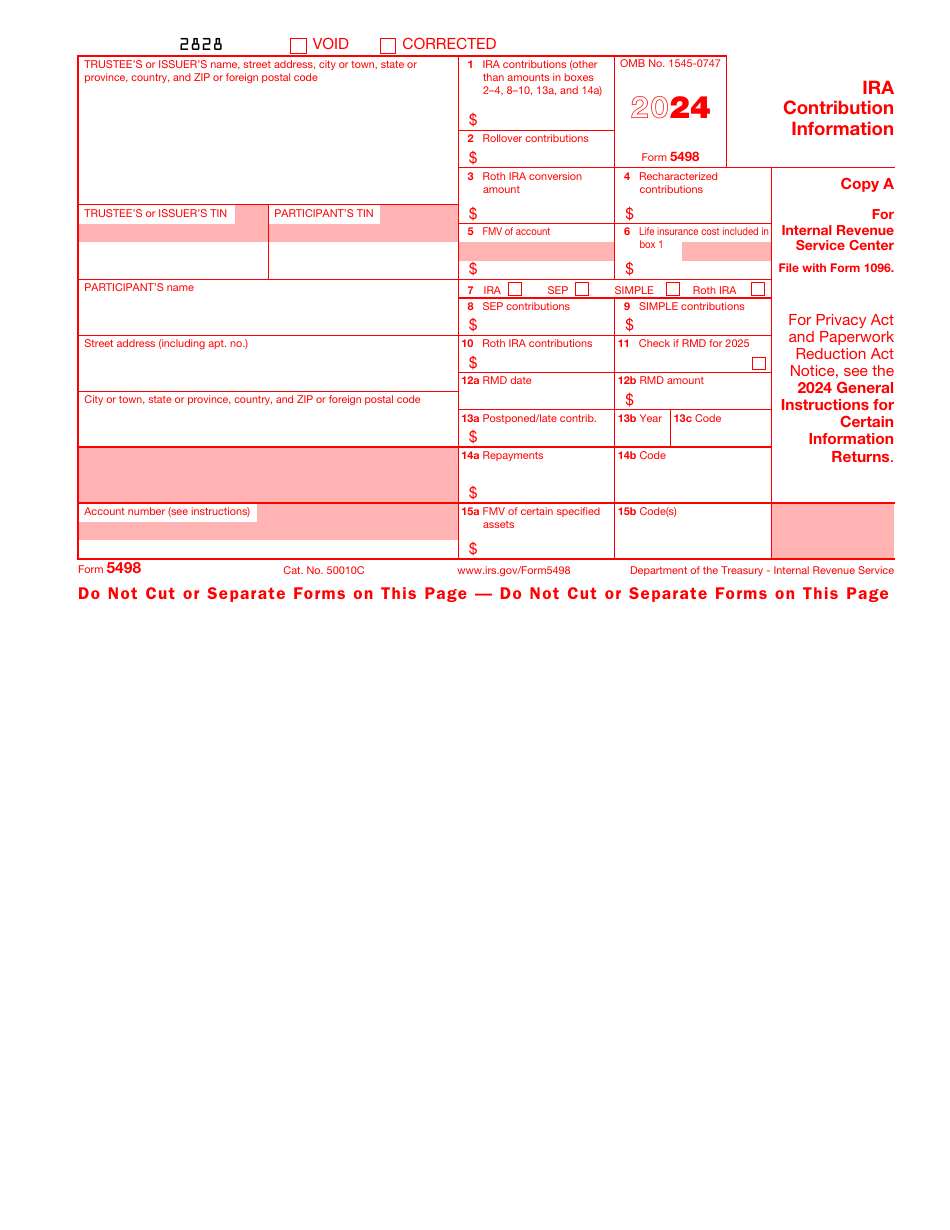

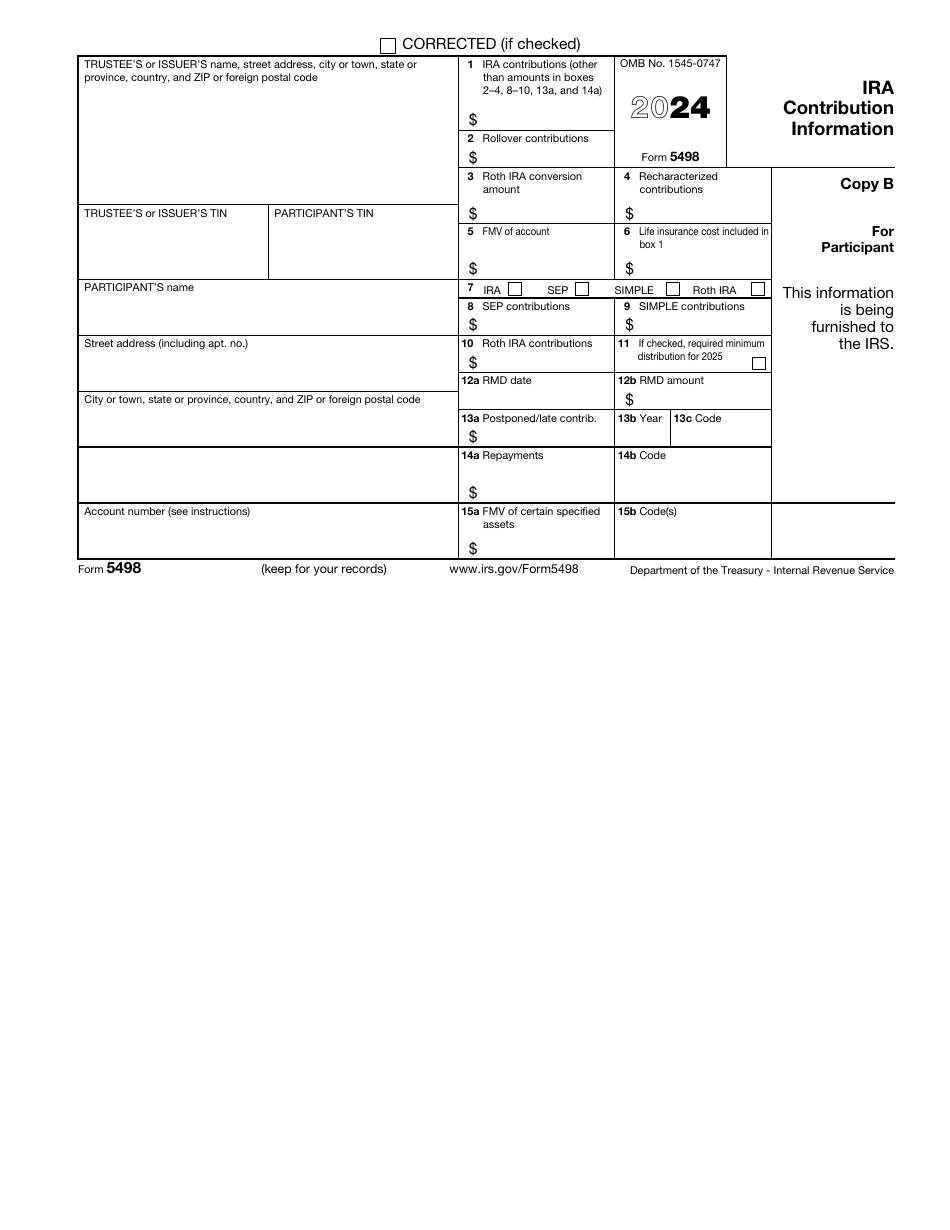

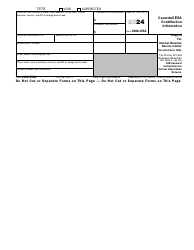

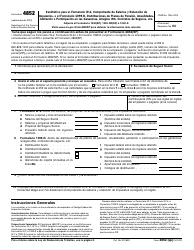

IRS Form 5498 Ira Contribution Information

What Is IRS Form 5498?

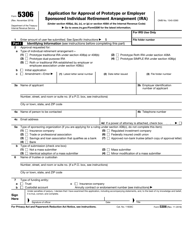

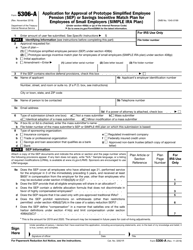

IRS Form 5498, IRA Contribution Information , is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

Alternate Name:

- Tax Form 5498.

Additionally, this instrument lets the contributors know about the market value of all the investments in the account and gives them a chance to increase their tax deductions.

This statement was issued by the Internal Revenue Service (IRS) in 2024 , rendering previous editions outdated. You can download an IRS Form 5498 fillable version via the link below.

What is Form 5498 Used For?

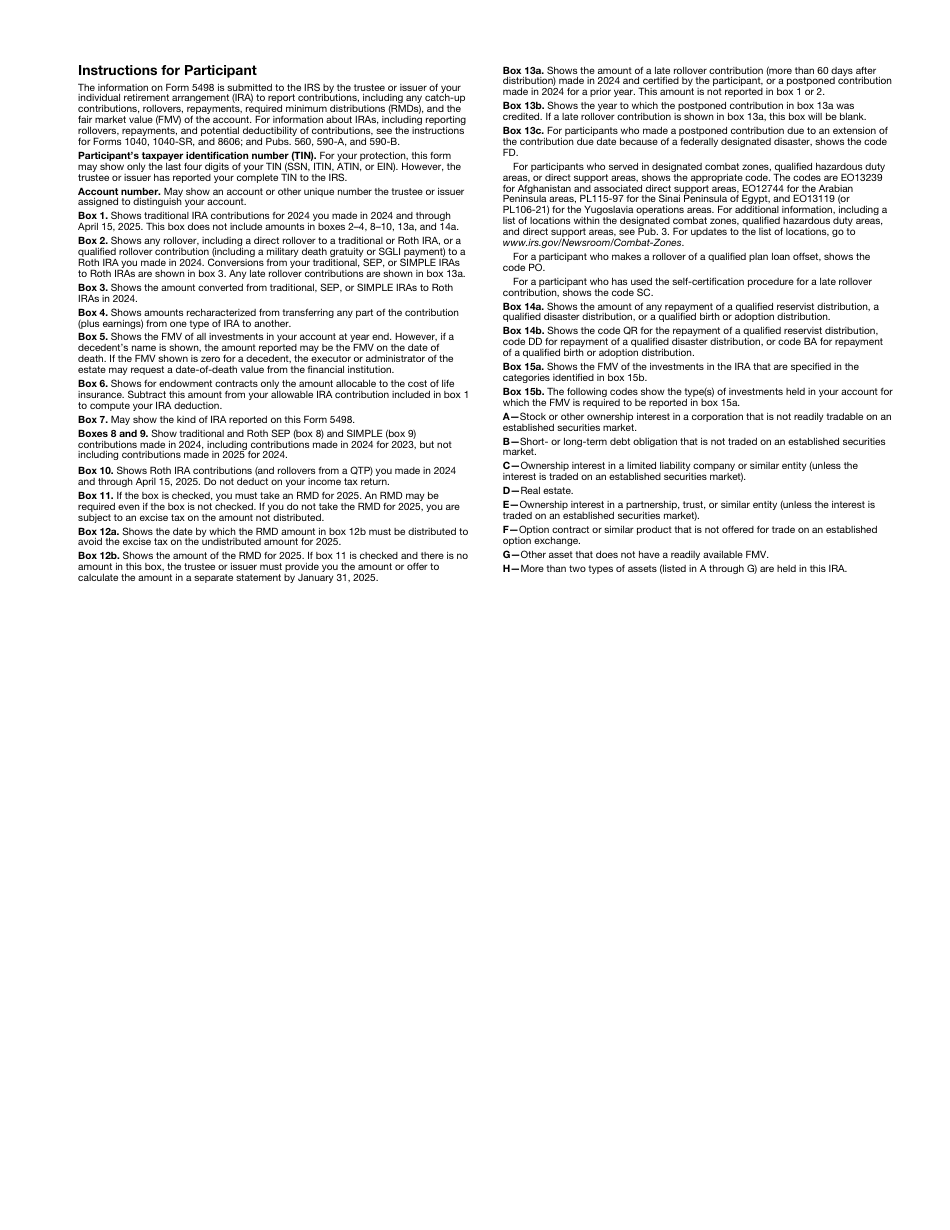

The 5498 Tax Form must be filled out and submitted to the IRS by the issuer or trustee (usually, a bank, insurance provider, or a similar financial institution that works with retirement accounts) if the person whose name is on the account made contributions to their individual retirement arrangement over the course of the calendar year. You will get a copy of this document in your mail after the custodian of that account gathers the information about the contributions and furnishes the details both to you and fiscal authorities. This will allow you to file a claim for a deduction from your contributions to the arrangement - make sure you make a reference to the amounts listed on this form.

Form 5498 Instructions

Follow these Form 5498 instructions to inform the IRS about all people on whose behalf you contributed to individual retirement arrangements:

-

Identify the trustee or issuer by their name, address, and taxpayer identification number . List the same details for the participant. Note that you must specify the number of the account if the recipient has more than one account with your entity.

-

Indicate the contributions to individual retirement arrangements - the amount has to include the money that will be distributed to the life insurance cost as well as extra contributions even in case they were later deducted.

-

State the amount of rollover contributions and the amount that was converted from other arrangements to the Roth arrangement . If any recharacterized contributions took place, the form has to list them.

-

Record the fair market value of the account in question, clarify the cost of the life insurance, and check the box to confirm the type of account you are describing in writing . List various types of contributions in separate fields and put a tick in the box in case the participant is obliged to take the required minimum distribution for the current year. Add the date of this event and the amount of the distribution if necessary.

-

Provide information about the postponed contribution - its amount, the year it was made, and the code that explains the reason behind the postponement . You may refer to the official instructions released by the IRS to find the codes.

-

If any repayments occurred, you have to state the amounts and choose the code that identifies the repayment . Enter the fair market value of investments that belong to certain categories such as real property and option contracts and record the codes to confirm the types of investments.

