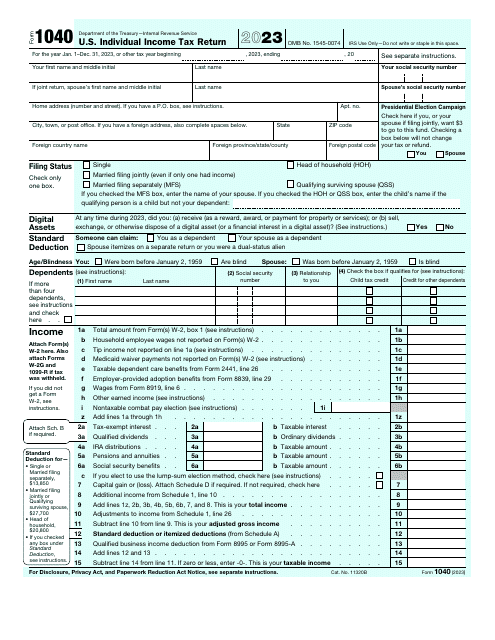

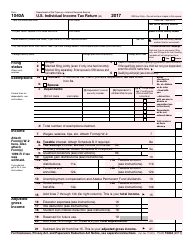

IRS Form 1040 U.S. Individual Income Tax Return

What Is IRS Form 1040?

IRS Form 1040, U.S. Individual Income Tax Return , is a formal document completed by taxpayers to report their income and taxes to fiscal authorities. Filed once a year, this tool allows all individuals to follow the tax legislation while the government ascertains no income was hidden and all taxes are paid in full.

Alternate Names:

- Tax Form 1040;

- Federal Form 1040;

- Income Tax Form 1040;

- 1040 Tax Return;

- Individual Income Tax Return Form.

This form was released by the Internal Revenue Service (IRS) in 2023 , making previous editions of the form obsolete. An IRS Form 1040 fillable version is available for download below.

Check out the 1040 Series of forms to see more IRS documents in this series.

What Is a 1040 Form Used For?

Prepare and submit the 1040 Tax Form to let tax organs know how much income you were able to generate during the previous year, calculate the accurate amount of tax you must pay, and confirm your right to receive certain credits and deductions. This is a key document most U.S. citizens and residents are expected to file annually to ensure the IRS they are paying the right amount of taxes and comply with all regulations that apply to people of their status.

What Is the Difference Between Form 1040 and 1040-SR?

There is an income statement similar to Federal Form 1040 - IRS Form 1040-SR, U.S. Tax Return for Seniors. While taxpayers who are 65 years of age and older may prepare Form 1040 if they want to, Form 1040-SR was specifically designed for their convenience and can be used as an alternative - it features larger letters and boxes to let older people complete their paperwork without an issue. Otherwise, the contents of both forms are identical.

IRS Form 1040 Schedules

During the last revision, the form was shortened and redesigned. The redesigned version of the IRS 1040 Form includes a number of new schedules:

-

Schedule 1, Additional Income and Adjustment to Income. Fill out this form to report additional income, like gambling winnings, prize money, capital gains, or unemployment compensation. This schedule also fits to claim deductions, e.g., self-employment tax, educator expenses, or student loan interest deductions.

-

Schedule 2, Additional Taxes. Use this schedule when you have to make an excess advance premium tax credit repayment or to report the sum you owe for the Alternative Minimum Tax.

-

Schedule 3, Non-refundable Credits. Attach this schedule to claim a nonrefundable credit, like an education credit, credit, or general business credit. Do not use it to claim a child tax credit or a credit for other dependents.

-

Schedule 4, Other Taxes. Complete this schedule to report other taxes you need to pay (e.g., household employment taxes, self-employment taxes, qualified retirement plans, and tax-favored accounts).

-

Schedule 5, Other Payments and Refundable Credits. Use it to claim a refundable credit. The refundable credit claimed on this schedule does not include the American opportunity credit, additional child tax credit, and an earned income credit. Besides, you can file this schedule for other payments such as an excess social security tax withheld or the amount paid with an extension to file a request.

-

Schedule 6, Foreign Address and Third-Party Designee. Fill out this schedule to report your foreign address or third-party designee.

