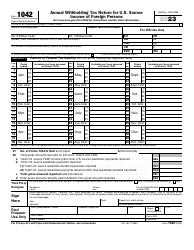

IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

What Is IRS Form 1042?

IRS Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons , is a fiscal document designed to outline the tax deducted from the income of various foreign persons.

Alternate Name:

- Tax Form 1042.

If any tax was deducted from the income of a nonresident alien or corporation, partnership, trust, or estate that operates in a foreign country, it is crucial to inform the authorities about these deductions. Additionally, this form is filed to clarify how much tax was paid on procurement payments on a federal level.

This tax form was issued by the Internal Revenue Service (IRS) in 2023 , rendering older editions obsolete. You can download an IRS Form 1042 fillable version through the link below.

Form 1042 Instructions

The IRS Form 1042 Instructions are as follows:

-

Make sure the form specifies the calendar year and not the fiscal year like many other similar instruments . Check the box if you are completing an amended return - in case you are modifying the documentation due to making errors during the previous filing. You will have to enclose a written explanation that tells the IRS why the amendments are necessary.

-

Write down the name of the withholding agent and state their correspondence address and the employer identification number . Include the status codes of the withholding agent no matter what kind of payment is being reported with the help of the form. If you believe this is the final version of the document you are submitting, put a tick in the appropriate box. Indicate the date the final payment was made if you checked the box in question.

-

Fill out the section of the form with tax liability broken down into sixty time periods - four for every month and twelve overall to showcase the tax liability at the end of every month of the year . Remember that this part of the form contains information about the tax liability and not the tax the withholding agent must deposit.

-

To confirm you are filing Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, or several copies of it, the number must be reflected in the document . There are separate boxes for paper forms and electronic documentation. Reconcile the amounts you report via Form 1042-S with the details you write down in this document and inform the IRS about the total gross income and tax deducted from it.

-

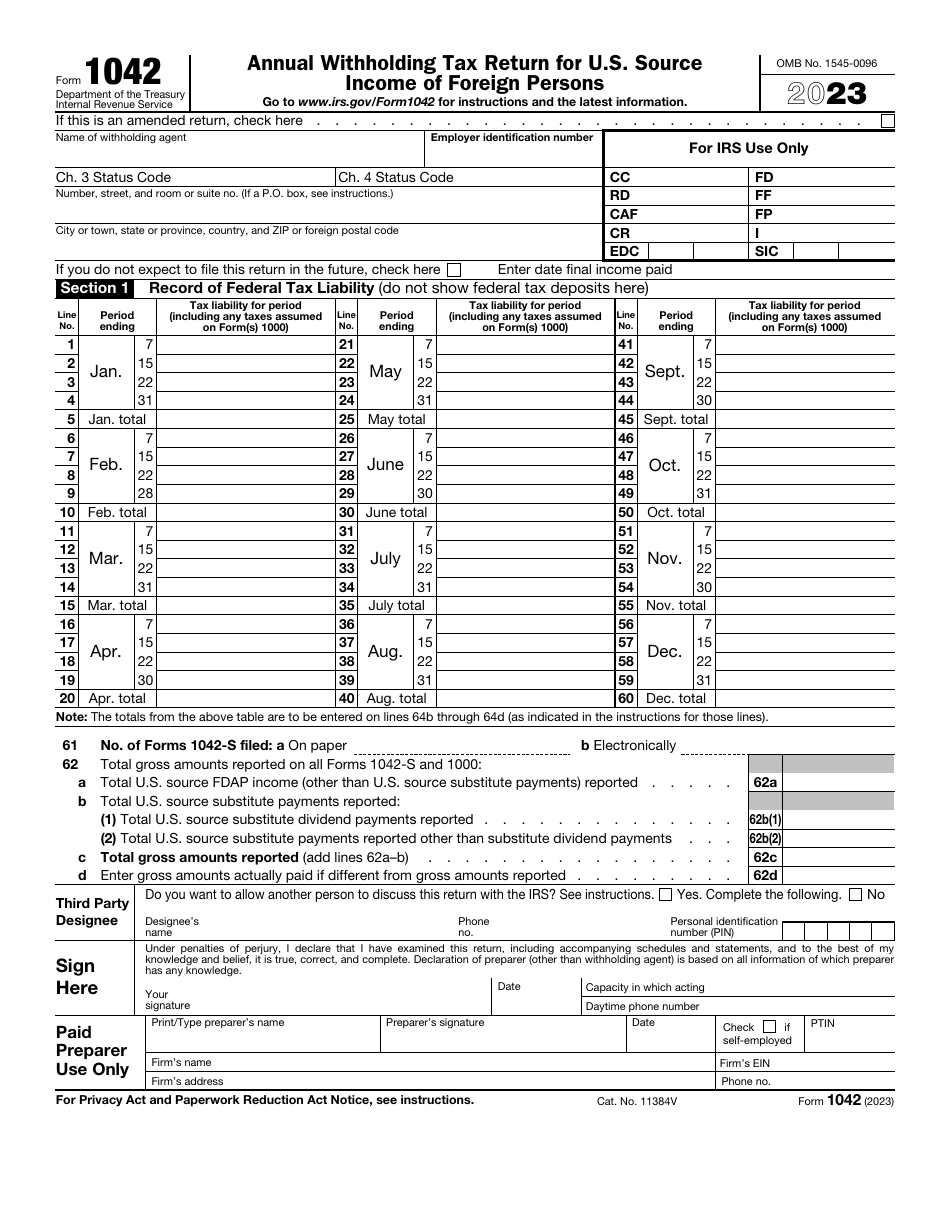

Record the total amount of tax you report as paid or deducted by the withholding agent across all the forms you submit . If there are any adjustments, they must be listed in the form. Calculate the total net tax liability. Ensure you take every type of payment and tax into account including electronic transfers, federal procurement payments, and dividend payments.

-

Reconcile the payment amounts if they came from Fixed, Determinable, Annual, or Periodical income including income that was paid in line with grandfathered obligations and related to businesses and trades in the United States.

-

Check appropriate boxes if the payments were finalized in line with Section 871(m) of the Internal Revenue Code or if any of the payments were formalized by qualified derivatives dealers - in the latter case, you have to identify the dealer.

-

Nominate a third party that is qualified to communicate with the tax authorities on your behalf . It can be an individual, partnership, or organization - as long as the document identifies them properly, the IRS will reach out to them to discuss possible issues with the paperwork. Record the name of the authorized person or company, their telephone number, and the identification number assigned to them. They will be able to receive and submit details relevant to the form but they cannot get refund checks in your name or represent your interest while dealing with the tax organs in any other way - certify a separate power of attorney if you want to expand the authority of your representative.

-

Certify the information put in writing is true and accurate to the best of your knowledge, sign and date the papers, clarify your status (it is permitted to delegate the duty of filing to a member, partner, or employee) and add your telephone number . Alternatively, the documentation can be completed by someone you hired - they have to identify themselves and confirm the instrument was filled out by an individual preparer or a representative of the firm.

When Is Form 1042 Due?

Taxpayers obliged to fill out and submit IRS Form 1042 have to do it by March 15 of the year that follows the calendar year described in the form. Alternatively, the deadline will fall on the next business day if March 15 happens to take place during the weekend or national holiday. It is important to comply with the Form 1042 filing requirements and not to miss the deadline which is why it is advised to request an extension if you need more time to prepare the form and supplementary documentation.

Where to Mail Form 1042?

There are two ways to submit IRS Form 1042 - you can file the paperwork the traditional way or opt for electronic filing. In case the first option is preferable, send the instrument to the Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409 .