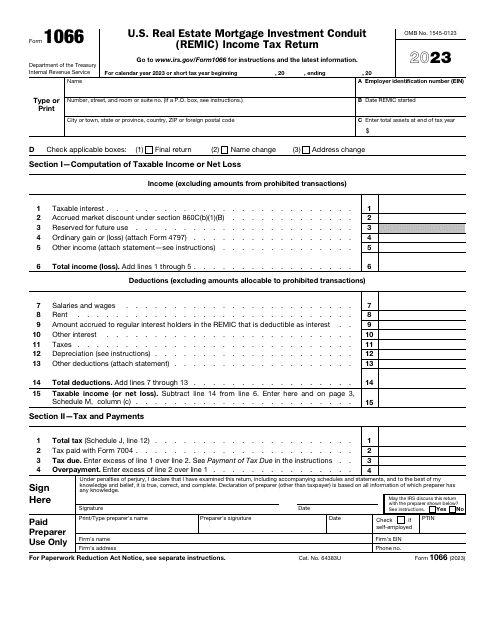

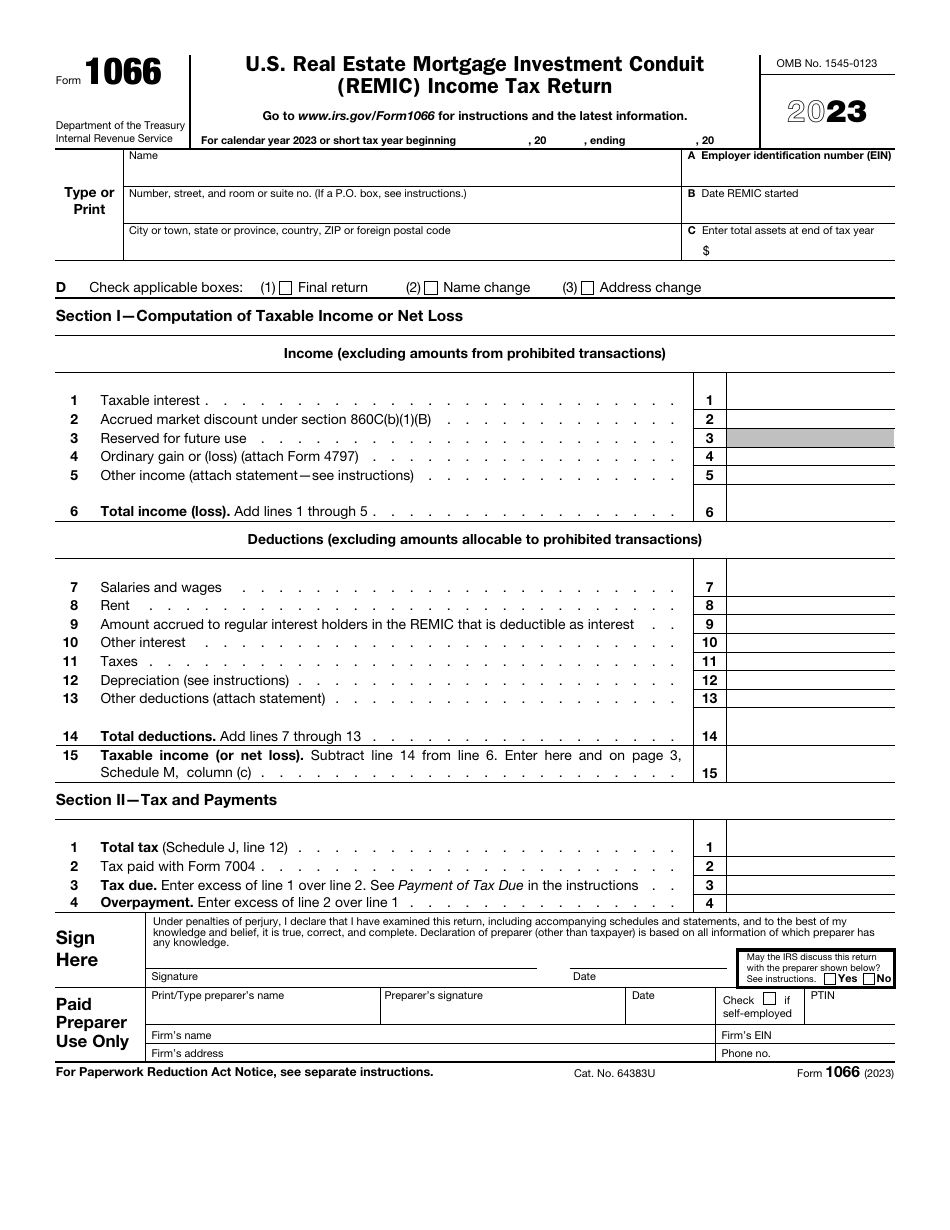

IRS Form 1066 U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

What Is IRS Form 1066?

