2020 Employer's Tax Guide: All You Need to Know About Employer Payroll Taxes

As the owner of a business with an array of employees to manage, it can be hard to keep track of every tax due date and all of the fun that that entails. This Employer Tax Guide lists all of the forms that an employer might need to file in 2020 and provides a straightforward overview of all of the taxes that are due in each quarter over the course of the year. All of the tax due dates are set by the Internal Revenue Service (IRS). It is also good to keep in mind that if any of the tax deadlines fall on a national holiday or weekend that the due date will be moved to the next applicable business day.

What Are Employer Payroll Taxes?

Employer Payroll Taxes are taxes paid by employers and employees based on their working salary amount. Employees generally pay this tax by a standard payroll deduction, while employers pay the remaining balance of this tax directly to the IRS.

How to Calculate Employer Payroll Taxes?

Calculating payroll taxes doesn’t have to be a messy situation. The IRS provides employers with several forms to help with this process:

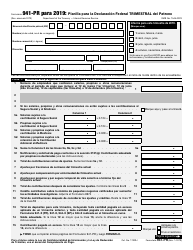

- Form 941, Employer's Quarterly Federal Tax Return;

- Form 941-PR in Puerto Rican Spanish.

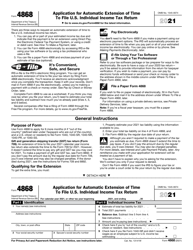

These quarterly forms must be filed by April 30th, July 31st, October 31st, and January 31st. You will have 10 additional calendar days to file a return if you fail to do so on time if you file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

First Quarter Tax Payments - January, February, and March

|

January 15th, 2020 |

Due date applies to:

|

|

January 31st, 2020 |

○ Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return; ○ Form 941, Employer's Quarterly Federal Tax Return; ○ Form 941-SS, Employer's Quarterly Federal Tax Return; ○ Form 943, Employer's Annual Federal Tax Return for Agricultural Employees and Form 943-PR (in Puerto Rican Spanish); ○ Form 944, Employer's Annual Federal Tax Return and Form 944 (SP) (in Spanish); ○ Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund and Form 944-X (SP) (in Spanish); ○ Form 945, Annual Return of Withheld Federal Income Tax. If the tax that you are required to report on these forms is paid in full and on time, employers will have an additional length of time to file their taxes. This will shift the due date to the 10th day of the second month that follows the end of the return period. |

| February 10th, 2020 |

○ File Form 941 for the fourth quarter of 2019; ○ Certain small business employers should file Form 944 to report withheld income tax, social security, and Medicare taxes for 2019; ○ Farm employers must file Form 943 to report withheld income tax, social security, and Medicare taxes for 2019; ○ Concerning the federal unemployment tax, employers should file Form 940 for 2019. |

| February 19th, 2020 |

All employers must begin withholding income tax from the salary of any employee who has claimed an exemption from withholding in 2019 but didn't give the employer Form W-4 or Form W-4(SP), its Spanish version, to continue the exemption this year. |

| February 28th, 2020 |

If any of these forms are being filed electronically with the IRS, the due date is pushed back until March 31st. |

| March 31st, 2020 |

This is the due date for any applicable forms that are filed electronically. These dates only apply to electronically-filed forms. The forms include: ○ Form W-2G, Certain Gambling Winnings (paper version due February 28th); ○ Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips (paper version due March 2nd); ○ Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns (paper version due February 28th); ○ Form 1095-C, Employer-Provided Health Insurance Offer and Coverage (paper version due February 28th); ○ Form 1094-B, Transmittal of Health Coverage Information Returns (paper version due February 28th); ○ Form 1095-B, Health Coverage (paper version due February 28th). |

Second Quarter Tax Payments - April, May, and June

| April 15th, 2020 |

If you are a Household employer file Schedule H (Form 1040 or Form 1040-SR) if you paid cash wages of $2,100 or more to a household employee in 2019. |

| April 30th, 2020 |

File Form 941 for the first quarter of 2020. If taxes for this quarter were deposited in a timely and proper manner you have until May 11th to file the return. |

| May 11th, 2020 |

Final due date to file Form 941 for the first quarter of 2020. This due date applies only if you deposited the tax for the quarter timely, properly, and in full. |

Third Quarter Tax Payments - July, August, and September

| July 31st, 2020 |

File Form 941 for the second quarter of 2020. If your tax liability is less than $2,500, it is possible to pay your taxes due in full with a timely filed return. If you deposited the tax you owe for the quarter in a timely and proper manner, employers have until August 10th to file the return. For any employers that maintain an employee benefit plan, such as profit-sharing, stock bonus plan or a pension file Form 5500 or Form 5500-EZ for 2019 by this date. If you are an employer which uses a fiscal year as your tax calendar, file the form by the last day of the 7th month after the plan year has ended. |

| August 10th, 2020 |

Final due date to file Form 941 for the second quarter of 2020 if taxes for that quarter were deposited in a timely and proper manner. |

Fourth Quarter Tax Payments - October, November, and December

As November rolls around, employers should encourage any applicable employees to fill out a new Form W-4 or Form W-4(SP) for 2020 if they experienced any personal or financial changes (for example, changes to filing status, number of jobs, other income, deductions, or credits).

| November 2nd, 2020 |

File Form 941 for the third quarter of 2020. If taxes for this quarter were deposited in a timely and proper manner you have until November 10th to file the return. |

| November 10th, 2020 |

Final due date to file Form 941 for the third quarter of 2020 if taxes for that quarter were deposited in a timely and proper manner. |

2020 Tax Deadlines for Individuals

Personal tax due dates can change year to year so as an American taxpayer it’s important to follow the IRS-given deadlines to avoid any penalties or late filing fees. Check out our individual tax guide to get all of the key information on critical tax due dates for 2020 and find out everything you need to know.