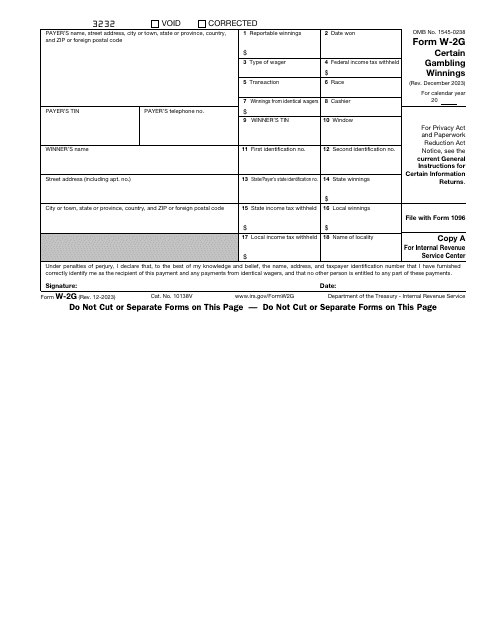

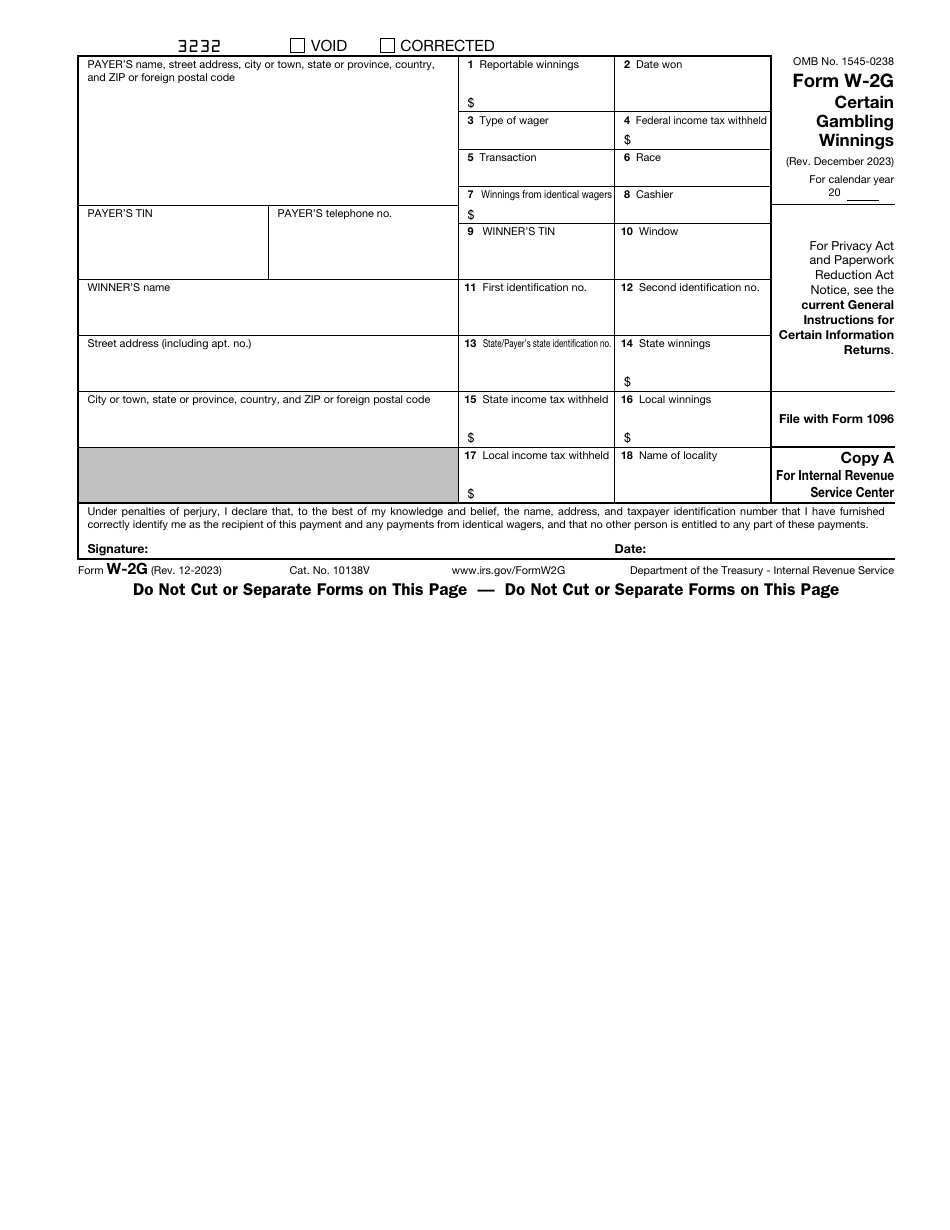

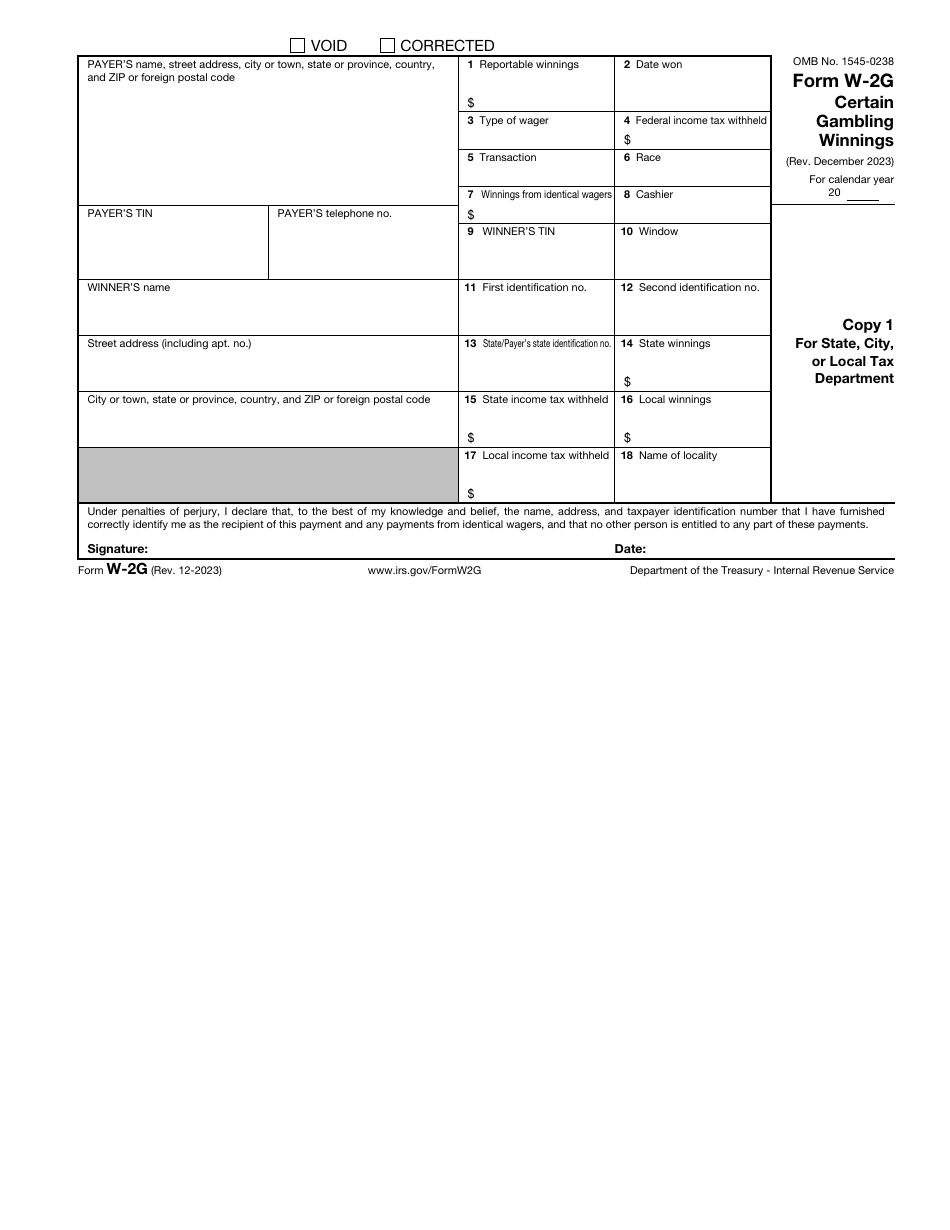

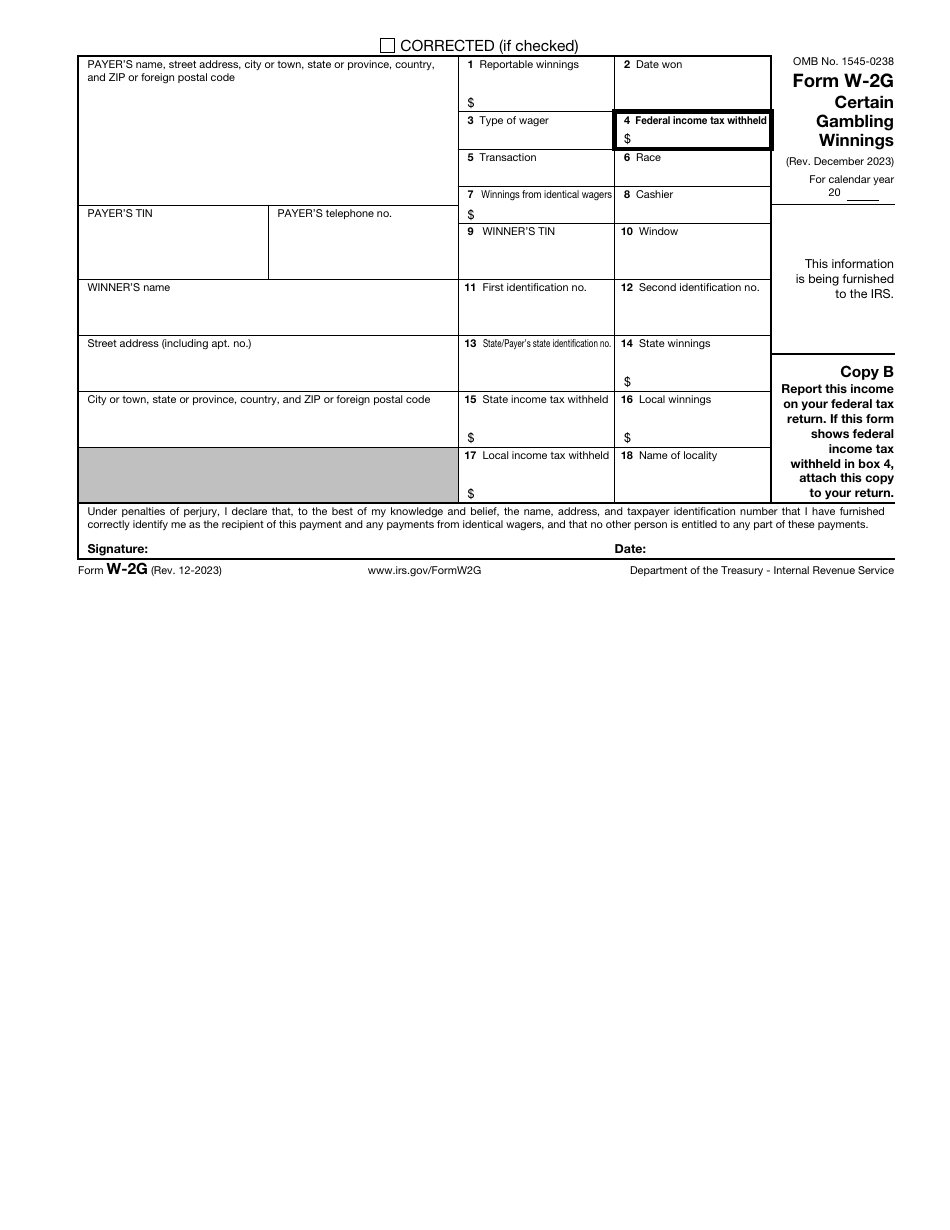

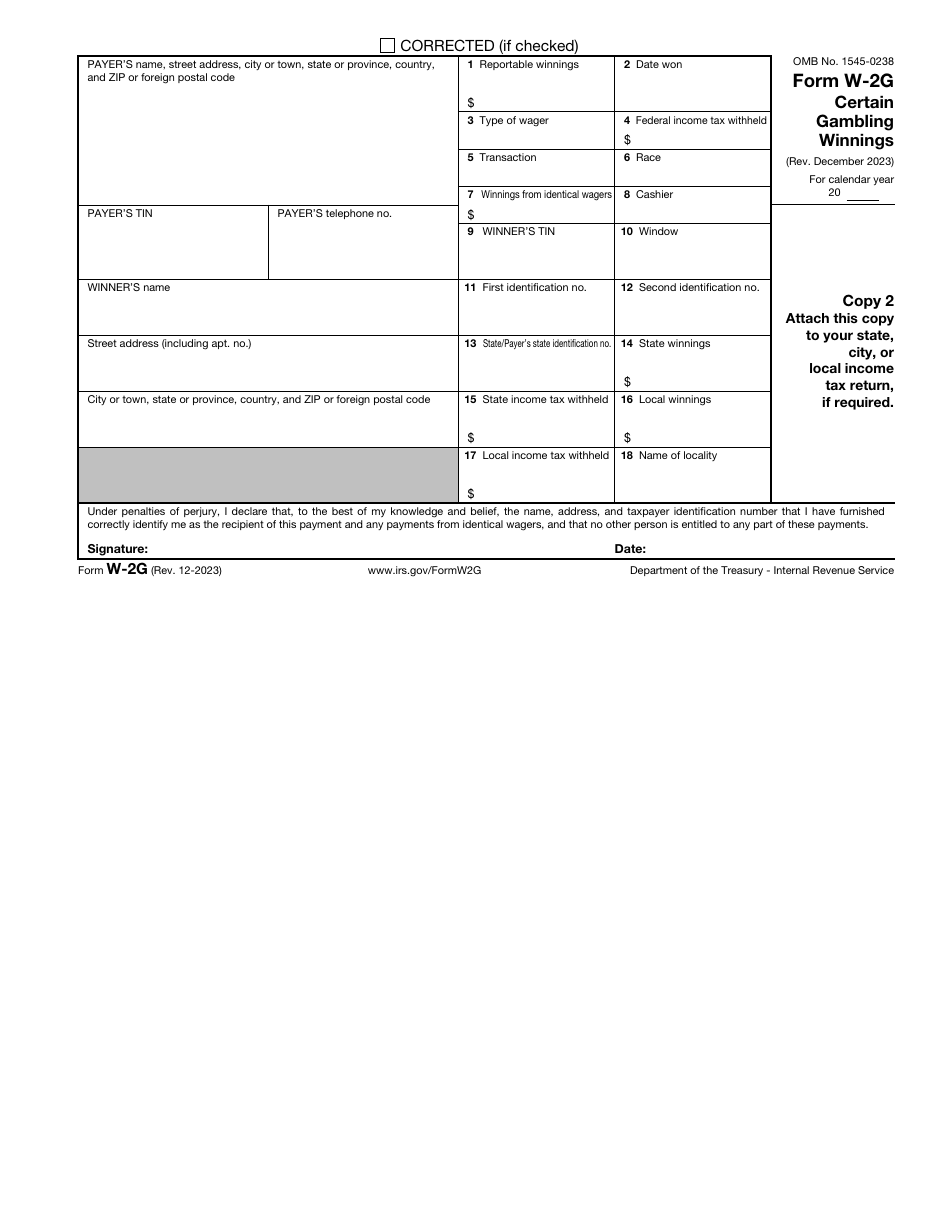

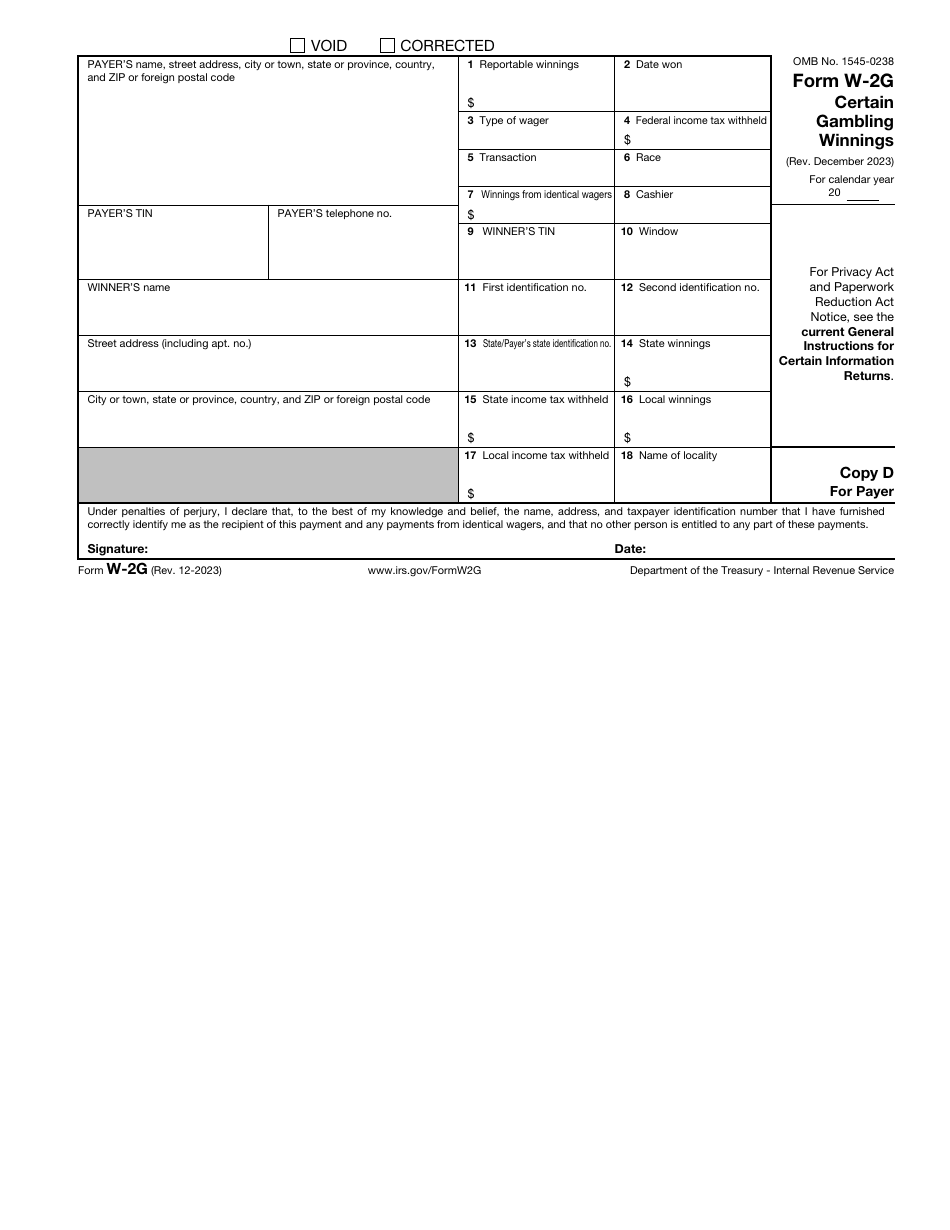

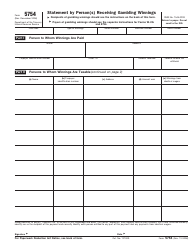

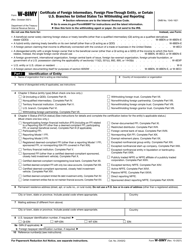

IRS Form W-2G Certain Gambling Winnings

What Is IRS Form W-2G?

IRS Form W-2G, Certain Gambling Winnings , is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

Alternate Name:

- Tax Form W-2G.

Both the party that carried out the payment and the recipient of the winnings are obliged to inform the government about this - use the instrument to clarify how much money was paid, when the individual won the money, and how many identical bets you have handled at the same time. Even if tax is deducted already, the winner may need to pay more to fiscal authorities depending on their financial status which is why it is important to supply them with a copy of Form W-2G without delay.

This document was released by the Internal Revenue Service (IRS) on December 1, 2023 , rendering previous editions of the form outdated. You may download an IRS Form W-2G fillable version below.

Check the IRS W-2 Series Forms to see more IRS documents in this series.

What Is Form W-2G Used For?

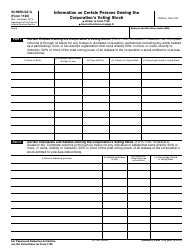

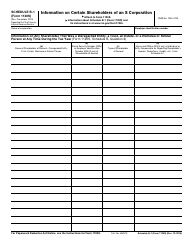

Prepare IRS Form W-2G to inform the IRS about gambling winnings and the taxes you already deducted from them for every individual that succeeded in various gambling activities. This form is completed by gambling establishments no matter what sort of gambling they facilitate - from horse races to slot machines.

Since all gambling winnings are subject to taxation, the duty of the organization is to let fiscal authorities know about the amount of money a certain individual won in a particular event and send the same information to the winner so that the latter is able to fill out their own tax documentation correctly. Describe the winnings and the taxes paid if the payments met established thresholds - for example, it is mandatory to file the form if the individual won $1,200 or more playing bingo.

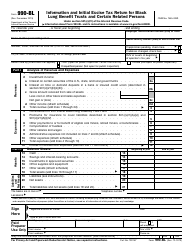

Form W-2G Instructions

The IRS Form W-2G Instructions are as follows:

-

Check the box to confirm you are filing a modified version of the form if you sent a copy of the document previously yet discovered a mistake later . Identify the payer by their name, taxpayer identification number, and contact details. List the name and address of the winner. Specify the year the form is filed for.

-

Record the accurate amount of winnings you are reporting and enter the date when the event that led to the victory took place . Ensure the document states the right date - it cannot be the date when the winner received the money if the event happened earlier.

-

Indicate the category of bet in question . Elaborate how much federal income tax has already been deducted from the winnings and name the game or race that applies to the winning tool. List the total amount of extra winnings from bets that were the same and identify the employee that handled the payment.

-

Write down the taxpayer identification number of the winner . If you do not have this information, you will have to use the backup withholding rate which means 24% of the winnings will be deducted from the total amount. Confirm the identity of the winner by listing the details from their documentation - for instance, their social security card or driver's license.

-

Fill out the rest of the fields if you need to - these are added for the filer's convenience . You may record the abbreviation of your state and its identification number, list the amount of state and local winnings, identify your locality, and indicate how much tax was paid overall.

-

Once the document is filled out, sign and date the papers . You have to send two copies of the form to the individual that won and submit a copy of the form to the IRS. Note that you are obliged to prepare IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, if you opt for paper returns; make sure both instruments are filed by February 28 of the year that follows the year described in the form. In case e-filing is more convenient for you, you will get extra time to complete the documentation - submit W-2G Tax Form by April 1.

IRS W-2G Related Forms:

- IRS Form W-2, Wage and Tax Statement. Complete this form if you are an employer with one or more employees and have paid them more than $600 in wages;

- IRS Form W-2C, Corrected Wage and Tax Statements. File this document to make amendments to the IRS Forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, or W-2C already filed with the SSA;

- IRS Form W-2AS, American Samoa Wage and Tax Statement. Submit this version of the W-2 form to report American Samoa wages and withheld taxes;

- IRS Form W-2GU, Guam Wage and Tax Statement. Fill out this document to provide information about Guam salaries and taxes deducted from these salaries;

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement. Use this form to inform your employees and the appropriate authorities about the United States Virgin Islands wages and withheld taxes.