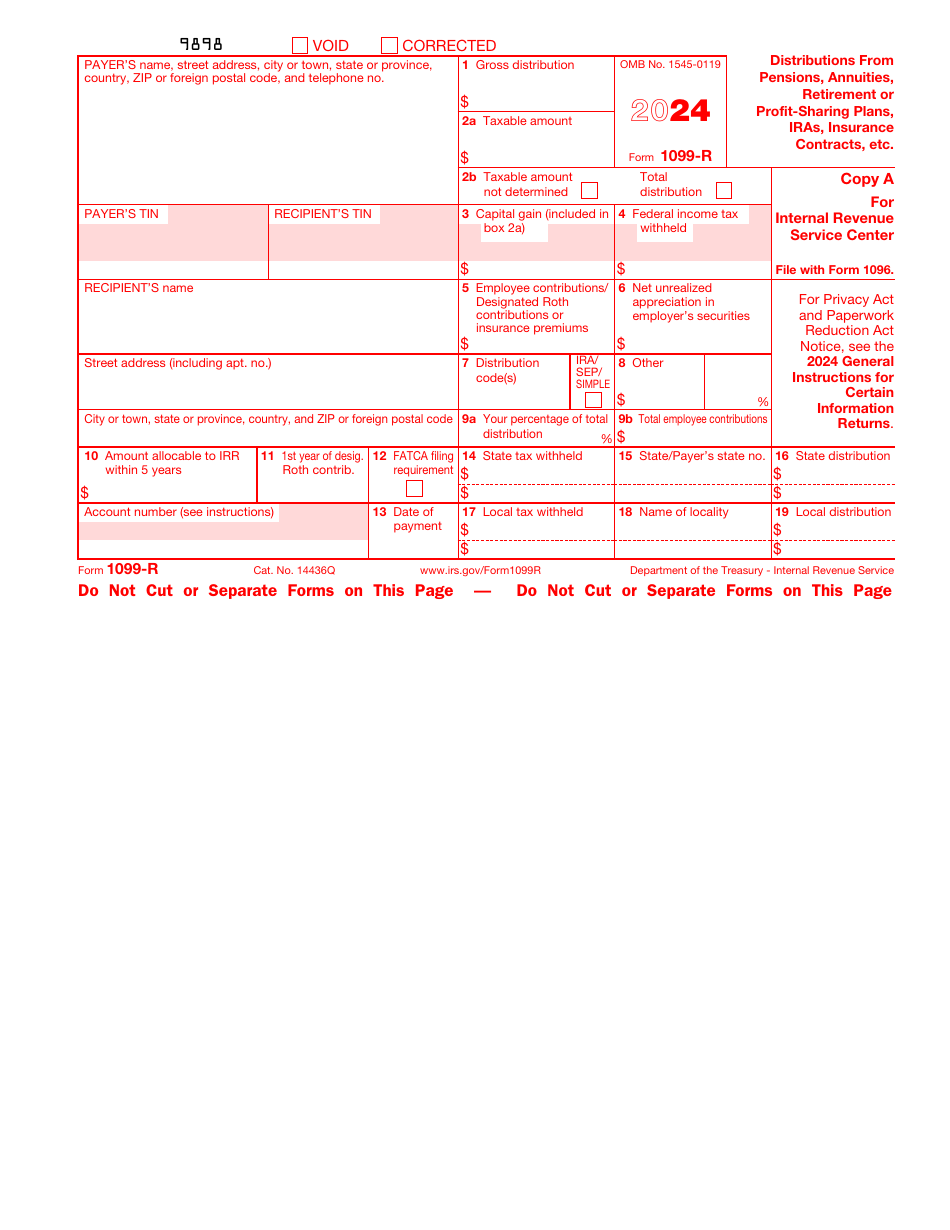

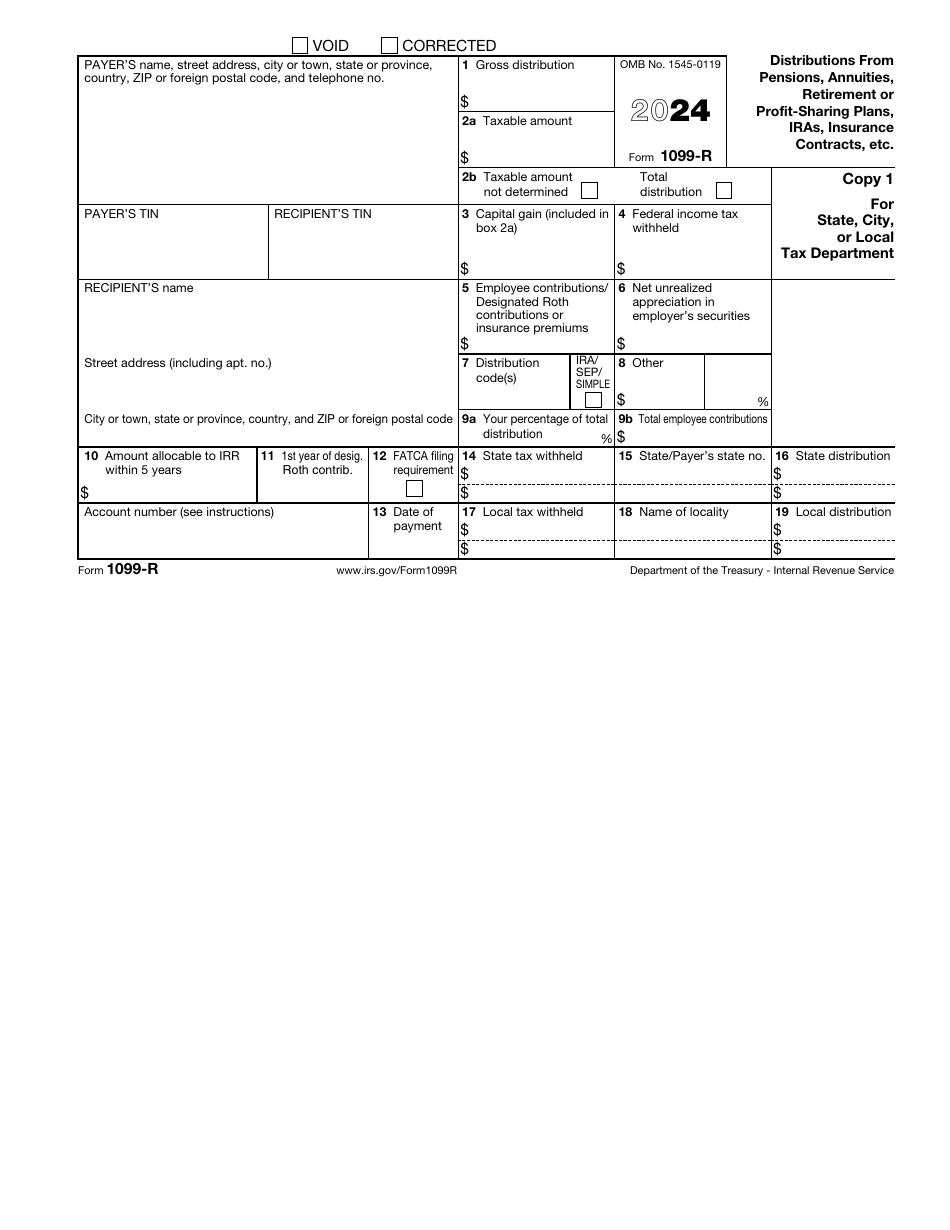

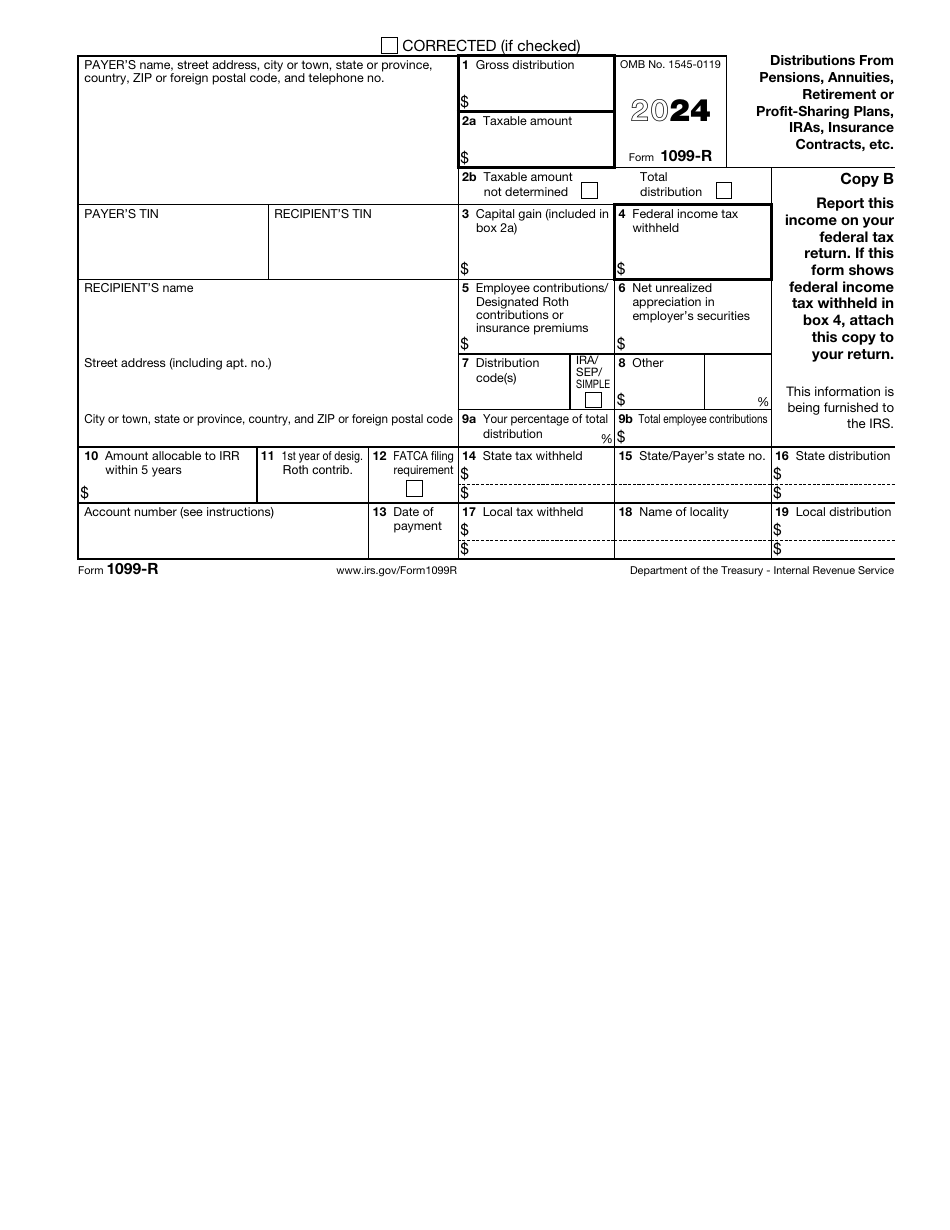

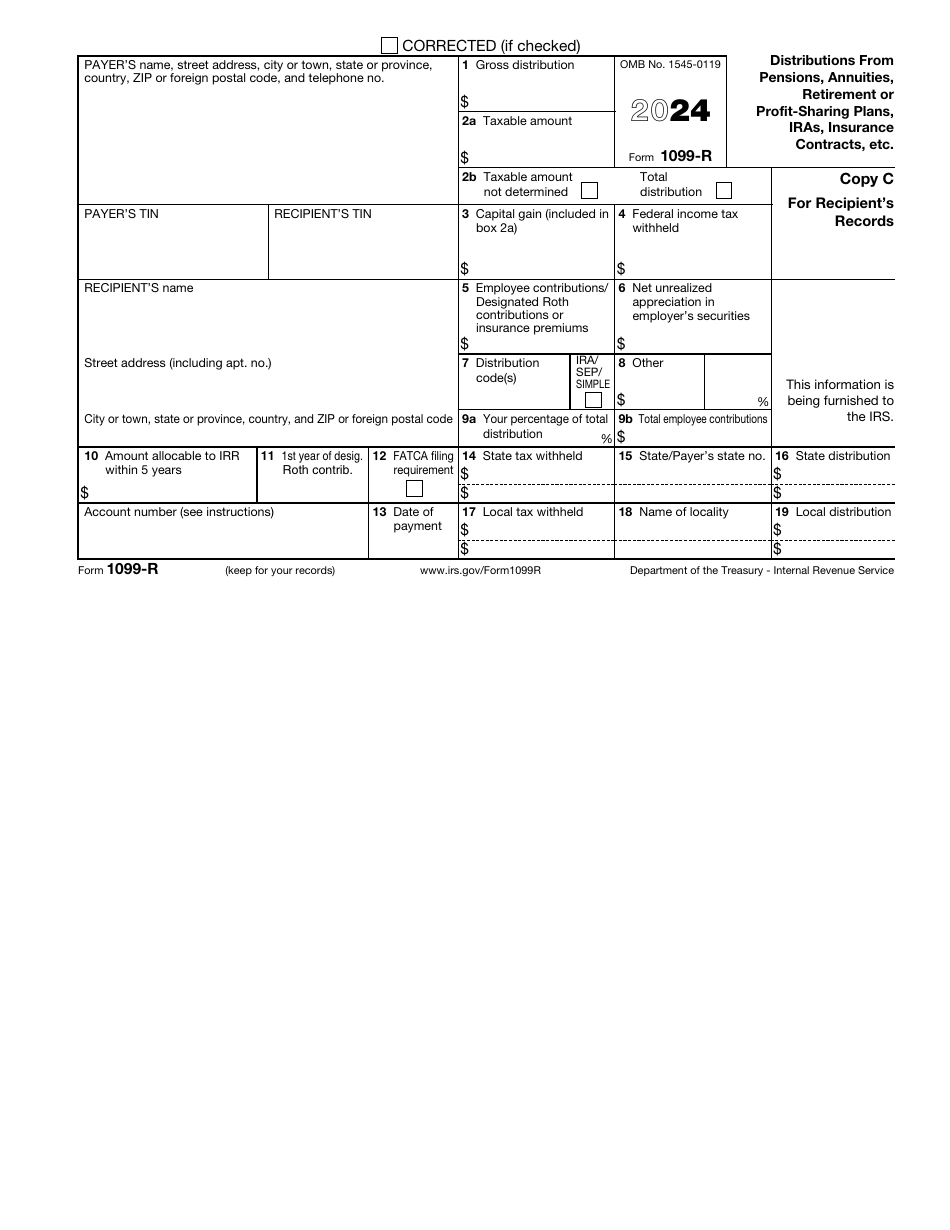

IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

What Is IRS Form 1099-R?

IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

Alternate Name:

- Tax Form 1099-R.

Taxpayers can expect to receive this document after the year when they made contributions to annuity and pension accounts is over and the distributions are paid out - basically, an individual will be obliged to consider extra sources of income apart from their salary when dealing with their own tax paperwork.

This document was issued by the Internal Revenue Service (IRS) in 2024, rendering older editions of the form outdated. An IRS Form 1099-R fillable version can be found below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-R Form Used For?

