IRS Form W-3 Transmittal of Wage and Tax Statements

What Is IRS Form W-3?

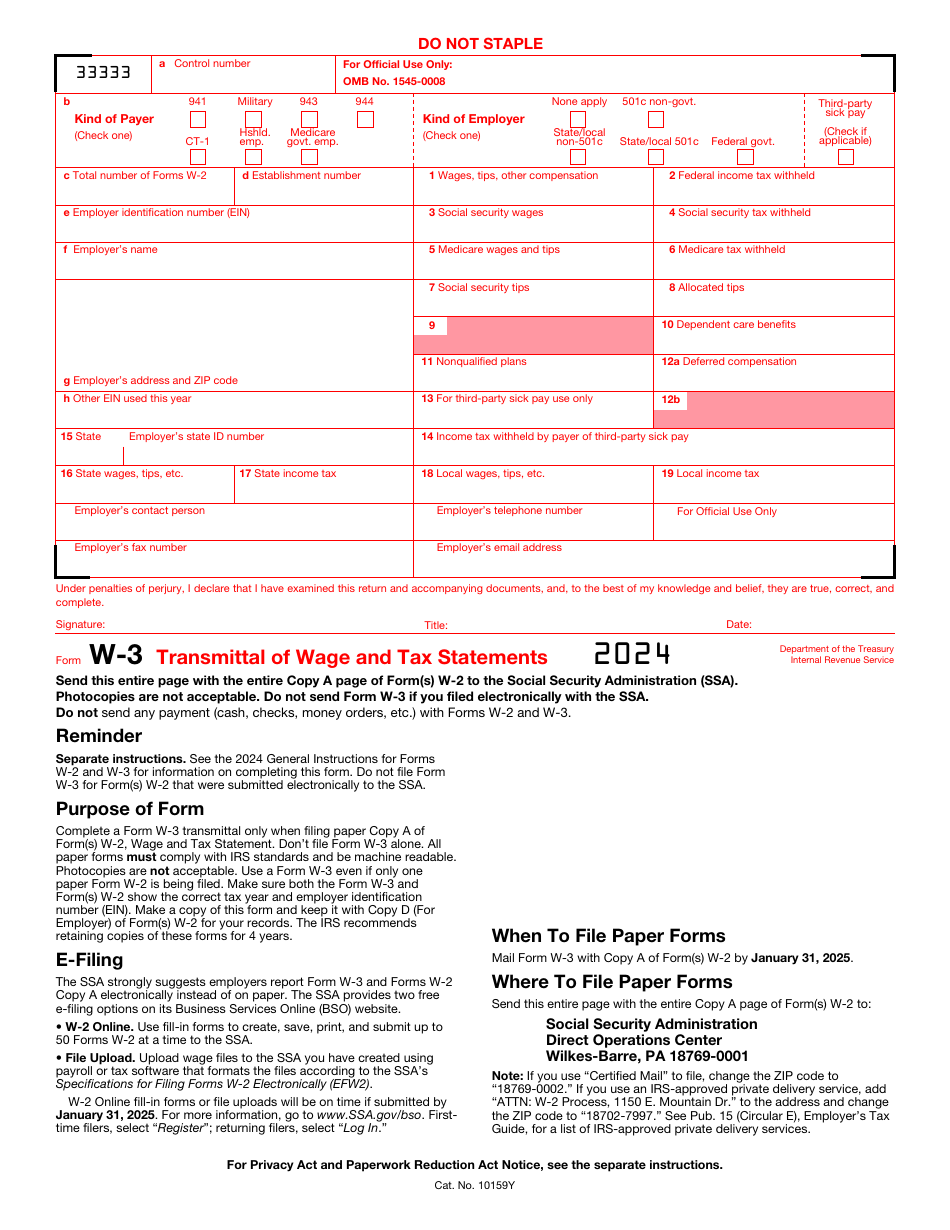

IRS Form W-3, Transmittal of Wage and Tax Statements , is a formal document used by employers to outline the details listed in IRS Form W-2, Wage and Tax Statement.

Alternate Names:

- Tax Form W-3;

- W3 Form.

If your employees earned income working for your business or trade during the previous calendar year and you deducted a certain amount of tax from their wages, you will have a responsibility to report these payments and deductions to the Social Security Administration, and Form W-3 is going to serve as a synopsis of the payments and taxes from those statements.

This form was released by the Internal Revenue Service (IRS) in 2024 - older editions of the form are now outdated. Download an IRS Form W-3 fillable version through the link below.

Check out the W-3 Series of forms to see more IRS documents in this series.

What is Form W-3 Used For?

Prepare and file the W-3 Tax Form for every IRS Form W-2 in order to report the combined calculations of taxable income and tax you report on behalf of your employees. This document will allow you to summarize information from all Forms W-2 you send to the Social Security Administration, verify the description of your business, and confirm the details of your employees are true and accurate. Even if you have only one employee for whom you file Form W-2, you must enclose Form W-3 with that statement.

While you do not have to furnish this instrument to the employee who gets all the information about their wages and taxes on Form W-2, retain a copy of the Tax Form W-3 in the records of your organization for at least four years. Likewise, employees will not need this form when they file their individual income statements - all the information that refers to their employment will be included in the Form W-2 instead.

Form W-3 Instructions

Follow these Form W-3 Instructions to inform the authorities about the combined income of your employees:

-

Write down the identification number to keep track of different forms - note that this field is optional, you may skip it. Check the box that correctly describes your filing status whether you are operating in the military industry, working in agriculture, or employing people for your own household. It is important to attach supplemental documents in accordance with the box you have checked.

-

Provide extra information about your employer status - for instance, you may have to confirm you conduct your operations with state or local governmental authority or represent an organization with a tax-exempt status. Confirm whether you are a third party that makes sick pay payments to employees.

-

Specify how many W-2 Forms you are submitting and help authorities differentiate between separate establishments in your organization if needed. List the main details of your business - its employer identification number, legal name, and correspondence address. It is possible you have filed documentation with a different identification number this year already - make sure you include them in the form. Identify the person that can be contacted so that the Social Security Administration can discuss the information put in writing with them.

-

Indicate the total amount of wages and other compensation you have paid to your employees during the year, record the amount of tax withheld, report the combined benefits and nonqualified plans, and enter the total amount of compensation you are supposed to pay at a later date.

-

In case you deducted tax on sick pay payments made by third parties, write down the amount of tax . Indicate the abbreviation of your territory or state and the identification number assigned to the location. List the total amount of wages on both state and local levels as well as the income tax from all W-2 Forms you submit. Certify the paperwork by adding your title, recording the date, and signing the form.

Where to Mail Form W-3?

Taxpayers are advised to opt for electronic filing - some of them are required to submit the information this way if they are sending more than 250 copies of the W-2 Form accompanied by the W-3 Form. However, it is still possible to file the documentation the traditional way - the mailing address is Social Security Administration, Direct Operations Center, Wilkes-Barre, PA 18769-0001 . The zip code changes if it is more convenient for you to use certified mail - 18769-0002 instead of 18769-0001. No matter what filing method you choose, you will be obliged to send the W-3 Tax Form by January 31 of the year that follows the year described in the document.

IRS W-3 Related Forms:

- Form W-3SS, Transmittal of Wage and Tax Statements, which is a form that must be filed with the SSA by anyone who is required to transmit a paper Copy A of forms W-2AS, W-2CM, W-2GU, and W-2VI to the SSA;

- Form W-3C, Transmittal of Corrected Wage and Tax Statements, a form used for transmitting Copy A of Form W-2C, Corrected Wage and Tax Statements. The latter is filed to correct errors on forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, and W‑2C that were filed with the SSA.