Do I Need to File a Tax Return? 2020 Filing Requirements Explained

In most cases, Americans try to file taxes to not miss out on important tax refunds or receive late fees as a penalty. But sometimes, especially if the individual has low income or no income at all, the decision to file is more complex. If you are wondering: Do I have to file taxes at all? or How much do I need to make to file taxes? - read our guide to see if you have to file a tax return and learn about the 2020 filing requirements and new standard deductions.

Do I Need to File Taxes at All?

The following categories might question whether filing an annual tax return is worth it:

- Individuals who earn less than the standard deduction. Currently, the amount is $12,200 ($24,400 for married joint filers);

- College students. They do not need to file a tax return if they are listed as dependents on their parents’ returns. If a student earned income above the standard deduction amount, it is required to file a return;

- Retirees. Some retirees have modest income from Social Security benefits, for example, which means they owe nothing to the IRS and do not need to file a tax return. Certain others may have investment withdrawals or taxes due on Social Security – it depends on their investment vehicles and income.

How Much Do I Need to Make to File Taxes?

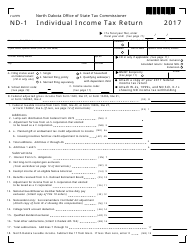

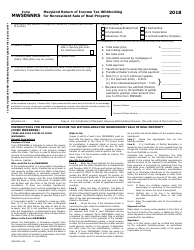

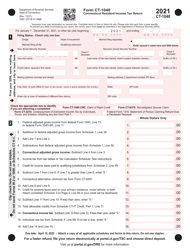

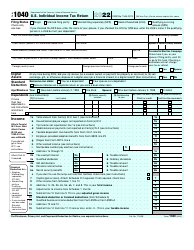

Form 1040, Individual Income Tax Return, is the main document used by taxpayers to file their annual income tax return. Determine how much tax you owe, report your income, and claim tax deductions and tax credits. Form 1040NR, Nonresident Alien Tax Return, is completed by non-resident aliens engaged in business in the U.S. If you are a non-resident alien without dependents, file Form 1040NR-EZ.

Federal Filing Requirements

| Filing status | Your age | You have to file a return if your income is at least |

| Single | Under age 65 | $12,200 |

| 65 and older | $13,850 | |

| Married filing separately | Any age | $5 |

| Married filing jointly | Both spouses under 65 | $24,400 |

| One spouse age 65 and older | $25,700 | |

| Both spouses age 65 and older | $27,000 | |

| Head of household | Under age 65 | $18,350 |

| 65 and older | $20,000 | |

| Widow(er) | Under age 65 | $24,400 |

| 65 and older | $25,700 |

The standard deductions were increased for the 2020 tax season:

| Filing status | Standard deduction amount |

| Single and married filing separately | $12,200 |

| Married filing jointly | $24,400 |

| Head of household | $18,350 |

For example: if you are single, 35 years old, and you have earned $40,000 in 2019, your taxable income is $27,800 ($40,000 - $12,200).

When Do I Need to File Taxes?

If your tax year ends on December 31 because you are a calendar year filer, the last day you can file your tax return, and all complementary forms and documentation, is April 15 of each year. In case you use a fiscal year (the tax year ends on the last day of the month that is not December), you must file your tax return not later than the 15th day of the fourth month after your fiscal year is closed. Although, for most taxpayers April 15, 2020 is the deadline.