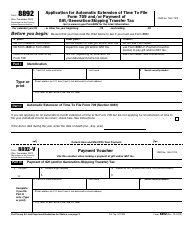

IRS Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

What Is IRS Form 4868?

IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is a fiscal document used by taxpayers who are unable to submit their income statements on time to ask for six more months to mail their paperwork. Make sure you complete this request so that you do not have to pay a penalty for late filing further increasing your tax liability.

Alternate Names:

- Tax Form 4868;

- IRS Extension Form;

- IRS Tax Extension Form 4868.

This application was released by the Internal Revenue Service (IRS) in 2023, rendering previous editions of the form obsolete. An IRS Form 4868 fillable version can be downloaded below.

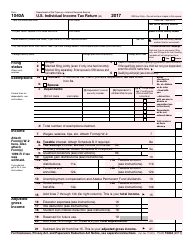

What Is Form 4868 Used For?

Submit a Form 4868 Extension if you require extra time to handle your income statement. This form is needed when you cannot file the following forms without a delay:

- IRS Form 1040, U.S. Individual Income Tax Return;

- IRS Form 1040-SR, U.S. Tax Return for Seniors;

- IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- IRS Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico);

- IRS Form 1040-PR, Self-Employment Tax Return (Spanish).

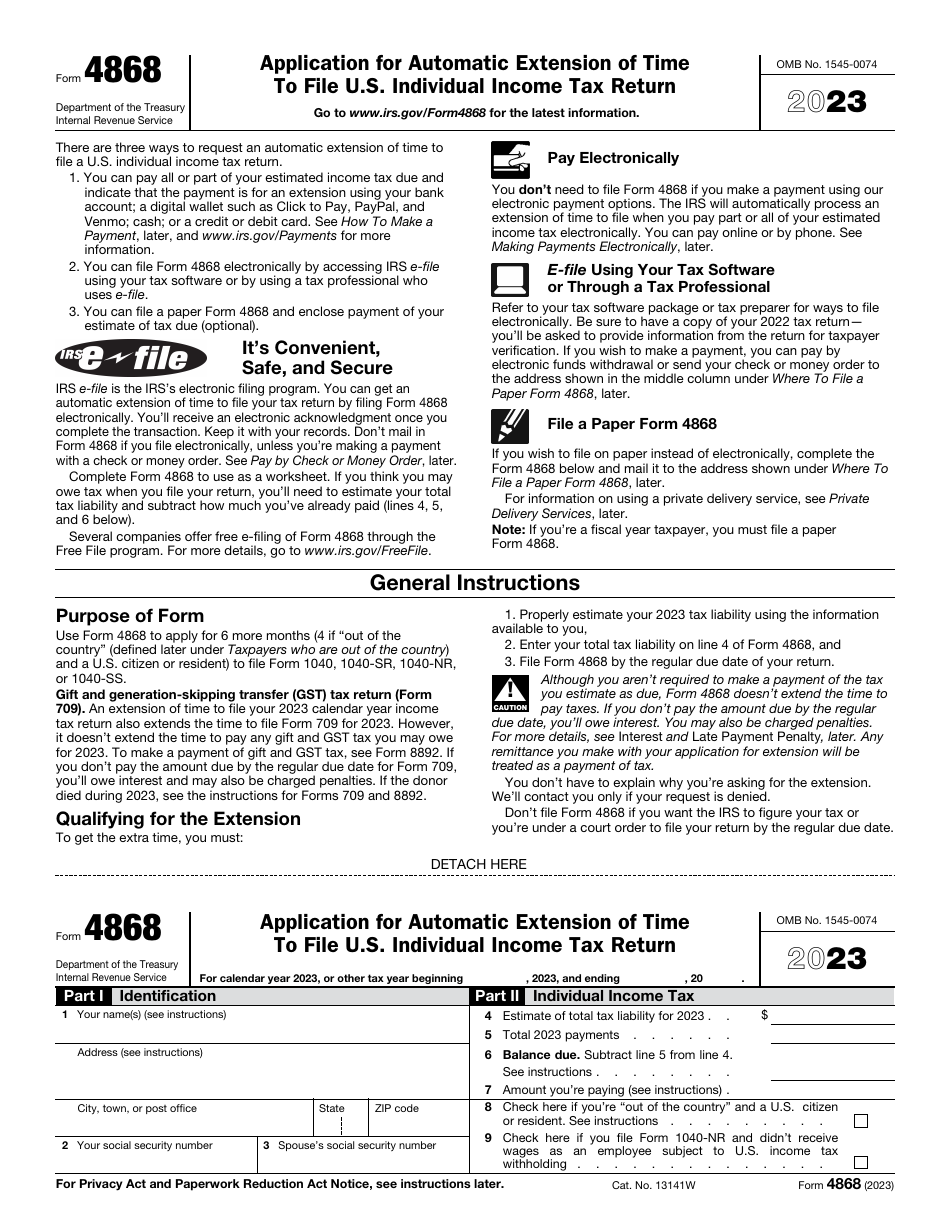

Form 4868 Instructions

Form 4868 instructions are as follows:

-

Specify the tax period your income statement is going to cover . Write down your name, mailing address, and social security number. The form must contain the social security number of your spouse if you are submitting a joint return.

-

Summarize your tax liability - write down the estimated tax you are planning to include on your income statement, state the total amount of payments for the year, calculate the balance due, and enter the amount you are paying.

-

Check the appropriate box to confirm you are going to be abroad when the time to file the tax return comes or to certify your duty to submit Form 1040-NR and state you did not receive a salary as a worker obligated to comply with the income tax deductions.

When Is Form 4868 Due?

File the IRS 4868 Form by the regular date of your tax return. In most cases, the due date for Form 4868 is April 17 if you live in Massachusetts or Maine and April 15 for many other states. It is advised that filers check with the state tax agency for the state in which they reside to not miss any important deadlines. Taxpayers who use fiscal year must submit this form before the original fiscal year return deadline.

If you are a United States citizen or resident and are out of the country by the due date of the return, you can submit the return or the extension form by June 17. Besides, if you did not receive any income subject to the United States income tax withholdings, the due date for submitting your tax return and Form 4868 is June 17.

The time extension to file an individual income tax return granted via this form automatically gives you permission for an extension to file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. Note, that permission to file the form after the due date does not allow you to pay taxes later. You must pay them on time; otherwise, you may be charged penalties.

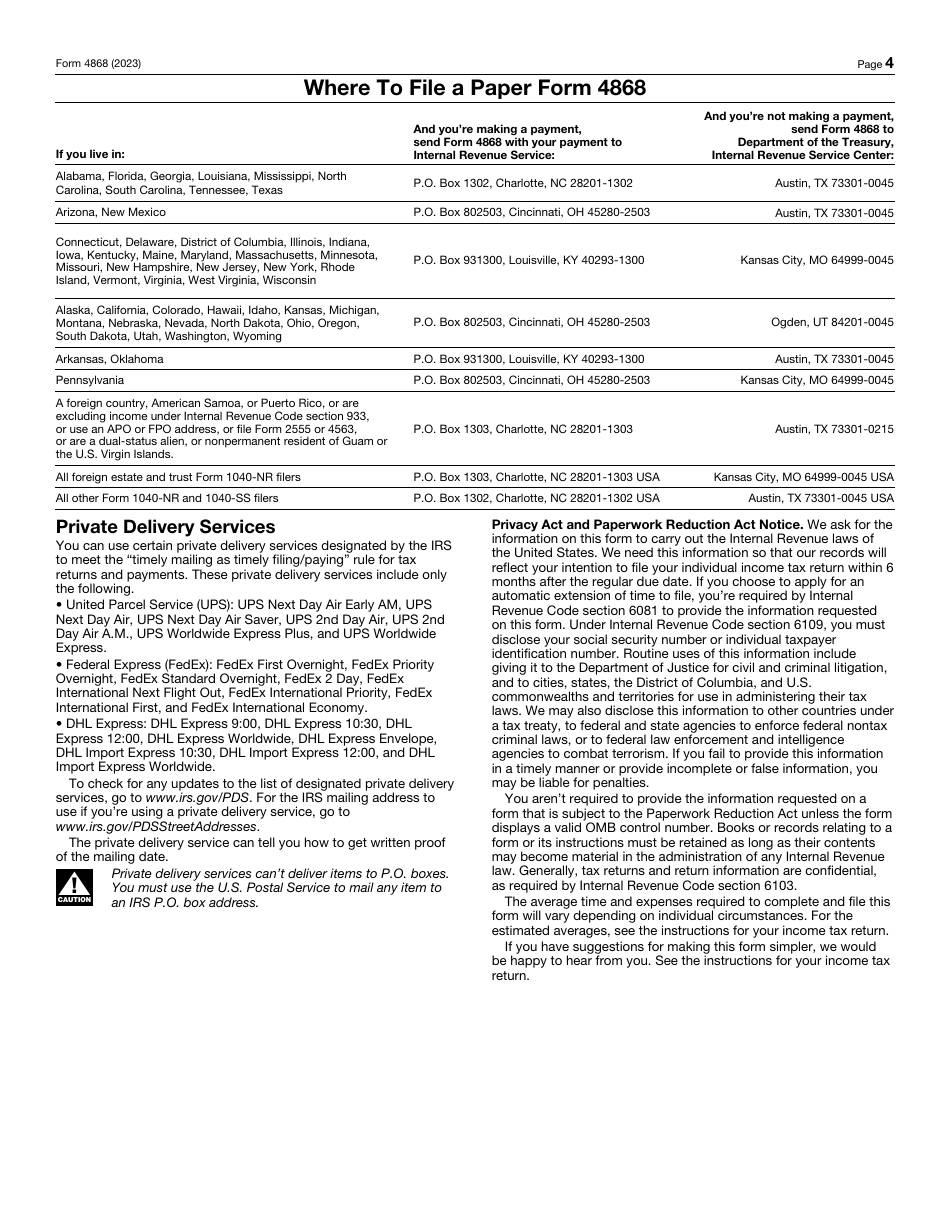

Where to Mail Form 4868?

Pick the IRS Form 4868 mailing address for your location:

-

Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, and Texas residents need to send the paperwork to the IRS, P.O. Box 1302, Charlotte, NC 28201-1302. Forms without a payment should be mailed to the Department of the Treasury, IRS Center, Austin, TX 73301-0045 .

-

If you live in Arizona or New Mexico, submit the application to the IRS, P.O. Box 802503, Cincinnati, OH 45280-2503 or Department of the Treasury, IRS Center, Austin, TX 73301-0045 if there is no payment enclosed.

-

Applicants from Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, and Wyoming must send the form to the IRS, P.O. Box 802503, Cincinnati, OH 45280-2503 . If no payment is mailed, the address is Department of the Treasury, IRS Center, Ogden, UT 84201-0045 .

-

Residents of Arkansas and Oklahoma are expected to apply for an extension to the IRS, P.O. Box 931300, Louisville, KY 40293-1300 or Department of the Treasury, IRS Center, Austin, TX 73301-0045 in case they are not providing a payment.

-

Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, West Virginia, and Wisconsin taxpayers are obliged to file the documentation with the IRS, P.O. Box 931300, Louisville, KY 40293-1300 ( Department of the Treasury, IRS Center, Kansas City, MO 64999-0045 in case no money order or check is attached).

-

If you reside in Pennsylvania, the mailing address you have to use is IRS, P.O. Box 802503, Cincinnati, OH 45280-2503 or Department of the Treasury, IRS Center, Kansas City, MO 64999-0045 for documents without money orders and checks.

-

People that live abroad, use a military address, submit IRS Form 2555 or IRS Form 4563, reside in Guam or the U.S. Virgin Islands, or are considered dual-status aliens are required to send the paperwork to the IRS, P.O. Box 1303, Charlotte, NC 28201-1303 . If they do not send a payment, the address for them is Department of the Treasury, IRS Center, Austin, TX 73301-0215 .

-

In case you need an extension to file Form 1040-NR on behalf of a foreign trust or estate, file the application with the IRS, P.O. Box 1303, Charlotte, NC 28201-1303 USA ( Department of the Treasury, IRS Center, Kansas City, MO 64999-0045 USA for filers that do not attach a payment).

-

Taxpayers with the responsibility to submit Form 1040-SS as well as all other individuals who need to mail Form 1040-NR for reasons not listed above have to send the papers to the IRS, P.O. Box 1302, Charlotte, NC 28201-1302 USA or Department of the Treasury, IRS Center, Austin, TX 73301-0045 USA for those who do not make a tax payment.

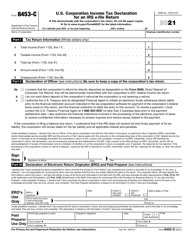

How to File Form 4868 Electronically?

You can file Form 4868 electronically - do it by using IRS e-file services with your own software or hire a professional who will advise you on the filing of this document. If you decide to make an online payment, do not submit the 4868 Tax Form - fiscal authorities will still process your extension.

Where to File Form 4868 Electronically?

File IRS Form 4868 electronically via the IRS e-file: IRS electronic filing program. Use your personal computer for this purpose. You can submit the form electronically in two ways:

- By using the IRS Free File program. The list of companies offering free e-filing of IRS 4868 Form is provided on the IRS website; and

- With the help of a tax software package.

In any case, make sure you have your tax return for the appropriate tax year period. You will need to provide the information indicated in the return for verification. After you complete the transaction, you will receive an electronic acknowledgment.