The other federal tax Form 1040 Schedules include the following:

-

Schedule A, Itemized Deduction. Fill out this schedule to itemize your deductions;

-

Schedule B, Interest and Ordinary Dividends. Use this schedule to report taxable interests or ordinary dividends over $1,500, including those received as a nominee, financial account in the foreign country, interest from a seller-financed mortgage, interest from a bond, original issue discount (an amount less than indicated on Form 1099-OID), and other similar cases;

-

Schedule C, Profit or Loss from Business (Sole Proprietorship). Submit it to report income or loss from a business you operated, as well as wages and expenses that occurred to you as a statutory employee;

-

Schedule C-EZ, Net Profit from Business (Sole Proprietorship). Fill out this schedule instead of Schedule C if you operated a business as a sole proprietorship with expenses $5,000 or less;

-

Schedule D, Capital Gains and Losses. Use this schedule to report the sale, exchange, or gains from involuntary conversions of capital assets;

-

Schedule E, Supplemental Income and Loss. Attach it when you need to specify income and loss from trusts, royalties, rental real estate, partnership, S corporations, and residual interests in real estate mortgage investment conduit;

-

Schedule EIC, Earned Income Credit. Fill it out to provide the IRS with information about qualifying children;

-

Schedule F, Profit or Loss from Farming. Report income and expenses from a farm;

-

Schedule H, Household Employment Taxes. Use it if you have paid cash wages that were subject to Medicare, social security, or federal unemployment taxes to a household employee;

-

Schedule J, Income Averaging for Farmers and Fishermen. Use it to figure out your average income from farming or fishing over the previous 3 years;

-

Schedule R, Credit for the Elderly or the Disabled. Complete this form to figure out the credit for the disabled or elderly;

-

Schedule SE, Self-Employment Tax. Fill out this schedule to figure the tax you have to pay from self-employment earnings;

-

Schedule 8812, Credits for Qualifying Children and Other Dependents. Document on this form that the child you entered an individual taxpayer identification number for is a United States resident.

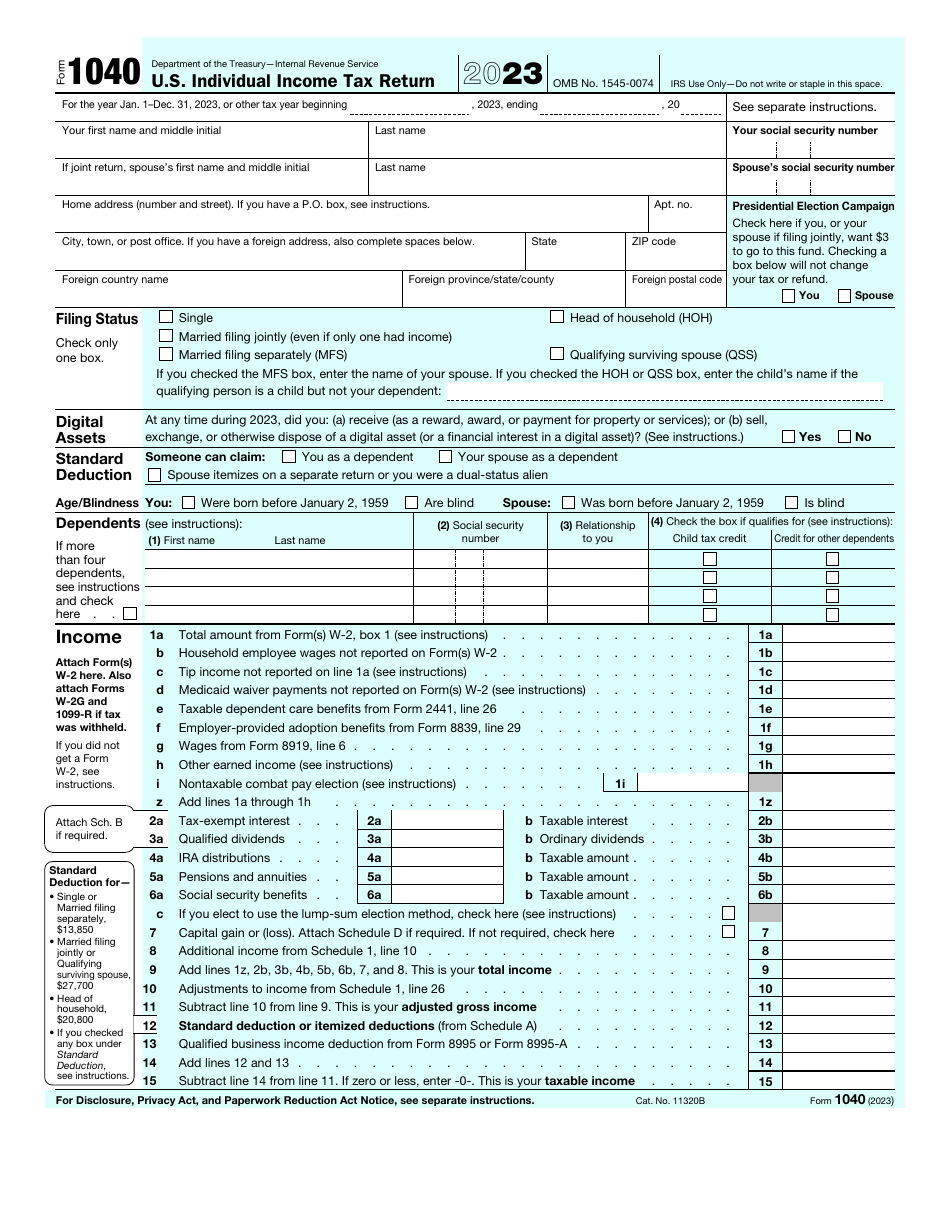

How to Fill Out a 1040 Form?

Follow these IRS Form 1040 Instructions to report your income and taxes to the fiscal authorities:

-

Specify the tax period outlined in the document . Write down your full name, social security number, and correspondence address. If you are filing the statement with your spouse, the form needs to contain their personal information. Check the box if either of you wants to donate to an election campaign of the president and confirm your filing status - record the name of your spouse or child if the guidelines require this detail.

-

Put a tick in the box if you participated in transactions that involved various digital assets over the course of the year . Inform the government about the deduction you qualify for if someone else names you or your spouse as a dependent. Certify your age and blindness in order to qualify for an extra tax deduction. Identify your dependents, explain their relationship to you, and indicate the type of tax credit you are entitled to claim.

-

Provide a summary of your income - include all the types of income you received; wages, benefits, dividends, distributions, annuities, and pensions must be taken into account . Apply adjustments to your income and use the formulas and rates in the document to compute the amount of income subject to tax.

-

Elaborate on the tax you owe . You need to indicate the amounts of tax credits you qualify for and attach supplementary documentation that further proves your claims. It is likely you overpaid your taxes - you have an opportunity to ask the government for a refund. Additionally, clarify the amount of the tax penalty you estimated using guidelines from the form.

-

Authorize another individual to speak on your behalf with the IRS if you want . Certify the document by adding your signature, actual date, and present occupation - your spouse must sign the paperwork too if it is a joint return. In case you hired a tax professional to help you out with the form, they have to identify themselves as well.

When Is IRS Form 1040 Due?

IRS Form 1040 due date is April 15. If you fail to meet the tax deadline, file IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, before the due date or make an electronic payment by the due date. In this case, you will get an automatic 6-month extension. If you do not file your 1040 Tax Return on time, your penalty will be 5% of the amount due for every month of the late return.

Where to Mail Form 1040?

The IRS Form 1040 mailing address depends on the location of the taxpayer:

-

Alabama, Georgia, North Carolina, South Carolina, and Tennessee filers must submit the form to the Department of the Treasury, IRS, Austin, TX 73301-0002 . Documentation with payments has to be sent to the IRS, P.O. Box 1214, Charlotte, NC 28201-1214 .

-

The address for Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, and Wyoming taxpayers is Department of the Treasury, IRS, Ogden, UT 84201-0002 ( IRS, P.O. Box 802501, Cincinnati, OH 45280-2501 if payment is attached).

-

In case you are residing in Arizona or New Mexico, send the form to the Department of the Treasury, IRS, Austin, TX 73301-0002 or IRS, P.O. Box 802501, Cincinnati, OH 45280-2501 if a check or money order is a part of your filing package.

-

People that live in Arkansas and Oklahoma have to submit the paperwork to the Department of the Treasury, IRS, Austin, TX 73301-0002 ( IRS, P.O. Box 931000, Louisville, KY 40293-1000 for statements with money orders and checks).

-

Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, West Virginia, and Wisconsin residents must file the document with the Department of the Treasury, IRS, Kansas City, MO 64999-0002 ; the address is IRS, P.O. Box 931000, Louisville, KY 40293-1000 if a tax payment is made.

-

Those who reside in Florida, Louisiana, Mississippi, and Texas need to send the form to the Department of the Treasury, IRS, Austin, TX 73301-0002 . If you are making a tax payment, the address is IRS, P.O. Box 1214, Charlotte, NC 28201-1214 .

-

Pennsylvania residents are expected to mail their paperwork to the Department of the Treasury, IRS, Kansas City, MO 64999-0002 or IRS, P.O. Box 802501, Cincinnati, OH 45280-2501 if they are planning to enclose a check or money order.

-

If you are currently living abroad, using a military address, submitting IRS Form 2555 or IRS Form 4563, or qualify as a dual-status alien, send the documentation to the Department of the Treasury, IRS, Austin, TX 73301-0215 unless you are making a payment - the address is IRS, P.O. Box 1303, Charlotte, NC 28201-1303 instead.

Not what you need? Check out these related forms: