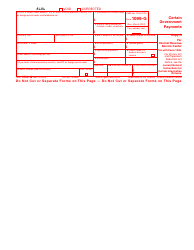

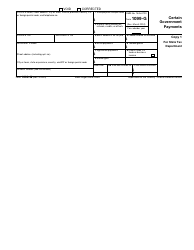

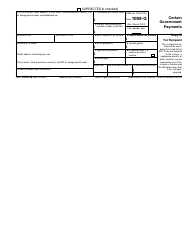

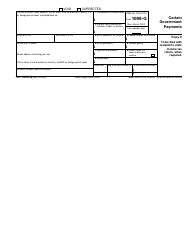

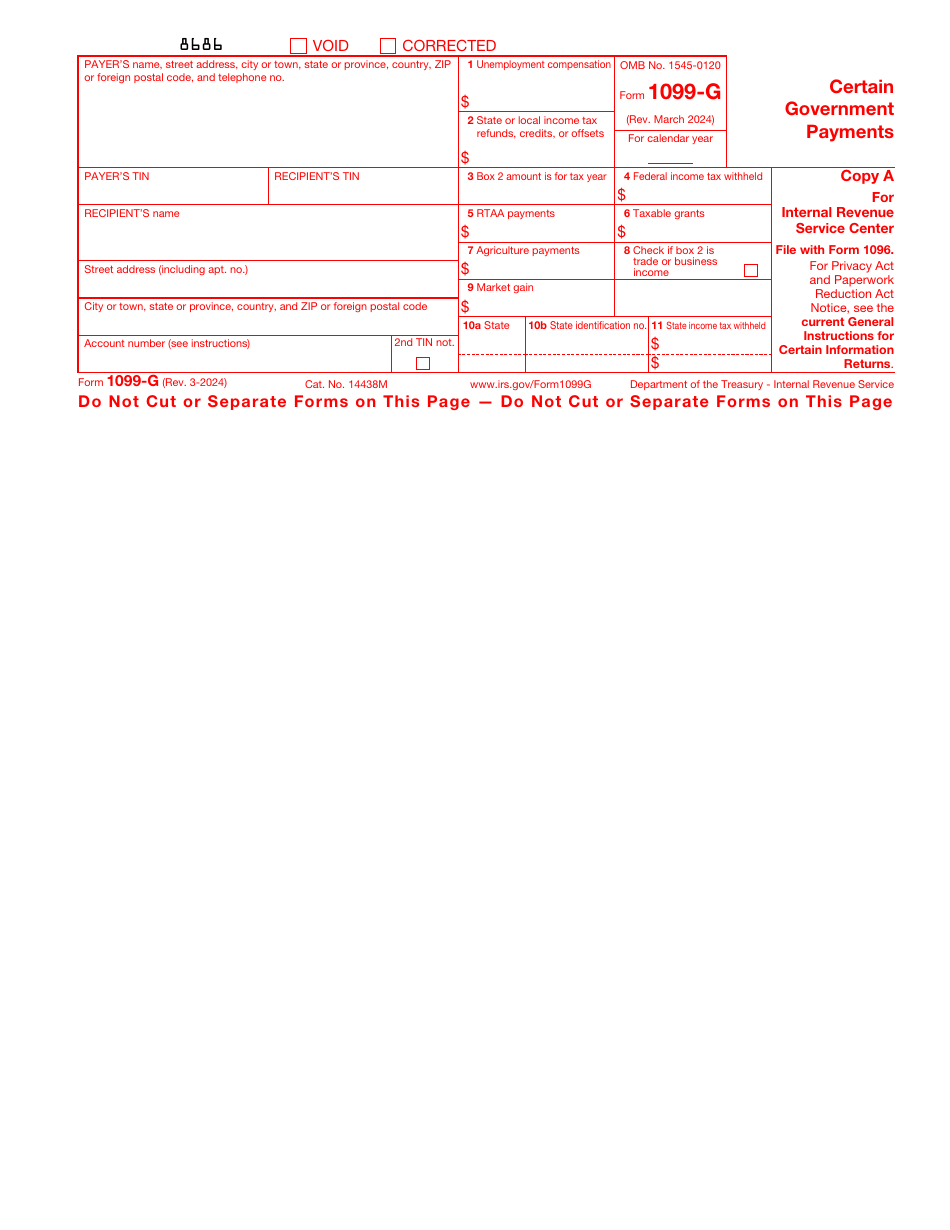

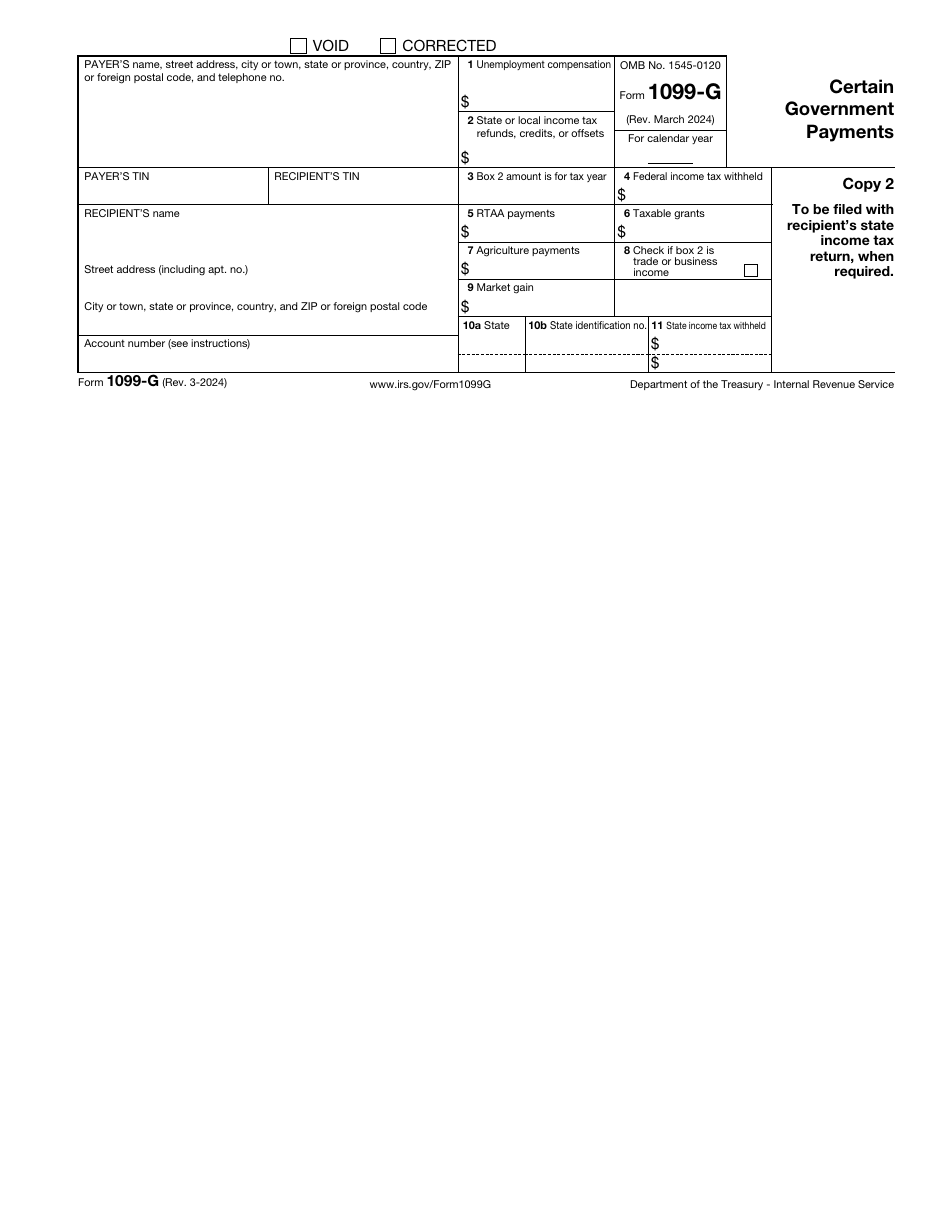

IRS Form 1099-G Certain Government Payments

What Is Form 1099-G?

IRS Form 1099-G, Certain Government Payments , is a legal document completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS) , state tax department, and taxpayers (recipients) if the following payments were made:

- State and local income tax credits, taxable grants, refunds, and offsets;

- Unemployment compensation or reemployment trade adjustment assistance (RTAA) payments;

- Agricultural payments.

This document, also known as the Unemployment Tax Form , was released by the IRS. This version of the form was issued in 2024 and should be used to file taxes for the previous year.

How to Get a Copy of Form 1099-G?

A fillable 1099-G Form is available for download below.

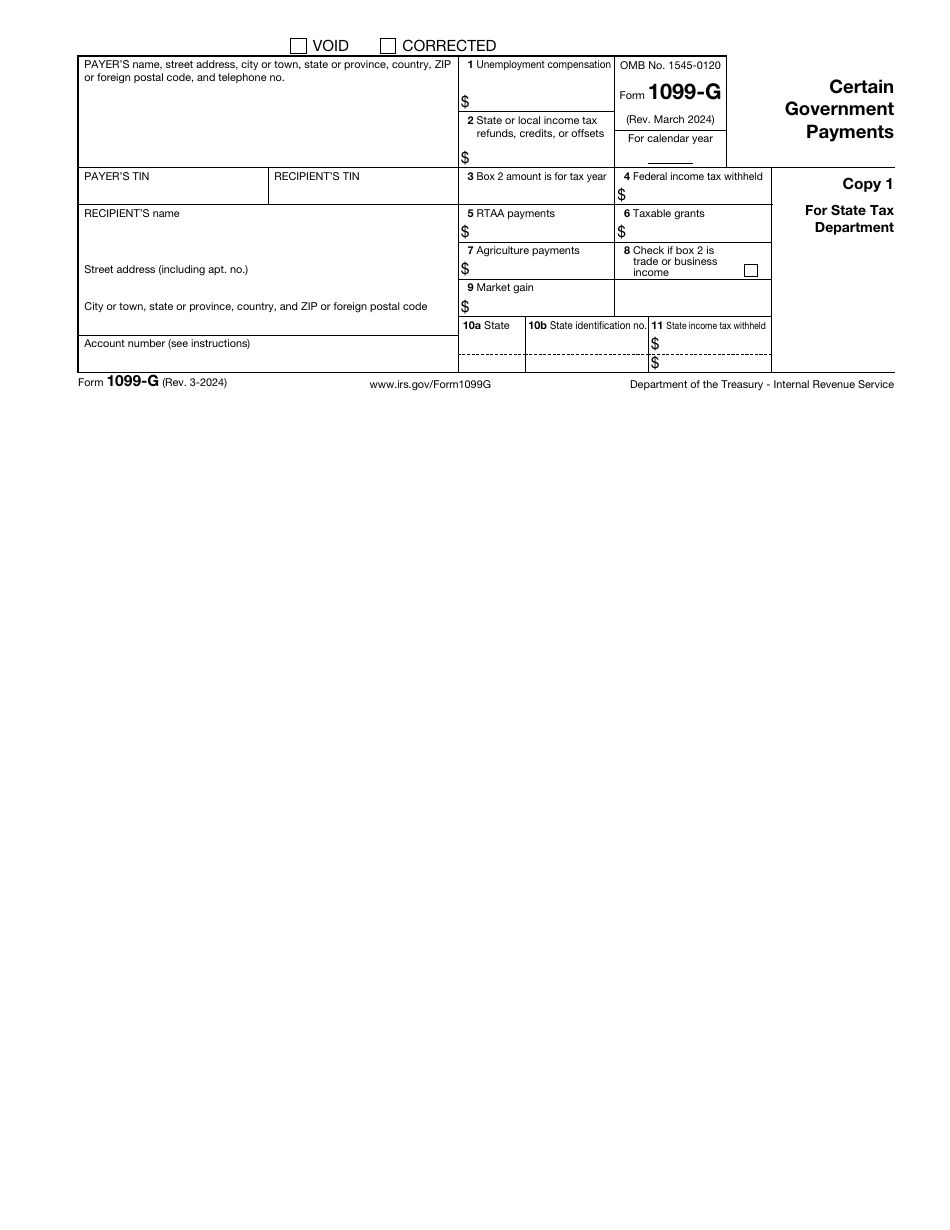

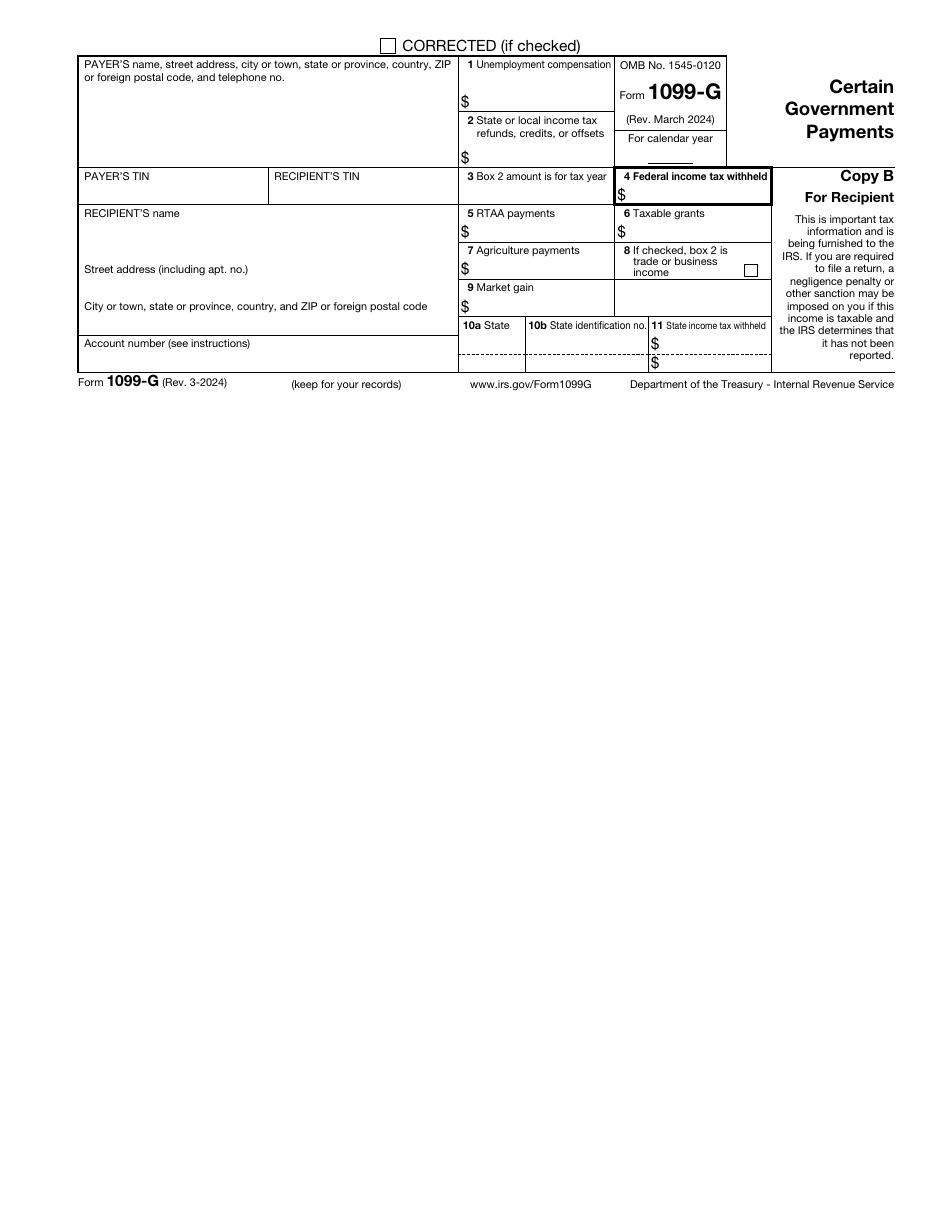

It includes several pages, and each of them serves its own purpose: Copy A is a sample and cannot be filed with the IRS, Copy 1 is sent to the state tax department if it is required that the government unit submits a paper copy of the form, Copy B is mailed to the recipient of the refund or payment for their records, Copy 2 is submitted with the recipient's income tax return, Copy C is retained by the government unit.

IRS Form 1099-G Instructions

Provide the following information in tax form 1099-G:

- State the payer's full name, address, telephone number, and Taxpayer Identification Number (TIN).

- Indicate the recipient's name, address, and TIN. If you have multiple accounts for one recipient, add the appropriate account number. If the IRS notified you twice within three years that the taxpayer provided an incorrect TIN, write X in the 2nd TIN Not. box.

- Record payments of $10 and more in unemployment compensation.

- Report local and state income tax credits, refunds, and offsets of $10 and more you made to the recipient. If they are for any other tax year than 2019, enter the appropriate year in the next box. If this amount applies exclusively to income from a business or trade, write X in box 8.

- Indicate backup and voluntary withholding on federal income tax.

- Enter the RTAA payments of $600 and more that you paid to eligible individuals.

- Record the amount of taxable grants administered by federal, state, local programs, and an Indian tribal government.

- State the United States Department of Agriculture (USDA) agricultural payments made during the year.

- Enter the market gain associated with the repayment of a Commodity Credit Corporation (CCC) loan.

- If you need to submit a copy of the form to the state tax department, write down the name of the state, payer's state identification number, and the amount of withheld state income tax.

1099-9 Related Forms:

- IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, is completed by employers who report the FUTA tax payments made during the tax year;

- IRS Form W-2, Wage and Tax Statement, is required to report the employee's annual wages and the amount of taxes withheld from them. It is different from Form 1099-G because the latter includes withholding on unemployment compensation, CCC loans, and crop disaster payments and you are not required to submit this information to the IRS;

- IRS Form 1040, Individual Income Tax Return, is used by U.S. taxpayers to submit their annual income tax return to the IRS. If you need to report unemployment compensation from the IRS Form 1099-G, show the taxable amount as other income and add it to Schedule 1 on line 7;

- IRS Form W-4V, Voluntary Withholding Request, is filled out by the taxpayer who receives the government payments (including unemployment compensation) and wishes to ask the payer to withhold federal taxes.