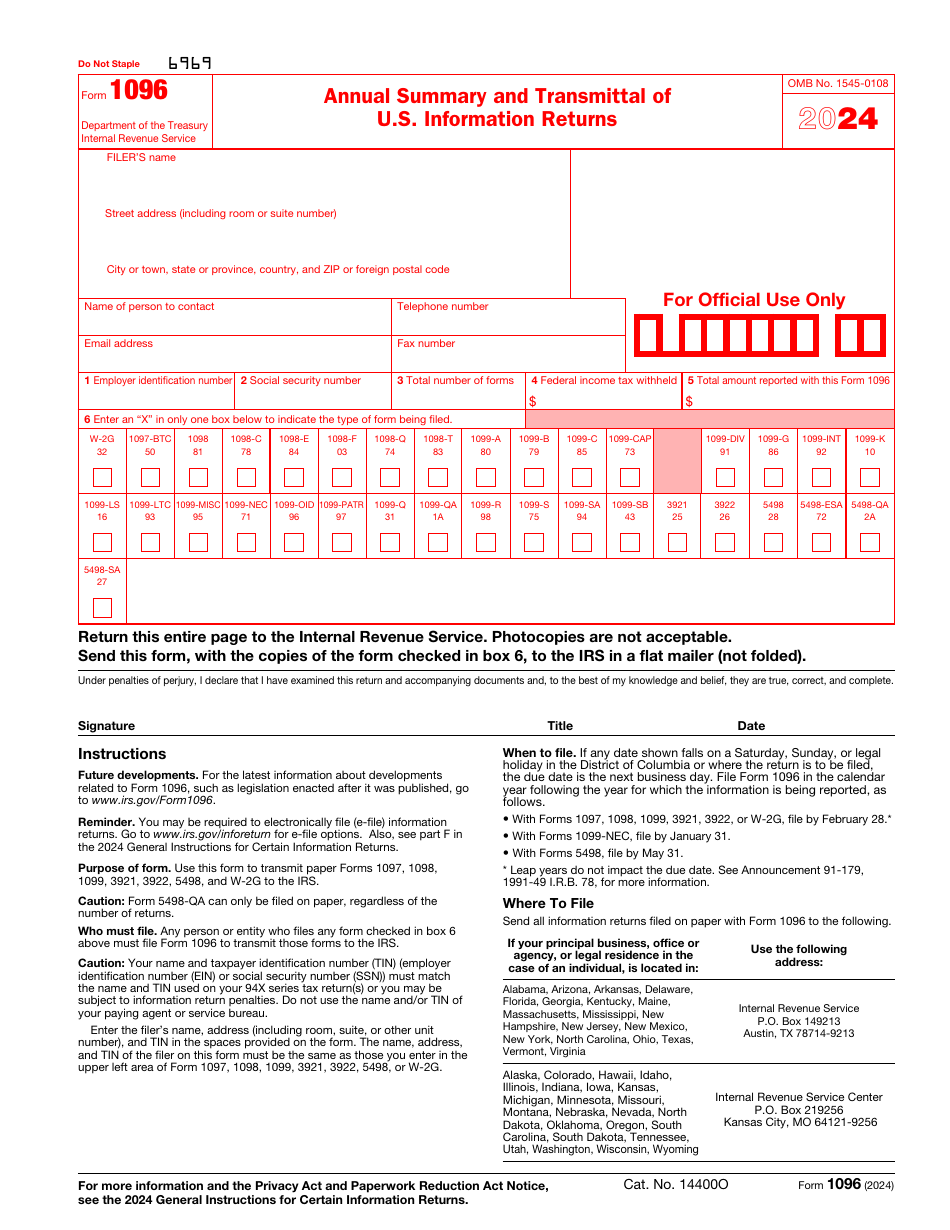

IRS Form 1096 Annual Summary and Transmittal of U.S. Information Returns

What Is IRS Form 1096?

IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns , is a formal instrument used by taxpayers that need to provide additional context for the documentation they file.

Alternate Names:

- Tax Form 1096;

- Federal Form 1096;

- 1096 Transmittal Form.

No matter what type of information return you submit to the authorities, whether you have to elaborate on the payments you have made to your health care provider, clarify the specifics of the stock transfer to an employee, or list the gambling winnings of a certain person, the return has to be filed with a summary of facts you describe in further detail in the main document.

This document was released by the Internal Revenue Service (IRS) in 2024 , rendering older editions of the form outdated. An IRS Form 1096 fillable version is available for download below.

What Is Form 1096 Used For?

Complete and submit the 1096 Tax Form every time you file either of these documents - Forms 1097-BTC, 1098, 1099, 3921, 3922, 5498, and W-2G.

Some of these documents are rather complex which is why you should facilitate the work of fiscal organizations and briefly summarize the details of the form you are sending by confirming the identity of the filer, stating how much tax was paid or is currently due, how large the amount of payment or income was throughout the tax period covered in the documentation, and what type of form you have prepared for the IRS to review. Even if you have to provide another individual or entity with a particular tax document, do not attach this transmittal tool to it - it is mandatory only for submissions sent to tax authorities.

Form 1096 Instructions

Follow these Form 1096 Instructions to properly transmit the information return you completed:

-

Write down your full name and correspondence address. Identify the person fiscal authorities can contact on your behalf in order to discuss the information you shared in the filed paperwork - indicate their name, telephone number, email address, and fax number.

-

State the employer identification number of your entity or social security number and record the total number of forms you are submitting - the latter number refers to the forms, not the pages you will include in your package . If you are a sole proprietor without an employer identification number, add your social security number to the form. Enter the amount of income tax deducted on a federal level as well as the amount of payment you report to the IRS. Check the box to specify what type of form you are sending to tax organs.

-

Certify the instrument - add your title, write down the actual date, and sign the papers . While the person or entity representative required to file the document is typically the one signing it, the certification may be carried out by the agent of the filer as long as the parties have a legally enforceable agreement that lets the agent act on behalf of the taxpayer in question.

-

Make sure you do not send black-and-white copies of this form - the document has to be printed out in its original form . If you are obliged to file documents with different form numbers, it is essential to attach a separate Form 1096 to every group of forms. Do not fold or staple any of the sheets - pick an envelope or package that fits the documentation and put Federal Form 1096 in the first of several packages if needed.

-

In case you failed to enclose supplementary forms in the process of filing, you may send them later and add a new Form 1096 that specifies what returns are submitted this time . You do not need to correct the details you previously disclosed on Form 1096. Be careful and ensure the information return and the transmittal form contain the same personal details of the filer. Besides, it is prohibited to submit the paperwork more than once - do it when all the information is collected for proper filing.

When Is Form 1096 Due?

All 1096 Transmittal Forms are supposed to be filed by February 28 of the year that follows the year outlined in the documentation. However, the Form 1096 due date, just like the deadline for a variety of information returns, is different when e-filing takes place - taxpayers are given extra time to prepare their paperwork, and the last day they are allowed to submit the return with a transmittal form is April 1. There are two exceptions to a general rule - the due date for IRS Form 1099-SB whether you opt for paper filing or send the form online is January 31. When you submit any of the forms that belong to the 5498 series, the deadline is May 31.

Where to Mail Form 1096?

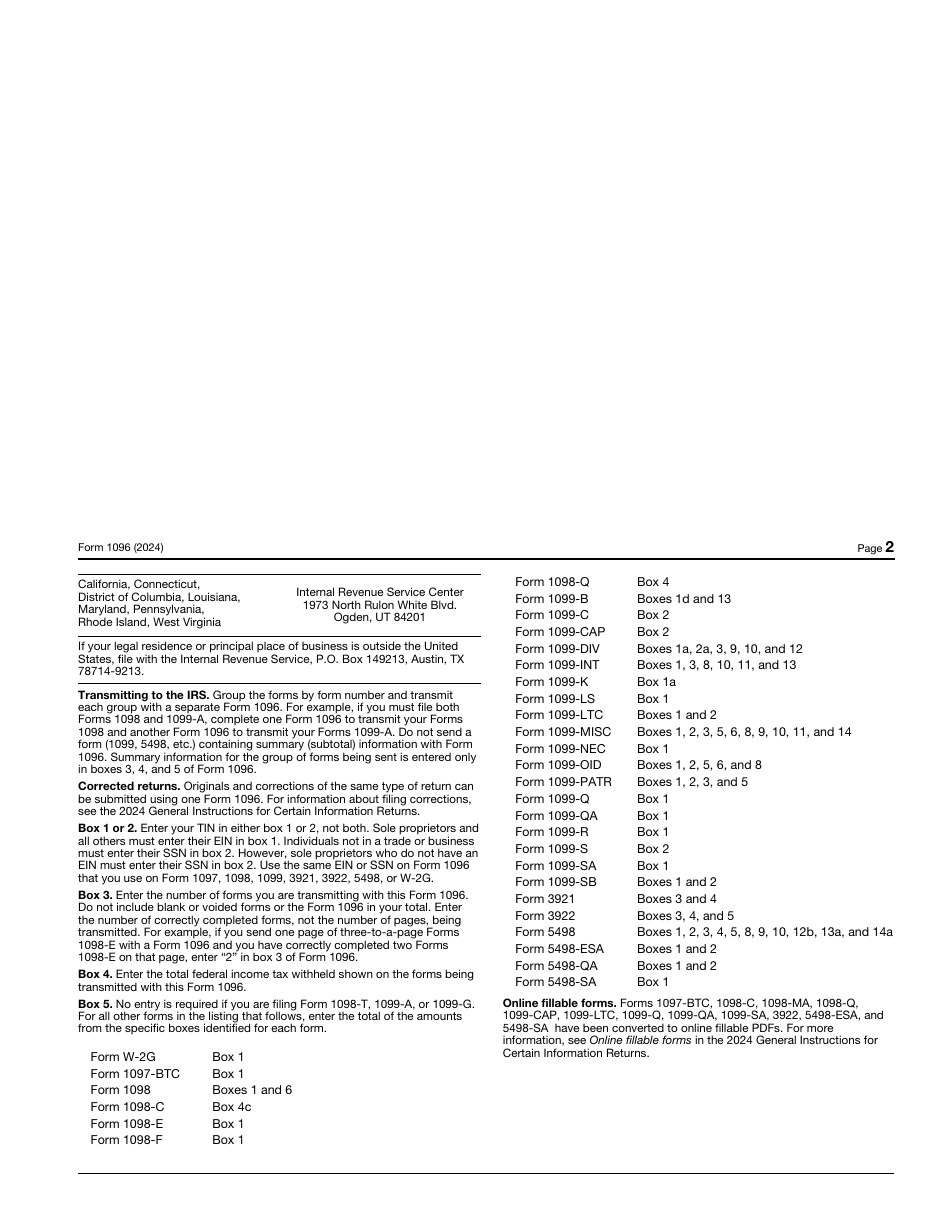

Form 1096 mailing address is based on the location of the filer:

-

If you operate or reside in Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, or Virginia, send the paperwork to the IRS, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 . The same address applies to individuals and businesses located outside of the United States.

-

Submit the form to the Department of the Treasury, IRS Submission Processing Center, P.O. Box 219256, Kansas City, MO 64121-9256 if your location is Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming.

-

Residents of California, Connecticut, the District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, and West Virginia as well as entities whose main office is in one of those states have to mail the instrument to the Department of the Treasury, IRS Submission Processing Center, 1973 North Rulon White Blvd., Ogden, UT 84201 .