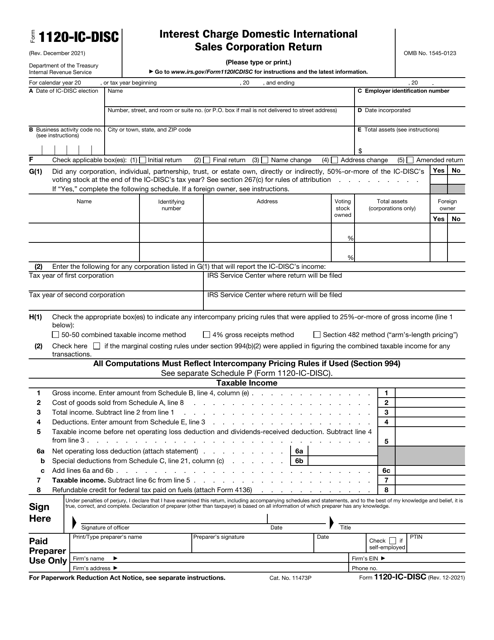

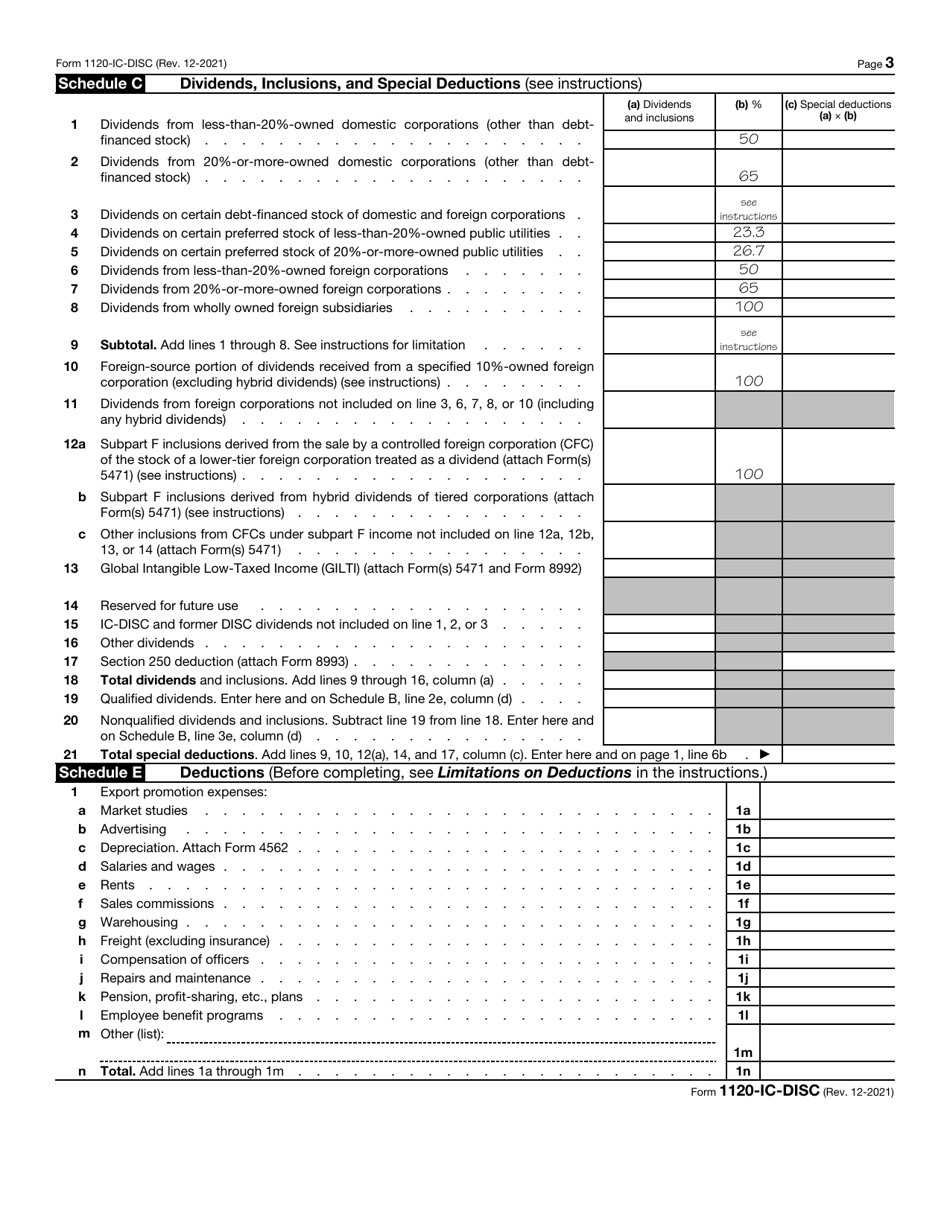

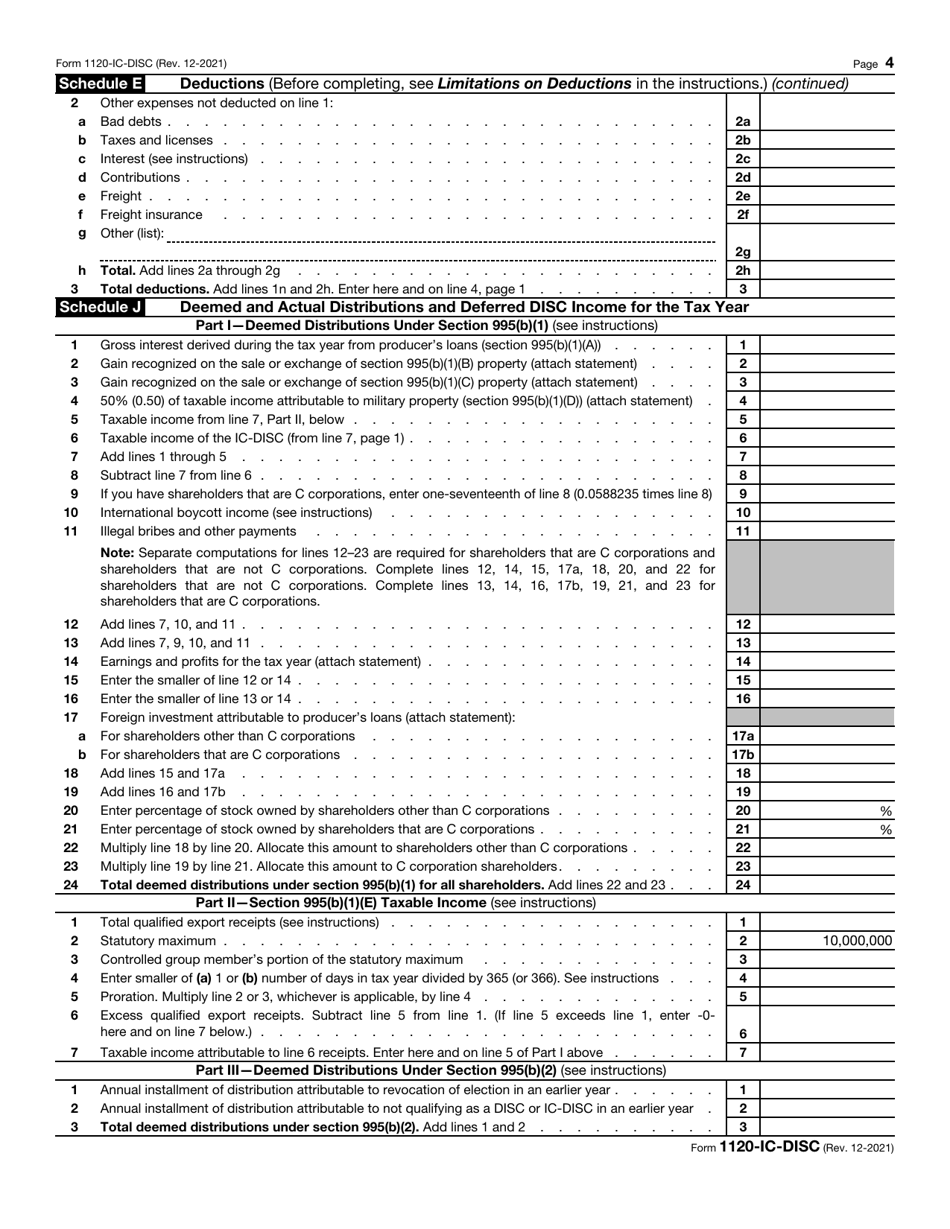

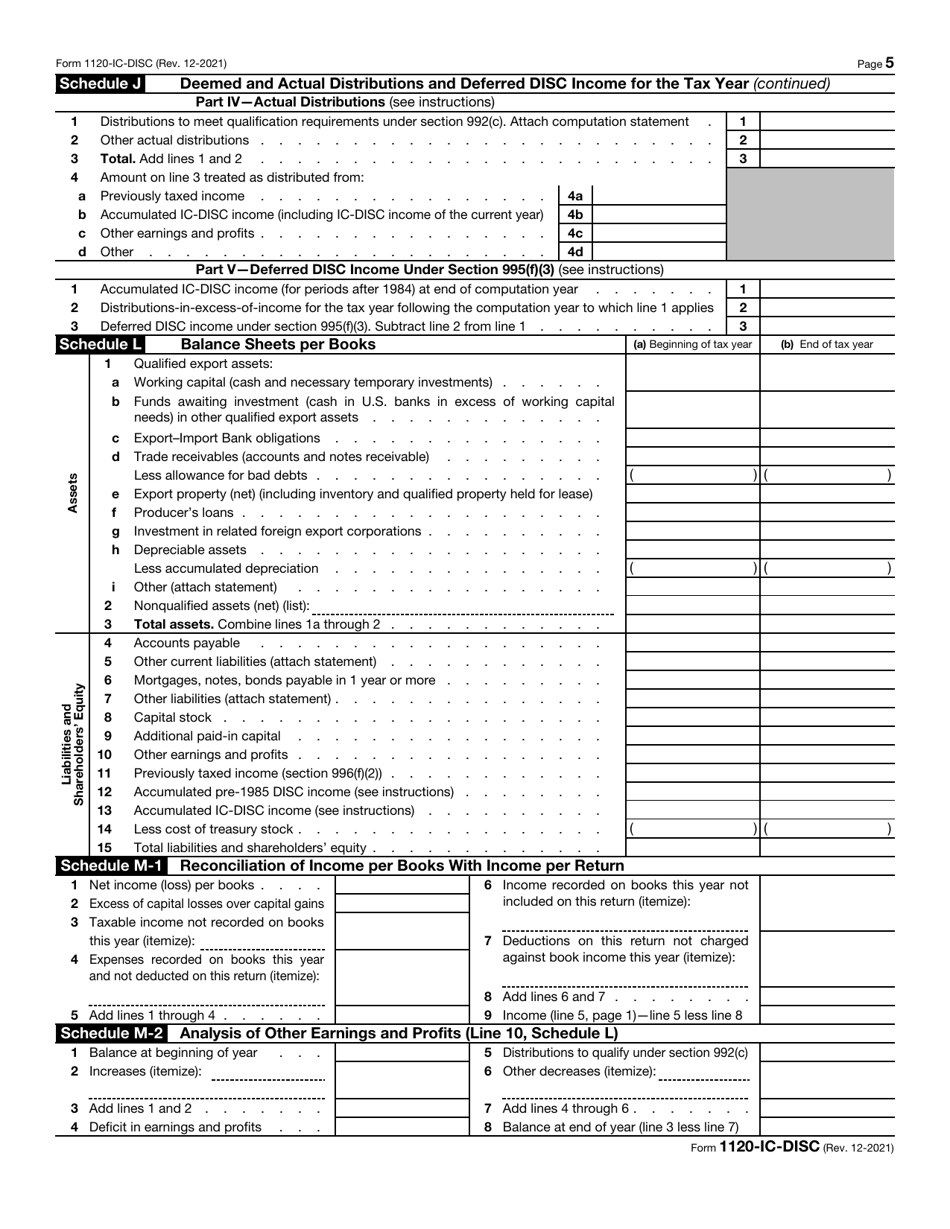

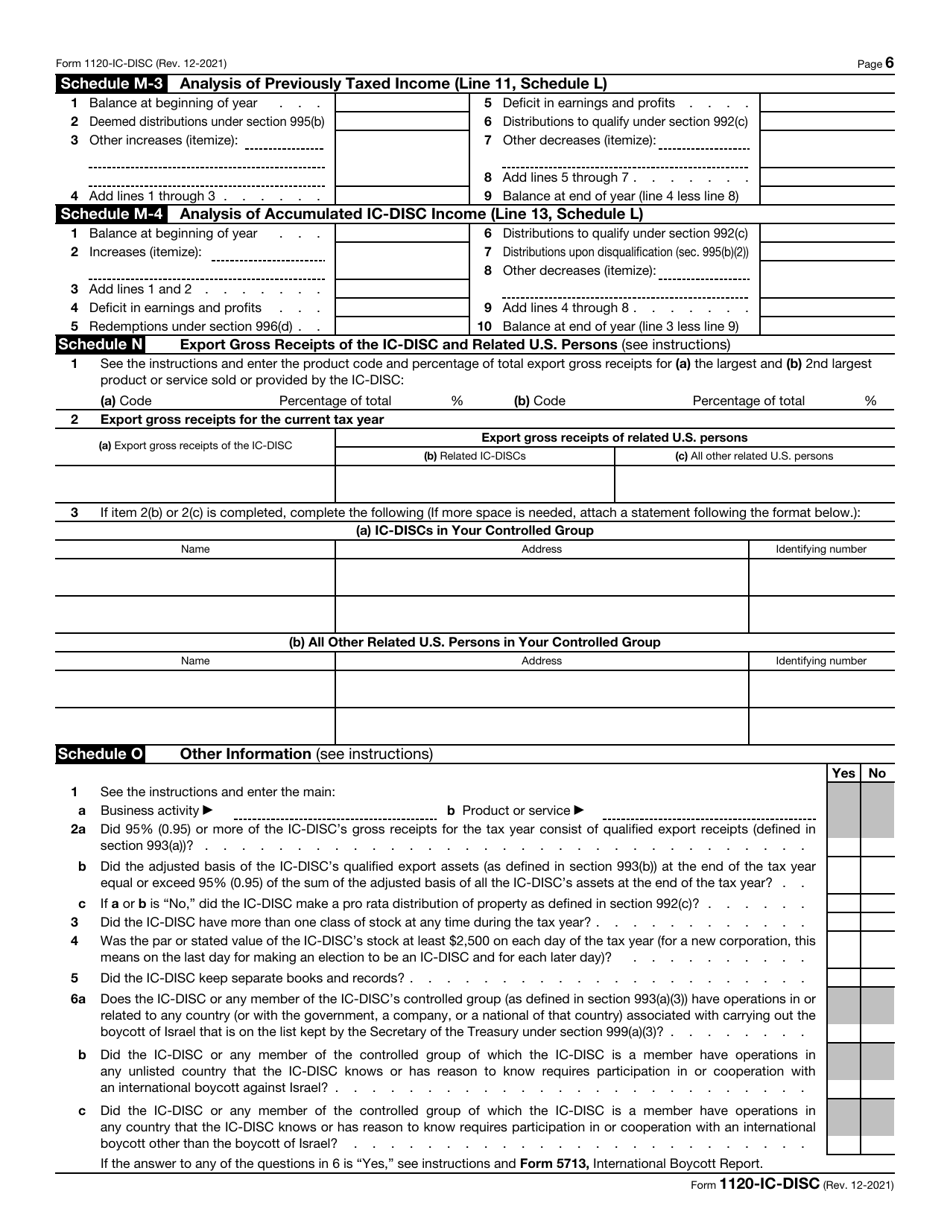

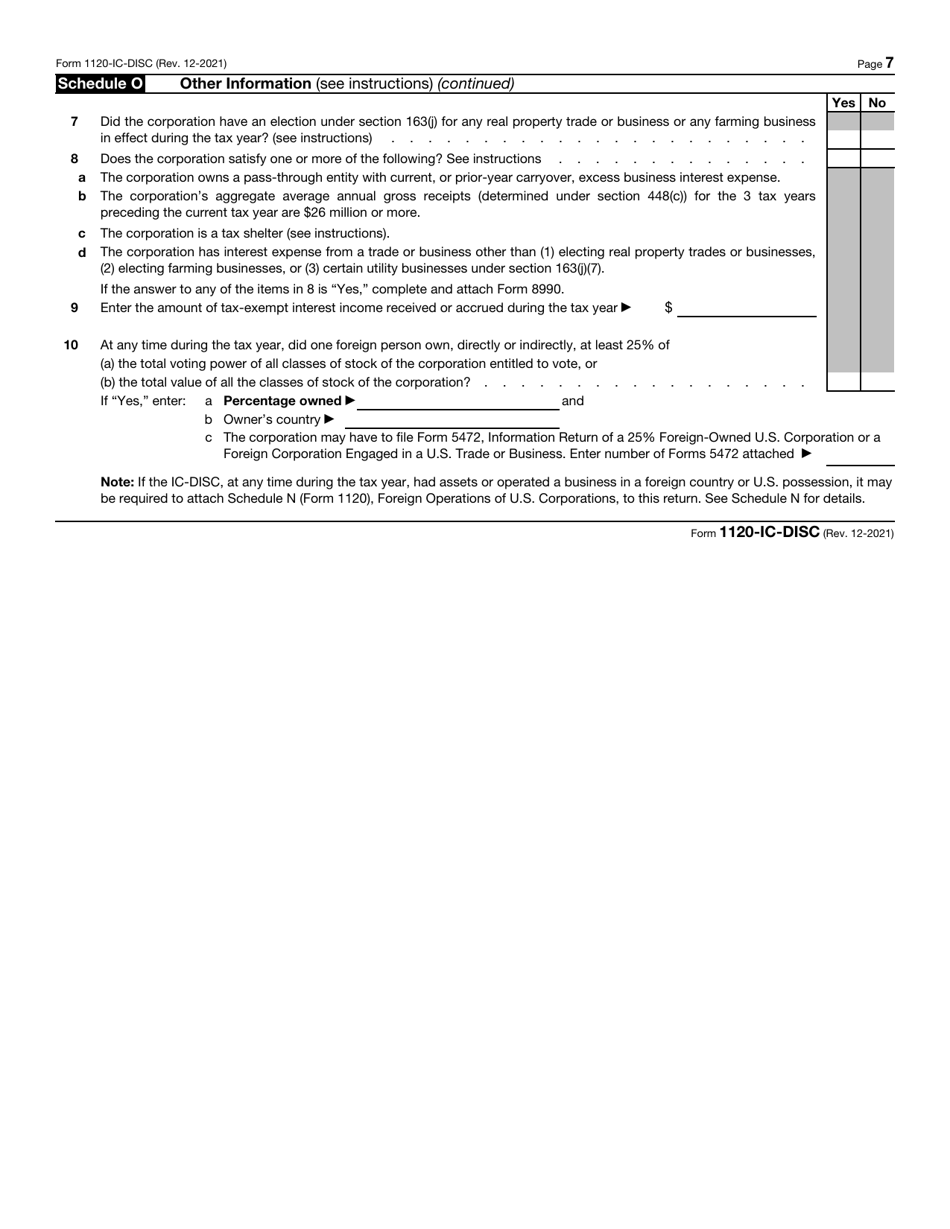

IRS Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation Return

What Is IRS Form 1120-IC-DISC?

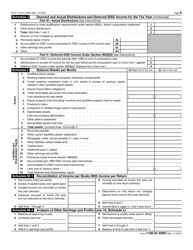

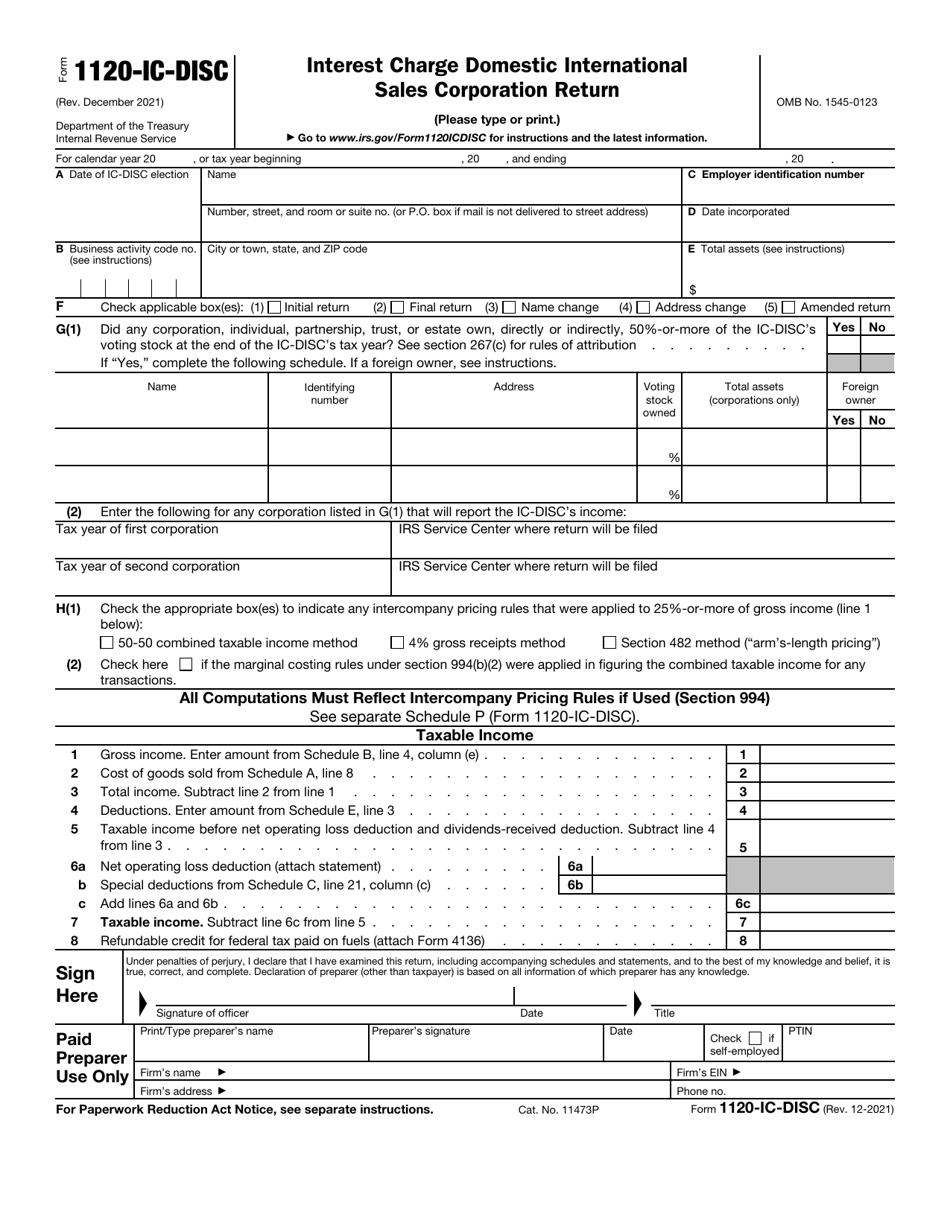

IRS Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return - also known as the IC-DISC tax return - is a document used by certain corporations as an information return filed with the Internal Revenue Service (IRS) . It was last revised on December 1, 2021 . Download the latest version of the fillable Form 1120-IC-DISC through the link below.

