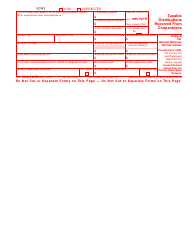

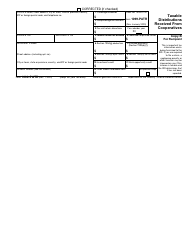

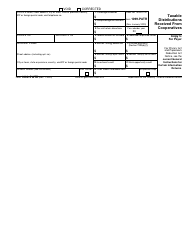

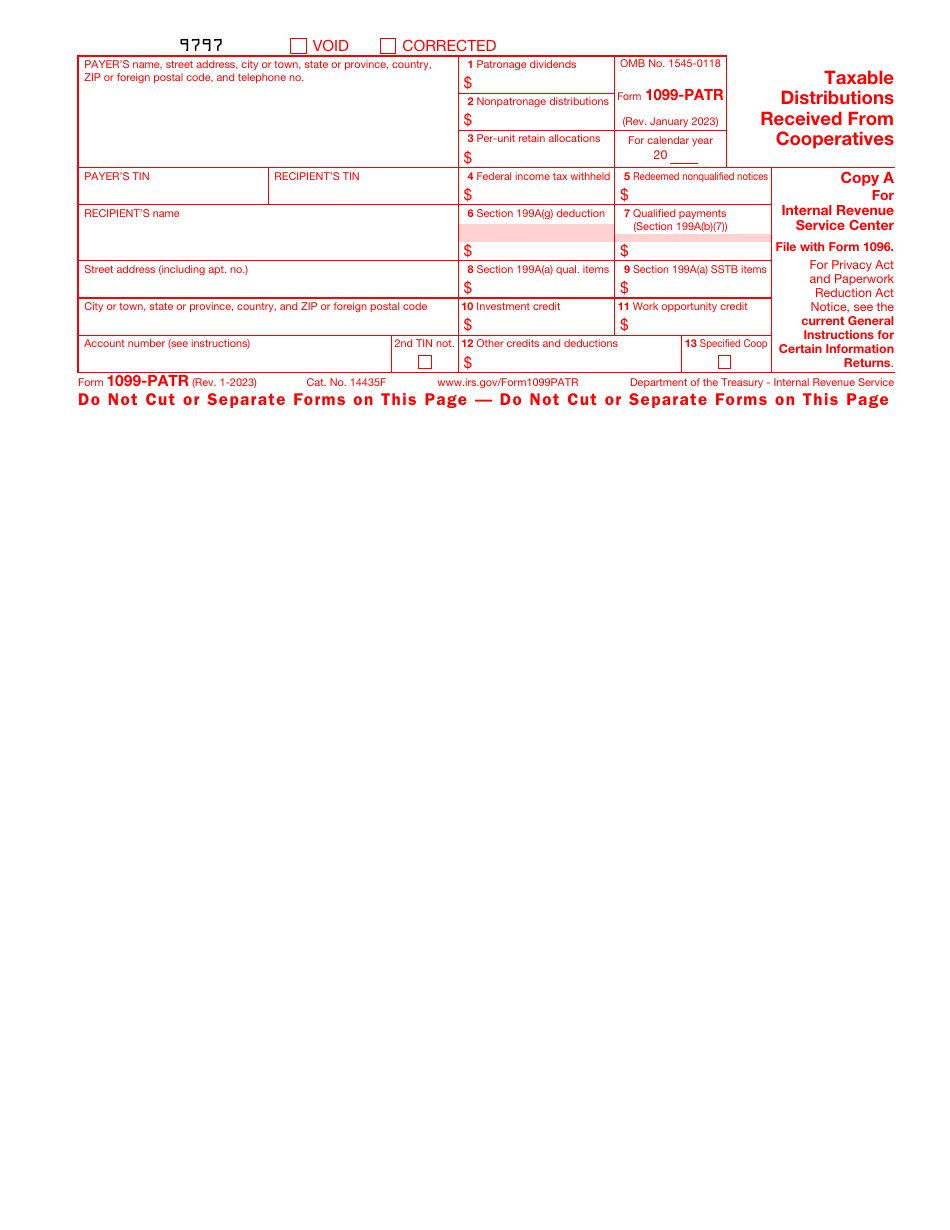

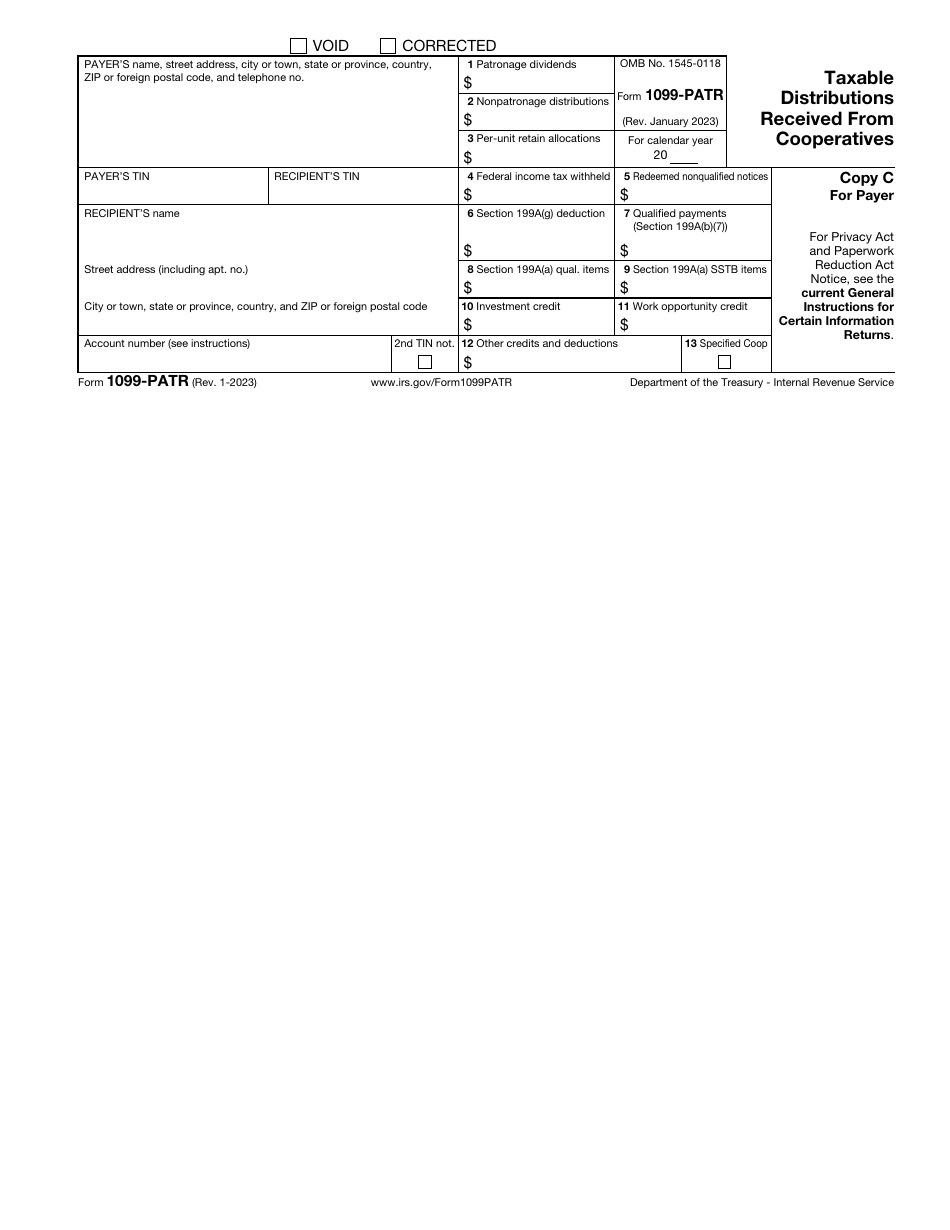

IRS Form 1099-PATR Taxable Distributions Received From Cooperatives

What Is IRS Form 1099-PATR?

IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives , is a fiscal instrument filled out by the cooperative that paid patronage dividends during the tax year.

Alternate Name:

- Tax Form 1099-PATR.

It is important to formally remind taxpayers about distributions they received throughout the last twelve months as well as properly report those distributions and tax deducted from the income to the tax authorities.

This document was released by the Internal Revenue Service (IRS) on January 1, 2023 - older editions of the form are now obsolete. Download an IRS Form 1099-PATR fillable version below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-PATR Used For?

It is essential to fill out and submit IRS Form 1099-PATR if your cooperative paid out patronage dividends and related distributions to individuals and entities. Distributions the cooperative paid its investors and members on the basis of the profit earned by the entity are considered patronage dividends. It is only obligatory to complete this instrument if the taxpayer got $10 or more from the cooperative. Cooperatives prepare Form 1099-PATR and send it to the IRS while a copy of the document goes to every patron - if you did not receive one by the end of January, reach out to the cooperative.

While many recipients of the form get it because their business operations are related to farming, there are other reasons that explain why a taxpayer would get this documentation - for instance, the deductions you are supposed to receive may have been calculated after the income tax deduction took place. Upon obtaining the paperwork and checking the numbers, the taxpayer will need to replicate the details from the form on their tax return as taxable income.

Form 1099-PATR Instructions

The IRS Form 1099-PATR instructions are as follows:

-

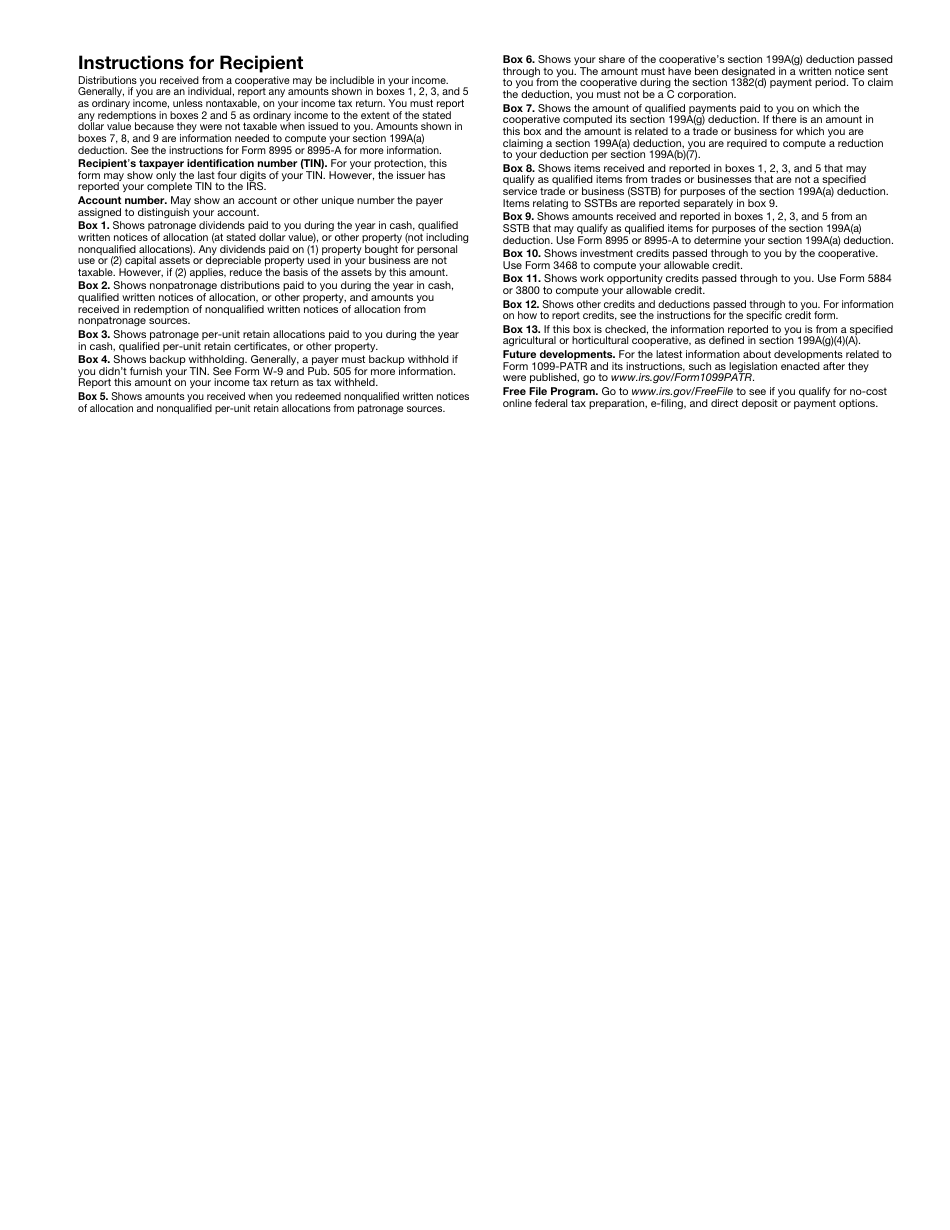

Indicate the name, mailing address, telephone number, and identification number of the payer. Identify the recipient of the distributions and add the number of their account - it is mandatory if there are numerous accounts for the recipient and you need to be specific. Note that the tax authorities advise taxpayers to assign numbers to all 1099-PATR Forms they prepare. Do not forget to state what year is described in the form.

-

Enter the total amount of patronage dividends the patron received in cash and other valuable items . If any nonpatronage sources led to earnings of your entity, this number has to be reflected in the form as well.

-

Specify how big the portion of the recipient is when it comes to distributing per-unit retain certificates, allocations, and other types of property . Outline how much tax you deducted from the patronage payments and write the amount of paid notices transformed into dividends. In case your entity operates in the field of agriculture or horticulture, record the amount of deduction the taxpayer is entitled to receive in line with the guidelines of the Tax Cuts and Jobs Act, the qualified payments, income, gain, loss, or deduction from trades they got, and the investment credit portion.

-

Indicate the work opportunity credit allocated to the recipient and other deductions they have a right to get such as a credit given to entities providing employment in economically distressed communities . Put a tick in the appropriate box if you submit the papers on behalf of the cooperative involved in producing or promoting corresponding products to further develop horticulture or agriculture. Consider retaining a copy of the instrument for the records of your business as you share the information with the tax organs and the recipient.