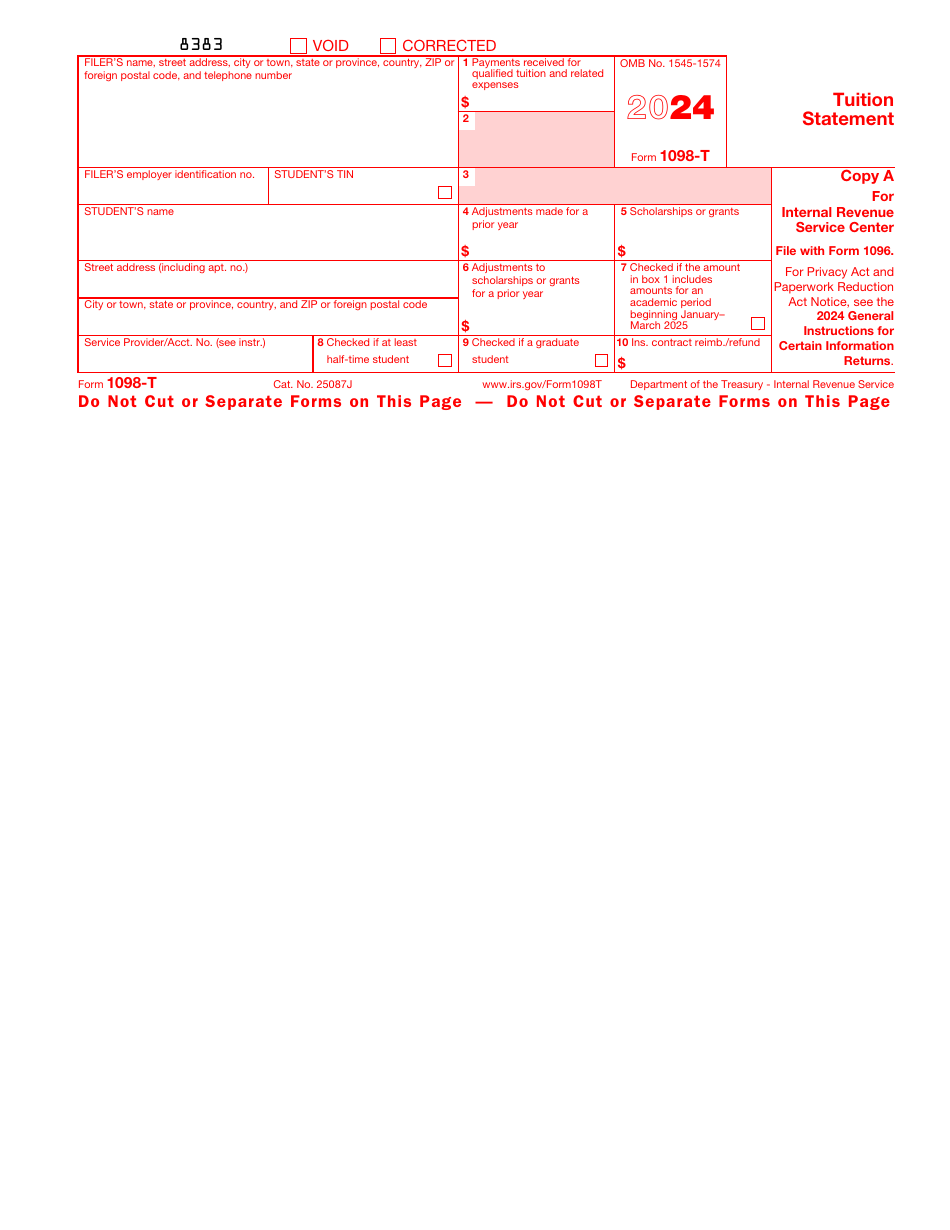

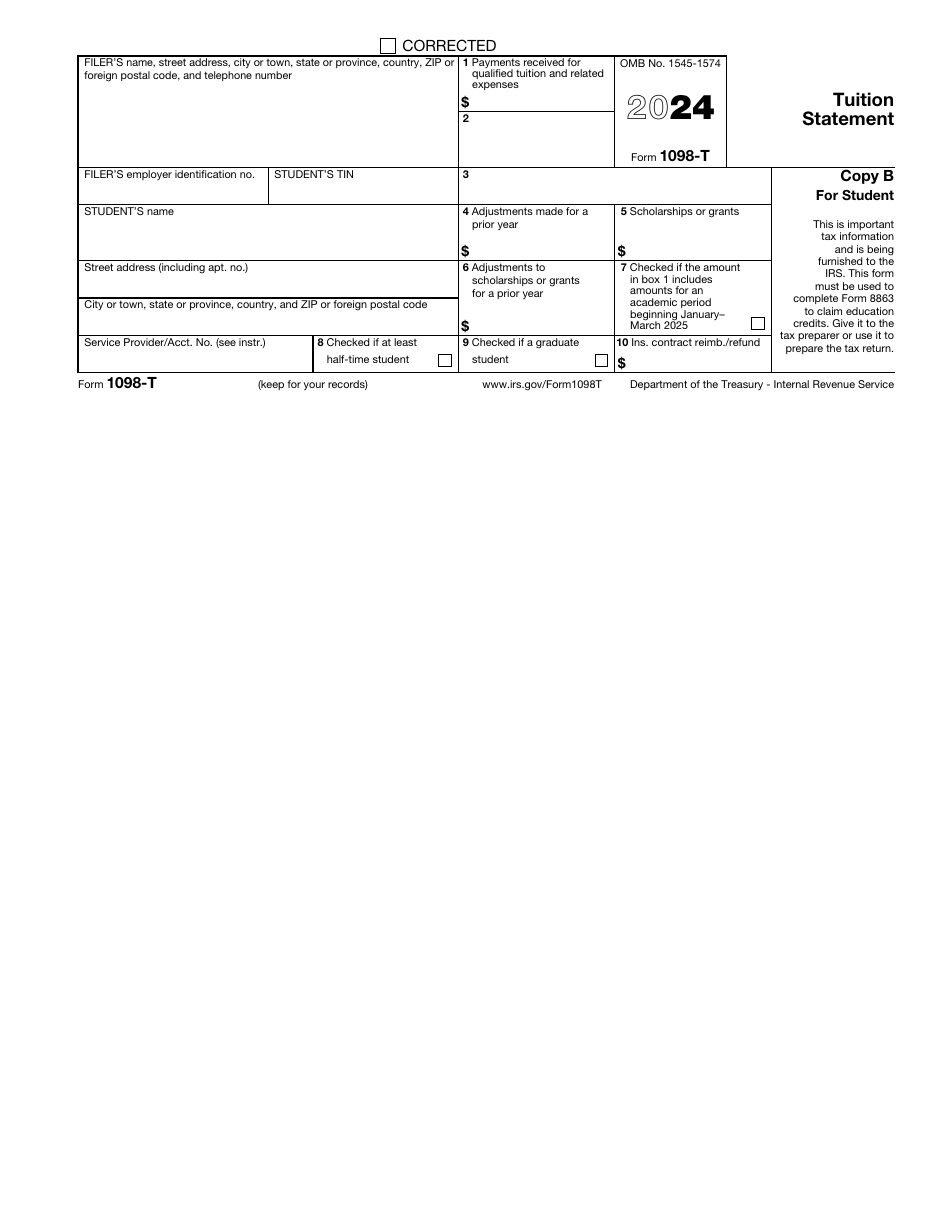

IRS Form 1098-T Tuition Statement

What Is a 1098-T Form?

IRS Form 1098-T, Tuition Statement - also known as the IRS Tuition Statement or the College Tuition Tax Form - is a form that provides information about qualified tuition and related fees paid during the tax year. It is filed with the Internal Revenue Service (IRS) by the educational institution and it can be used by the paying student to calculate their education-related tax deductions and credits. This document also reports any scholarships and grants received that may reduce these deductions or credits.

The IRS issued and revised the form in 2024 . Use the link below to download Form 1098-T.

How Does a 1098-T Affect My Taxes?

This Tuition Statement shows any adjustments made by the school to qualified expenses reported on the 1098-T of the past year. If previous year's expenses were lower than initially reported, the student may have to pay an additional tax for that year.

Students may claim an education credit on Form 1040. The 1098-T form is required to support any claim for an education credit and shows the amount of scholarships and grants paid to the school for the student's expenses. This amount may reduce the amount of qualified expenses when calculating a student's credit.

If the current form shows any adjustments by the school to scholarships and grants reported on a previous year's 1098-T, the student's tax liability for the previous year may be altered, and an amended return may have to be filed by the student.

How to Get 1098-T Form?

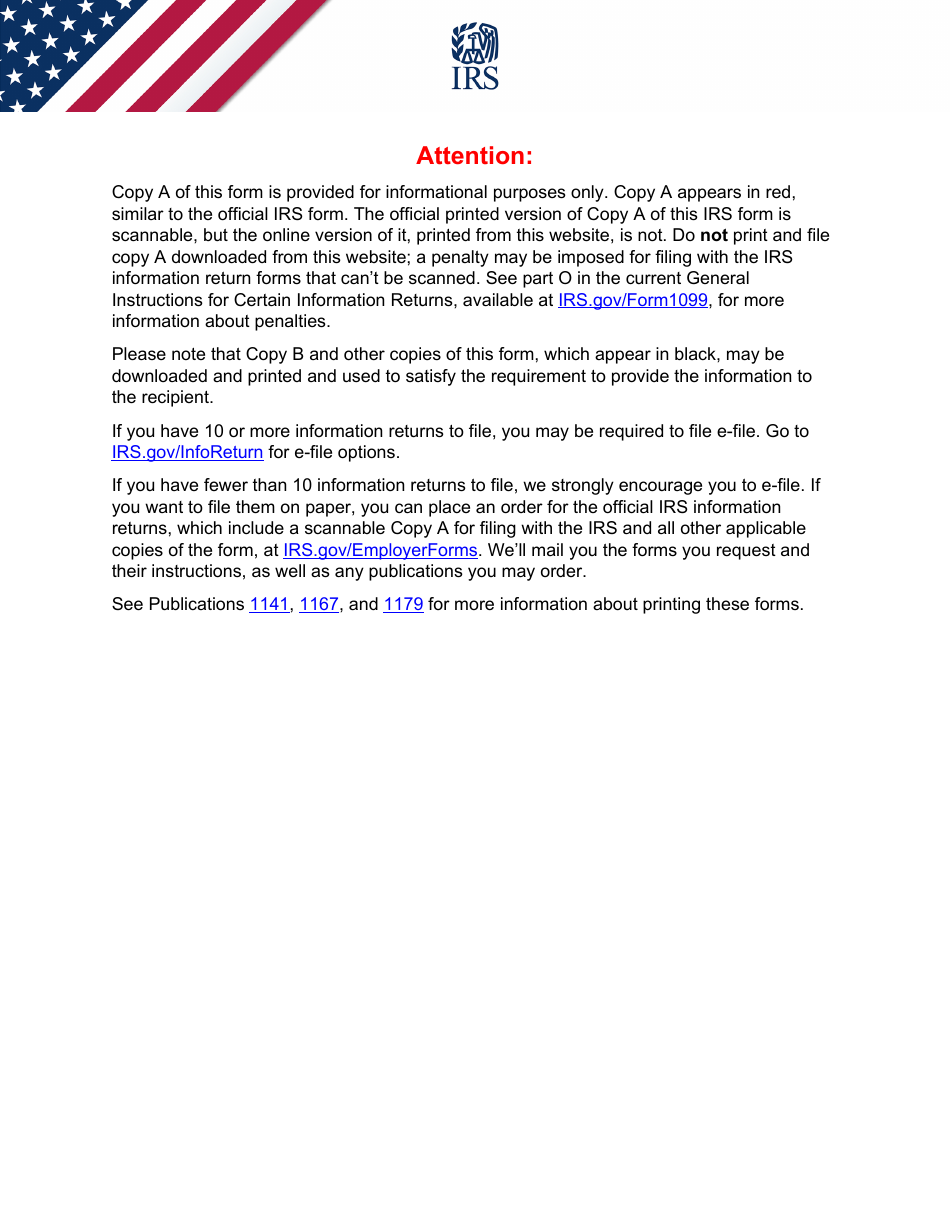

If you are an eligible educational institution or an insurer, the official Copy A may be ordered through the IRS website and received by mail. Fillable Copies B and C may be downloaded, printed and used to satisfy the requirement to furnish the statement to the payer.

If you are an eligible post-secondary student, you will receive a copy of this form every year. This form may be furnished to you by the educational institution or the insurer that reimbursed or refunded qualified educational expenses to you. Qualified expenses include tuition, an enrollment fee, and required course materials.

IRS Form 1098-T Instructions

The IRS provides separate instructions for Form 1098-T, which you can find on the IRS website or by clicking on this link. Schools can report a student's qualified expenses based on how much the student actually paid (in Box 1) or on how much the school billed the student during the year (in Box 2). Eligible educational institutions must file the form for each enrolled student for whom a reportable transaction is made. Insurers must file Form 1098-T for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Fillable Form 1098-T copies B and C are available online in pdf format at the IRS website. The students who paid tuition or related reportable expenses will be provided with this form by January 31, 2020.

Qualified schools must file electronically if they need to file 250 or more returns. Paper forms must be filed by February 28, 2020, or March 31, 2020, if filed electronically. Late filing penalties shall apply if the educational institution fails to file a correct return by the due date without a reasonable cause. The penalties are as follows:

- $50 per information return if you correctly file within 1 month;

- $110 per information return if you correctly file more than 1 month after the due date but by August 1;

- $270 per information return in case the return is filed after August 1 or not filed at all.

Taxpayers who mail paper versions of their tax returns should enclose a Form 1096 with their Form 1098-T. You can file information returns electronically via the IRS Filing Information Returns Electronically (FIRE) system or the IRS Affordable Care Act Information Returns (AIR) program.

IRS 1098-T Related Forms:

- IRS Form 1098, Mortgage Interest Statement. This form reports the amount of interest and related expenses that an individual or sole proprietor paid on a mortgage during a tax year in order to estimate tax deductions.

- IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. This document details automobiles, boats, and airplanes donations made to charitable organizations, to allow that donor to claim a donation tax deduction.

- IRS Form 1098-E, Student Loan Interest Statement. This document reports the interest amount that was paid on the qualified student loans during the tax year, to have it deducted on the taxpayer's income tax return.

- IRS Form 1098-Q, Qualifying Longevity Annuity Contract. This form is filed by a person who issues a contract intended to be a Qualifying Longevity Annuity Contract (QLAC), to allow the annuity holder to claim distribution taxes deductions based on the income earned on top of the original investment.