Form 1099-R is prepared and submitted by entities that manage retirement plans for every recipient of the distribution from the retirement plan. This document outlines various distributions from annuities, pensions, insurance agreements, and retirement accounts.

The purpose of this statement is to remind the recipient of the distribution above $10 about their obligation to take this income into account when submitting their tax documentation. Additionally, the form elaborates on death benefits that may have been paid out to the estate of the beneficiary, loans, and account rollovers.

Is Form 5498 the Same as 1099-R?

The 1099-R Tax Form is often confused with a similar instrument - IRS Form 5498, IRA Contribution Information. Unlike the former document that focuses on partial and full distributions, Form 5498 covers all contributions, distributions, repayments, and rollovers as well as the determined price of the account at the end of the tax period. Another important factor the recipient of distributions should keep in mind is that they do not need a copy of Form 5498 to file their annual tax paperwork with the IRS while a copy of Form 1099-R must accompany their income statement.

Form 1099-R Instructions

Follow the Tax Form 1099-R Instructions below:

-

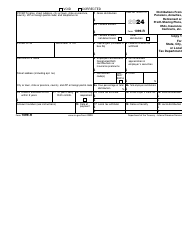

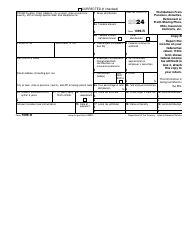

Specify whether you are filing a corrected version of the form or voiding the instrument you filed already - if neither scenario applies, leave the boxes blank. Write down the name of the entity that issued the plan, its contact information, and taxpayer identification number. Identify the recipient of the distribution by their full name, correspondence address, taxpayer identification number, and the number of their account if they have multiple accounts with the entity listed above.

-

State the total amount of the distribution before applying any deductions and figure out the amount subject to taxation. Depending on the situation, you will need to check one of the boxes - you either certify the amount included in the form reflects the total distribution or you were unable to determine the amount correctly.

-

In case the amount you are reporting is a capital gain, record it in the appropriate field. Indicate the amount of income tax deducted on a federal level, enter the contributions and premiums the plan participant may recover without those amounts being subjected to tax, and certify the difference in value between the stock's cost basis and its market value at the time of distribution.

-

Confirm the distribution in question comes from a traditional individual retirement account, a simplified employee plan, or an employee plan with incentives. Refer to official Form 1099-R instructions released by the IRS to check Form 1099-R distribution codes and write down the ones that apply in the participant's case. Enter the current value of future annuity payments in the field marked with the word "Other."

-

Add the percentage of the distribution the person identified in the form receives unless the distribution is connected to the individual retirement account or takes place as a result of a direct rollover. Specify the total amount of contributions made by employees and record the amount of the distribution that will be allocated to the in-plan Roth rollover over the course of the next five years.

-

Point out when the recipient established their Roth account, put a tick in the box if you represent the interests of a foreign financial institution obliged to inform the government of a contract related to the U.S. account, and add the date the death benefits payment was carried out. Confirm the amount of tax deducted on the state or local level, clarify your location, and enter the amount of state or local distribution.

When Is Form 1099-R Due?

Make sure you do not miss the Form 1099-R due date - for those who prefer to submit paper returns, the deadline is February 28 while e-filers get extra time to prepare the paperwork and get to send the document by March 31 of the year that follows the calendar year covered in the form.

Taxpayers that opt for paper filing must attach IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, to the statement that elaborates on distributions. Remember that the deadline above is in line with Form 1099-R reporting requirements when it comes to disclosing information to fiscal authorities - it is your duty to send the form to the plan participant by the end of January.

Where Is the Federal ID Number on 1099-R?

The Federal ID Number on a 1099-R Form is also known as a Taxpayer Identification Number (TIN). It is a unique nine-digit number that identifies an individual or business in tax returns and other documentation submitted to the IRS. You need to enter the payer's TIN in the box located under the payer's name and contact information.