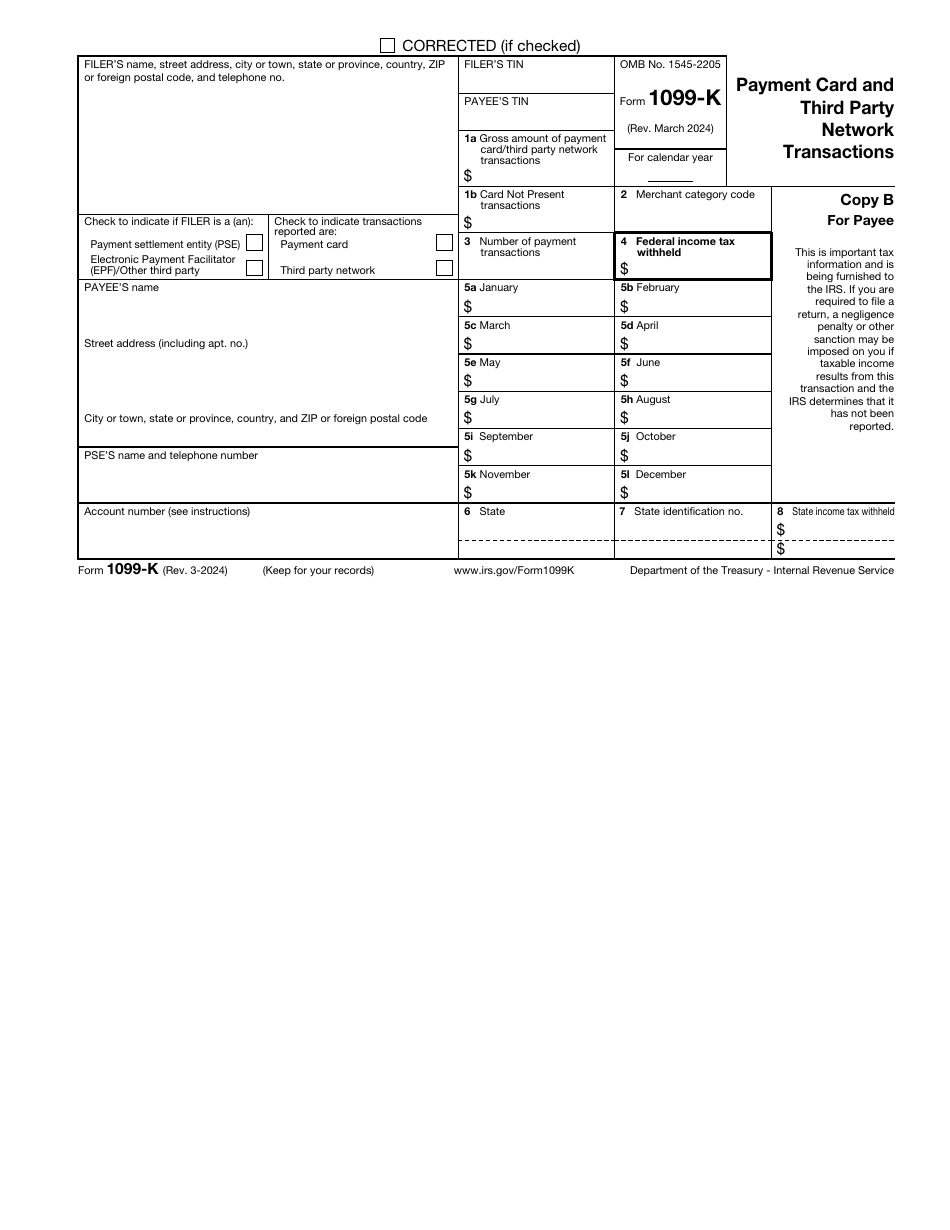

IRS Form 1099-K Payment Card and Third Party Network Transactions

What Is IRS Form 1099-K?

IRS Form 1099-K, Payment Card and Third Party Network Transactions , is a formal document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

Alternate Name:

- Tax Form 1099-K.

This form is becoming rather common since many online apps and platforms carry out financial operations through credit cards or transactions made through popular payment processors. At the end of every tax year, the business you manage is expected to report all these electronic transactions so that you do not hide your income from the authorities.

This statement was released by the Internal Revenue Service (IRS) on March 1, 2024 , rendering older editions obsolete. Download an IRS Form 1099-K fillable version below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is a 1099-K Form Used For?

