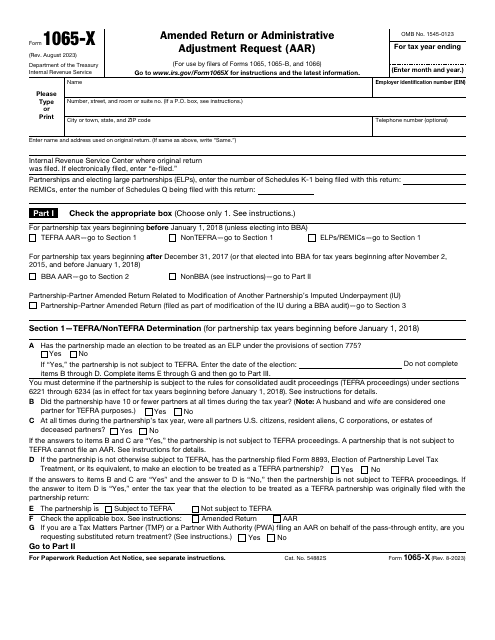

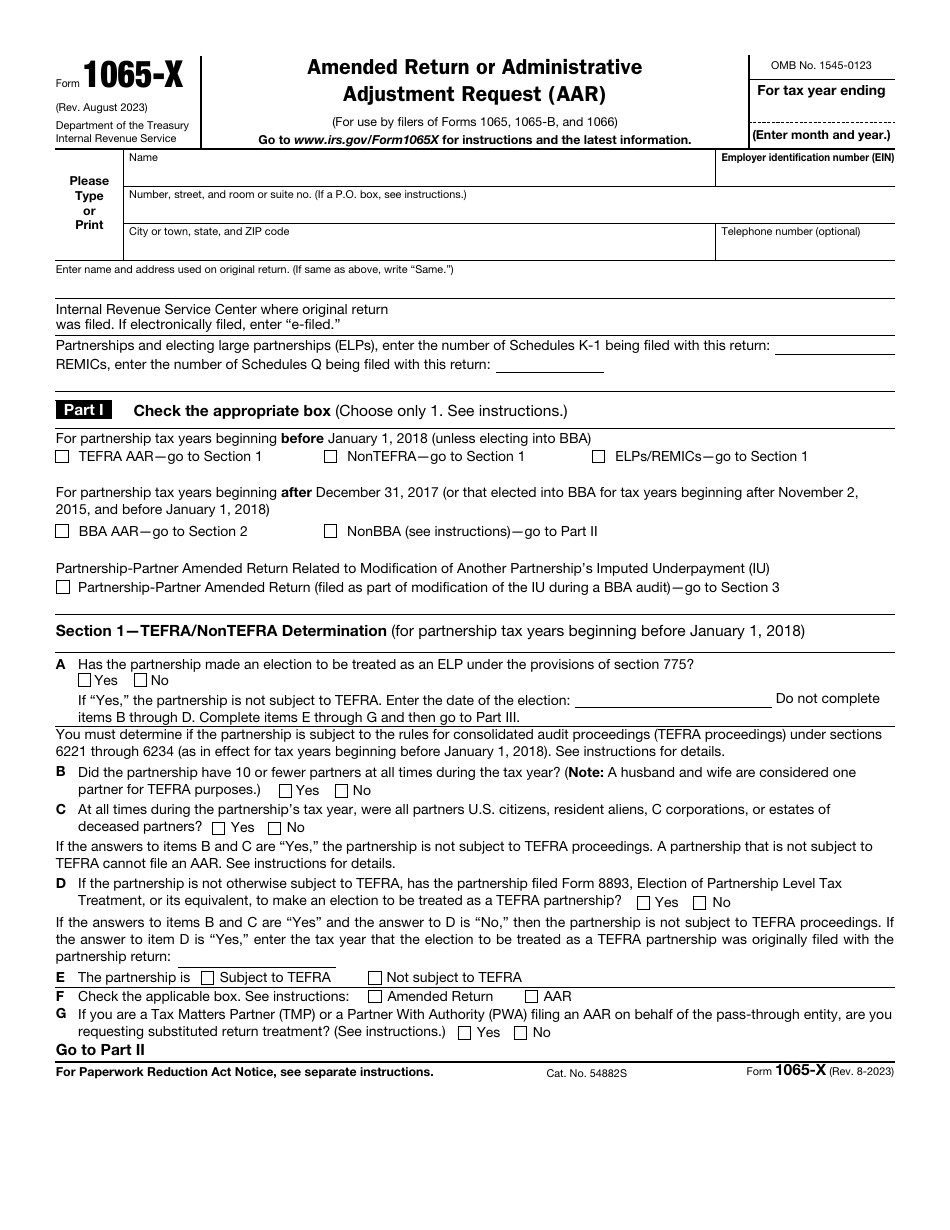

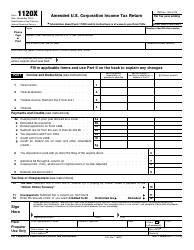

IRS Form 1065-X Amended Return or Administrative Adjustment Request (AAR)

What Is IRS Form 1065-X?

IRS Form 1065-X, Amended Return or Administrative Adjustment Request (AAR) , is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in the documentation they submitted previously.

Alternate Name:

- Tax Form 1065-X.

If you noticed a mistake on Form 1065, U.S. Return of Partnership Income, Form 1065-B, U.S. Return of Income for Electing Large Partnerships, or Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, you have an opportunity to correct the information you have included in writing. Additionally, you can complete this form to make an administrative adjustment request and modify non-income items related to the partnership.

This document was issued by the Internal Revenue Service (IRS) on August 1, 2023 , rendering older editions of the form obsolete. Download an IRS Form 1065-X fillable version below.

Check out the 1065 Series of forms to see more IRS documents in this series.

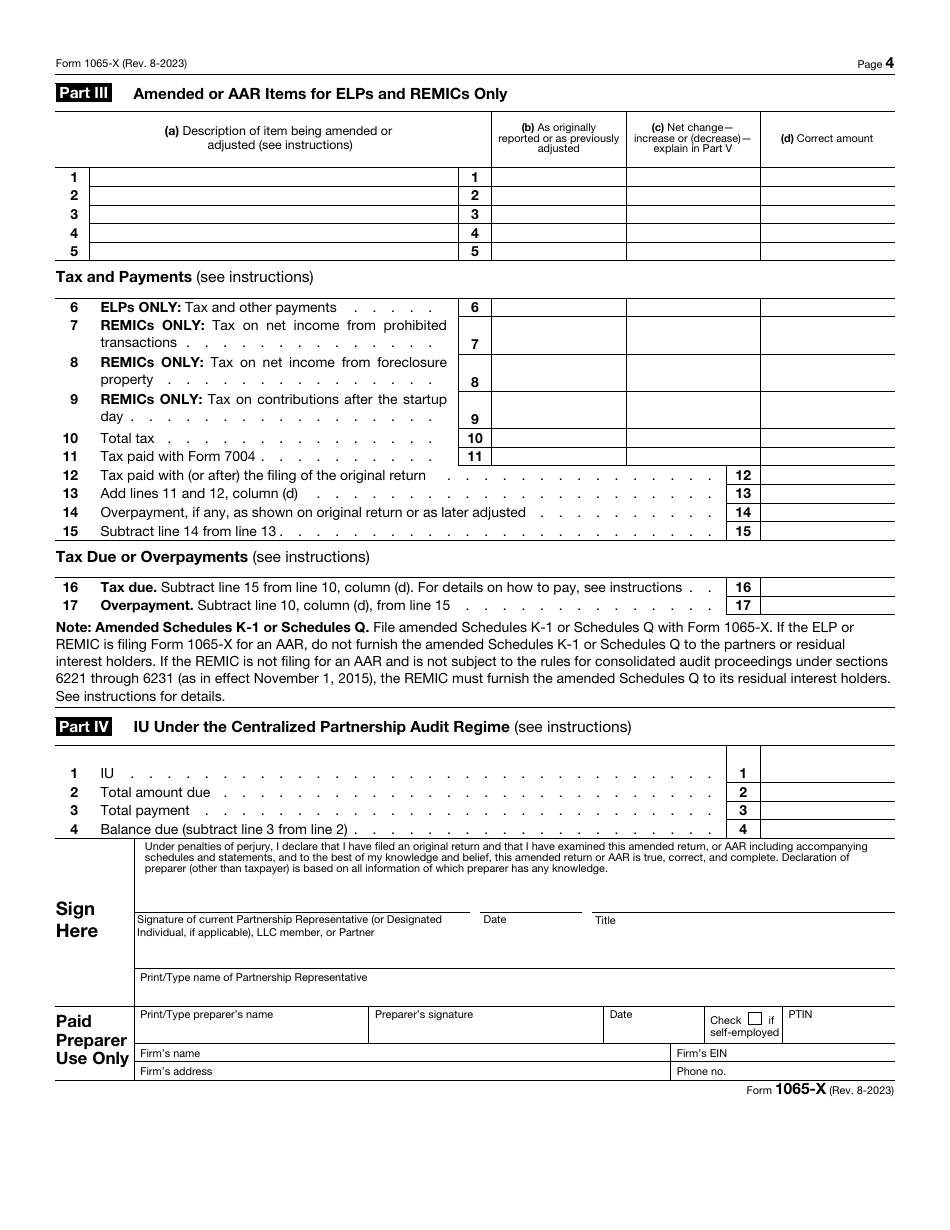

Form 1065-X Instructions

Follow these Form 1065-X Instructions to report the amended information to tax authorities:

-

State the tax period covered in the original return, identify your entity by its name, employer identification number, address, and telephone number, and list the business details you have written down on the return that requires corrections . State where the form was submitted and how many schedules were attached to the return in question. Check the box that specifies your partnership status and use the guidelines in the form to understand what sections of the form you have to complete.

-

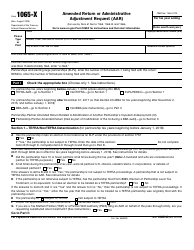

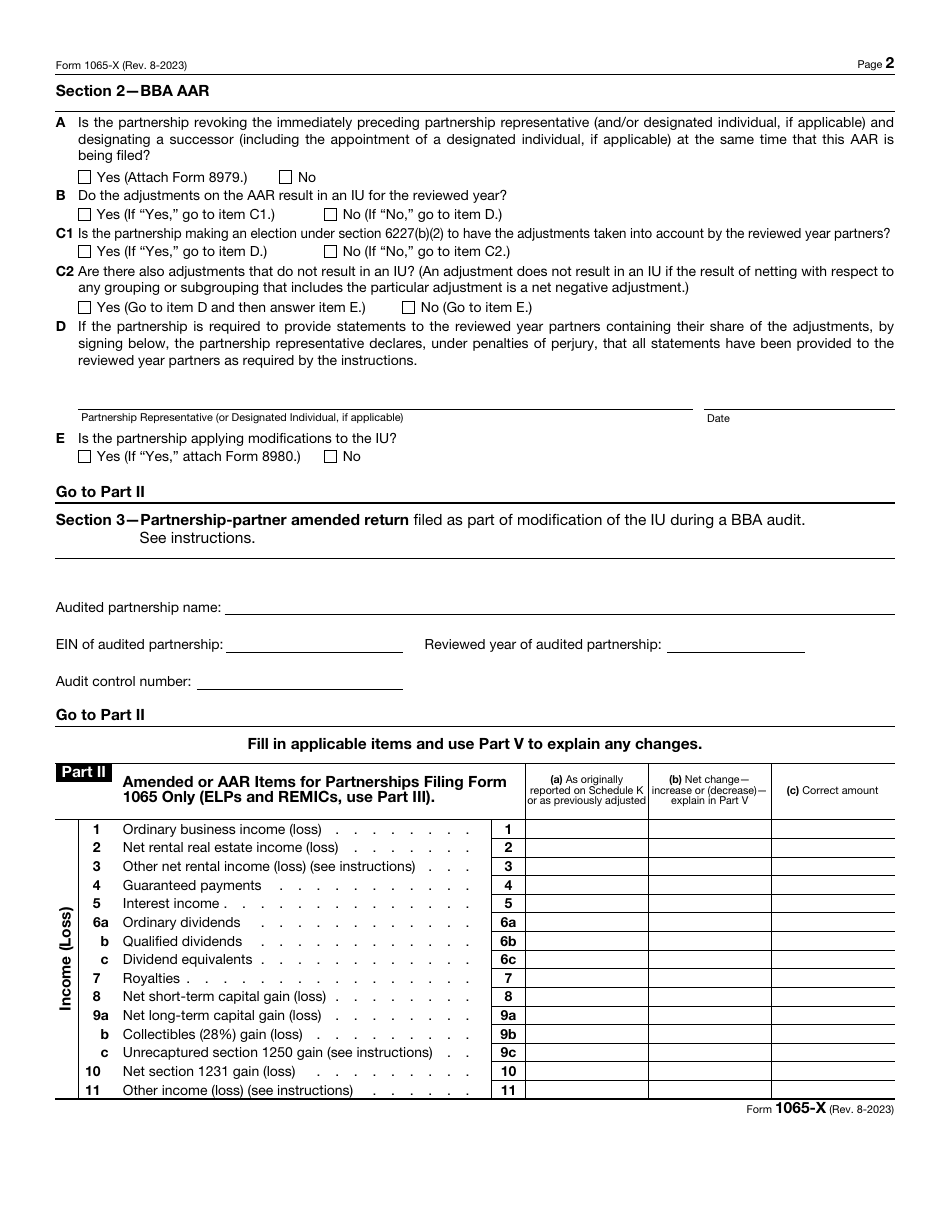

Read the requirements listed in the document and determine whether you are subject to those rules - you will need to elaborate on the number of partners, their citizenship status, and documentation you may have filed in the past to change the status of your organization and be treated in accordance with specific proceedings. Confirm whether you are able to file a request for administrative adjustment. Enter the details of your partnership if it was audited and record the details of the audit.

-

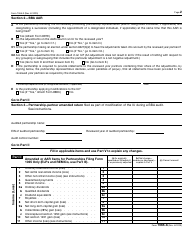

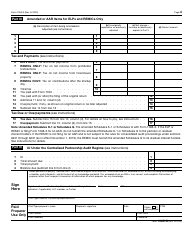

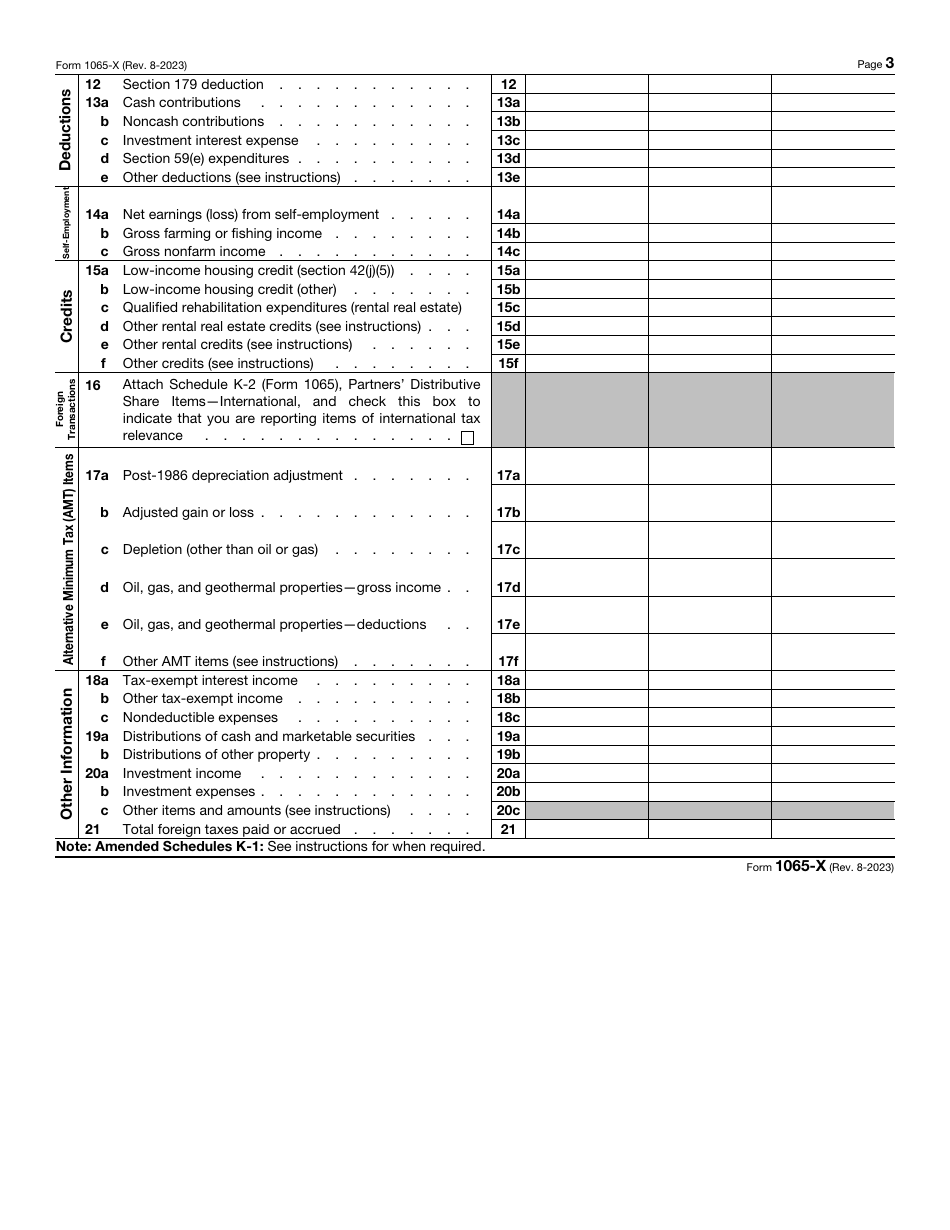

Proceed to the list of amounts you have reported on the return you are amending . You can skip the fields that do not need to be corrected or do not apply to your partnership or mortgage entity. Otherwise, indicate the wrong amount first, specify whether it increased or decreased, and write down the amount for the IRS to take into consideration.

