2020 Business Tax Deadlines: When Are Business Taxes Due?

What Is Business Tax?

Business taxes are the taxes on a business’s income. There are five kinds of business taxes:

- Employment (Withholding) Tax;

- Value-Added Tax (VAT);

- Gross-Receipts Tax;

- Corporate Franchise Tax;

- Excise Tax.

Depending on the type of business you have there are different forms that are needed to be filed in order to pay the taxes that are owed. In general, it is expected for businesses and employees alike to pay their taxes as they receive income over the course of the year. If an employee doesn’t have their tax withheld from their pay, an estimated tax must be paid, if that is not the case then you may pay tax when a tax return is filed. Every business except for partnerships must file an annual tax return on their income. Partnerships must file an information return.

When Are Business Taxes Due?

The filing dates and forms below are sorted by month and quarter. You may click on the forms you need to find out more about specific details and any applicable filing penalties set by the IRS.

First Quarter Tax Payments - January, February, and March

|

January 31st, 2020 |

○ Form 1099-MISC, Miscellaneous Income (Box 7); ○ Form 1099-A, Acquisition or Abandonment of Secured Property; ○ Form 1099-C, Cancellation of Debt; ○ Form 1099-DIV, Dividends and Distributions; ○ Form 1099-G, Certain Government Payments; ○ Form 1099-INT, Interest Income; ○ Form 1099-K, Payment Card and Third Party Network Transactions; ○ Form 1099-PATR, Taxable Distributions Received From Cooperatives; ○ Form 1099-OID, Original Issue Discount. Use Form 1096, Annual Summary and Transmittal of U.S. Information Returns, as a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, and W-2G to the IRS. The due date for giving the recipient these forms remains January 31. If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form. |

|

February 10th, 2020 |

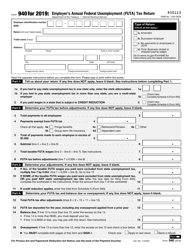

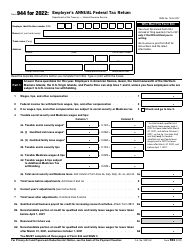

Final date to submit Form 940 and Form 941 (if all previous payments have been made). |

|

February 15th, 2020 |

|

|

February 28th, 2020 |

○ Form 1097-BTC, Bond Tax Credit; ○ Form 1098, Mortgage Interest Statement; ○ Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes; ○ Form 3921, Exercise of an Incentive Stock Option Under Section 422(b); ○ Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c); ○ Form 1098-T, Tuition Statement; ○ Form W-2G, Certain Gambling Winnings. Use Form 1096, Annual Summary and Transmittal of U.S. Information Returns, to transmit paper Forms 1097, 1098, 1099, 3921, 3922, and W-2G to the Internal Revenue Service. Do not use this form if you plan to transmit electronically. |

|

March 15th, 2020 |

○ Form 1065, U.S. Return of Partnership Income (for Partnerships); ○ Form 1120-S, U.S. Income Tax Return for an S Corporation (for S Corporations); ○ Form 1065-B, U.S. Return of Income for Electing Large Partnerships (for Electing Large Partnerships); ○ Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return (for Real Estate Mortgage Investment Conduits). Form 1065X, Amended Return or Administrative Adjustment Request (AAR) may be filed to correct information on a previously filed Form 1065, Form 1065-B, or Form 1066. Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, is used to request an automatic 6-month extension of time to file any of the returns above, shifting the date to September 15th, 2020. |

|

March 16th, 2020 |

E-filing and paper filing due date for Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, and Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. |

|

March 31st, 2020 |

○ Form 1097-BTC, Bond Tax Credit; ○ Form 1098, Mortgage Interest Statement; ○ Form 3921, Exercise of an Incentive Stock Option Under Section 422(b); ○ Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c); |

Second Quarter Tax Payments - April, May, and June

|

April 1st, 2020 |

Due date to e-file Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. |

|

April 15th, 2020 |

○ Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation; ○ Form 1120-H, U.S. Income Tax Return for Homeowners Associations; ○ Form 1120-L, U.S. Life Insurance Company Income Tax Return; ○ Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons; ○ Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. |

|

May 15th, 2020 |

○ Form 990-N, Electronic Notice (E-Postcard), is filed by organizations with gross receipts of $50,000 or less; ○ Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, is filed by companies with a gross receipt lower than $200,000 and total assets exceeding $500,000. |

|

June 1st, 2020 |

Due date to file Form 5498, IRA Contribution Information. |

|

June 15th, 2020 |

|

Third Quarter - July, August, and September

|

July 31st, 2020 |

File Form 941, Employer's Quarterly Federal Tax Return, if you have made all of the required payments in full by the due dates, you have 10 more days to submit this form (by August 10). |

|

August 10th, 2020 |

Final date to submit Form 941, Employer's Quarterly Federal Tax Return, as long as all of the previous payments have been made. |

|

September 15th, 2020 |

○ File a 2019 calendar year return (Form 1065, Form 1065-B, or Form 1066). This due date applies only if you timely requested an automatic 6-month extension. ○ S Corporations need to file a 2019 calendar year income tax return (Form 1120-S) and pay any tax, interest, and penalties due. This due date applies only if you timely requested an automatic 6-month extension of time to file the return. This is also the extended deadline for filing FinCEN Form 114, Foreign Bank and Financial Accounts Report. |

|

September 30th, 2020 |

This is the extended deadline to report all income, gains, losses, deductions, and credits from the operation of a trust or an estate via Form 1041. |

Fourth Quarter - October, November, and December

|

October 15th, 2020 |

Corporations must file a 2019 calendar year income tax return (Form 1120) and pay any tax, interest, and penalties due. This due date applies only if you timely requested an automatic 6-month extension. |

|

November 16th, 2020 |

This is an extended deadline given to nonprofit organizations to file any form of the Form 990 Series. |

|

December 16, 2019 |

Corporations must estimate their fourth and final installment of estimated income tax for 2020. The amounts are estimated via Form 1120-W. |

2020 Employer's Tax Guide

As an employer, it’s important to understand if the people that work at your business are your employees or self-employed. This can have an impact on any deductions or payments that you are legally required to make. Creating a structured tax calendar can help you to understand your tax responsibilities for any applicable tax returns using our tax deadline schedule for employers.