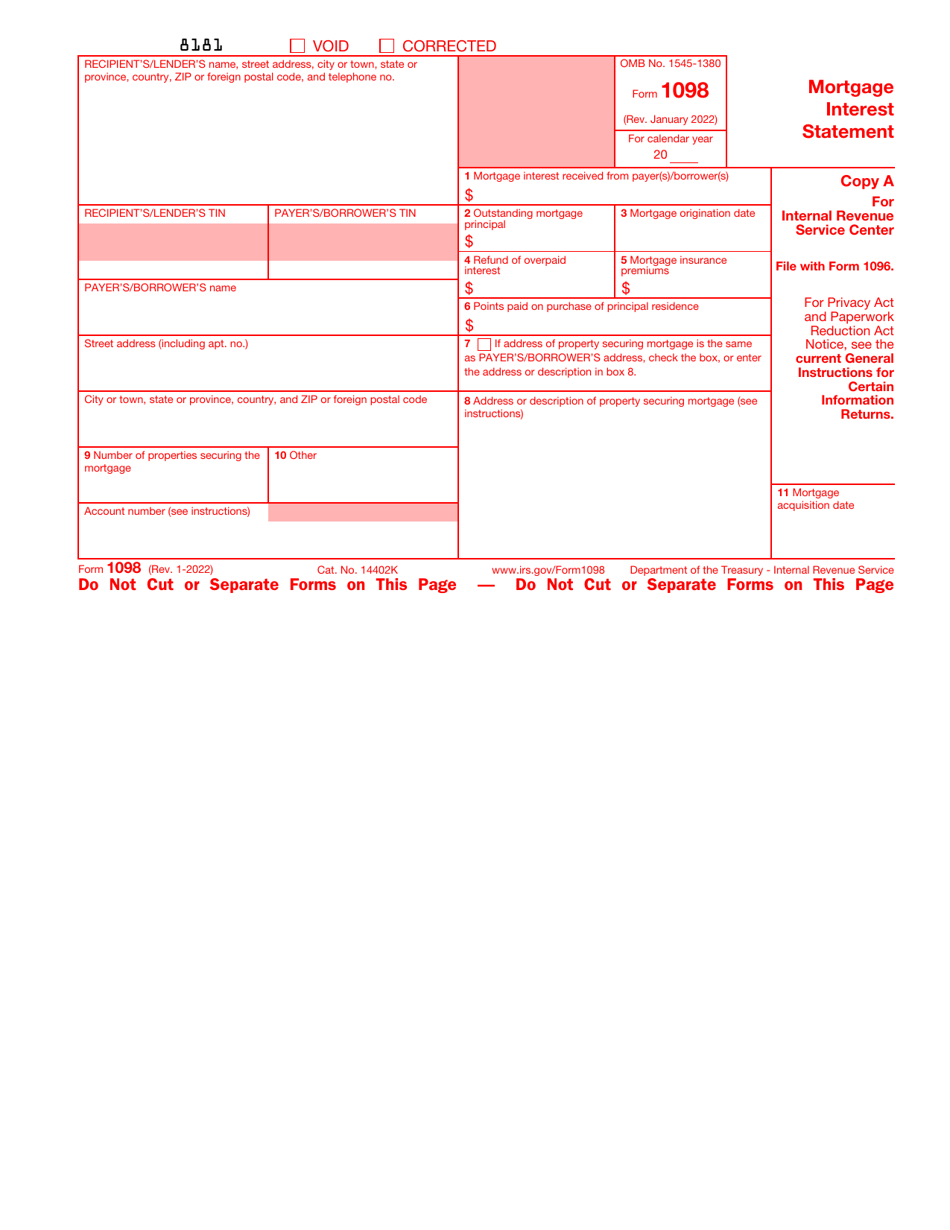

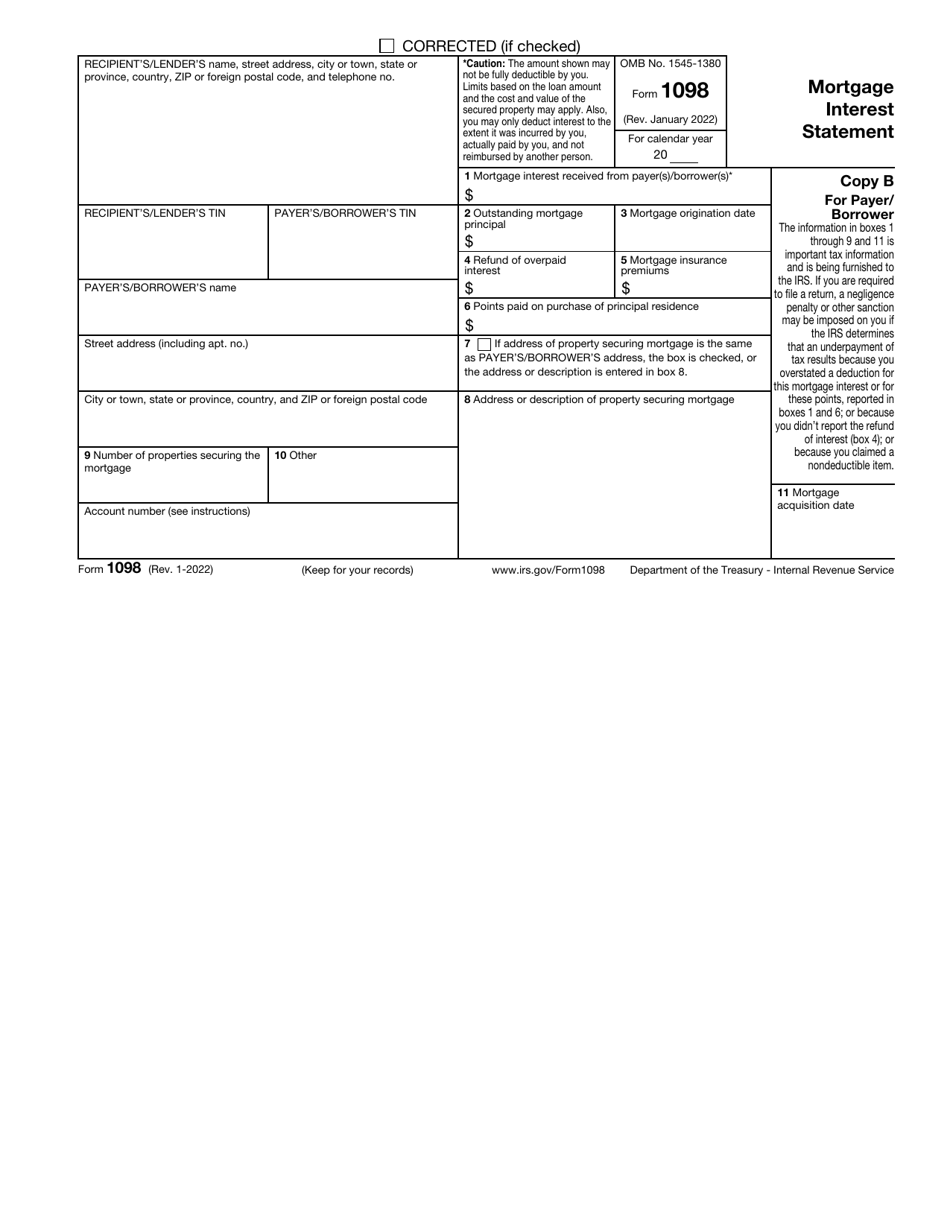

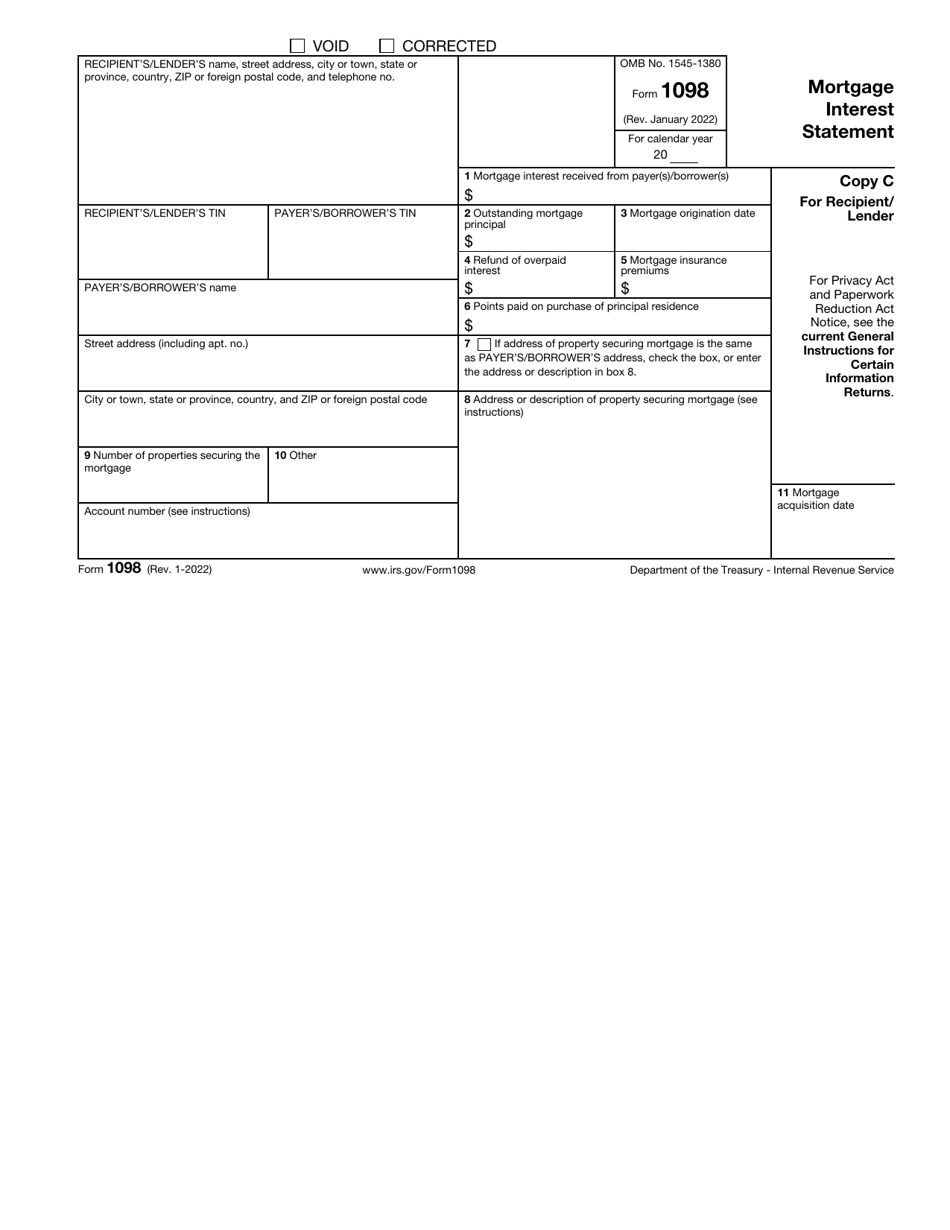

IRS Form 1098 Mortgage Interest Statement

What Is IRS Form 1098?

IRS Form 1098, Mortgage Interest Statement , is a fiscal instrument used by financial institutions and certain corporations that conduct business operations and receive mortgage interest from payers and borrowers during the year.

Alternate Name:

- Tax Form 1098.

It is the duty of the business in question to submit a separate statement elaborating on the mortgage and all related expenses for every mortgage if they retain the property title.

This document was released by the Internal Revenue Service (IRS) on January 1, 2022 , making older editions of the form obsolete. You can find an IRS Form 1098 fillable version through the link below.

Check out the 1098 Series of forms to see more IRS documents in this series.

What Is a 1098 Tax Form Used For?

Taxpayers are expected to fill out and submit the 1098 Tax Form if they represent a business or trade that received a Mortgage Interest Deduction paid on a particular mortgage provided that the amount is $600 or above. The information outlined in the form must be furnished on time to fiscal authorities and payers or borrowers alike.

The IRS will ascertain whether the recipient of the payment or lender properly accounted for the interest income during the Tax Year while the individuals that made the payments will receive reminders about the payments which may affect the tax deductions they claim on their annual income statements and potential penalties that will be imposed if they fail to disclose crucial tax information. The lender or recipient will have to submit a copy of this instrument to the IRS but the individual taxpayers are not obliged to do so - all the details will be replicated on their tax returns in order to qualify for deductions.

Do not fill out Form 1098 if the borrower or payer is an association, corporation, estate, partnership, or trust - anyone who is not an individual except for a sole proprietor.