-

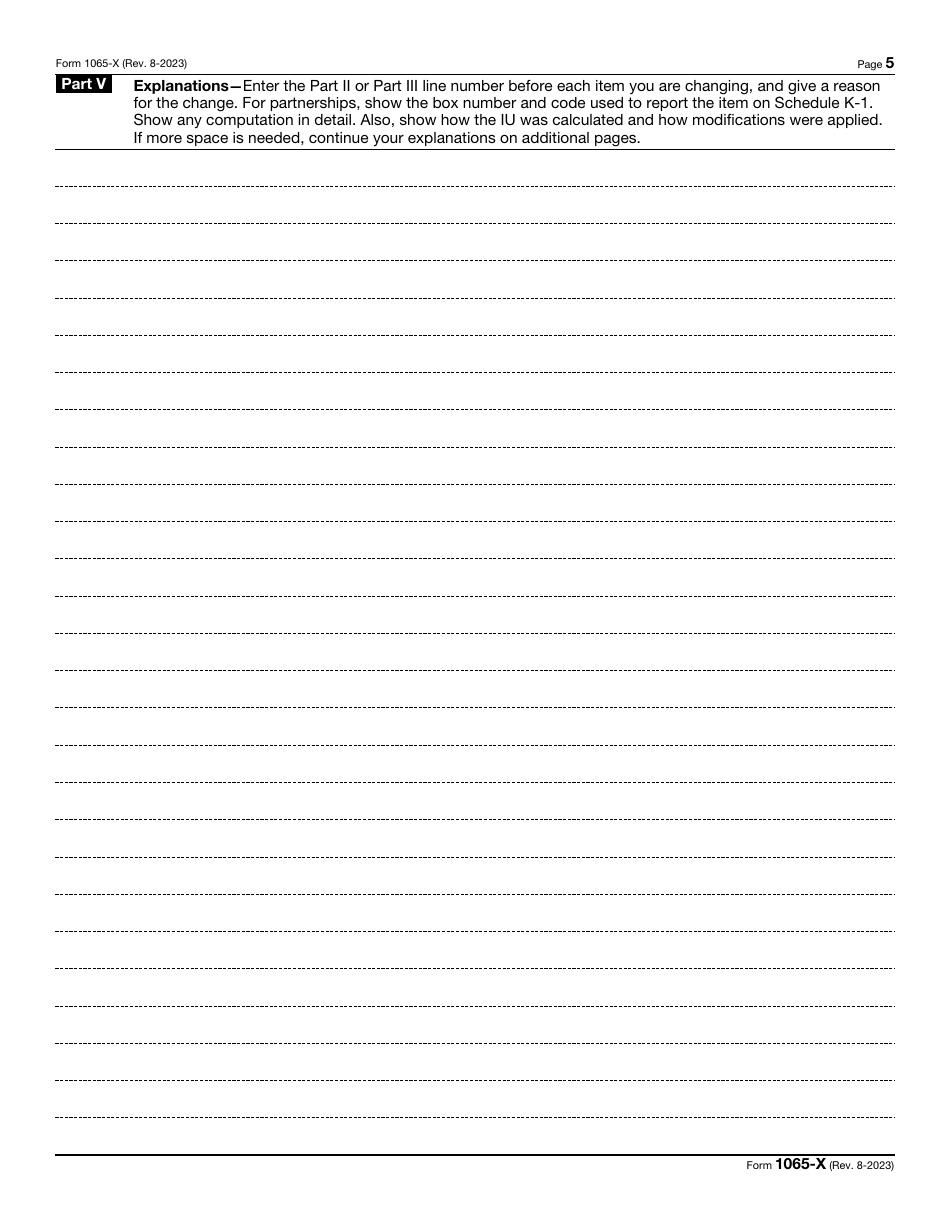

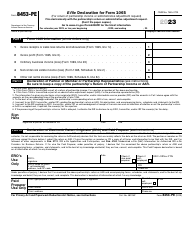

Certify the document by signing it and adding your name, title, and actual date . Only an authorized representative of the entity can sign the form. If you hired a tax preparer, they need to identify themselves as well. Use the last page of the form to elaborate on the changes you have made to the return showing the calculations in detail.

-

File the paperwork within three years of the date the partnership return was submitted or the due date for that instrument . Form 1065-X mailing address is the same one you used when sending the documentation for the first time.

-

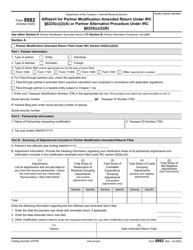

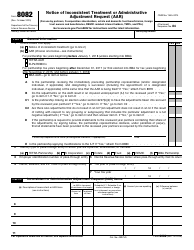

If the AAR or amended return must be filed electronically or you choose to file it electronically, you need to use IRS Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR).