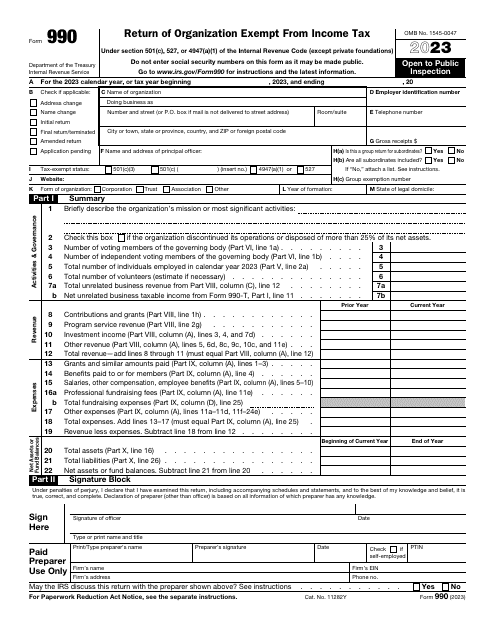

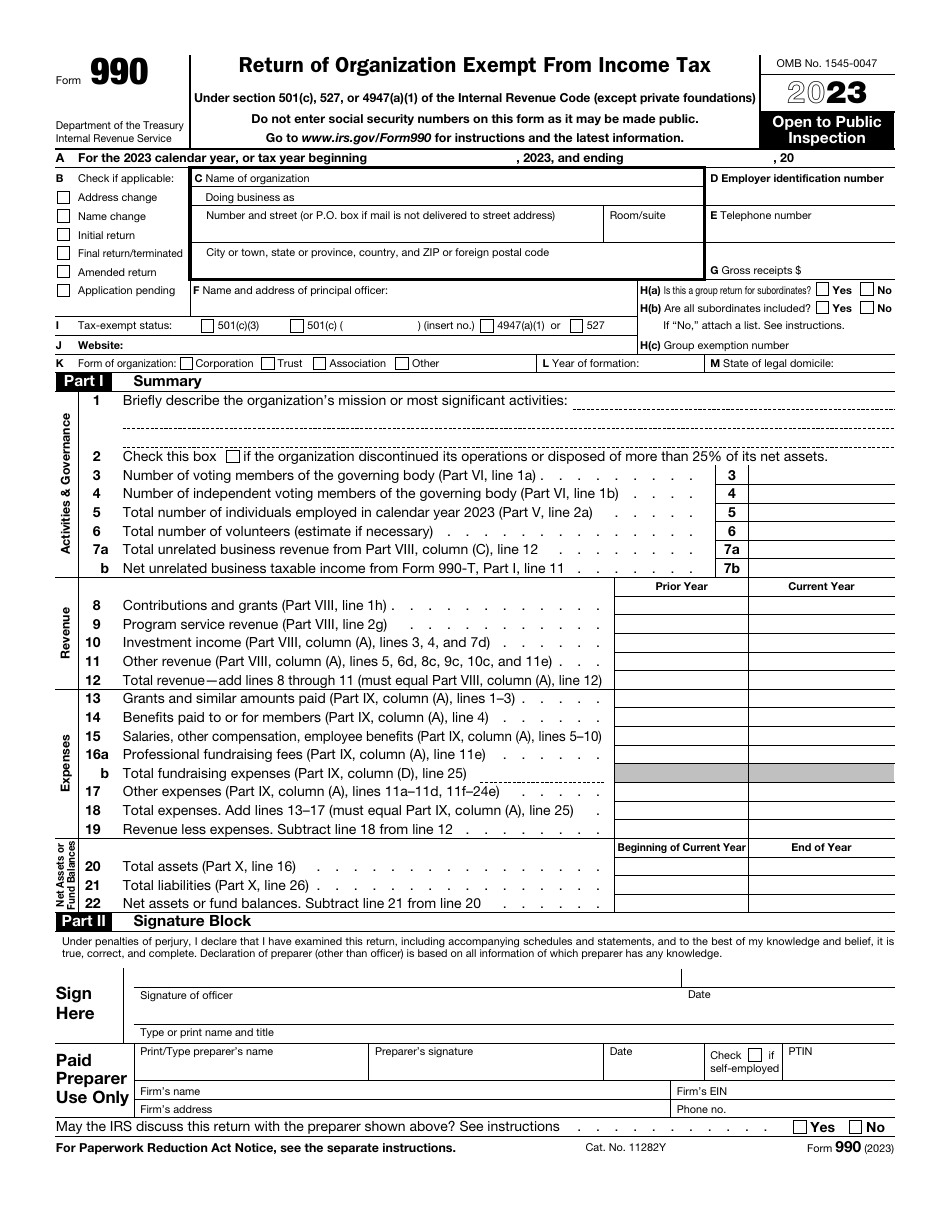

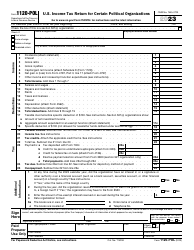

IRS Form 990 Return of Organization Exempt From Income Tax

What Is IRS Form 990?

IRS Form 990, Return of Organization Exempt from Income Tax , is a formal instrument used by tax-exempt organizations to summarize their work during the tax year. It is essential to prove to fiscal organs your entity is devoted to its purpose and actively engages in operations and events that allow you to raise money for a charitable cause or promote your political agenda.

Alternate Names:

- Tax Form 990;

- Federal 990 Form.

This document was released by the Internal Revenue Service (IRS) in 2023 , making older editions of the statement outdated. An IRS Form 990 fillable version is available for download below.

Check out the 990 Series of forms to see more IRS documents in this series.

What Is a 990 Form Used For?

Prepare and submit Tax Form 990 if you represent the interests of an entity that does not owe income tax on a federal level. Even despite this status, the IRS still wants to know about your activity whether you manage a political organization or a charitable trust.

The statement offers a comprehensive picture of your operations and financial activities allowing tax organs to confirm your tax-exempt status remains valid and you continued to strive to focus on your non-profit targets instead of generating revenue for the leaders and managers of your entity - if there is doubt in regard to the high salary your officers receive, the tax-exempt status may be in danger.

When Is Form 990 Due?

Form 990 due date falls on the fifteenth day of the fifth month that follows the tax period described in the document - this means that for organizations that outline the calendar year in the tax return the deadline for filing comes on May 15. If this day happens to be a legal holiday, Saturday, or Sunday, taxpayers may submit the paperwork on the next business day. The same due date applies if your entity ceased its activities.

You also have an opportunity to use a form that serves as a Form 990 extension request - send IRS Form 8868, Application for Extension of Time To File an Exempt Organization Return, to fiscal organizations and you will get extra time to work on your statement.

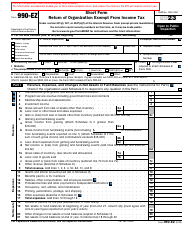

What Is the Difference Between Form 990 and 990-EZ?

Tax authorities have issued a document similar to Tax Form 990 - IRS Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. The difference between those two instruments is the category of taxpayers that are entitled to file Form 990-EZ instead of Form 990 - if during the year you have collected gross receipts whose amount is below $200,000 and the assets you have accumulated by the end of the fiscal period are valued less than $500,000, you are permitted to submit Form 990-EZ since the IRS does not demand the same comprehensive breakdown of operations and finances from medium- and small-sized entities.

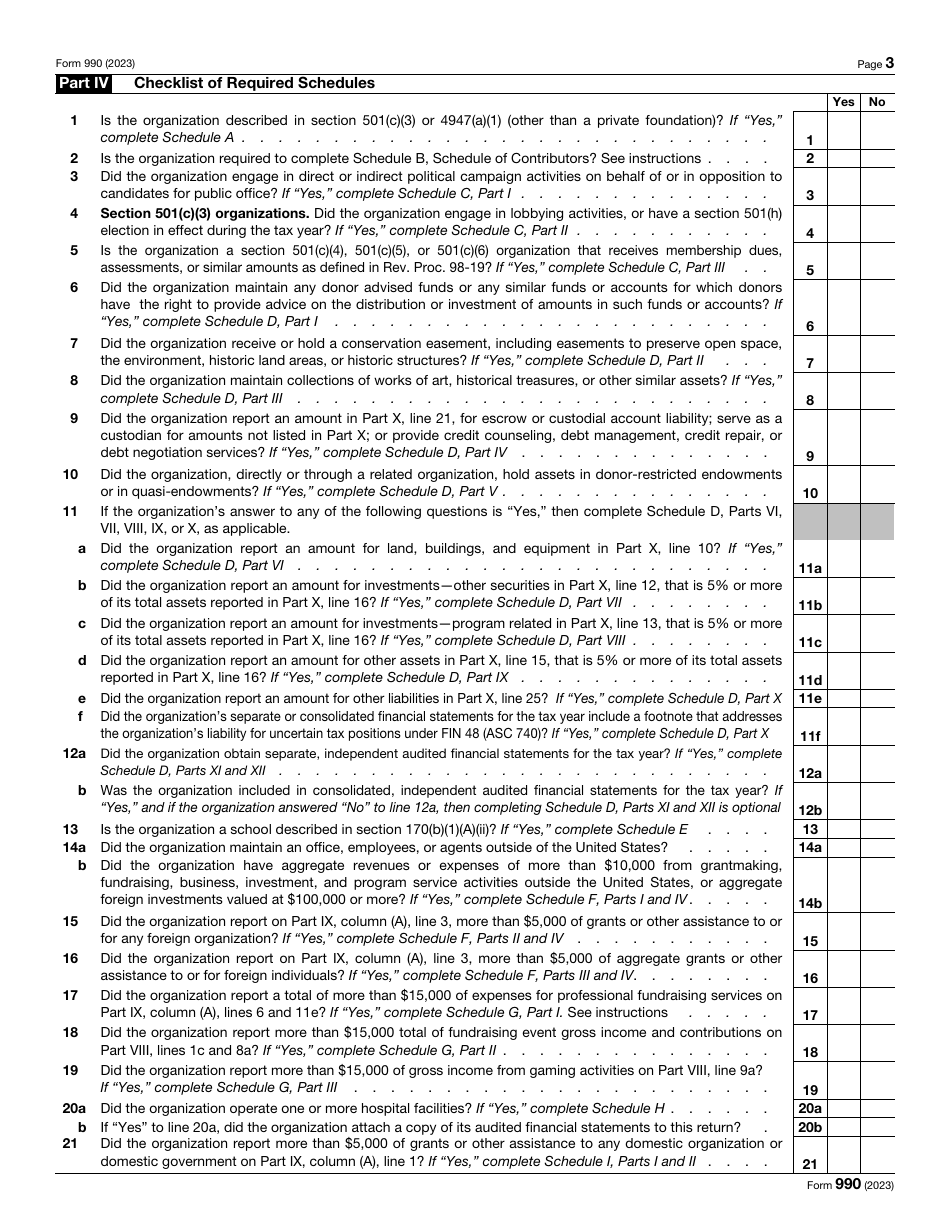

IRS Form 990 Schedules

- Schedule A, Public Charity Status and Public Support.

- Schedule B, Schedule of Contributors.

- Schedule C, Political Campaign and Lobbying Activities.

- Schedule D, Supplemental Financial Statements.

- Schedule E, Schools.

- Schedule F, Statement of Activities Outside the United States.

- Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule H, Hospitals.

- Schedule I, Grants and Other Assistance to Organizations, Governments, and Individuals in the United States.

- Schedule J, Compensation Information.

- Schedule K, Supplemental Information on Tax-Exempt Bonds.

- Schedule L, Transactions with Interested Persons.

- Schedule M, Noncash Contributions.

- Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O, Supplemental Information to Form 990.

- Schedule R, Related Organizations and Unrelated Partnerships.

Form 990 Instructions

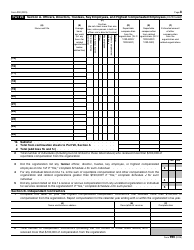

Follow these Form 990 instructions to disclose the details of your activities to the fiscal authorities:

-

Specify the tax period the form elaborates on . Check the appropriate box to confirm the organization has changed its name or address, this is your first or final return, you modified the statement you submitted previously, or you are currently waiting for the approval of your tax-exempt status. Write down the name of your entity, its contact details, and employer identification number. Identify your principal officer, state the total amount of gross receipts, indicate the form of organization that applies in your case, add the year your entity was formed, and record your permanent location. You also need to clarify what section of the Internal Revenue Code established your tax-exempt status.

-

Provide a brief summary of your organization's operations, income, costs, assets, and liabilities . You will need to take the prior and the current years into account and list the accurate amounts. Certify the document by signing and dating it; a tax professional that helped you with the instrument is also supposed to identify themselves.

-

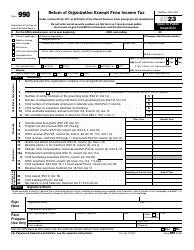

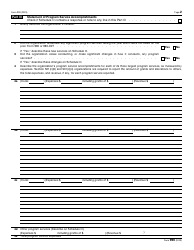

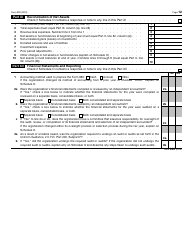

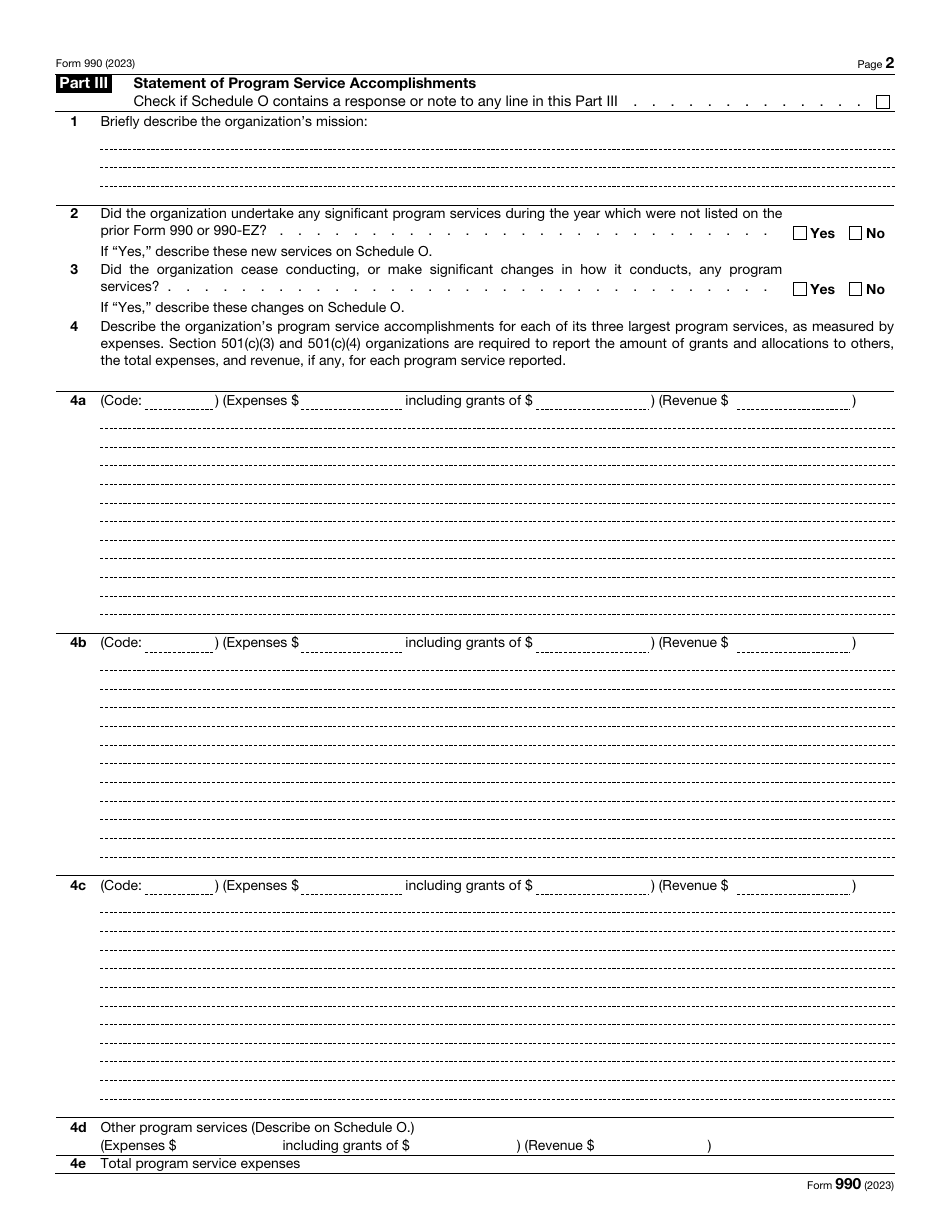

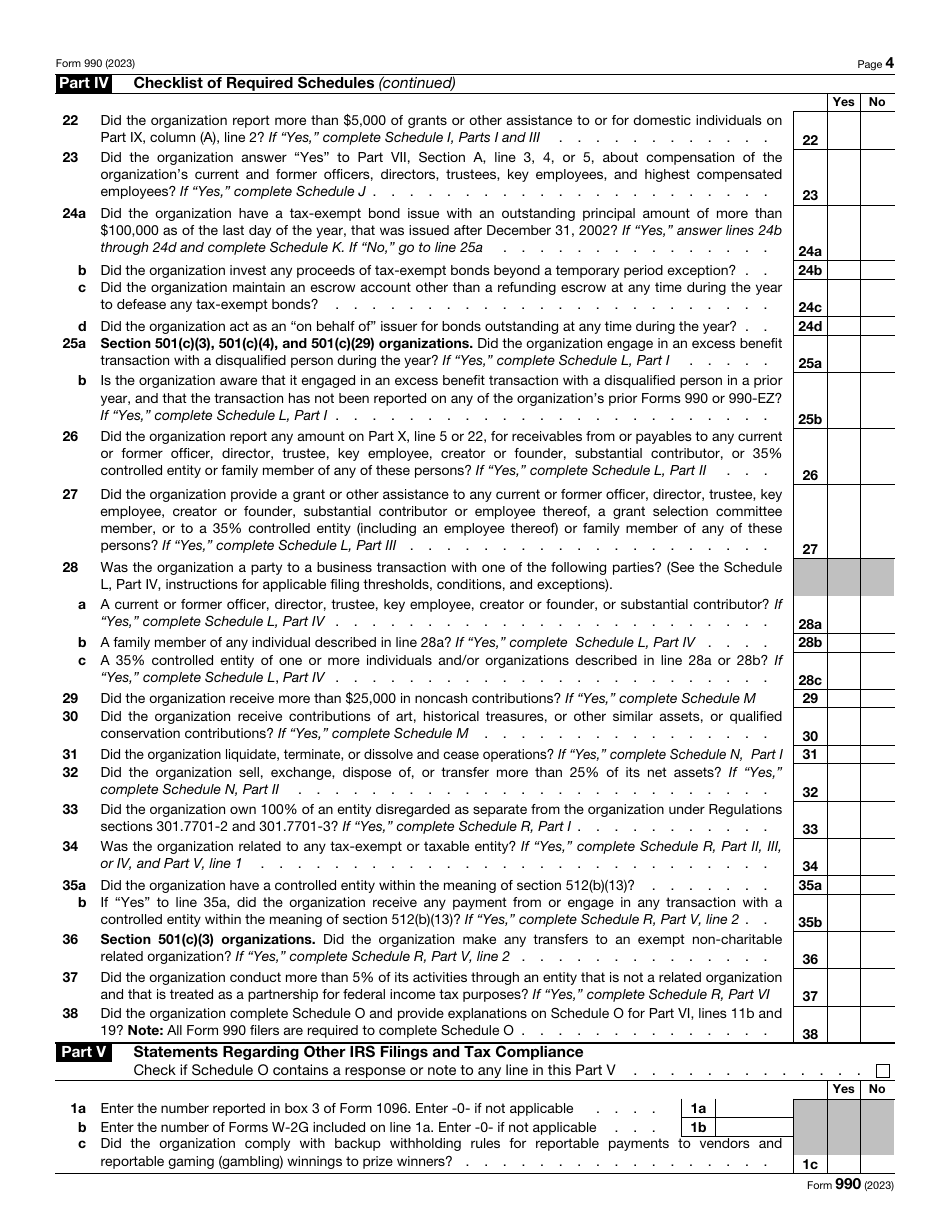

Clarify the mission of your entity and explain the achievements of your organization based on its expenses - those activities are meant to support your ongoing mission or objective . Carefully scan the checklist that tells the taxpayer what schedules they must attach to the form when the submission takes place and check the boxes when necessary - in the process, you will be able to answer numerous questions about the operations of your entity.