Form 1098 Instructions

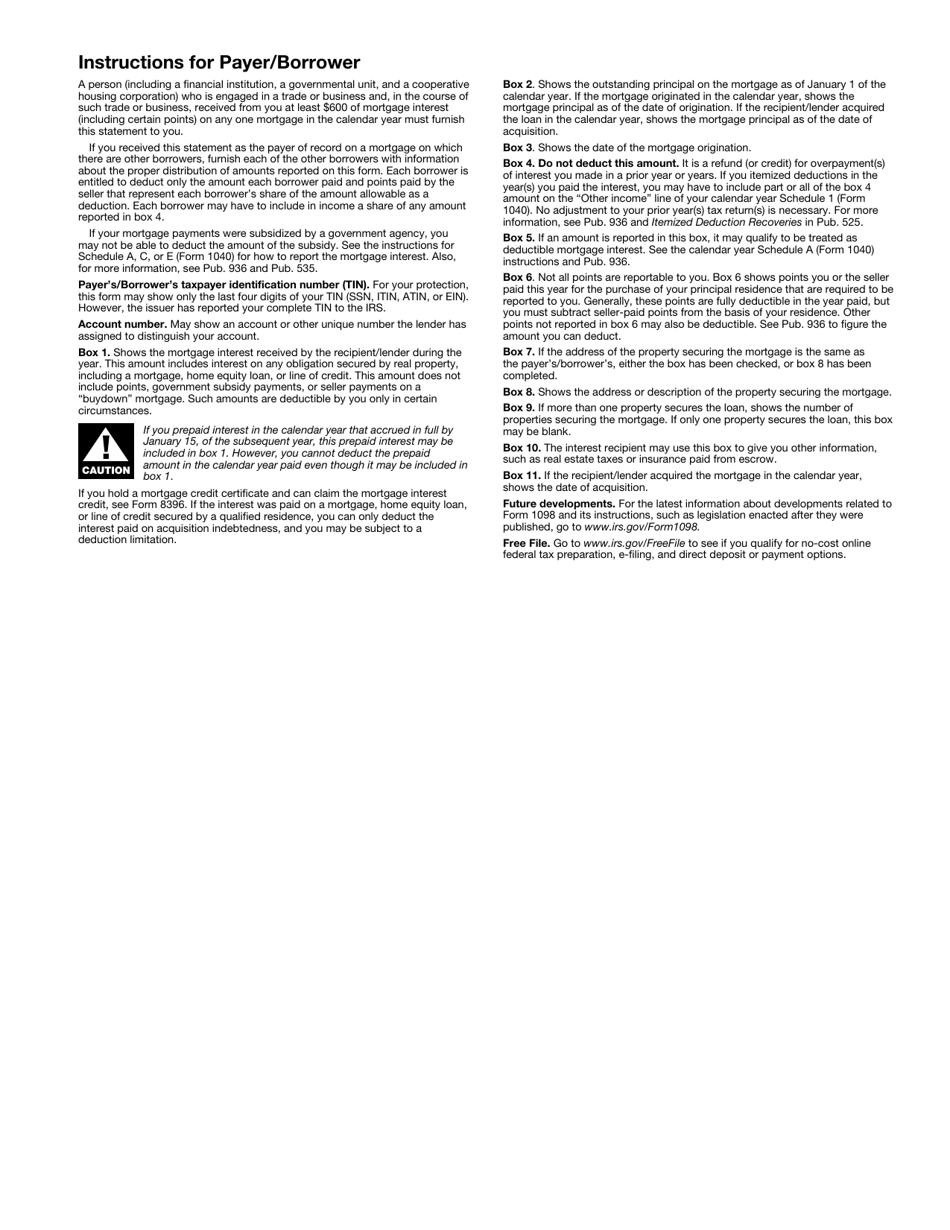

The IRS Form 1098 instructions are as follows:

-

Mark the appropriate box to inform the IRS about your determination to void the form or to correct the details you indicated in the previously filed statement . State what calendar year is described in the document.

-

Add the required details to identify the recipient of the interest or lender - your name, address, and taxpayer identification number . Include the same information to specify who the payer or borrower is. In case you maintain several accounts for the individual in question, you may indicate the number of the account the payment was made through.

-

Enter the amount of Loan Interest you got from the payer or borrower over the course of the calendar year . It is necessary to calculate that amount without taking seller payments, prepaid interest, and government subsidies into account. Record the remaining amount of the mortgage and the date the mortgage originated. Clarify how big was the amount of overpaid interest or refund, state the total amount of premiums that equal or exceed $600, and specify how many points were paid when the purchase of the main residential property of the payer or borrower.

-

Check the box to confirm the address of the real estate used as collateral for the mortgage is the same one where the payer or borrower will receive formal correspondence . Otherwise, you have to add the legal address or detailed description of this property. Specify how many properties serve as collateral for the mortgage and verify the date the mortgage was acquired.

-

Create three identical copies of the document - send one to the individual that paid you, retain the other in your records, and file the last with tax organs . Ensure you attach an IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, to this statement. The due date for submission differs for taxpayers depending on the filing method they choose - businesses that prefer to file paper documentation will have to mail the paperwork by February 28 while electronic filers must do it by April 1, getting extra time to prepare the instrument. Note that the statement you complete for the payer or borrower is supposed to be furnished by January 31 so that they are able to include the information from the form in their tax documentation.

Late Filing penalties shall apply if the lender fails to file a correct information return by the due date without reasonable cause.

IRS 1098 Related Forms:

- IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. It details the donations of automobiles, boats, and airplanes made to charitable organizations, and it is filed and reported by the recipient organization so that a donor can claim a donation tax deduction.

- IRS Form 1098-E, Student Loan Interest Statement. This form reports the interest amount that was paid on qualified student loans during the tax year. These amounts can be deducted by the taxpayer on their income tax return.

- IRS Form 1098-T, Tuition Statement. This statement provides information about qualified tuition and related fees during the tax year. It is filed by the educational institution and can be used to calculate education-related tax deductions and credits. It also reports any grants and scholarships received that may reduce the above-mentioned deductions or credits.

- IRS Form 1098-Q, Qualifying Longevity Annuity Contract. This form is filed by the person who issues a contract intended to be a Qualifying Longevity Annuity Contract (QLAC), so that the annuity holder can claim distribution tax deductions based on the income received on top of the original investment.