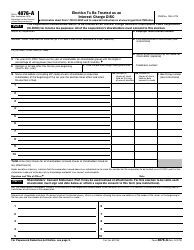

The form is used by an Interest Charge Domestic International Sales Corporation (IC-DISC). IC-DISC return is filled out by every corporation that elected to be treated as such by submitting the form 4876-A and the election remains in effect for the current tax year. Besides, it must be filed by former DISC and IC-DISC in addition to other required returns.

The due date for the IC-DISC tax return is the 15th day of the 9th month after the end of the tax year. No possible extensions are allowed. However, if the deadline falls on a Saturday, Sunday, or legal holiday, you may submit the form on the next business day.

IRS Form 1120-IC-DISC Instructions

File IRS Form 1120-IC-DISC at the following address: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999. The IRS may apply the following penalties for not providing all the required information or not filing the return without any reasonable cause:

- $100 for each case of not furnishing the necessary information (up to $25,000 per the calendar year);

- $1,000 if you do not file your return.

Do not attach explanations when filing the form. Wait until you receive a notice about penalty and interest from the IRS and after that provide your explanations. The IRS will decide if you meet the "reasonable cause" criteria and if you have to pay any penalties.

General instructions for the form are as follows:

- Fill out every applicable entry space on the form;

- Never enter the phrases "Available upon request" or "See attached" instead of filling out the box;

- If the space provided is not enough, attach separate statements of the same size and format as the printed form. Provide the name and the employer identification number (EIN) on each attachment;

- You must provide the EIN while completing the IC-DISC return. If you do not have one, apply for it online or by submitting the Form SS-4, Application for Employer Identification Number;

- If you have applied for the EIN but have not received it yet, enter "Applied for" and the date of application in Box C;

- You may round off cents to whole dollars on the main form and its schedules. Note that if you decide to round, you must round all amounts. If you must add two or more amounts to figure the amount you have to enter in the box, add them with cents and round off only the total.

The step-by-step guide for the Form 1120-IC-DISC and its schedules are provided in the IRS-distributed instructions.

IRS 1120-IC-DISC Related Forms:

