2020 Tax Changes: Everything You Need to Know about Changes for 2019 Tax Returns

The IRS has recently released updates for 2020 tax brackets and standard deductions along with new forms to file, and contribution limits. Here is what you should know about the latest tax law changes.

2020 Income Tax Brackets & Tax Rates

There are seven 2020 tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. As always, a tax rate depends on your filing status. This is how the brackets look with the 2020 tax changes:

| Single Filing | Married Filing Jointly | ==> | | -- | -- | | Taxable Income | Tax Due | Taxable Income | Tax Due | | 0 - $9,700 | 10% | 0 - $19,400 | 10% | | $9,701 - $39,475 | $970 + 12% | $19,401 - $78,950 | $1,940 + 12% | | $39,476 - $84,200 | $4,543 + 22% | $78,951 - $168,400 | $9,086 + 22% | | $84,201 - $160,725 | $14,382.50 + 24% | $168,401 - $321,450 | $28,765 + 24% | | $160,726 - $204,100 | $32,748.50 + 32% | $321,451 - $408,200 | $65,497 + 32% | | $204,101 - $510,300 | $46,628.50 + 35% | $408,201 - $612,350 | $93,257 + 35% | | $510,301 + | $153,798.50 + 37% | $612,351 + | $164,709.50 + 37% |

| Married Filing Separately | Head of the Household | ==> | | -- | -- | | Taxable income | Tax due | Taxable income | Tax due | | 0 - $9,700 | 10% | 0 - $13,850 | 10% | | $9,701 - $39,475 | $970 + 12% | $13,851 - $52,850 | $1,385 + 12% | | $39,476 - $84,200 | $4,543 + 22% | $52,851 - $84,200 | $6,065 + 22% | | $84,201 - $160,725 | $14,382.50 + 24% | $84,201 - $160,700 | $12,962 + 24% | | $160,726 - $204,100 | $32,748.50 + 32% | $160,701 - $204,100 | $31,322 + 32% | | $204,101 - $306,175 | $46,628.50 + 35% | $204,101 - $510,300 | $45,210 + 35% | | $306,176 + | $82,354.75 + 37% | $510,301 + | $152,380 + 37% |

Increased Standard Deductions

The standard deduction amount will be increased, as is customary:

| Filing status | Standard deduction amount |

| Single filing, married filing separately | $12,200 |

| Married filing jointly | $24,400 |

| Head of the household | $18,350 |

Top 5 Changes for 2020

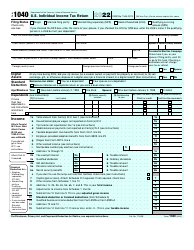

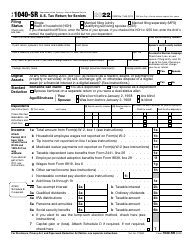

- Form 1040-SR, U.S. Tax Return for Seniors. This is a new tax return specifically designed for individuals aged 65 and older. It is a simplified version of Form 1040 with better color contrast and larger font size. Seniors will be able to itemize their deductions on Schedule A or claim the standard deduction.

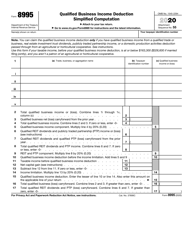

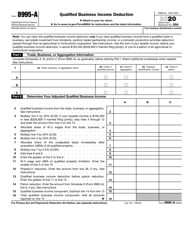

- Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction. The former document must be completed by taxpayers who have qualified business income, income from a publicly traded partnership, or real estate investment trust dividends. Form 8995-A will be used for more complex business income computations.

- New Supplemental Schedules. There are three new schedules built on the Form 1040 that combine prior schedules into larger forms. One of the most important tax changes for 2020 - the threshold for medical expenses for Schedule A is 10% of the adjusted gross income – for two years it has been 7.5%.

- Alimony Deduction Eliminated. The payer is no longer allowed a deduction for alimony payments made for every divorce decree signed after December 31, 2018 . The payee will not have to claim alimony payments as income on the tax return.

- New 401k, IRA and HSA Contribution Limits:

| Name of the contribution | Limits |

| 401K contribution | $19,000 ($6,000 catch-up amount for individuals over 50) |

| IRA contribution | $6,000 ($1,000 for individuals over 50) |

| HAS contribution | $3,500 for self-coverage, $7,000 for family coverage |