1099-K Tax Form must be completed and submitted by businesses that receive multiple payments via credit cards, services designed to handle online payments, and platforms created to deal with customer payments on behalf of various organizations. You will receive a request to fill out this form only if the volume of transactions crossed the threshold prescribed by the government; nevertheless, if you think there is a chance you fit the criteria yet the form has not arrived, contact the bank or third party processor and ask for a copy to ensure your records are in order.

Remember that all transactions that may seem like they came from your customers are supposed to be included in the total amount you are reporting with the help of this form - for instance, if your relative gave you some money to congratulate you on a personal achievement yet they used a device you give your clients to make their payments with, this kind of transaction will be considered a business payment - remember to be careful throughout the year and do not mix your professional obligations with your personal affairs.

Form 1099-K Instructions

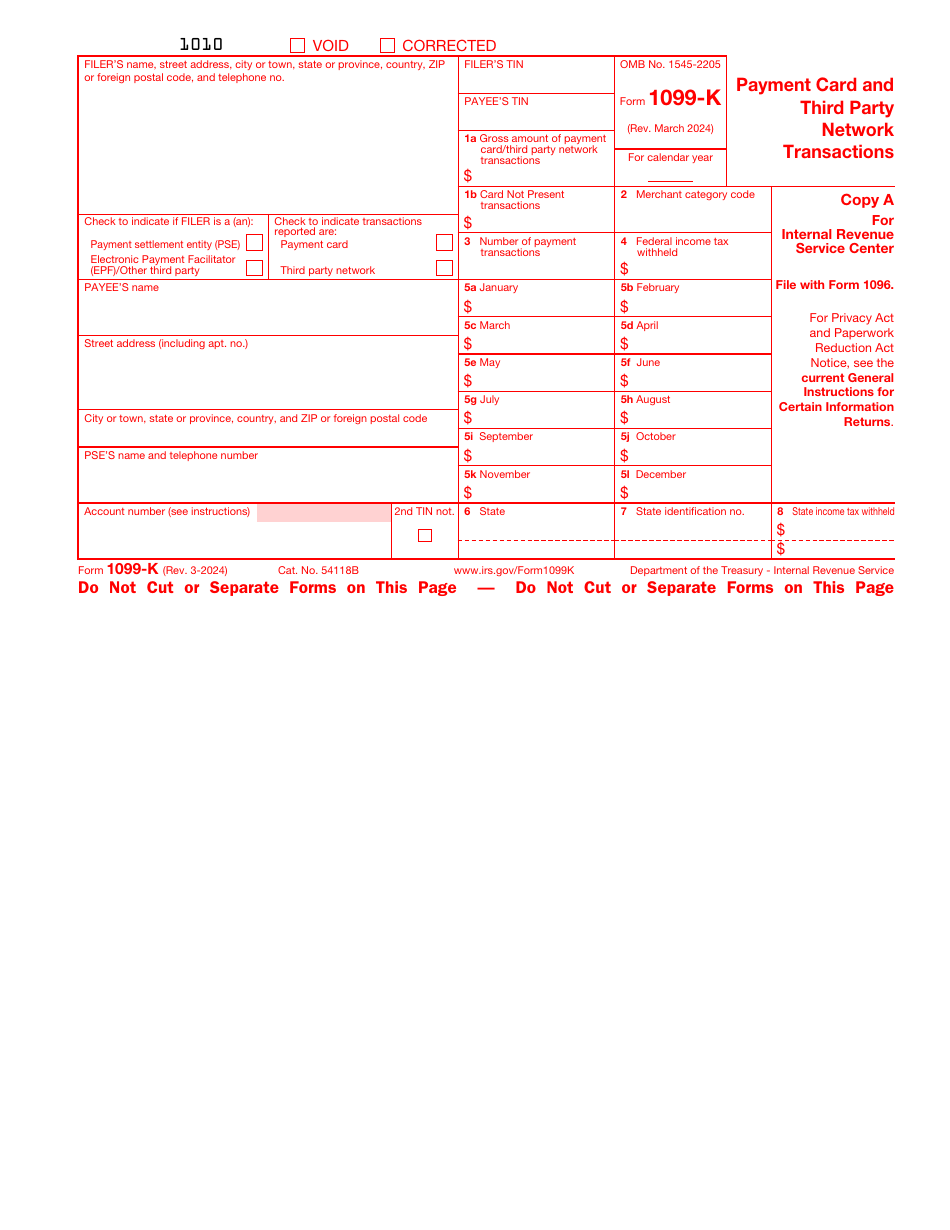

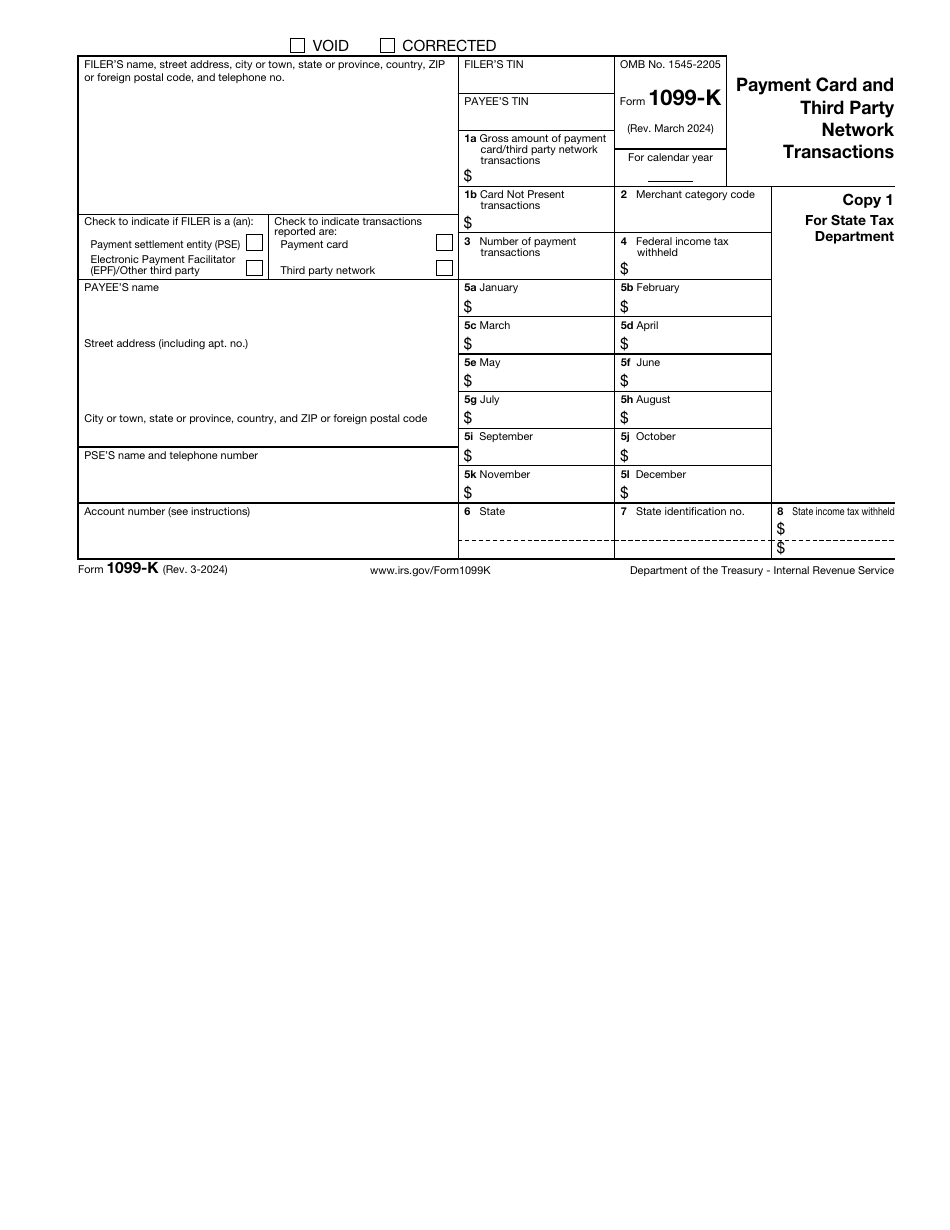

IRS Form 1099-K Instructions are as follows:

-

Write down the name of the filer and indicate their mailing address, telephone number, and taxpayer identification number . Check the box to further elaborate on their status - it is important to specify whether they are an entity whose objective is to settle payments or a facilitator of electronic payments.

-

Provide information about the payee - their name, address, and taxpayer identification number . Record the tax year you are describing with the help of this tool, add the name and telephone number of the entity that settles payments, and enter the number of the account if the payee in question has multiple accounts and you need to differentiate between them to avoid confusion.

-

Write down the gross amount of all transactions you believe must be listed in this form . These include operations with credit cards and transactions carried out via third parties. It is also necessary to notify the tax organs about the amount of transactions where the card was not present - for example, online sales which may be prevalent for many online businesses.

-

Indicate the merchant category code that identifies the payee and their card transactions and enter the number of payment transactions you processed . Report how much income tax you deducted from payments; it is also required to separate the amounts month by month and record the numbers in each of the twelve fields to show how your entity earned money throughout the year.

-

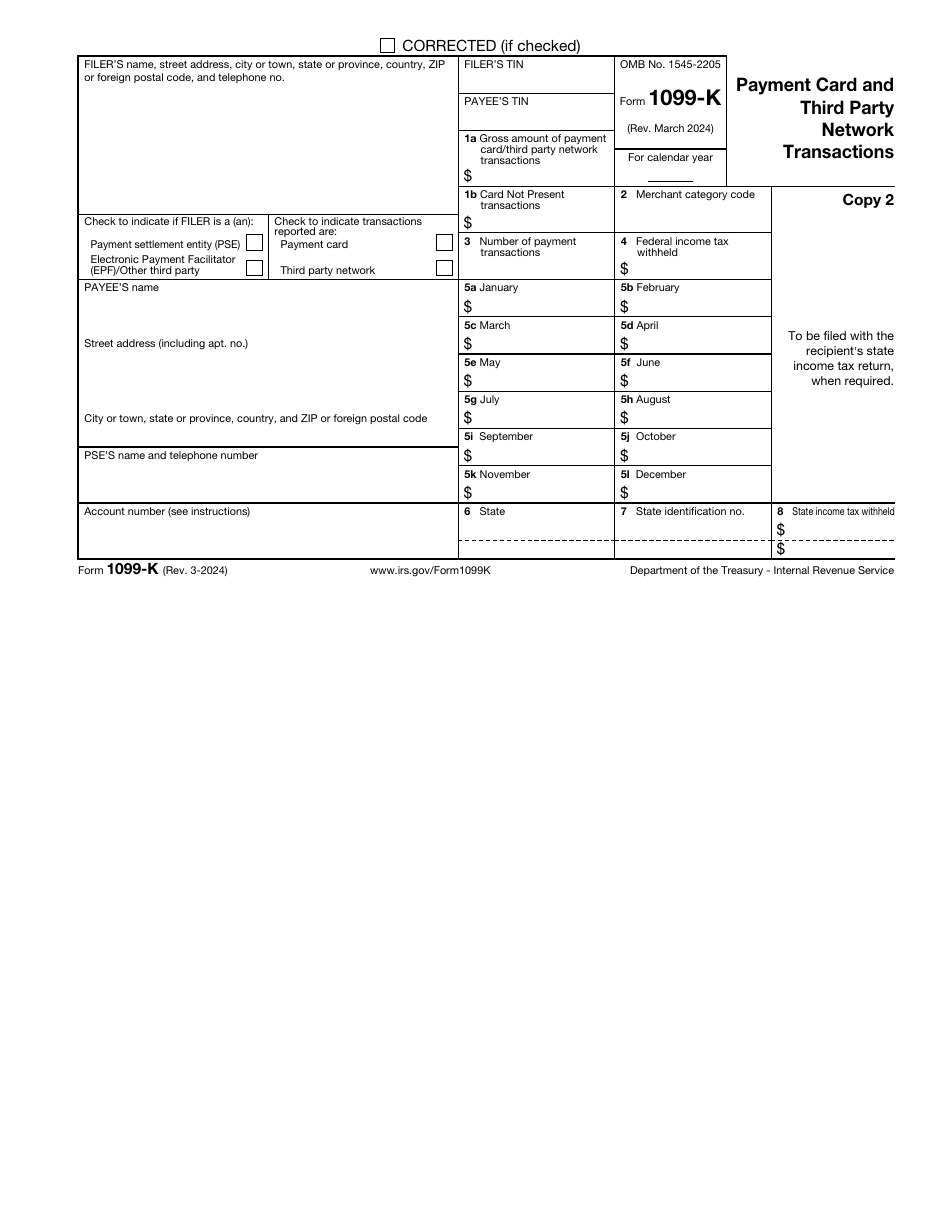

In case you are a participant of the program that allows taxpayers to combine their tax filing on state and federal levels, you have to provide information about the state - use the abbreviation and the identification number of the state where you conduct your business operations. Finish completing the paperwork by stating the amount of income tax you deducted from the transactions you described.

-

Make sure you prepare several copies of the instrument - for the payee, for the filer, and for the state tax department . Do not forget one of the key Form 1099-K requirements - you must replicate the amounts you reported on this form on your tax return no matter what your business status is.