Home Office Tax Deduction: Filing Taxes for a Home-Based Business

Small-business owners and entrepreneurs working from home may obtain a home office tax deduction. You are able to save money on your taxes if you meet the Internal Revenue Service (IRS) requirements and keep accurate accounting records. You may get a refund for rent, utilities, real property taxes, repairs, cleaning, maintenance, and other related costs in the case you use part of your home for business activities exclusively and regularly, meaning children and guests do not use this room.

How to Calculate a Home Office Tax Deduction?

If you qualify for a home office tax deduction you may either use a simplified or a regular method to claim it. If you use the regular method, it is possible to deduct the costs that you paid for your home: part of the rent or mortgage interest, maintenance and repairs, insurance, taxes, utilities, and other expenses. The amount you can deduct usually depends on the percentage of your home used for business. To calculate the tax deduction for a home office, measure the square footage of the home office plus all of the related business areas such as storage, halls, and bathrooms and find out what percentage of the total area of your home they occupy. You are eligible to deduct expenses on the amount of interest depending on the area of your home used for business purposes.

How to Claim a Home Office Tax Deduction?

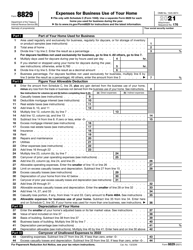

If you choose the regular method, use Form 8829, Expenses for Business Use of Your Home, provided by the IRS, to figure the expenses you can deduct.

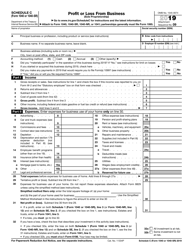

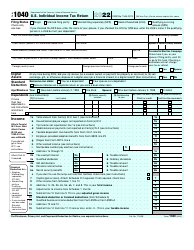

You can also claim your deduction through form Schedule C, Profit or Loss From Business. It is part of the individual income tax return (Form 1040) that's used to report the income of the at-home business for the tax year, as well as deductible expenses.

To complete both Form 8829 and Schedule C, you need to keep accurate records and be ready to enter the following information:

- Your income and losses;

- All kinds of expenses you incurred;

- Your net income.

You may use the simplified option when the square footage of your space is multiplied by the prescribed rate. The rate is $5 per square foot with a maximum of 300 square feet.

Other Home Office Deductions

Here are some more options to get your home office deduction.

Tax Cuts and Jobs Act (TCJA) 20 Percent Deduction for Small Businesses

Partnerships, sole proprietorships, single-member companies with limited liability, and S corporations are eligible to receive a 20% deduction of net income.

This tax break is for small entrepreneurs whose income is transited to their own individual Form 1040 from Schedule C and other tax forms.

Office Supplies, Furniture, and Equipment

You can deduct business supplies you buy so it is important to keep the receipts to offset your taxable business income. Business owners who buy office furniture and equipment can deduct purchase costs of up to $1 million under Section 179 . The exemption also lets business owners deduct the full purchase price of qualified equipment from their gross income with such things as vehicles, machinery, roofs, heating, ventilation and air-conditioning property, fire protection, alarm systems, and security systems.

Travel, Mileage, and Meals

If you use a car for your private business, it also allows you to claim some tax deductions. Make notes on the date, mileage, tolls, parking costs, and the purpose of your trip; include gas, repairs and insurance, payments for car leasing, loans, and depreciation expenses on your vehicle.

Furthermore, meals, lodging, and company cars used for business purposes, are also tax-deductible.

Want to learn more? Check out these related posts: