundable tax credit for a child in college. This tax break can be claimed if you pay for an undergraduate’s education, for graduate school or technical school for an unlimited number of years with the student not required to be working toward a degree program.

The Lifetime Learning Credit allows you to get a tax credit for tuition, fees, and required books and supplies for classes taken at any qualified educational institution. This credit is non-refundable. If the credit brings your tax bill below zero, you cannot get a refund in excess of the tax you’d paid in.

If you intend to get the full $2,000 Lifetime Learning Credit, your MAGI can’t be higher than $56,000 for singles or $112,000 if you’re filing a joint tax return. You’re ineligible for the tax credit if your filing status is married filing separately, you were a nonresident alien at some point during the year and/or someone else is claiming you as a dependent.

The Lifetime Learning Credit applies to undergraduate, graduate, and professional degree courses, and even to post-graduate courses that help improve your job skills. Felony drug convictions do not make the student ineligible.

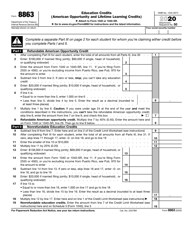

Complete the IRS-issued Form 8863 to calculate and claim both the American Opportunity Tax Credit and Lifetime Learning Credit.

Can I Claim My Child's College Tuition on My Taxes?

According to the IRS, parents can claim a child as a dependent until he or she is 19, but once a child becomes a student, that dependency status can be extended until 24. If this is the case, you need to indicate the child as a dependent on your tax return while filing taxes.

The main tax forms file din relation with tuition tax breaks are:

- Form 1098 - a tuition statement provided by the educational institution. It includes information about the tuition paid, related expenses, any scholarships or grants the student had received, and any adjustments from last year.

- Form 8863 is a form that is used to check if a student qualifies for education credits, including the American Opportunity Credit and the Lifetime Learning Credit.

- Qualifying individuals must complete all applicable sections on their annual tax returns (Form 1040).

Once you have filed all the necessary forms, provide the completed documents to your local IRS office.

If you still have trouble with determining the tax breaks you are eligible for, check out the chart below:

| American Opportunity Credit | Life Learning Credit | Tuition and Fees Deduction | ==> | | -- | -- | -- | | How much is it worth? | 100% of the first $2,000 of qualified expenses, 25% of the next $2,000 ($2,500 max) | 20% of the first $10,000 of qualified expenses. | As much as $4,000 on qualifying expenses excluded from income. | | Refundable? | Up to $1,000 | No | N/A | | Income limit for full benefit | $80,000 (single), $160,000 (joint) | $55,000 (single), $110,000 (joint) | $65,000 (single), $130,000 (joint) | | Income limit for partial benefit | $90,000 (single), $180,000 (joint) | $65,000 (single), $130,000 (joint) | $80,000 (single), $160,000 (joint) | | Restricted to undergraduate study? | Yes | No | No | | Time limit for claiming benefits (in years) | 4 | Unlimited | Unlimited |

Additional Tax Breaks for Parents

Want to find out how to get even more out of your tax return? Check out the benefits and breaks listed below.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a tax break for working people with low income. According to the IRS, you can claim if your Adjusted Gross Income (AGI) is less than $14,820 and you’re single, if you’re married filing jointly and your AGI is less than $20,330, or you have three or more kids, are married, and your AGI is no more than $53,267, you can qualify for this tax credit up to $6,242.

$1,000 Child Tax Credit

This tax credit can reduce your tax bill by as much as $1,000 per child, but you have to match the following requirements:

- The child must be under age 17 at the end of the tax year for which you’re filing;

- The child must be your biological child or an adopted child, a stepchild, or a foster child placed with you by a court or authorized agency;

- You must have claimed the child as a dependent;

- The child must be a U.S. citizen;

- The child must have lived with you for at least half the year for which you’re filing;

- Your modified adjusted gross income must be below certain IRS-required amounts: $55,000 for married couples filing separately, $75,000 for single, head of household, and qualifying widow or widower filers, and $110,000 for married couples filing jointly.

The available child tax credit is reduced by $50 for each $1,000 of income above the limit.

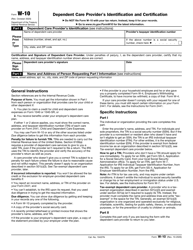

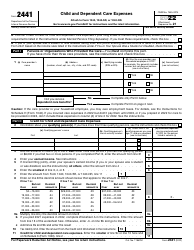

Dependent Care Tax Credit

This is a credit for taxpayers that have financially provided for a claimed dependent that has been living with them for no less than half of the current tax year. The maximum amount of allowable care expenses is $3,000 for a person. Related forms include the following:

- Form W-10, Dependent Care Provider's Identification and Certification, used for providing information about all persons and organizations that provide care for the dependent.

- Form 2441, Child and Dependent Care Expenses, filed by qualifying applicants of the Dependent Care Tax Credit.

- Form 1040 Schedule 3, Nonrefundable Credits that qualifying applicants must file along with their annual tax return.

- Form W-2, Wage and Tax Statement, completed by individuals receiving dependent care benefits from their employer.

Consult the IRS for additional details on claiming the Dependent Care Tax Credit.