-

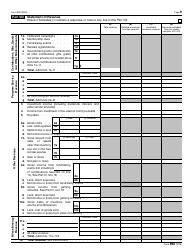

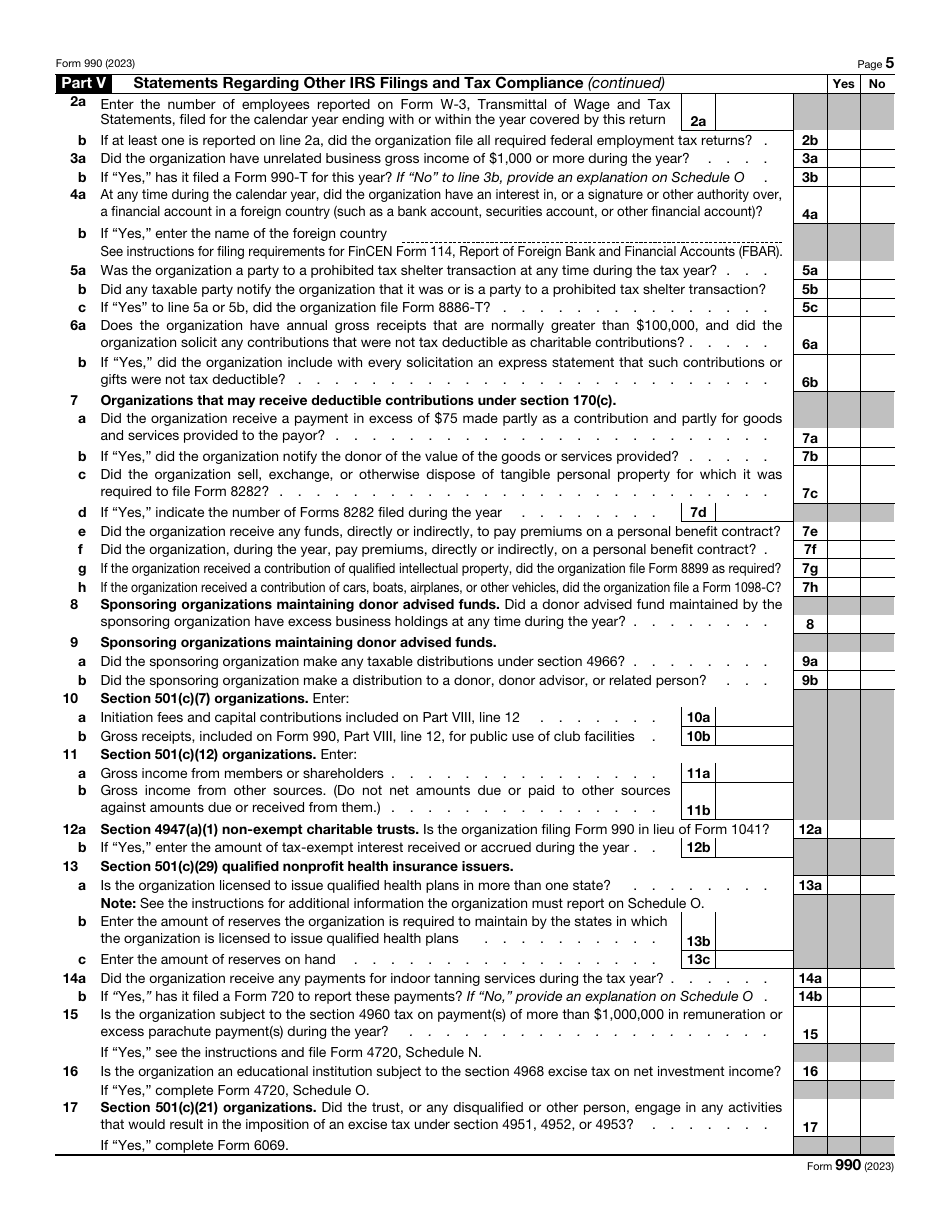

Share information related to other tax paperwork you are going to file - whether you have a responsibility to deduct taxes from your employees' salaries or you participated in a transaction to dispose of tangible assets that must be revealed to the IRS, answer the questions and be ready to enclose additional forms.

-

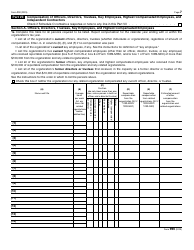

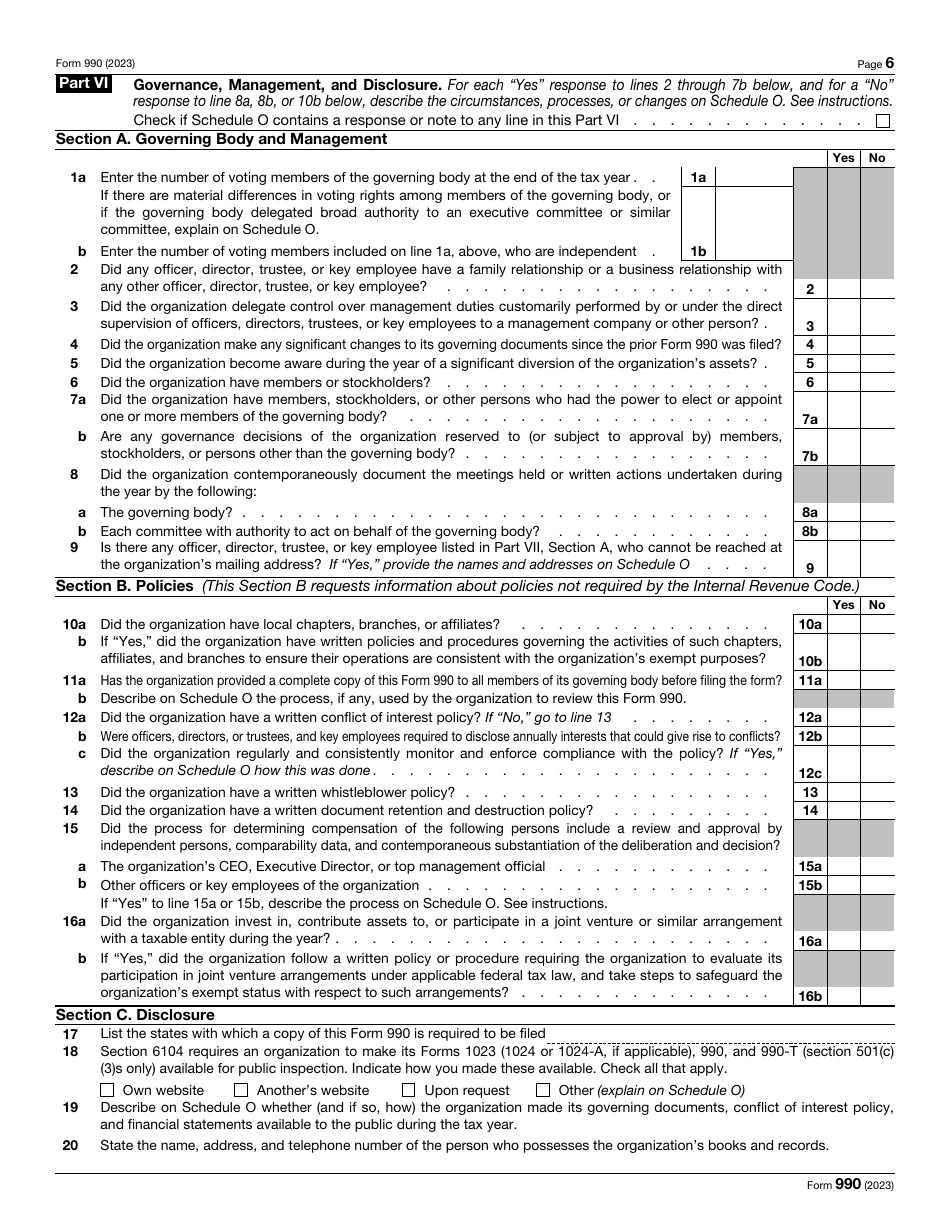

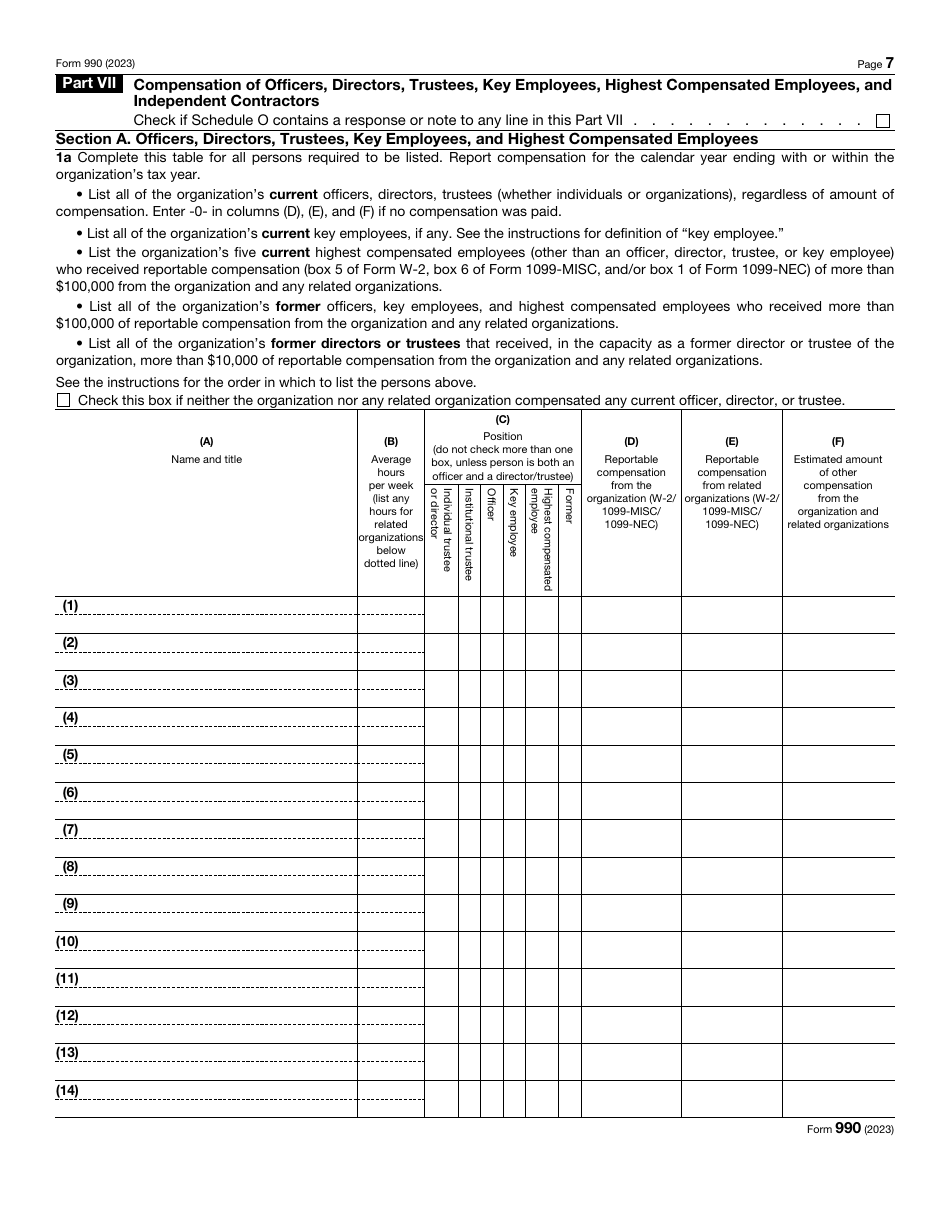

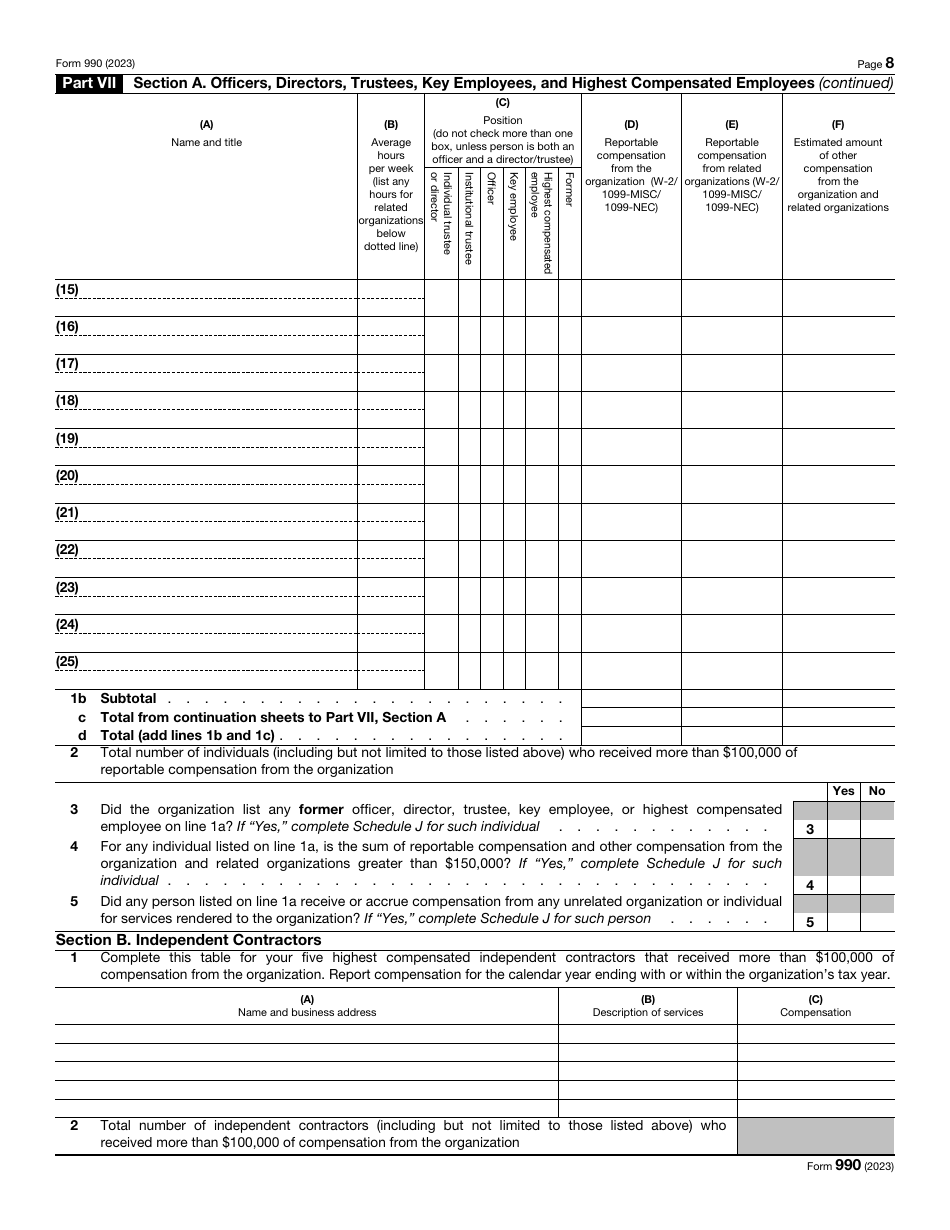

Elaborate on individuals in charge of your organization - inform the tax organs about the decision-making process in your entity, provide specifics of your internal policies and regulations, and explain how your directors, officers, and most significant workers are compensated over the course of the year. Note that you are also obliged to identify self-employed individuals you hired and state how much money they received for their services.

-

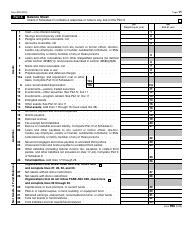

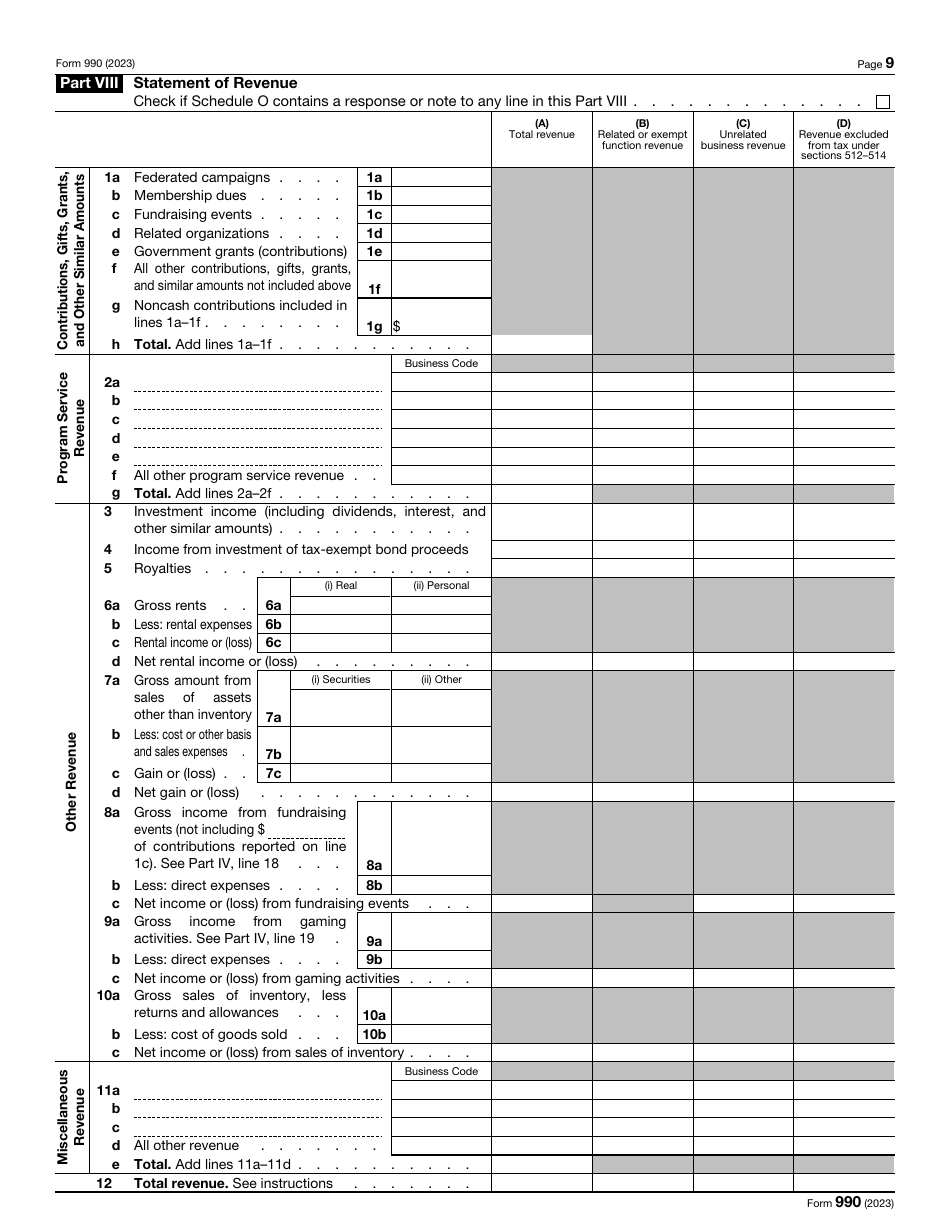

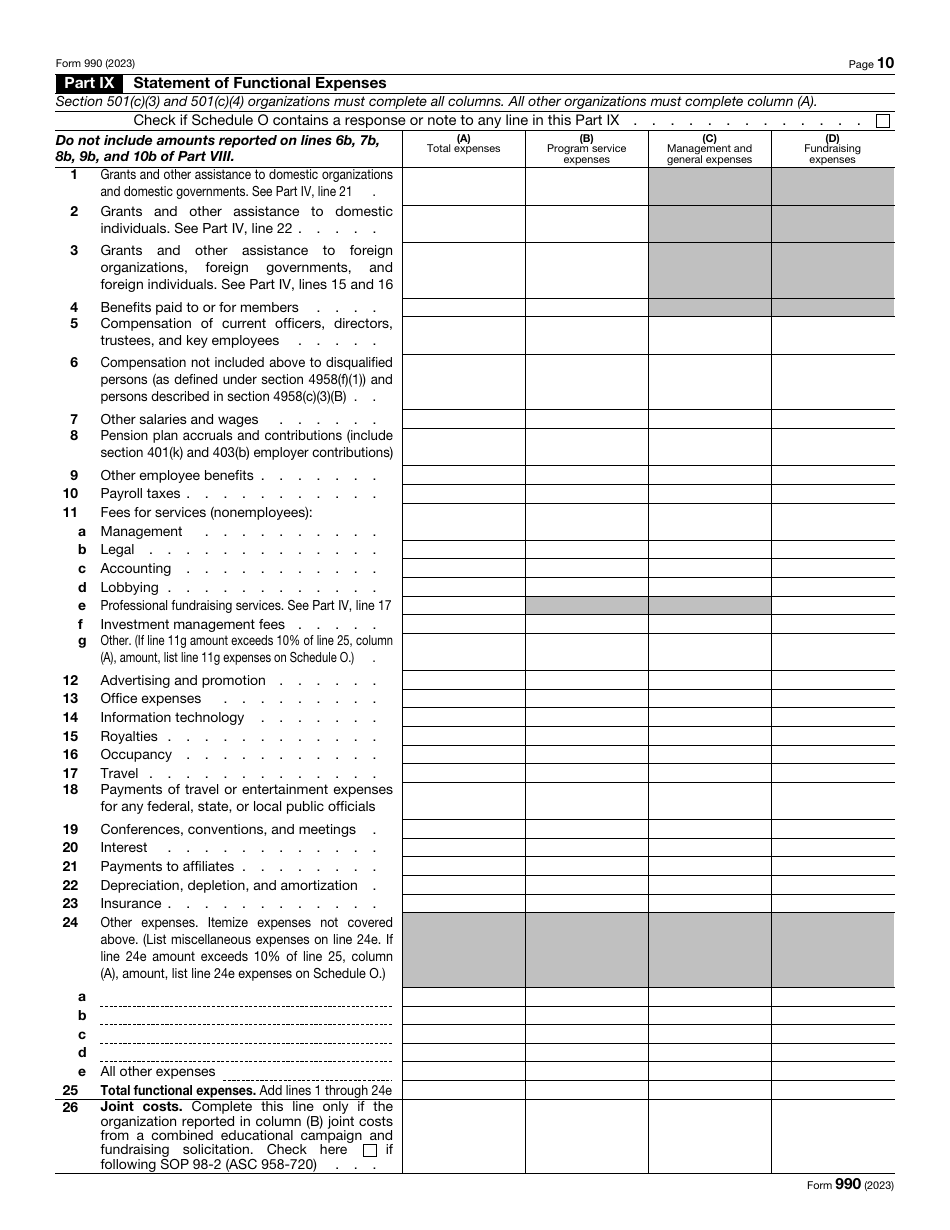

Talk about the revenue of your entity in more detail . Report the contributions, grants, and gifts you received, disclose the revenue from specific activities in line with your mission, and list other sources of income - from rental payments to money you generated through gaming activities. Record different types of expenses you had to deal with - make sure they are all calculated and put in separate categories.

-

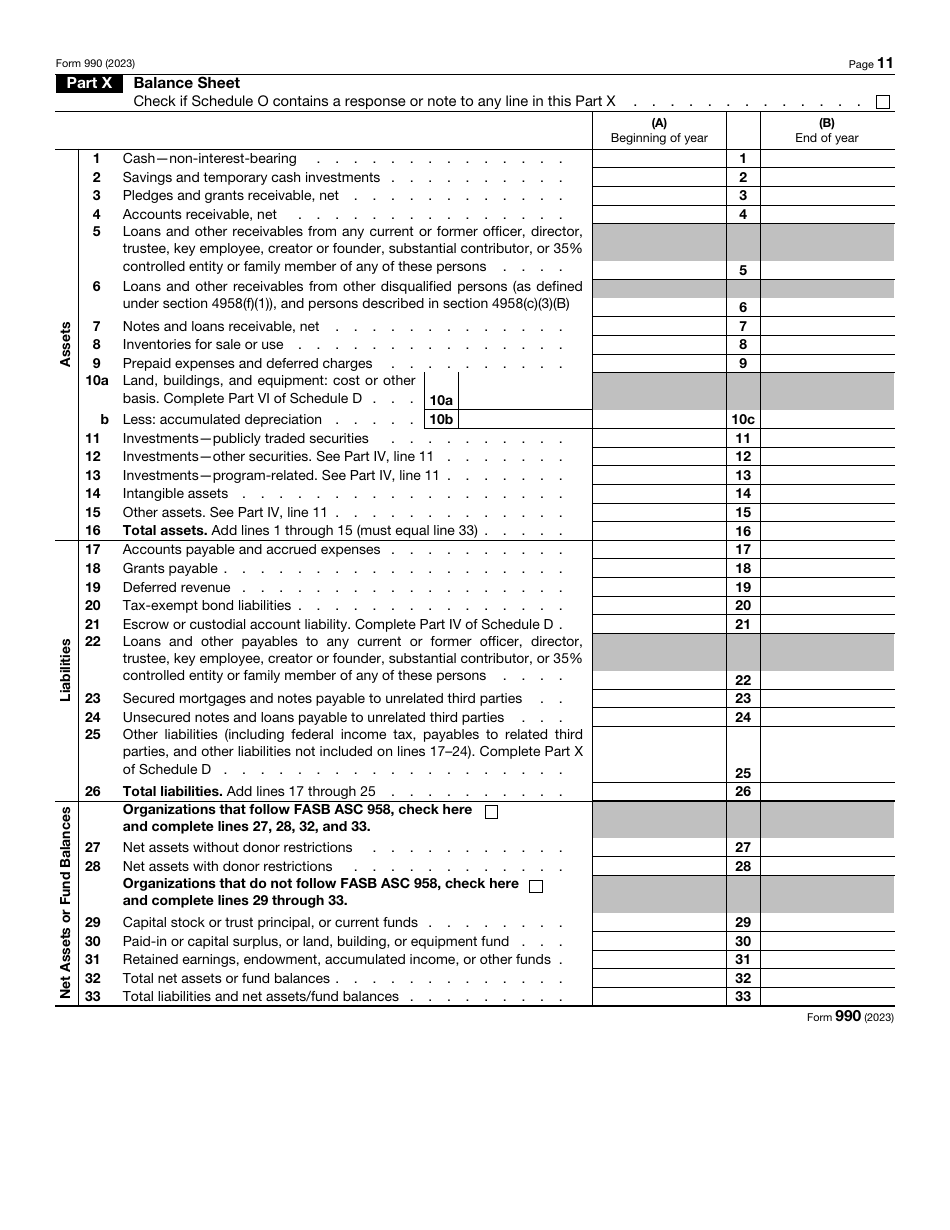

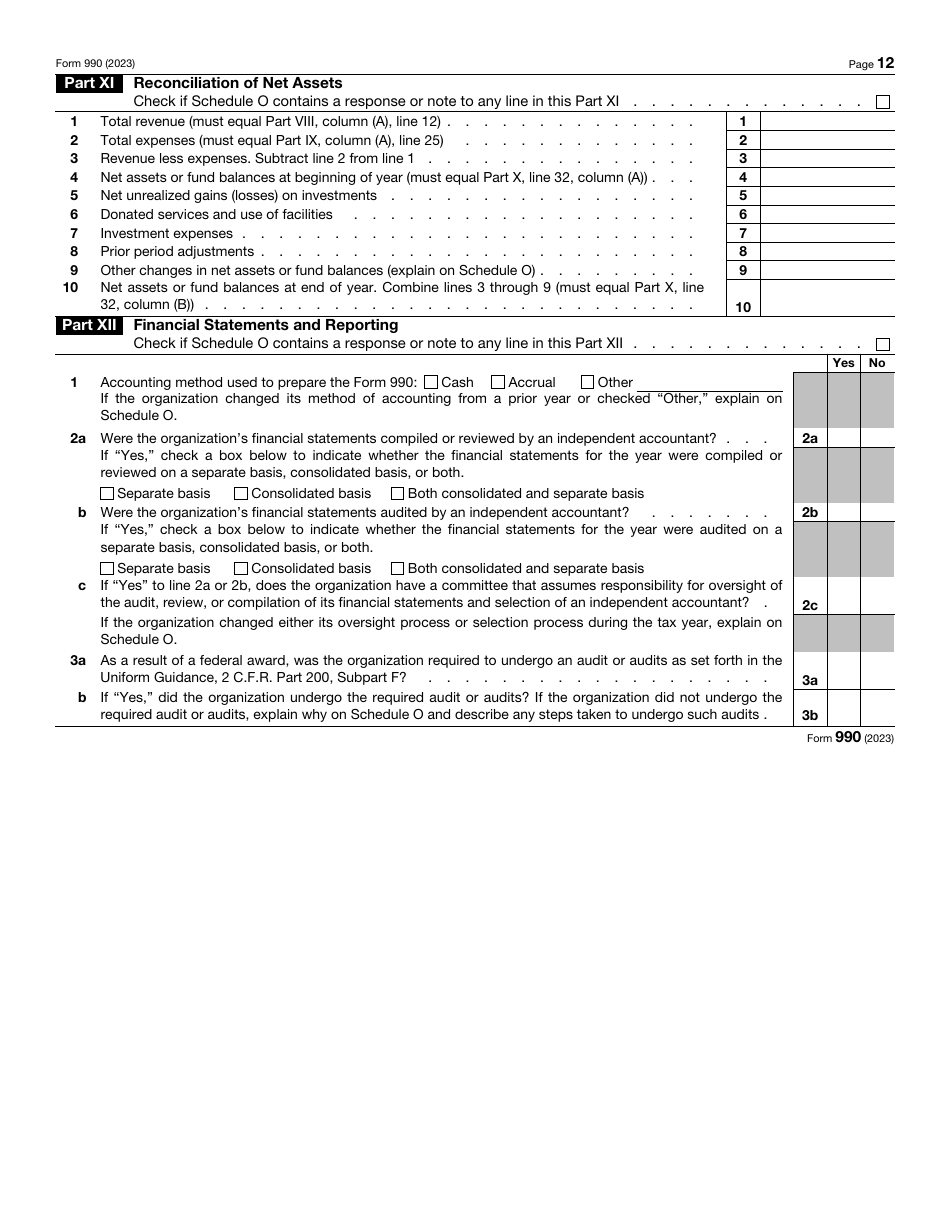

Fill out a balance sheet to specify your liabilities and assets . Once again, you are expected to share the numbers you had at the start of the tax year and at the end of it. Reconcile the assets and explain what methods you used during the calculations, who observed the process of compiling the financial records, and whether you had to undergo audits.

Where to Mail Form 990?

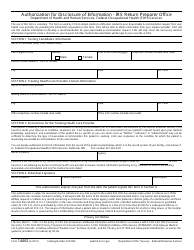

It is mandatory to adhere to the most recent Form 990 filing requirements and send the document to tax organs online - electronic filing is obligatory which means non-profits and charities are not given a mailing address to submit paper returns. This decision to include this instrument in the e-file program was made to provide taxpayers with a secure and simple alternative to traditional paper filing - instead, your documentation will be delivered instantly, and as a result, tax authorities will have access to the papers right away which reduces the time of processing.

How to File Form 990 Electronically?

You can file a Federal 990 Form with the help of an e-file provider that has formal authorization from the IRS. These providers are tax professionals with permission to complete tax returns and send them to the government via an electronic filing program. Taxpayers of all sorts can trust those e-file providers since they undergo a registration process with the IRS - reach out to one of the companies that have the software capable of processing data correctly and be certain your documentation will be sent to the fiscal organs without delay.

IRS 990 Related Forms:

- Form 990-EZ, Short Form Return of Organization Exempt from Income Tax;

- Form 990-N, Electronic Notice (e-Postcard);

- Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation;

- Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- Form 1023-EZ Instructions, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- Form 1024, Application for Recognition of Exemption Under Section 501(a);

- Form 1128, Application to Adopt, Change or Retain a Tax Year;

- Form 2848, Power of Attorney and Declaration of Representative;

- Form 3115, Application for Change in Accounting Method;

- Form 4506, Request for Copy of Tax Return;

- Form 8822-B, Change of Address or Responsible Party - Business;

- Form 8868, Application for Extension of Time to File an Exempt Organization Return.