-

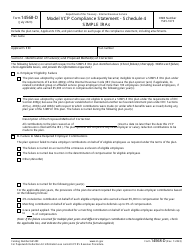

Make three identical copies of Tax Form 5498 - one must be sent to the IRS before the deadline (May 31), the other goes to the recipient, and the third instrument remains in your documentation. When you file the statement the traditional way, it must be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Where to Mail Form 5498?

The Form 5498 mailing address depends on the location of the issuer or trustee:

-

If you are working in Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, or Virginia, send the paperwork to the Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 .

-

Submit the form to the Department of the Treasury, IRS Submission Processing Center, P.O. Box 219256, Kansas City, MO 64121-9256 if you are located in Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming.

-

Issuers and trustees that operate in California, Connecticut, the District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, and West Virginia are obliged to file the document to the Department of the Treasury, IRS Submission Processing Center, 1973 North Rulon White Blvd., Ogden, UT 84201 .

-

In case you are located outside the United States, you can send the documentation to the Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 .

When Is IRS Form 5498 Due?

Form 5498 due date is June 1, filing for the previous year. If this date falls on a weekend day or a legal holiday, the form may be filed on the next business day. It is possible to get an automatic 30-day extension of time to file by completing IRS Form 8809, Application for Extension of Time to File Information Returns, by June 1, and this request may be filed on paper only.

The penalty for failing to timely file the form is $50 per return with no maximum, except if the failure is due to reasonable cause.

IRS 5498 Related Forms

There are three other forms that belong to the same series:

- IRS Form 5498-QA, ABLE Account Contribution Information. This form is filed with the IRS by any State or its agency or instrumentality for reporting the contributions made to an ABLE account for each qualified ABLE account they established and maintained.

- IRS Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information. This is a form filed with the IRS by trustees or custodians of a Health Savings Account (HSA), Medicare Advantage MSA (MA MSA), or Archer Medical Savings Account (Archer MSA) for reporting amounts contributed to these savings accounts and their FMV.

- IRS Form 5498-ESA, Coverdell ESA Contribution Information. This is a form filed with the IRS by trustees or issuers of a Coverdell education savings account (ESA) for each person for whom they maintained any ESA, for reporting amounts of contributions (including rollovers) to a Coverdell ESA.