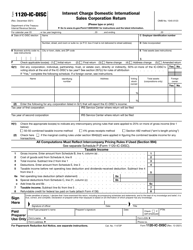

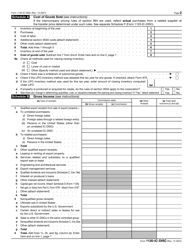

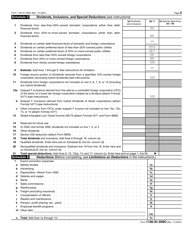

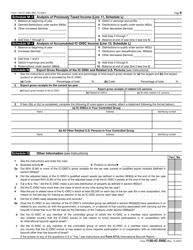

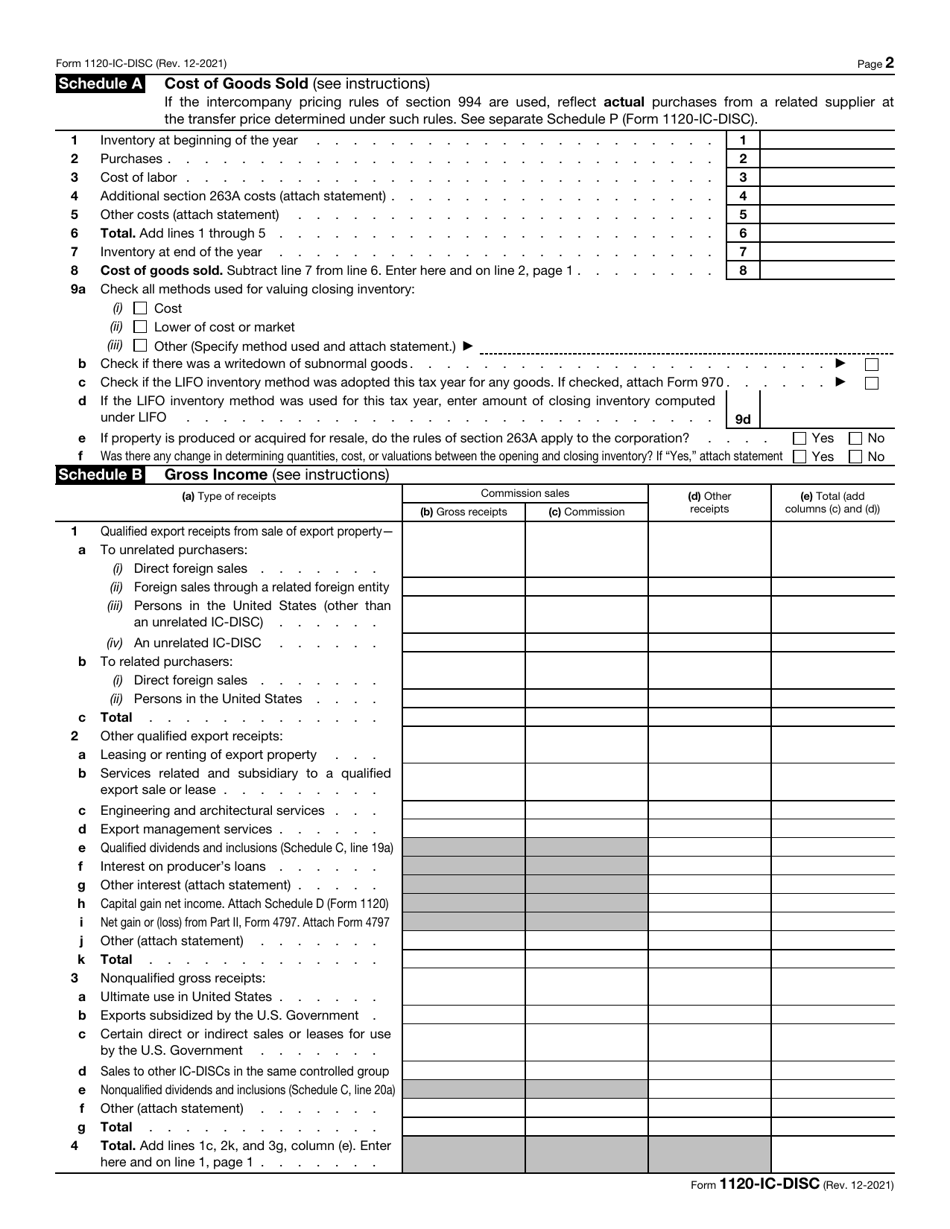

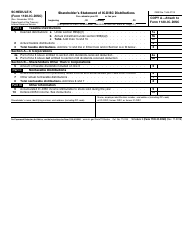

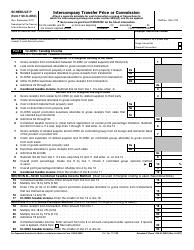

The form includes the following schedules:

- Schedule K, Shareholder's Statement of IC-DISC Distributions;

- Schedule P, Intercompany Transfer Price or Commission;

- Schedule Q, Borrower's Certificate of Compliance with the Rules for Producer's Loans.

The following forms are related to the IRS Form 1120-IC-DISC:

- Form 1120, U.S. Corporation Income Tax Return. Complete this form to report the income, losses, credits, deductions, gains and to figure your tax liability. The document is completed by domestic corporations;

- Form 720, Quarterly Federal Excise Tax Return. Fill out this form and attachments to report your liability by IRS number and to pay the listed taxes;

- Form 945, Annual Return of Withheld Federal Income Tax. Use this document to provide information about federal income tax withheld from nonpayroll payments. Nonpayroll payments include: pensions, gambling winnings, military retirement, certain government payments, Indian gaming profits, and payments subject to backup withholdings;

- Form 941, Employer's Quarterly Federal Tax Return. File this form to report income, social security and Medicare taxes withheld from employees' paychecks;

- Form 970, Application to Use LIFO Inventory Method. Submit this document to ask permission to use the last-in, first-out inventory method. The form must be submitted with the income tax return.