IRS Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return , is a tax instrument used by a REMIC to inform the fiscal authorities about the details of its operation - the income they have generated, the gains and losses throughout the tax year, and the deductions lowering the amount of income that will be taxed.

Alternate Name:

- Tax Form 1066.

This form was issued by the Internal Revenue Service (IRS) in 2023 , making older editions of the form obsolete. Download an IRS Form 1066 fillable version below.

Provide information about your REMIC and specify whether you are submitting the original version of the tax return or looking to change your name or address. Figure the income you have earned, the deductions that apply in your case, and the taxable income or net loss you are reporting to the IRS.

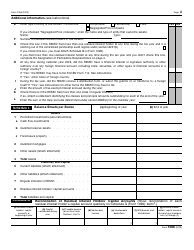

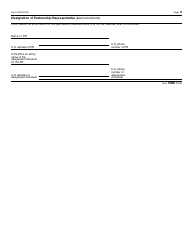

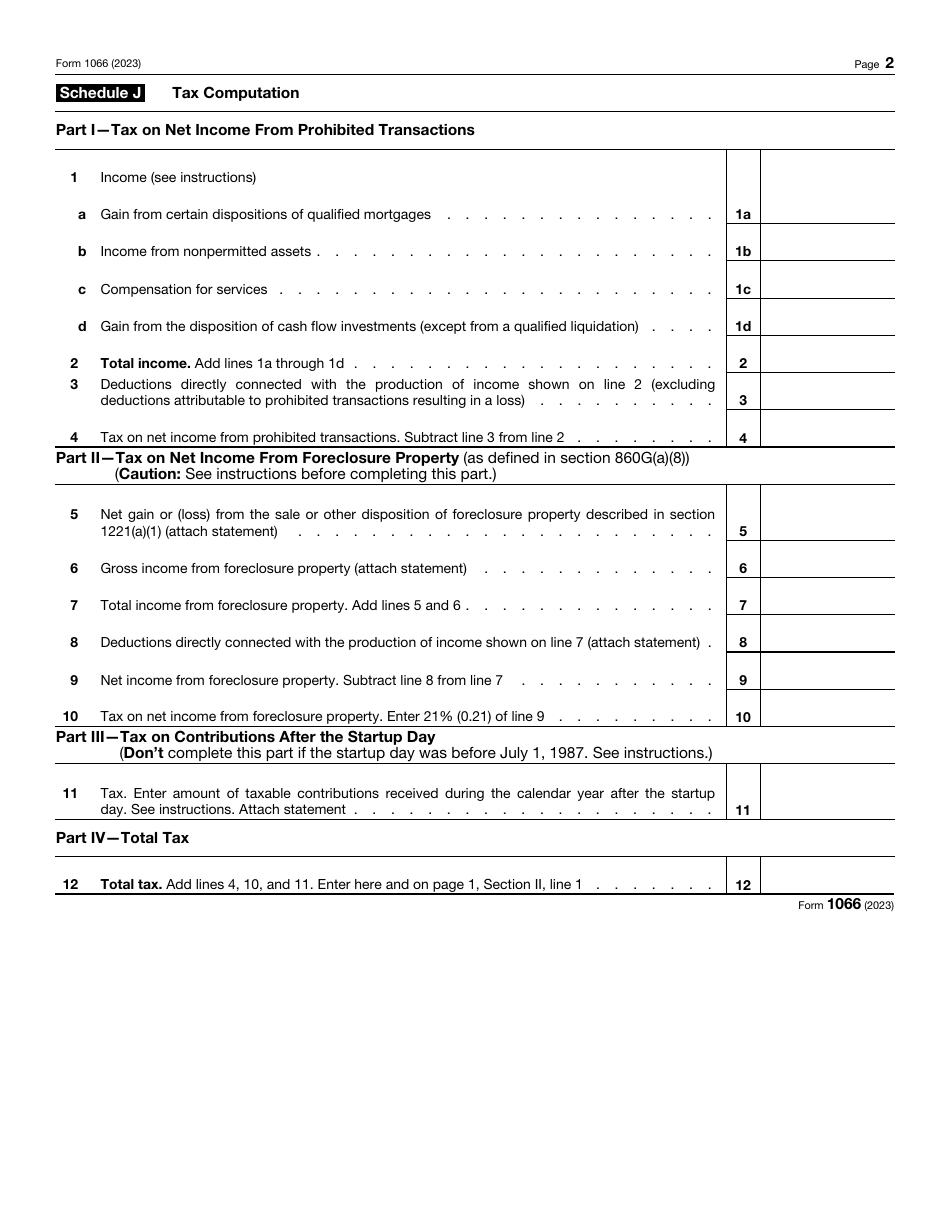

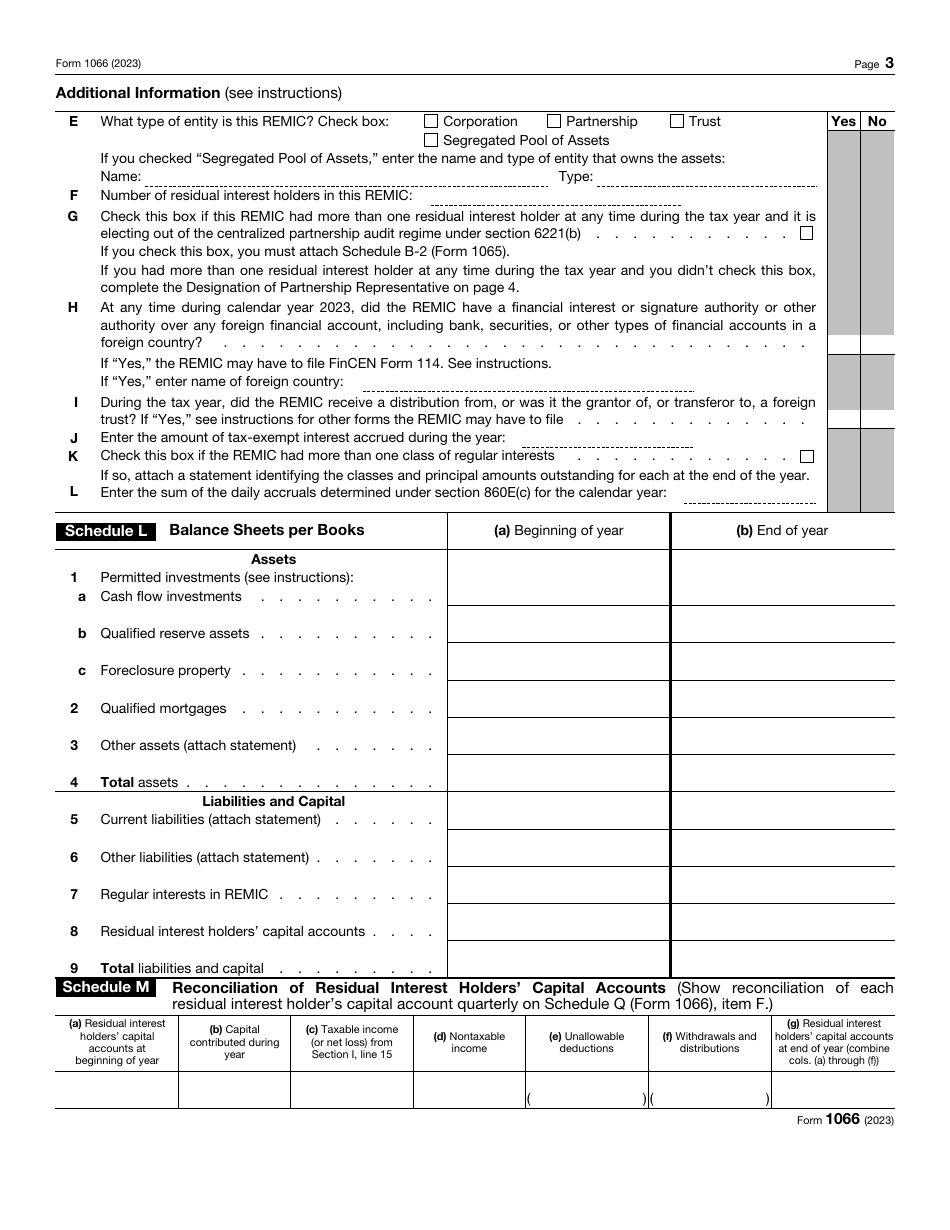

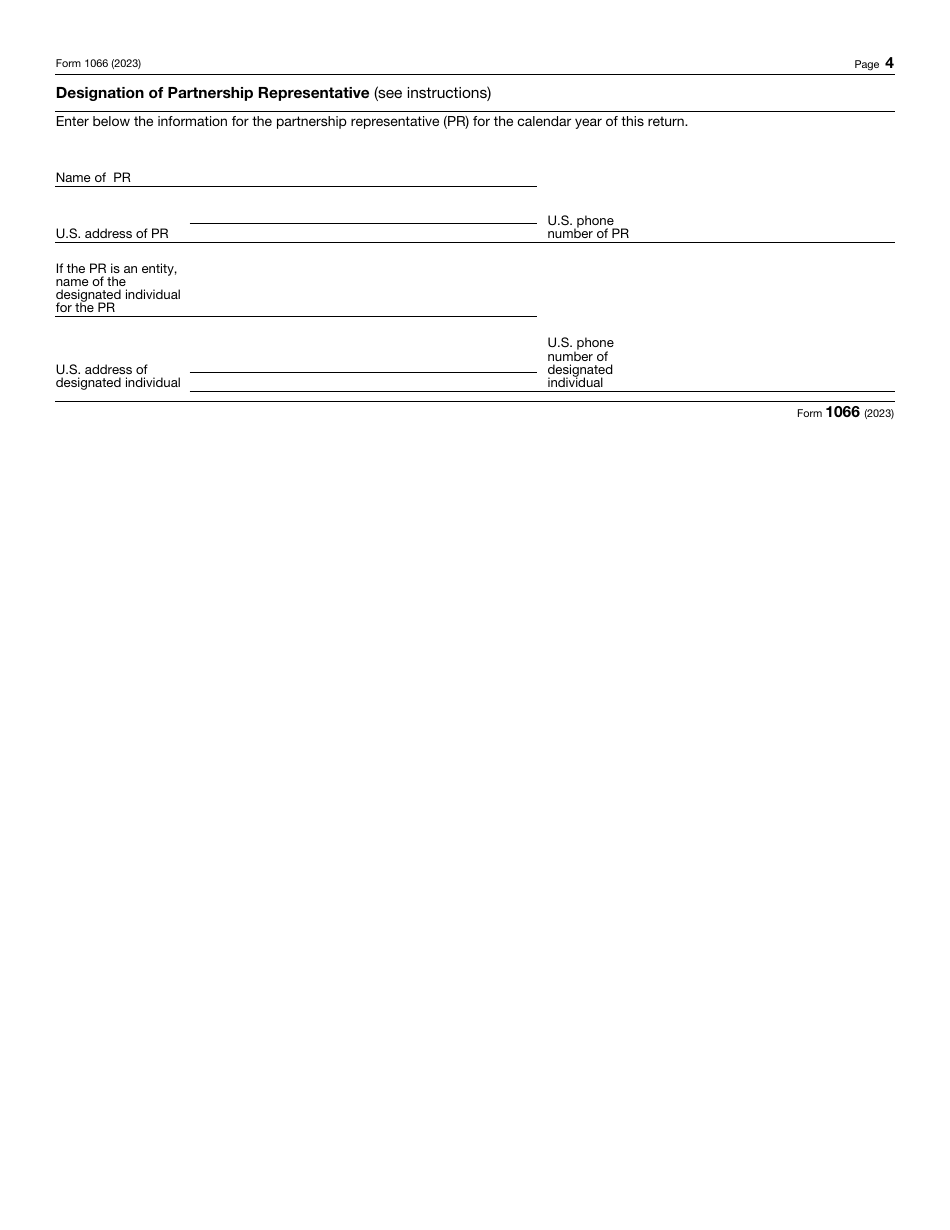

Outline the activities of the REMIC in further detail - record your type of organization, number of residual interest holders, and amount of interest exempt from taxation. It may be necessary to elaborate on your activity in foreign countries - be ready to disclose the specifics of your foreign financial accounts. Complete the schedules to compute the tax, balance the amounts with your internal records, and explain the changes to capital accounts of residual interest holders. You may also authorize a representative for your partnership - fill out the last page of the document if needed.

Check the official IRS-issued instructions before completing and submitting the form.